Executive Summary

The United States economy is not dependent on fossil fuels for growth. Gas provides about 24% of total energy sources, and its price is, therefore, a major factor in overall economic productivity. There have been relatively mild changes in the price of gas over a long period, with pronounced shocks in the 80s and 2000s decades. On a long term scale, rising gas prices have caused a general slowdown in the total factor productivity. However, the immediate effects of the changes in prices continue to vary by scale and sector.

States that depend on gas-related industries are the most affected by changes in prices, just like firms that have energy costs higher than 5% of their output value. In addition, the changes in the technologies of energy-related industries have also changed their exposure to gas price changes. Many petrochemical and refining industries retain their profit margins with relative changes in prices. Thus, contrary to the effects in the 80s, today’s price shocks are only severe for extractive industries whose incomes depend on the prevailing prices. On the economy, as a whole, the Federal Reserve has been responsible for initiating policy changes to counter the likely effects after high or low sudden prices of gas. The changes affect consumer price index inflation and other inflation rates, but the effects show up in the medium term, after about five years.

The Impact of Gas Prices on the U.S. Economy

The U.S. attained its competitive edge due to an adequate supply of gas, which led to reduced prices of the commodity. The country could now produce and transport goods cheaply and, therefore, compete with other countries that enjoyed high technology advancement and low labour costs. Chemical manufacturers in the U.S. that rely on natural gas and its derivatives may also increase their production of plastics to substitute other materials for making goods, given that sustained low prices of oil will make production costs significantly cheaper.

A number of factors limit the immediate translation of low gas prices in the U.S. economy. Policy changes on natural gas exposures and emission targets affect current and projected consumption targets. Any technological breakthrough for gas or alternative fuels also affects eventual demand. The changes in interest rates affect the allocation of capital for investment and, therefore, influence the overall long term supply decisions. The decisions, in return, shape price projections for gas. In addition, the relative position of the U.S. dollar to other currencies also affects the level of gains that the U.S. economy can make regarding lower gas prices (Ladislaw, Hyland, Pumphrey, Verrastro, & Walton, 2013).

Historically, low prices have mostly affected industries that are heavy energy consumers. Other industries only register marginal benefits that are direct or passed from the heavy energy-consuming industries. In the U.S. only, about 10 per cent of manufacturing companies’ energy costs makes up more than 5 per cent of the value of their output. Another relevant statistic is the fact that less than half of 1% of U.S. workers are in manufacturing industries that are likely to receive competitive benefits when the electricity prices lower (Ladislaw et al., 2013).

Explorations of shale gas in the U.S. have grown in the last several years, despite earlier concerns about the limited availability of the resource. In fact, continued production has now demonstrated that the resource is abundant, and this has the effect of reducing pressure on gas prices that would arise with decreasing production (Ladislaw et al., 2013). In short, reduced gas prices would lead to a vibrant economy.

At the beginning of the 2000s decade, the price of crude oil started to increase and rose to the highest level since 1980 (Adelman & Watkins, 2005). The prices remained relatively high for the years leading to the economic recession. The main reasons for the high prices were a strong demand for the growing economy and weak supply. In the 2004-2006 periods, high crude oil prices siphoned off buying power from the United States.

Residents paid more for energy importation. As a result, their investment and another spending in the economy reduced. A very small effect of high prices was the shift in income and wealth within the United States towards energy producers and owners of energy assets. Therefore, high prices promoted investment and speculation activities for oil-related industries and caused a rise in their stock prices (the United States Congressional Budget Office, 2006).

Price increases dampened the growth of the economy by about a quarter of a percentage in 2004 and less than a half of a percentage point in 2005, with signs of a similar dampening in the following year (the United States Congressional Budget Office, 2006). High prices affected non-energy consumer prices by about a half percentage point in 2005. The expectation at the time was that there would be no further increases in prices and inflation would remain at a core level of 2-3% throughout the period; from 2006 to 2007 (United States Congressional Budget Office, 2006).

