Abstract

The National Bank of Bahrain is the nation’s first locally-owned bank, founded in 1957 and owned partially by the country’s government and partly by private investors. This report attempts to analyse the characteristics that determine its attractiveness to investors, namely its financial structure and corporate governance framework. The former appears to be mostly average for the industry, though the bank seems to be highly risk-averse, as shown by its refusal to loan out more than 60% of its deposits. With that said, the behaviour does not appear to be damaging the bank substantially, as its performance is still adequate. There are no concerns regarding corporate governance, as the policies that direct it is robust and cover various aspects of operations. Overall, this report finds that there is no need to adjust the NBB’s structure significantly, though intensified loan practices may improve its growth rate.

Introduction

The National Bank of Bahrain (NBB) is the nation’s first banking institution that operates in the country as well as two others. Its ownership is shared, with private as well as institutional investors and the country’s government holding the entirety of its shares. Its stated mission is to enrich the lives of generations by providing people with opportunities (National Bank of Bahrain, 2020a). To that end, the bank serves private as well as business clients, offering them a variety of services such as account management, relationship management services, and personal as well as mortgage loans. Having been founded in 1957, the institution has created a robust set of governance policies and achieved a strong financial performance. To obtain an improved understanding of the institution’s functioning, this report will analyse and discuss its financial performance and corporate governance policies in detail.

Financial Structure Analysis

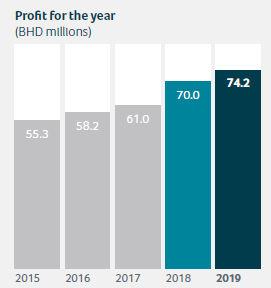

The NBB’s financial structure can be seen from its 2018 and 2019 annual reports, which indicate stable profit growth as shown in Fig. 1. They provide an adequate representation of its recent performance and the trends that may have affected it. The statement by the National Bank of Bahrain (2020b) highlights an ROAA of 2.3% and an ROAE of 14.7% in 2019, and the net profit margin can be calculated to be 59%. Meanwhile, similar statistics for the National Bank of Bahrain (2019a) are 2.2%, 15.2%, and 59.6%, respectively. All of these characteristics, with the possible exception of the ROAE, compare favourably with much of the banking industry. Bank assets tend to be substantially larger than their year-to-year earnings and expenses, which is why the ROA may be lower than in other sectors. With that said, the bank’s net profit margin is very high, and the ROE is average and sufficient to maintain attractiveness for investors.

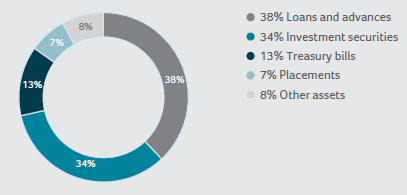

With that said, the profitability of the company is not the only determinant of its success. It is also necessary to consider measures of stability, such as the debt-to-equity ratio and sources of funding. Using data from the National Bank of Bahrain (2019a; 2020b), it is possible to calculate the rate, which is 17.5% for 2018 and 20% for 2019. Additionally, it is possible to see from Fig. 2 that the NBB’s primary sources of assets are loans, advances, and investment securities, which represent more than two-thirds of the business’s total assets. With that said, as can be seen in the statements by the National Bank of Bahrain (2019a; 2020b), the NBB’s loan-to-deposit ratio was 54.3% in 2018 and 58% in 2019, which suggests subpar liquidity of its assets. The bank likely has extensive reserves but is at risk of suffering opportunity costs through missing chances to loan out more of the deposits that it stores.

The last statistic that is of interest to shareholders is the potential of the company to generate value for them, which is expressed through the cost of capital. It consists of two distinct characteristics: the cost of equity and the cost of debt. The cost of equity can be calculated from the financial statements by the National Bank of Bahrain (2020b) and can be estimated at 13.7%. Meanwhile, the cost of debt would be 6%, which would make the total cost of capital 9.8% as the weighted average of the two values. This cost of capital is average for businesses and marks the NBB as neither particularly attractive nor unattractive. Overall, the company appears to be moderately attractive, though there are some issues that it may need to address to improve its overall results.

Governance Analysis

The NBB has a robust corporate governance policy that features an extensive overview of rules and ethics. According to the National Bank of Bahrain (2020c), its systems feature a code of conduct, best practices on consumer credit and charging, anti-money laundering, a complaints procedure, a key persons’ dealing policy, a business continuity plan, and a whistle-blower policy. The detailed guidelines, available from the National Bank of Bahrain (2019b), outline vital aspects of the NBB’s operations such as the roles and responsibilities of the board of directors, the decision-making process, audits, risk management, and others. Explicit descriptions of these practices are critical to securing the trust of the company’s shareholders, and the NBB succeeds in providing a clear picture. Additionally, the company offers other documents that further outline its practices and guarantee to the investors that its conduct will be ethical.

