Most countries have a free market economy. The market forces of demand and supply determine the price of various products in a free market economy. There is usually very little interference from the government or regulatory bodies. High demand and low supply lead to a rise in the price of various products. On the other hand, low demand and high supply would lead to low prices. Governments or relevant agencies may fix the minimum price of certain products to protect the income of the producers (Sloman & Wride, 2009, p. 52). On the other hand, governments or relevant agencies may fix the maximum price of a product to protect the interests of consumers (Sloman & Wride, 2009, p. 52).

Coffee is one of commodities that provide a clear illustration of the problems that confront the producers of agricultural raw materials. Approximately 125 million people in developing countries depend on coffee for their livelihoods. However, the price of the commodity keeps fluctuating wildly. This makes coffee an unreliable product (Burnell, Randall & Rakner, 2010, p. 78). Production of coffee by Brazil determines the global prices of coffee as Brazil is the world’s largest coffee producer. Low harvest of coffee in Brazil reduces the global supply of the commodity. This leads to a significant increase in the price of the product in the international market. One instance that portrays the effect of the quantity of Brazilian coffee on the global coffee prices is the price hike of coffee in 1977. During the year, frost destroyed most of the country’s coffee harvest. This reduced the global supply of coffee leading to a significant increase in the price of the product. The price of coffee in the international market reached $3000 per tonne. Two years earlier the price of coffee was $500 per tonne. After reaching the peak of $3000 per tonne, the price of the product declined in subsequent years and stabilised at around $350 per tonne (Burnell, Randall & Rakner, 2010, p. 78).

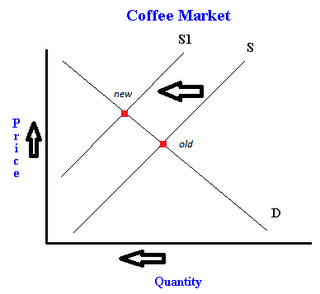

The above graph shows how reduction in supply affects the price of coffee. Reduction in supply does not affect the demand leads to an increase in the equilibrium price and quantity. This was the factor that led to the increase in the price of coffee in 1977.

The price hike of coffee in 1977 made certain countries reap huge financial benefits from coffee farming. This prompted other people to venture into coffee farming as it was very profitable (Burnell, Randall & Rakner, 2010, p. 78). This created a surplus of the product, as the demand was unable to cope with the increased supply. This led to a shift in the market equilibrium price of coffee to a lower price (Sloman & Wride, 2009, p. 45). The World Bank exacerbated this problem by encouraging countries to grow coffee. Some of the countries that started growing coffee due to the World Bank’s initiative include Vietnam. In fact, Vietnam is currently one of the major producers of the product. It accounts for 10% of global production of coffee (Burnell, Randall & Rakner, 2010, p. 78). Weather conditions play a critical role in determining the price of coffee. Weather conditions may lead to reduced production in some regions leading to an increase in the price of coffee in the global market. This reduces the control that farmers have on the price of coffee since they cannot control the weather conditions.

In addition, the structure of the coffee industry makes it difficult for retail farmers to have a significant effect on the price of the product. Small-scale farmers account for a significant percentage of the total global coffee production. However, a small number of large-scale producers who have enormous powers that enable them to control the retail price of the commodity. In addition, there are very many intermediaries between the small-scale farmers and retailer of the final product. In some instances, coffee there may be more than 150 intermediaries between the farmer and retailer of the final product. The large number of intermediaries reduces the proportion of the final price that reaches the farmer. A clear example is the fact that despite coffee having a $30 billion retail market in the 1990s, farmers received between $10 and $12 billion (Burnell, Randall & Rakner, 2010, p. 78). Millions of farmers received approximately $10 billion, whereas a few thousand of intermediaries received approximately $20 billion. This shows that intermediaries wield vast powers over the coffee farmers.

Speculators also play a critical role in regulating the price of coffee. When speculators foresee a shortage in the coffee, they usually buy huge quantities of the product at a low price. During periods of shortage, speculators release certain quantities of the product into the market at a significantly higher price. Speculators help in stabilising the price of coffee since if they did not buy the product prior to the shortage, the shortage would have been worse. This would have led to extremely high prices of the product (Greaves, 2007, p. 97).

The price of coffee is a clear example of how market forces may work to the detriment of the producer. Small independent farms account for a sizeable percentage of the global coffee production. Small scale farmers have little control of the price of coffee in the retail market. Intermediaries and large scale farmers control the price of coffee in the retail market.

References

Burnell, P, Randall, V & Rakner, L 2010, Politics in the developing world, Oxford University Press, Oxford.

Greaves, BB 2007, Free Market economics: A reader, Ludwig von Mises Institute, Auburn, AL.

Sloman, J & Wride, A 2009, Economics, 7th edition, Pearson Education, London.