In 2015, drops in energy prices caused a drop of inflation to zero as consumer prices remained unchanged from their levels in September 2014 (Lawyer, 2015). This effect was due to a drop of nine per cent of gasoline prices. However, the lower prices did not affect food and shelter costs in the short-run. Another indicator, the core inflation, went up by 1.9 on an annual basis as of September 2015. The core inflation does not consider food and energy costs and represents the general status of the economy (Lawyer, 2015). This shows that a drop in energy prices in the short-run has a limited effect on core inflation because it does not affect fundamental factors that comprise the gross domestic product.

America’s economic strength arose because of abundant and inexpensive energy. The present sources of energy are both renewable and fossil sources. The fossil sources account for 90 per cent. Out of this share, natural gas takes up 24%, while petroleum takes up 37 per cent (Miller, 2011).

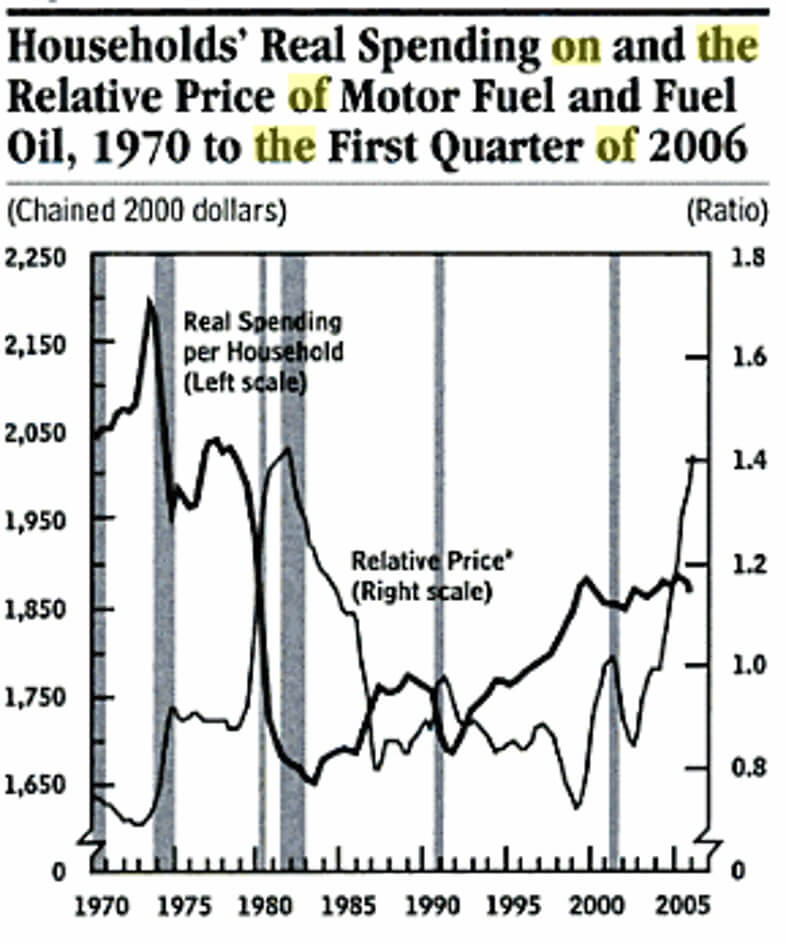

Rises and falls in gas prices affect medium-term economic indicators like total consumption and savings levels. A review of the levels of household spending and the relative price of motor fuel and fuel oil from 1970 to 2006 provides a glimpse into the historical effects of energy prices. The representation below shows that real spending fell sharply in the early 1980s as prices rose. However, the period from 1990 to 2005 experienced a relative increase in real spending amid an accompanying increase in prices. The data showed that households’ real spending became less prone to changes in energy prices. One of the potential reasons was the increase in the availability of debt instruments to cushion consumers against the rising costs of living.

While consumer spending seems to fluctuate with changes in energy prices, the income and expenditure of corporate sector seem to stay relatively stable as energy prices rise. From 2003 to 2006, the corporate profitability in general in the United States grew rapidly, especially for energy producers. As long-term interest rates remained low during the period, many firms opted to restructure their debts and enjoy higher profitability. Nevertheless, the rise in profits was not due to the rise in oil prices, but due to the overall better performance of the economy at the time. In fact, the increase in the prices of energy led to the reduction of profitability marginally (United States Congressional Budget Office, 2006).

