SWOT stands for Strength, weakness, opportunity and threat of a company while some of such variables of General Electric are –

Strengths

Some stronger criteria of GE are –

- General Electric Co. (GE) has long experience as it established in 1892;

- GE has a strong brand image in the global market;

- According to annual report 2009 of GE, General Electric maintained position as forth most valuable brand with a valuation of nearly $50 billion according to one survey;

- It has about 304,000 skilled dynamic, highly motivated, and well-trained employees. Among them 134,000 employees are the US citizen;

- Furthermore, it has effective administrative control over the employees as it uses 31 languages to communicate with the employees.

- GE has strong financial capabilities to expand its business operation all over the world;

- In 2009, GE’s net income was $10.70 billion, total assets was $782.0 billion, total equity was $117.0 billion, strong industrial cash flow from operating activities (CFOA) was $16.60 billion, and consolidated cash at year-end was $72.0 billion (General Electric, 2009);

- GE has reduced its total operating costs by $6 billion;

- It has ability to offer more customer value at a lower cost than any of our competitors;

- In addition, General Electronic possesses unique expertise and incessant competitive advantage over competitors along with economies of scale, supply chain management, positioning strategy, remarkable performance in consumer care and successful implementation of future strategic plan;

- It has control over the subsidiaries of the company; so It earns huge profit from subsidiaries like GE Energy, GE Technology Infrastructure, GE Capital, NBC Universal, GE Home & Business Solutions (Karan, 4);

- The company always appreciates recruitment of paramount R&D personnel. In 2009, R&D operating cost was $535 million, which was a 7% rise since that in 2008;

- Moreover, GE has more than 40,000 engineers and scientists all over the world, who engage to introduce modifying industry-specific solutions;

- It has effective audit procedure to measure internal risks, key credit risks, liquidity risks, market risks, and profitability of new business sector;

- Diversified product line is one of the strong point of the company;

- Finally, GE has capability to offer low price for its products and services.

Weaknesses

Some vulnerable factors are –

- GE has to face problem with expatriate recruiting and selection process to reduce staff redundancy rate; however, it has more than 170,000 expatriate employees;

- Integration of local rules and regulations;

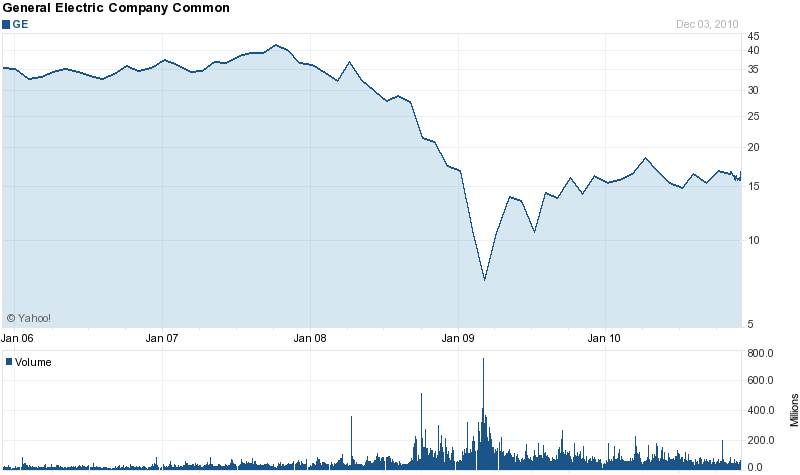

- Share price is decreasing in New York stock exchange;

- Frequent change of exchange rates, interest rates, contamination of its products and for increase of product liability claim, it has to change its operation management (Karan).

Opportunities

General Electric has huge opportunities, such as –

- GE is highly diversified company, so it can introduce new products easily in this competitive market. Karan stated that GE offers industrial products, for example, jet engines and gas turbines, but it has a significant presence in consumer businesses such as home appliances (refrigerators and dishwashers) and consumer finance (financial products such as credit cards and mortgages);

- It has opportunity to be world market leader as its position is still behind Coca-Cola, Microsoft and IBM;

- However, GE has the scope to provide high quality products and quick customer service with high satisfaction;

- General Electric (34) forecasted the last three year’s financial data of the company which showed that its annual revenue has increased each year from all business segments;

- According to annual report 2009 of GE, it has financial capabilities to takeover medium sized companies or merger with other large companies to spread out its business worldwide.