As a large business with substantial assets, the NBB may be prone to insider trading on the part of its senior executives. The National Bank of Bahrain (2020d) has introduced a Key person policy that identifies any such individuals and maintains a register of them. The information is then transferred to the Bahrain Bourse, which monitors the stock purchases and sales that they conduct for signs of illegal activity. Additionally, the National Bank of Bahrain (2019c) has a robust whistle-blower policy that protects any employees who disclose wrongful conduct in good faith from unfair treatment and enables them to access the CEO and the Chairman of the Audit Committee to highlight any such mistreatment. The existence of these policies highlights the NBB’s commitment to lawful and ethical conduct, which is a sign of a healthy governance structure.

As a bank, the NBB also has to follow specific guidelines that apply to institutions that are primarily occupied with financing and money deposits. The National Bank of Bahrain (2020c) identifies these policies as the Code of Best Practice on Consumer Credit and Charging and programmes against money laundering and terrorist financing. The people who apply for loans must have a clear understanding of the contract that they intend to enter before committing to it. They should be made aware of any changes that take place and have access to pertinent information at any time. Furthermore, the NBB is obligated to identify its customers clearly and prevent the abuse of its systems by criminals. The existence of policies to that effect further serves to enhance the trustworthiness of the bank’s corporate governance structure.

Discussion

Overall, in terms of financial performance, the NBB’s statistics provide an overall positive outlook that makes it attractive to investors. Its ROA and profit margin is high for a bank, and the ROE is average, which marks it as a potentially attractive investment target. However, at the same time, the NBB may present some concerns in terms of liquidity and its efforts to expand. While it has extended its operations to Saudi Arabia and the UAE, it still only has 29 operating branches and 100 ATMs (National Bank of Bahrain, 2020a). A likely reason for this slow expansion is the excessive degree of caution that is exhibited by the bank, which leads it only to loan out 60% of its current deposits. It should be possible to achieve substantial benefits by increasing that figure to 80 or 90% while still maintaining a considerable degree of preparedness for risk.

Most of the NBB’s other financial characteristics are adequate for the industry and moderately attractive to the industry. The company favours consistency over rapid growth, providing high-quality, reliable services and generating continuous performance improvements. As such, it is a low-risk investment with consistent performance, which is an attractive category to specific categories of investors. While the bank may be able to alter its strategy to achieve improved performance, doing so is not necessary. The current model is viable, and the NBB has justified it through its sustained success over the last fifty years.

In terms of corporate governance, there is also nothing that requires substantial adjustments or improvements. As a partly nationally owned bank, the NBB is highly motivated to be compliant with the law. As such, its corporate governance framework is robust and incorporates all of the necessary components to achieve excellent ethics. The critical aspects are covered in detail, and updates are supplied to match evolving business circumstances. Both general business ethics and the specific requirements that are applied to banks are covered in detail. The framework enables the company to display consistency and ethical performance, which are highly attractive qualities for investors. As long as it continues to evolve to suit the local and global business environments, no further modification to its corporate governance frameworks and processes should be necessary.

Conclusion

Overall, the National Bank of Bahrain is not an exceptional company, but it performs well compared to other members of the industry. Its financial performance and structure are satisfactory and make it an attractive, low-risk stock for investors. The business may be overly risk-averse, but since these practices do not cause its business performance to decline below an acceptable standard, there is no compelling reason to recommend a change. In terms of corporate governance, there appear to be no issues in the NBB’s organisation that warrant a strong response. All of the necessary aspects are covered by respective policies, and investors should not need to be concerned about misconduct at the organisation. Overall, the NBB should continue its current practices, as they have contributed to its currently excellent performance and economic status. If it continues to improve as it has in the past, there should be no investor concerns associated with either of the factors discussed in this report.

References

National Bank of Bahrain. (2019a). Annual report 2018. Web.

National Bank of Bahrain. (2019b). Corporate governance guidelines. Web.

National Bank of Bahrain. (2019c). Whistle blower policy. Web.

National Bank of Bahrain. (2020a). About NBB. Web.

National Bank of Bahrain. (2020b). Annual report 2019. Web.

National Bank of Bahrain. (2020c). Corporate governance. Web.

National Bank of Bahrain. (2020d). Key persons’ dealing policy. Web.