The total factor productivity of the economy reduced to an average of 0.8 per year from 1973 to 1994, which came after a 1950 to 1973 annual growth of 2.1% (the United States Congressional Budget Office, 2006). This reduced rate also coincided with a period when oil prices were increasing. The reality is that when the country relies much on imported gas, a high rise in the international price will lead to reduced growth of productivity for a while. The recovery of the growth depends on the extent of the high prices and their duration. After 2010, the effects of recession had caused a slowdown in the global economy, leading to reduced demand for oil. The expectation was that lower prices would help to stimulate the production of the economy and lead to higher growth rates as the country became competitive once more.

The global prices of oil went down sharply in the 19th and 20th centuries. In 1985-86 and in 2008, the prices declined, and the effects on the economy were felt. Mostly, there was notable growth in the economy in the years after the massive drop in prices. The change was attributed to strategic choices that firms took to improve their positions and took advantage of lower energy costs. However, a larger effect was in the import bill of the country, which translated to better macroeconomic factors. In 1985-86, high oil prices had led to conservation practices that caused a massive slowdown of consumption. The same effects were witnessed in 2014. In both cases, new discoveries of oil changed perceptions about the scarcity of oil and caused additional drops in prices.

The biggest effect of changes in gas prices on consumers is an increase in disposable incomes, which eventually leads to increased spending or saving. However, the increase in spending power is offset by the reduction in earnings for oil producers. In addition, the U.S. now produces two-thirds of its consumption of oil and has become less prone to changes in international prices. Another factor worth considering is the uneven distribution of gas reliance within the economy, which leads to uneven effects across different economic sectors of the United States.

States that rely on oil production for their economies are hurt by lower gas prices while those that are net consumers of gas benefit when there is a substantial reduction of prices. In addition, the overall level of demand also affects the earnings of oil-producing states at any time (Brown, 2014). In the 1980s, states that benefited from low energy prices were those that had intensive refining and petrochemical industries without or with little energy extraction industries. They included South Carolina and New Jersey. In that period, the effects of changing prices on the economic prospects of refining and petrochemicals were high. However, changes in technologies and diversification have now reduced the exposure of those states to massive swings in energy prices.

When there are oil price shocks, the Federal Reserve tries to influence the consumer price index inflation and the GDP growth forecasts by changing its rates’ target. Studies that have sought to find out the exact effects of oil price increases on the economy have tried incorporating the prices as part of the variables affecting the respective indexes. One such study was by Bachmeier, Li and Liu (2008), who revealed that oil prices as predictors do not significantly affect forecasts for CPI inflation or the various measures that are used for output and monetary policy. Therefore, oil prices can signal the Federal Reserve to consider making changes to the monetary policy, but the price changes do not dictate the exact charges that will be done to correct the price effects on the economy.

The changes in the behaviour of the Federal Reserve or firms that are not directly dealing with gas are not readily clear. However, when consumers change their behaviour or firms that are directly affected by energy prices change their behaviour, then the results can be attributed to the changes in gas prices. Nevertheless, the Federal Reserve is in charge of safeguarding economic progress through appropriate policies. It understands the effects of price changes for gas, and it is seen to take corrective measures that reduce any shocks to economic growth (Bachmeier et al., 2008). The most indicative sector of the economy for reactions to changes in gas prices in the stock market. Reactions of markets in the past few decades showed that energy price shocks were not similar.

The study by Broadstock and Filis (2014) confirmed that the effects of oil shocks on stock prices were different, although they related mostly to the types of shocks witnessed. The impact varied with industries and the U.S. stock markets became generally less resilient to energy price shocks compared to China. Energy price shocks can be supply or demand-driven as discussed earlier when comparing 1985-86 shocks to the 2014 shock that reduced prices significantly.

When there are aggregate demand shocks, the positive correlation of the shocks with the fluctuation of prices at the New York Stock Exchange (NYSE) is more pronounced than in the supply-driven shocks (Broadstock & Filis, 2014). It is likely that speculation on the oil and gas market has also been driving market-specific shocks witnessed in the stock exchanges in the U.S. The increase is attributed to the overall improvement in stock activity in the country. There are more hedge funds participating in the market, and they create an increased correlation between prices and stock returns. The increased activity on energy-related stocks is also partially responsible for the increase in the overall real spending of the consumers (Bachmeier et al., 2008).

