Abstract

A number of studies have used investment-cash-flow sensitivity as a yardstick for measuring financial constraints in firms, where as there are equal instances of disagreement for adopting the instrument. This disparity can be attributed majorly to variation in opinions as concerning separation of financially-constrained firms from non- financially-constrained firms. Limitation of small firms as against larger ones are numerous, particularly depending on the availability of problem stemming, from unbalanced information it is obvious that ‘big’ firms (which have established names of financial successes and have equally had quite numerous amounts of fixed-assets) would restrain themselves from seeking for external funding.

The limitations of the small firms are further made more difficult by lack of access to monitory bodies such as stock-markets; resultantly, they fall back to the debt-markets for obtaining additional funds to necessitate their growth/advancement. Be it as it may, debt-markets make available funds at expensive conditions in addition to demanding for collateral as well as requesting for multifaceted contracts that sometimes would intimidate the small firms and make it quite uneasy for them to have the funds. These challenges would often leave small firms with limited options for stable operations and growth-opportunity. This study, therefore, is instituted by the need to access in a deterministic manner the possibilities of investment-cash-flow being monotonic inline with a firm’s financing constrict.

Introduction

Background

Considering the fact accessing external funds by firms is to an extend is dependent on the availability of problem stemming, particularly from unbalanced information, it has become the expectation that ‘big’ firms (which have established names of financial successes and have equally had quite numerous amounts of fixed-assets) would restrain themselves from seeking for external funding. Given the qualities, principle of operation, established marketing pedigree, easy of information flow, and of course the size of such (larger) firms, they have higher chances of accessing capital-market funds. Small firms (in the group of SMEs, particularly) undergo much constraints during attempts for obtaining funds from monitory sources due to lack of distinctive information or a pedigree of performance; thus the result of these often times would create the need to present collaterals for obtaining funds.

The limitations of the small firms are further made more difficult by lack of access to monitory bodies such as stock-markets; resultantly, they fall back to the debt-markets for obtaining additional funds to necessitate their growth/advancement (Jensen, 1986). Be it as it may, debt-markets make available funds at costly conditions in addition to demanding for collateral as well as requesting for multifaceted contracts that sometimes would intimidate the small firms and make it quite uneasy for them to have the funds. The challenges would leave the small firms with limited options of seeking for monitory aids domestically from friends and from family member to enable their possible expansions- most of the times; these aids are grossly inadequate to push small firms to stable operational levels, hence constituting growth-opportunity challenges (Jain, 2001).

There is a form of liberation, however, for small firms whereby they could have the intervention of venture-capitalist towards expanding their businesses with funds (Ang, 1991). This would ease their inadequacies in terms of resources that they could access through venture capitalist. Holmes and Kent (1991) and Guariglia (2008) conducted studies on a sample of companies in the United States to determine the degree of cash-flow sensitivity and they noted that, ‘the relation between financial constraints and investment-cash flow sensitivity was non-linear’ (Guariglia, 2008, p.1799).

Earlier studies conducted by the later showed varying results; a situation that was attributed to errors with selected sample. This thus brought to the fore the suggestion that monotonic/positive relations that interconnect financial constraints/involvement cash-flow sensitivity happens not to be robust when large samples are considered in a study. However, Hellmann and Puri expressed this from a different point-of-view that:

Most studies of the investment-cash flow sensitivity hypothesis in the literature compare estimates of the sensitivity coefficients from cross sectional regressions across groups of firms classified into more or less financially constrained groups based on some measure of perceived financial constraint (Hellmann and Puri, 2002, p.173).

Conclusively, ‘The presence of specialized investors offers value-addition to firms, which may materialize in different ways, and is positively assessed by entrepreneurs’ (Cassar and Holmes, 2003, p.130).

This study is instituted by the need to access in a deterministic manner the possibilities of investment-cash-flow being monotonic inline with a firm’s financing constrict. The study makes use of an ample distribution of public firms (from sample data) which lack financing to establish the point. Similar studies where conducted by Chittenden and Hutchinson (1996) to show that ‘the investment-cash flow sensitivity is neither monotonically increasing nor decreasing in the most common proxies of financing constraints; [but] on the contrary, an inverse U-shaped relationship was observed’ (Kadapakkam et. Al., p.311). The study also showed that, ‘parameter of interest displays, to some extent, a monotonic behaviour with respect to size only’ (Guariglia, 2008, p.1798).

