Purpose of the Report

The present report aims at applying DuPont analysis to evaluate the performance of the Chinese Bank of Communications (BoCom) against its competitor, China Merchants Bank (CMB). The assessment is based on financial performance during the past three years (2017-2019) of two companies.

Background Information

Bank of Communication

BoCom is a financial service group that covers “banking, offshore finance, fund, trust, financial leasing, insurance, overseas securities, debt-to-equity swap, and asset management” (Bank of Communications, 2020, p.2). The bank is ranked 150 among organizations listed among Fortune 500, and it is number 11 among the top 1000 banks in the world in terms of Tier 1 capital (Bank of Communications, 2020). It provides jobs to nearly 88,000 employees in 244 domestic branches and 22 overseas branches in 17 countries (Bank of Communications, 2020). The company’s philosophy is to maintain prudent operations focused on the core goal of creating value (Bank of Communications, 2020).

China Merchants Bank

CMB is a Chinese bank comparable in size with BoCom, and it offers the same range of services. CMB is has been present among Fortune 500 brands for seven consecutive years on the 213th position, and it is ranked 20th among the top 1000 banks in the world in terms of Tier 1 capital (China Merchants Bank, 2020). The company employs over 70,000 people in more than 1,800 branches worldwide (China Merchants Bank, 2020). The company’s service concept is “We Are Here Just for You,” and it has proven to be a valid philosophy, as the bank is developing steadily (China Merchants Bank, 2020).

DuPont Analysis

Overview

BoCom has been performing relatively stable in terms of ROE, which can be seen in Table 1 below. Even though net income, revenues, total assets, and shareholder equity are growing at a stable pace, the DuPont analysis coefficient experienced a slight decrease in 2019 (Bank of Communications, 2018; Bank of Communications, 2019; Bank of Communications, 2020). The decrease is accounted for a reduction in financial leverage, which is a positive tendency (Hargrave, 2019).

Table 1. DuPont Analysis of BoCom

CMB is also a stable performer in terms of DuPont analysis, which can be seen in Table 2 below. The company’s management is gradually increasing the profit margin and decreasing financial leverage (China Merchants Bank, 2018; China Merchants Bank, 2019; China Merchants Bank, 2020). According to Hargrave (2019), these two tendencies imply that operating efficiency is improving. Moreover, the company uses less debt for development, which makes it less vulnerable.

Table 1. DuPont Analysis of CMB

Comparative Analysis

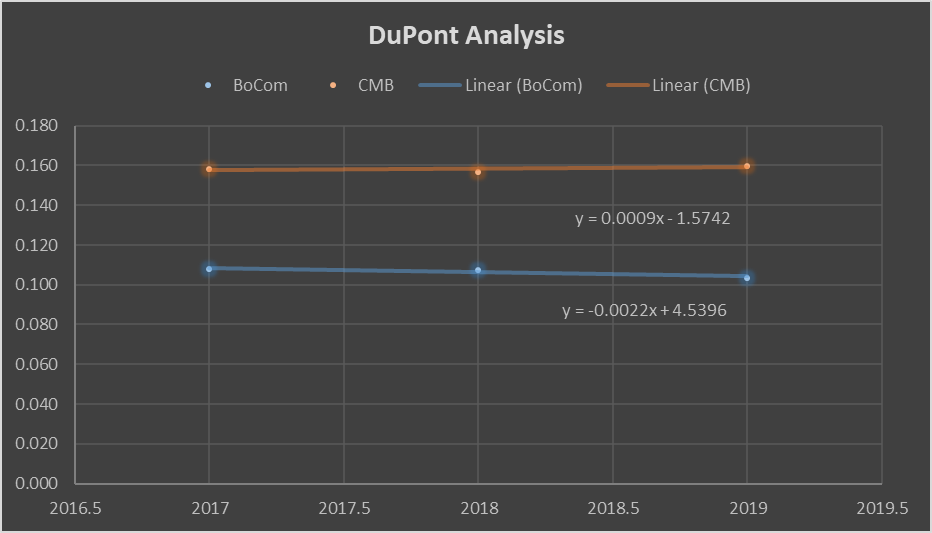

BoCom is underperforming in terms of the DuPont analysis coefficient in comparison with CMB. The DuPont analysis coefficient of BoCom was lower than that of CMB during all three years of analysis. Moreover, BoCom’s DuPont analysis coefficient has a negative trend, while CMB’s coefficient has a positive trend (see Figure 1).

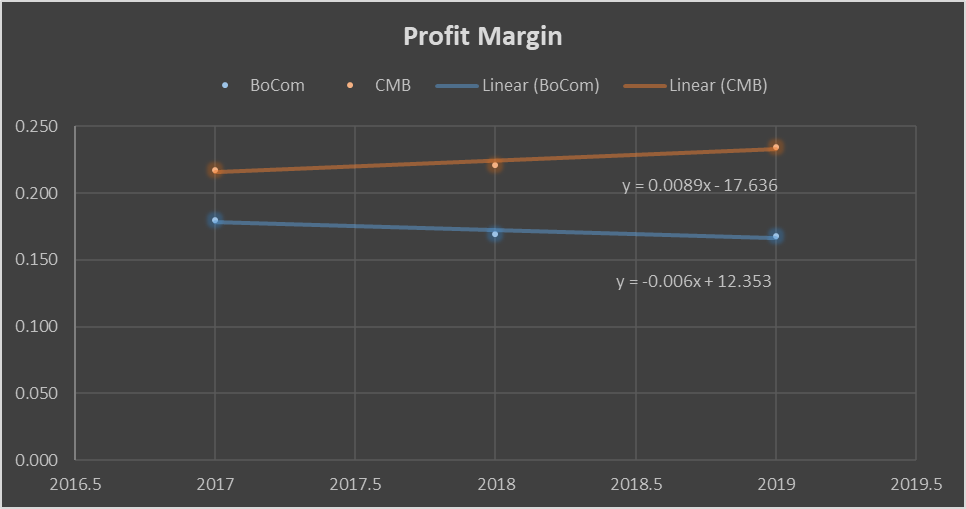

According to the analysis, BoCom’s central problem is decreasing operating efficiency. BoCom’s profit margin is lower than that of CMB and has a negative trend (see Figure 2).

Conclusion

The DuPont analysis of BoCom revealed that the company underperforms in comparison with its direct competitor, CMB. The central issue was identified as inefficient operations management. The company needs to develop effective intervention strategies to address the identified problem. Currently, CMB is a more favorable candidate for investments in comparison with BoCom.

References

Bank of Communications. (2018). Annual report 2017.

Bank of Communications. (2019). Annual report 2018.

Bank of Communications. (2020). Annual report 2019.

China Merchants Bank. (2018). Annual report 2017.

China Merchants Bank. (2019). Annual report 2018.

China Merchants Bank. (2020). Annual report 2019.

Hargrave, M. (2019). DuPont analysis. Investopedia.