Threats

Some challenging issues are-

- The biggest apprehensive threat for General Electric is the global financial crisis because long lasting recessionary period may lead to falling sales;

- It endures intense competition in the international market;

- Volatile price of raw materials, unstable market, and other risk factors are also major threats for the company;

- According to the annual report 2009 of GE, possible risks of the company are higher receivable delinquencies and bad debts, delays, or cancellations of sales and orders mainly associated to power and aircraft equipment, and slowdown in established financial services activities, and so on.

Stock Performances of GE

Yahoo finance (2010) suggests that the stock prices of GE has always been quite steady and enough attractive for drawing attention of investors; however, in recent financial downturn, the stock prices of GE declined significantly which created practical difficulties for the business. The figure below shows that from January 2006 to mid 2008, GE has enjoyed rather constant share prices, which started to fall from the very beginning of January 2009 due to adverse economic-environment. Nevertheless, it is arguable that along with GE recovering from the financial crisis, its stock prices have also started to revive from 2010.

Future Company Plans

- General Electric plans to work jointly with AVIC in order to construct the most sophisticated open architecture avionics throughout the globe for the industrial aviation sector; these joint cooperation between the two companies would help General Electric to form a competent business organization with a global strategy to benefit China and the United States;

- The company has a future intention to focus on business expansion strategy and it is rather committed to achieve optimistic growth; in addition, GE wants to facilitate and fuel up an American growth renewal;

- With a plan to achieve competitive advantage over its competitors, GE will be expending more on the development and formation of a strong technological infrastructure, IT specialization, and other technical expertise; moreover, with the same vision, it will be upgrading its manufacturing capabilities and selling its products in every corner of the world;

- At GE Audit Committee meeting, the senior-management has planned to concentrate on increasing the efficiency level of employees at every level of the GE to develop risk management skills and financial services-portfolio as well as improving risk-oversight-processes to handle every rudiments of risk managed by ERMC; risk-management-professionals would include underwriters, portfolio managers, collectors, environmental-engineering specialists, and specialized asset managers;

- General Electric’s loss alleviation plan will diminish financial loss and can bring about price cutback, primary moderation, expansion, self-control, or supplementary proceedings that can cause the correlated credit to categorize like a troubled-debt-restructuring (TDR); in fact, this policy will help the company in well management of financials during bad economic times like global financial crisis;

- The decision makers at GE hope to develop and enhance the superiority of its healthcare for patients by associating along with general practitioners, doctors, and other stakeholders to concentrate more on modernization and invention practices that purify healthcare-procedures and speed-up caring standards; this would help GE to capture bigger market share and ensure more secured market position for future;

- The company would support its cost cutting strategies by a number of methods; one of the key strategy of the business is to make its production process more lean by introducing a number of approaches (for example, just in time approach, total quality management, total productive maintenance, etc) by replacing unproductive human resources with latest technological assistance;

- With a vision to ensure more convenient customer service and support easier access to the services of GE, the company’s strategy is to expend more on convenience assurance proposals; this, according to the company’s specialists, would raise to company’s revenues by attracting more people toward its services;

- The future objective of lowering the environmental impacts of the business resulting from its operations has made GE to invest in a number of sectors to protect ecological concerns; GE Capital’s Energy Financial Services division has prepared the renewable energy investments and planned creating “green-collar” jobs and assisting US to raise power-generation from renewable-sources, supporting invention, and attracting foreign-investment;

- The top management of the company believes that for such a large business like GE, it is important to ensure that the leadership qualities of the managers remain intact in future; therefore, it intends to train and impose leadership instincts among tomorrow’s leaders with a view to continually assess and enhance talent.

Works Cited

General Electric. Annual report 2009 of General Electric. 2009. Web.

Karan, Len. General Electric. 2010. Print.

Yahoo finance. Basic Chart: General Electric Co. (GE). 2010. Web.