It is argued that, ‘while it is reasonable to expect that in the presence of financial market imperfections, firms display positive investment-case flow sensitivity’ (Gompers and Lerner, 2001, p.152), on the objective, the situation is not a warrant to establish a magnified parametric monotonic increment as reflected by intensity of a firm’s financing constraints (Hovakimian, 2009; Hovakimian and Hovakimian, 2009.).

Aim of this Work

The aim of this work is to test the hypothesis that ‘financially constrained groups of firms have higher cash flow sensitivities as compared to financially unconstrained ones’- the work will equally test sample using eViews

Relationships between Cash Flow Sensitivities and Financial Constraints

Estimation of the Cash Flow Sensitivity for the Subgroups

Emergent challenges encountered through studies that stem from information-asymmetries are usually an indication of lack of access to common information on group of firms. It follows that:

- The lack of sufficient information to determine the quality of different investment projects in the firm as well as the quality of management for making investment decisions determines the level of risk that creditors and/or investors face; the level of risk is then reflected through a high cost of capital, plus the requirement of additional collateral and/or the limitation of the amounts supplied;

- When additional financing is required, there is a hierarchy in the use of funds which is based on information asymmetry- whenever possible, funding of a firm should be covered by internally generated funds, which are not affected by adverse selection problems. If these were not enough, debt would be the next option, since the risk associated with stocks is greater than that of debt;

- Firms with high levels of internally generated funds will not have such a strong need to seek for external finance- this occurs in the presence of considerable financial slack (Titman and Wessels, 1988). The availability of cash and/or liquid assets enables the firm to take advantage of growth opportunities with no need to access external funds; and

- In the particular case of SMEs, problems of information asymmetry are acute (Kaplan and Zingales, 1997), since beyond the shareholders’ motivation of avoiding ownership becoming diluted and their desire to keep control of the business, the growth and survival of SMEs are affected by hidden information, the lack or have low level of collateral and the lack of any history or financial track record to characterize them (Kaplan and Zingales, 1997). Evaluation of the quality of assets and investment opportunities by suppliers of external funds may be difficult (Kaplan and Zingales, 1997), so obtaining resources to finance SMEs’ growth is limited to certain funding sources (Hogan and Hutson, 2005, p.376).

Looking at this from the point-of-view of an entrepreneur, when an issue with stocks is placed against debts, the initial/original stockholders would have preference on the later- based on their ownership dilution against losses and management-control (Hogan and Hutson, 2005). The translation of this is that there are preferences for the source of funding that minimizes loss-of-control (Titman and Wessels, 1988; Kaplan and Zingales, 1997). More so, the stock-market is not a constituent option for small-scale business funds (considering the fact that it makes available its offers at higher cost) and it is not within the reach of small firms (Jensen and Meckling, 1976; Lewellen and Badrinath, 1997; Carpenter and Petersen, 2002).

Otherwise, information-asymmetry as concerning small firm’s capability of accessing loans from banks and their inadequacy (most times) to produce satisfactory collaterals (Jensen, 1986; Hsu, 2004) results into excessive costs (Ang, 1992; Watson and Wilson, 2002; Gregory et. al., 2005) and consequently makes establishing contracts complicated (Hoshi et. al., 1991). Such firms would therefore be pressed-down against investments based on the fact that their expectations for getting acceptable returns would be erased, unfortunately (Berger and Udell, 1998). This would then condition the firm based on the following:

- If long-term debt is not available, SMEs are compelled to rely on short-term debt (Myers and Majluf, 1984; Kadapakkam et. al., 1998). Commercial credit is usually easily obtained, even when it involves paying in no more than thirty days- however, the firm’s financial position would be compromised by not being able to match the maturities of accounts receivable and account payable. Similarly, short-term bank loans are a relatively accessible source of funds for SMEs but their high cost may be impossible for entrepreneurs to take on; this type of funding has a significant effect on the SME’s level of liquidity but puts its financial stability in jeopardy; and

- Evidence of SMEs’ main source of external financing is stock issues rather than debt when equity capital is supplied by specialized investors such as venture capitalists- unlike other financial intermediaries, venture capitalists can alleviate the problems of information asymmetries and provide funds that the SMEs cannot obtain from other sources (Sahlman, 1990), while, at the same time adding value to the firms they are investing in (Jain, 2001; Paul et. Al., 2007). The likelihood of losing independence and control of the firm is offset by the benefits provided by external funding and opportunities for growth are favoured not only by the arrival of financial resources, since choosing a good investor adds value to the firm (Kaplan and Zingales, 1997). Additionally, this source of finance would not require collateral and would not have a negative impact on working capital (Paul et. Al., 2007, p.17).