The connection arises in the way companies continue with production and hiring of labour, even as prices increase. Meanwhile, investments in oil-related industries, including extractions, continue at a higher rate than they were in the 80s. Thus, today’s energy price shocks are less significant in their effect on consumption practices because there are multiple other factors affecting the eventual transfer of the shocks to consumers (Broadstock & Filis, 2014). Since companies do not cut production immediately and credit access continues to be high relative to prevailing interest rates, the economic effects continue to narrow to the specific extractive industries and energy-dependent manufacturing sectors that use gas.

Bahgat (2014) indicates that the U.S. continues to become self-sufficient in oil and gas. Therefore, the country is less inclined to rely on the Middle East for its imports or the regulation of the price of energy in the global market. There has been falling demand in recent years, while supply has increased because of improvements in technology. Consumer trends are also changing as more Americans buy fuel-efficient cars and live in smaller homes. These factors are yet to dominate the effects of gas prices on the economy, but they are gradually building up to contribute to an overall decline in gas demand relative to the demand for other energy sources and the total demand for energy in the economy.

The U.S. had 1,919 drilling rigs that were active. They were more than the rest of the world combined. The effects of high prices in the 2000s decades led to major investment in gas extraction industries. The improvement in shale extraction technology also led to more investment, which eventually caused an increase in the production of domestic gas to reduce dependence on imports. Unlike cheap imports that lead to reduced import bill, low prices for local products do not provide a significant effect on the balance of trade and on the value of the U.S. currency. However, in both cases, the cost of production in the economy reduces, according to the distribution of industries related most to the energy sector, as discussed earlier.

In the end, this paper shows that monthly changes in inflation only occur in commodities directly affected by day-to-day changes in prices of gas, such as food. Core inflation remains the same or changes slightly unless price changes of gas are significant. Finally, the U.S. is less exposed to international oil price changes in regards to its import bill. This has reduced the severity of the shocks on the country’s competitiveness and overall economic growth prospects. In addition, consumers are affected differently by rises and fall in gas prices. Thus, it is not enough to look only at the major economic indicators for the whole economy.

In conclusion, the inflation, unemployment rates, and savings rates will differ in specific states, according to the dependence of the economies of those states to gas as a factor of production and as a resource. States like Texas, where gas is part of the natural resources available end up negatively affected by low prices. However, sustained low prices also create a new baseline that informs investment decisions. This explains why there was increased investment in gas extraction in the 2000s after relatively stable prices in the 90s, as prices were increasing and investors saw the sector as a profitable frontier. Overall, the U.S. economy has shown mixed results in its reaction to changes in gas prices. Nevertheless, a pattern emerged in the distribution of gains and losses among states and sectors of the economy.

References

Adelman, M., & Watkins, G. (2005). U.S. oil and natural gas reserve prices, 1982–2003. Energy Economics, 27(4), 553-571.

Bachmeier, L., Li, Q., & Liu, D. (2008). Should oil prices receive so much attention? An evaluation of the predictive power of oil prices for the U.S. economy. Economic Inquiry, 46(4), 528-539.

Bahgat, G. (2014). The shale gas and oil “revolution”: Strategic implications for United States policy in the Middle East. The Journal of Social, Political, and Economic Studies, 39(2), 219-231.

Broadstock, D. C., & Filis, G. (2014). Oil price shocks and stock market returns: New evidence from the United States and China. Journal of International Financial Markets, Institutions and Money, 33, 417 – 433.

Brown, S. P. (2014). Falling oil prices and US economic activity: Implications for the future. Washington, DC: Resources for the Future. Web.

Ladislaw, S. O., Hyland, L. A., Pumphrey, D. L., Verrastro, F. A., & Walton, M. A. (2013). Realizing the potential of U.S. unconventional natural gas. Washington, DC: Center for Strategic and International Studies.

Lawyer, J. (2015). Falling energy prices push inflation to zero in September, but core heats up. Washington Examiner. Web.

Miller, B. G. (2011). Clean coal engineering technology. Burlington, MA: Butterworth-Heinemann.

United States Congressional Budget Office. (2006). The economic effect of recent increases in energy prices. Washington, DC: Congressional Budget Office.