The Sensitivity of Investment to Cash Flow as a Measure of Financial Constraints

With the current prevailing constraints which small firms are been subjected to financially, it is obvious that the growth/development of these firms has been positioned through the available internally generated funds to hang (Myers and Majluf, 1984; Lewellen and Badrinath, 1997). It has been noted that amongst a number of things, getting resources externally from a supplier could have to do with high costs (Jensen, 1986; Titman and Wessels, 1988; Watson and Wilson, 2002). Based on this reason, funds that are raised within a firm could basically constitute a financial source for investing in opportunities as well as for insuring the growth of the firm. It is further noted that:

- The presence and importance of financial constraints in a firm’s investment take as their basis a model relating to investment and internally generated funds; a common practice is the use of available cash flow as a proxy for internally generated funds (López-Gracia and Aybar-Arias, 2000). Additionally, Hsu (2004) include Tobin’s Q as a measure of the firm’s growth opportunities- the results showed that investment in firms with low dividends, as a measure of the presence of financial constraints, shows greater sensitivity to available cash flow; and

- The sensitivity of investment to changes in cash flow in a sample of firms belonging or not to a characteristic business organization are characterized by their close links with large banks, whereas a group of firms not belonging to these organizations has very little connection with the banks- this poor link with financial institutions hinders this latter group in obtaining financing, so that investment made by these firms shows itself as more sensitive to cash flow than that of the former (Jensen and Meckling, 1976, p.341-345; Vogt, 1994, p.18).

Sahlman (1990) made efforts to substantiate the point raise by Vogt (1994) – particularly in terms of establishing the relationship that binds investment and cash-flow (Kadapakkam et. al., 1998). He discovered that the evidences connecting an acceptable element and the levels of its significance are in excess with firms that have lower Tobin Q (Gompers and Lerner, 1998).

However, studies conducted by Fazzari et. al.,(1988), and then Fazzari et. al., (2000) generated a contrasting result: these showed that the investment sensitivity against cash-flow could be accepted for evidence of financial-constraints. When a sub-sample of firms were considered by Hoshi et. al., (1991) and Ang (1992), there was a pre-classification of the firms in terms of ‘financially-constrained’ or ‘not financially-constrained’ through the use of quantitative/qualitative information, as well as testing of sensitivities hinging together the investments and cash-flow. They came to the conclusion that an investment in a firm that has few financial-constraints is most sensitive in terms of causing a change in cash-flow. Further studies were conducted by Jensen and Meckling (1976) to respond to the approach that was adopted by Ang (1992) by indicating quite a number of disparities concerning the sample-sizes as well as the method of classification that was made use of by the later; this was necessitated by a desire to arrive at an acceptable conclusion.

Methodology

Estimations

This paper employs the estimation of the investment-cash-flow sensitivity adopted from an unbalanced panel of 520 firms from the United Kingdom during the periods of 1994 -2000 considering an entire sample of 5829 observed firms. These samples were ordered through the adaptation of a dividend-payout criterion in a progression that ensured the removal of lower 5.0, 10.0, 15.0, 20.0, 30.0, 35.0, 40.0, 45.0, as well as 50.0 percent of considered observations as to arrive at 10.0 sub-samples of the entire displayed firm/year collections in an increased dividend-payout ratio. The work estimates the investment-cash-flow sensitivity for the various classes and as well there is the testing of null-hypothesis of the parameters to ensure there is no statistical differences from estimated parameters as the samples are considered. It should be noted that this is possible for conducting the performance of the analysis with no financial-statue statements made on the firms. However, in a similar study conducted by Iona et.al, it was noted that:

If the dividend payout ratio is inversely related to the degree of the financing constraints and if the investment the investment-cash flow sensitivity is higher for the firms that are more likely to be financially constrained, one would then expect that the investment cash-flow sensitivity monotonically decreases across the classes of the firms (Iona et.al, 2006, p.4).

Otherwise, in a situation whereby the dividend-payout ratio has been interconnected inversely to the financial-constraint’s limit but the cash-investment flows sensitively more for the less-likely-constrained firms, there would be the expectation that ‘the investment cash-flow sensitivity monotonically increases across the classes of the firms’ (Iona et.al, 2006, p.4). The analysis equally employs a number of ordinary proxies of financing-constraints in terms of criteria-ordering, optional estimated frameworks, as well as varying empirical Q-model specifications.

Iona et.al from their studies noted that:

if the investment-cash flow sensitivity is strictly non-monotonic in the proxies of financing constraints which are typically used by researchers-not always decreasing or increasing across classes of firms- (it could be claimed) that it should not be used as a measure of the differential cost between internal and external financing (Iona et.al, 2006, p.5).

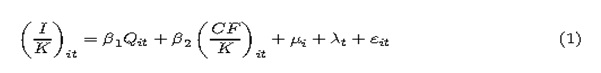

Therefore, performing a monotonicity-condition test devoid of reliance upon degree-of-financial-constraints statement becomes realizable. This work thus employs an empirical model, as shown below, in testing for any possible financing-constraints as suggested by Iona et.al (2006):

From equation (1), i is the investments, k stands for a measure of the entire capita-stock, β stands for the cost’s inverse adjustment, q expresses the Q-Tobin that is a representation of the markets-to-book values of firms, β2 stands for the investment-cash-flow sensitivity, CF is an expression depicting the flow of the cash, μi and λt constitute individual/yearly fixed effects, and then is an expression regarded as the white-noise-distribution.

It is noted that, ‘under some regular regularity conditions, the average q may be used to proxy for the marginal Q’ (Iona et.al, 2006, p.9). Equally, ‘under the assumption hat financial markets are perfect; the parameter β2 should not be statistically different from zero’ (Iona et.al, 2006, p.10). This therefore infers that a reasonable β2 positive-value may rather generate a suggestion of the occurrence of asymmetric-information as well as possible agency-costs (Iona et.al, 2006, p.10).

The investigations were repeated through the use of the entire assets of the firms, and this was adopted for the firms’ sizes proxy. 10 classes where also obtained for the firms in a progressive sequence. And then there was the estimation of the equation (1) considering the classes, afterwards the estimations were tested to determine the possible existence of statistical differences in the investment-cash-flow sensitivity regarding the entire sample.

In a similar study, it was observed that, ‘if the degree of financing constraint is meaningfully related to the firm size, the investment-cash-flow sensitivity should either monotonically decrease or monotonically increase across classes’ (Iona et.al, 2006, p.12). The classes were obtained for the firms through joint-sorted criterion of cash-holdings and leverages based on the fact that there are progressive debates on the certainty firms’ classification inline with financial-constraints or as financial conservatives (Iona et.al, 2006)

Tests for the Null Hypothesis with Non-Varying Coefficients across Classes of Firms

Table 2 provides data of firms in consideration. The availability of financial-constraints on these firms suggests lack of capital venture interventions during the periods of 1994 to 2000.

- In accordance with the data obtained, in that period private equity investments were recorded, including all stages – finding information on these is possible; and

- From this group, firms which have at least three years of accounting data of investment have better chances for standing out (Carpenter and Petersen, 2002, p.299).

Equally, ‘based on the original approach by Gregory et. Al., (2005), a dummy variable that takes value when the firm received an investment or zero otherwise was set’ (Hogan and Hutson, 2005, p.372). The following contains a covariance/correlation/regression result from the data (where R2 is 0.3899, and suggests a poor fit):

Table 1: Using Eviews, the correlation coefficient r = 0.6244.

Using Eviews, the correlation coefficient r = 0.6244 between cash flow and financial constraints is thus found:

Hypothesis Testing

The BLUE property of the OLS estimates is used to test hypotheses about a and b; this involves testing the null hypothesis Ho: b = 0. Given a regression equation;

Y = a + b X + e

The calculation of t-Statistic in this case is usually referred to as a t-ratio due to the fact that it is the ratio of the OLS estimator to its estimated standard error

In the present situation, b can not be zero; hence it could be either positive or negative because a priori, the direction of causality is not obvious

Therefore, test is conducted of:

Ho: b = 0 against H1: b ≠ 0

Because h0 in the present case is sufficiently greater/smaller than zero, a two-tail test will be used (using a 0.05 level of significant, the critical t-value, with 3 d.o.f., is t0.05 = 3.18). The decision criterion here is Reject H0 if |t-Statistic| > 2.353

Given b = 19.46454 and sb = 14.05681, t-Statistic = b/sb = 19.46454/14.05681= 1.384707. The t-Statistic therefore is 1.384707, which is less than 2.353; hence reject Ho at the 0.05 level of significance is inappropriate (i.e. there is no evidence that financially constrained groups of firms have higher cash flow sensitivities as compared to financially unconstrained ones

Multivariate Regression Model

y = b0 + b1x1 + b2x2 + b3x3 +… + e

y is the DEPENDENT variable where as each of the xj is an INDEPENDENT variable- then, the following conditions are stated:

Each explanatory variable Xj is assumed:

(1A) to be deterministic or non-random; (1B): to come from a ‘fixed’ population; and (1C): to have a variance V(xj) which is not ‘too large’

Assumptions concerning the random term b0 , b1, b2 , b3

(IIA) E(ei) = 0 for all I; (IIB) Var(ei) = s2 constant for all; IIC) Covariance (ei , ek k) = for any i and k

(IID) each of the ei has a normal distribution

Properties of b0, b1, b2, b3: 1. Each of these statistics is a linear function of the Y values; 2. Therefore, they all have normal distributions; 3. Each is an unbiased estimator [i.e, E(bk) = β2, and, 4. Each bk is the most efficient estimator of all unbiased estimators (Hsu, 2004)

Thus, each of b0 , b1 , b2 ….is:

Best; linear; unbiased; and estimator of the respective parameter

Conclusion:

Each estimator bi has a normal distribution with mean = bi and variance = sbi2 where sbi2 is unknown

The Test (at 10% Significance) of the Hypothesis that ‘Financially constrained groups of firms have higher cash flow sensitivities as compared to financially unconstrained ones’

The proposed regression model is:

Cash Flow = ß0 + ß1(Financial Constraints) +ß2(Investment)+ ß3(Sensitivity)

It is hereby proposed that Cash Flow is the variable dependent on three independent variables:

Financial Constraints; Investment; and Sensitivity

The estimation of the proposed model is

Ye = -1001.86 + 8.84* Financial Constraints + 95.17* Sensitivity + 1.51* investment

Here Ye is the estimated value of Cash Flow

The least-squares estimates of the ß-values are denoted by b-values; thus, b1 is the estimate of ß1 and b2 is the estimate of ß2 (in this present case, b1 = 8.84, and b2 = 95.17

It can be said that the data has been supported (with nearly 98% accuracy), hence the hypothesis that Financially constrained groups of firms have higher cash flow sensitivities as compared to financially unconstrained ones is accepted

Discussion of Results

The results obtained as a result of this analysis have suggested that investment-cash-flow sensitivities do not increase in a monotonical fashion nor do they decrease inline with dividend payout-ratios, sizes, leverages, or cash holdings. Instead, the findings present evidences of inversely related ‘u-shape’ of investment-cash-flow sensitivity and proxies of financing constraints: since the average levels of the samples increased, with an initial increment of investment-cash-flow sensitivity, and finally decreased. The earlier part of the analysis suggested the possibility of sorting criteria used were not related to the financing-constraints and the investment-cash-flow sensitivity was not dependent on the level of financing-constraints entirely.

Conclusion and Suggestions

This paper was developed as a need to test the hypothesis that ‘financially constrained groups of firms have higher cash flow sensitivities as compared to financially unconstrained ones’- the work will equally test sample using eViews. The study was instituted by the need to access in a deterministic manner the possibilities of investment-cash-flow being monotonic inline with a firm’s financing constrict. From research conducted, it can be said that the hypothesis that financially constrained groups of firms have higher cash flow sensitivities as compared to financially unconstrained ones is accepted

Reference List

Ang, J. S., 1991. Small business uniqueness and the theory of financial management. The Journal of Small Business Finance, 1(1), p.1-13.

Ang, J. S., 1992. On the theory of finance for privately held firms. The Journal of Small Business Finance, 1(3), p.185-203.

Berger, A. N. and Udell, G. F., 1998. The economics of small business finance: The roles of private equity and debt markets in the financial growth cycle. Journal of Banking & Finance, 22(6-8), p.613-673.

Carpenter, R. E. and Petersen, B. C., 2002. Is the growth of small firms constrained by internal finance? The Review of Economics and Statistics, 84(2), p.298-309.

Cassar, G. and Holmes, S., 2003. Capital structure and financing of SMEs: Australian evidence. Journal of Accounting and Finance, 43(2), p.123-147.

Chittenden, F. Hall, G. and Hutchinson, P., 1996. Small firm growth, access to capital markets and financial structure: Review of issues and an empirical investigation. Small Business Economics, 8(1), p.59-67.

Fazzari, S. M. Hubbard, R. G. and Petersen, B. C., 1988. Financing constraints and corporate investment. Brooking Papers on Economic Activity, 1998(1), p.141- 206.

Fazzari, S. M. Hubbard, R. G. and Petersen, B. C., 2000. Investment-cash flow sensitivities are useful: A comment on Kaplan and Zingales. The Quarterly Journal of Economics, 115(2), p.695-705.

Gompers, P. and Lerner, J., 1998. What Drives Venture Capital Fundraising? Brookings Papers on Economic Activity. Microeconomics, 1998(98), p.149-204.

Gompers, P. and Lerner, J., 2001. The Venture Capital Revolution. Journal of Economic Perspectives, 15(2), p.145-168.

Gregory, B. T. Rutherford, M. W. Oswald, S. and Gardiner, L., 2005. An empirical investigation of the growth cycle theory of small firm financing. Journal of Small Business Management, 43(4), p.382-392.

Guariglia, A., 2008. Internal financial constraints, external financial constraints, and investment choice: Evidence from a panel of UK firms. Journal of Banking & Finance, 32(9), p.1795-1809.

Hellmann, T. and Puri, M., 2002. Venture Capital and the Professionalization of Start-Up Firms: Empirical Evidence. The Journal of Finance, 57(1), p.169-197.

Hogan, T. and Hutson, E., 2005. Capital structure in new technology-based firms: Evidence from the Irish software sector. Global Finance Journal, 15(3), p.369- 387.

Holmes, S. and Kent, P., 1991. An empirical analysis of the financial structure of the small and large australian manufacturing enterprises. Journal of Small Business Finance, 1(2), p.141-154.

Hoshi, T. Kashyap, A. and Scharfstein, D., 1991. Corporate structure, liquidity, and investment: Evidence from Japanese industrial groups. The Quarterly Journal of Economics, 106(1), p.33-60.

Hovakimian, A. and Hovakimian, G., 2009. Cash flow sensitivity of investment. European Financial Management, 15(1), p.47-65.

Hovakimian, G., 2009. Determinants of Investment Cash Flow Sensitivity. Financial Management, 38(1), p.161-183.

Hsu, D. H., 2004. What Do Entrepreneurs Pay for Venture Capital Affiliation? The Journal of Finance, 49(4), p.1805-1844.

Iona, A. Leonida, l. and Ozkan, A., 2006. On the Relationship between the Investment- Cash Flow Sensitivity and the Degree of Financing Constraints. Economics Department Discussion Paper Series, 14, p.6-12.

Jain, B.A., 2001. Predictors of Performance of Venture Capitalist-backed Organizations. Journal of Business Research, 52(3), p.223-233.

Jensen, M.C. and Meckling, W.H., 1976. Theory of the firm: Managerial behaviour, agency costs and ownership structure. Journal of Financial Economics, 3(4), p.305-360.

Jensen, M.C., 1986. Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers. American Economic Review, 76(2), p.323-329.

Kadapakkam, P. Kumar, P. and Riddick, L. A., 1998. The impact of cash flows and firm size on investment: The international evidence. Journal of Banking & Finance, 22(3), p.293-320.

Kaplan, S. and Zingales, L., 1997. Do investment-cash flow sensitivities provide useful measures of financing constraints? The Quarterly Journal of Economics, 112(1), p.169-215.

Lewellen, W. G. and Badrinath, S. G., 1997. On the measurement of Tobin’s q. Journal of Financial Economics, 44(1), 77-122.

López-Gracia, J. and Aybar-Arias, C., 2000. An Empirical Approach to the Financial Behaviour of Small and Medium Sized Companies. Small Business Economics, 14(1), p.55-63.

Myers, S. C. and Majluf, N. S., 1984. Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), p.187-221.

Paul, S. Whittam, G. and Wyper, J., 2007. The pecking order hypothesis: does it apply to start-up firms? Journal of Small Business and Enterprise Development, 14(1), p.8-21.

Sahlman, W. A., 1990. The structure and governance of Venture-Capital Organizations. Journal of Financial Economics, 27(2), p.473-521.

Titman, S. and Wessels, R., 1988. The Determinants of Capital Structure Choice. The Journal of Finance, 43(1), p.1-19.

Vogt, S., 1994. The cash flow/investment relationship: evidence from U.S. manufacturing firms. Financial Management, 23(2), p.3-20.

Watson, R. and Wilson, N., 2002. Small and Medium Size Enterprise Financing: A Note on Some of the Empirical Implications of a Pecking Order. Journal of Business Finance & Accounting, 29(3-4), p.557-578.