Abstract

Financial markets have been under a lot of pressure, volatility, and uncertainty since COVID-19. Since the end of February 2020, global financial markets have been in a state of extreme uncertainty. Unlike other pandemics, the spread rate of COVID-19 is much higher and more challenging to control. This paper examines the impact of COVID-19 on the global financial market and the harmful effect of the pandemic on the worldwide economy. The main negative trends of the modern world economy at the end of 2020 are summarized. The author highlights the economic costs of the spread of the COVID-19 pandemic. Proposals were formulated for the implementation of monetary policy in the context of the COVID-19 pandemic.

The analysis of economic policy measures taken in the world’s leading countries to smooth out the adverse effects of the spread of the global COVID-19 pandemic was also carried out. Under the conditions of the corona crisis, the economic damage associated primarily with quarantine restrictions led to a synchronous shock in the financial markets. The article will be of interest to economists and political scientists, stock market analysts, specialists in the field of the world economy, and people interested in the state of affairs in the world.

Introduction

The pandemic of the new coronavirus infection COVID-19 began in the city of Wuhan in the central Chinese province of Hubei in 2019. As of May 28, 2020, there were more than 5.8 million confirmed cases of the disease, approximately 360,000 deaths from the virus (Phan & Narayan, 2020, para 2). As of December 4, 2020, there were more than 65.9 million confirmed cases of the disease, approximately 1.5 million deaths, and 45.6 million cases of recovery from the virus (Boone et al., 2020, p. 30). Thus, for six months of 2020, the situation in the world has worsened, despite the measures taken. The rapid spread of the pandemic creates a problem in economic forecasting since it is difficult to predict when precisely restrictive measures should be lifted. There is a constant threat of a new outbreak of the virus, which may entail new restrictions and prohibitions that will affect the global economy.

This paper is devoted to assessing whether the new coronavirus infection has affected the increase in mortality in the world. Also, it is necessary to discover what effect the spread of the pandemic has had on the global energy and stock market and what difficulties the world trade is experiencing. The author used demographic indicators of the world’s countries, stock indices, and statistical data on world trade turnover as part of the research.

Analysis

Specialists in global health immediately put forward several recommendations as the first line of defense to reduce the spread of the coronavirus. Among them, face masks, frequent hand washing, social distancing, and self-isolation can be listed. These measures have implications for businesses around the world. The trade stoppage has harmed small and medium-sized enterprises, which cannot exist without constant consumer demand. There is an unprecedented high level of unemployment in many countries due to the disruption of labor and trade markets. In addition, as a result of the long period of self-isolation, the level of domestic violence and suicide has increased.

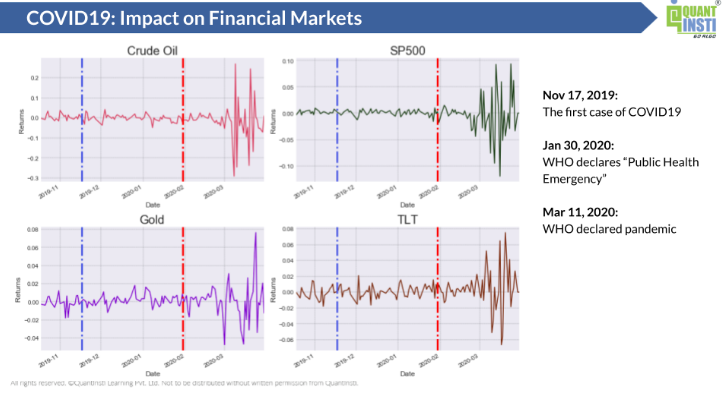

The coronavirus has led to economic costs and, undoubtedly, can cause an unprecedented economic downturn across the globe. Even health experts have provided various suggestions, but the nature virus is difficult to predict, so it is problematic to develop the right macroeconomic policy to contain it (Klose & Tillmann, 2021). There is always a threat of a mutation of the virus or a new, unexpected outbreak, the place of which is complicated to project. COVID-19 began to threaten the health of citizens of various countries and the very basis of the world economy. Figure 1 shows the impact of COVID-19 on global financial markets (Ozili & Arun, 2020). It becomes evident that the fluctuations in stock market indices were insignificant until the World Health Organization declared a state of emergency.

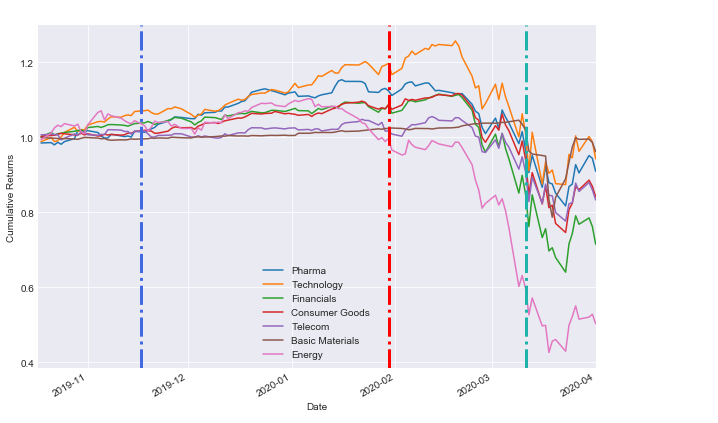

Due to high economic uncertainty, global stock markets experienced a crash, losing approximately six trillion dollars in one week from February 24 to 28, 2020 (Nicola et al., 2020). This paper aims to analyze the impact of the COVID – 19 pandemic on the world economy. Figure 2 clearly shows which industries were most and least affected by the worldwide pandemic (Ozili & Arun, 2020). Pharmaceuticals and technology were the least affected of all other sectors, and the energy sector was the most severely affected.

The pandemic provoked an economic and health crisis both in the world as a whole and in the economies of individual countries. To solve the spread of the virus, the heads of state decided to take serious measures. They are complete isolation, border closure, quarantine, travel restrictions, and complete closure of enterprises. These measures reduced the supply of goods, compounded by a panic accumulation of stocks and a collapse in demand due to self-isolation (Klose & Tillmann, 2021). But the most important thing that the pandemic has led to is a massive increase in demand for medical products. This fact caused instability in other sectors of the economy since spending on non-essential goods is reduced for most consumers under quarantine. Nevertheless, the pharmaceutical industry has not suffered as much as other areas of the financial market.

The slowdown of the Chinese economy as the leading supplier of consumer and manufacturing goods has led to an imbalance in the global commodity markets due to the disruption of the supply chain (Liu et al., 2020). Unemployment has increased, and the population’s inflation rate and impoverishment have increased (Liu et al., 2020). The turmoil hit global financial markets, and significant stock indexes began a sharp decline (Nicola et al., 2020).

The global financial system is suffering huge losses due to the outbreak of the coronavirus pandemic. The state of stock markets is always affected by external factors, for example, the global financial crisis of 2008. It should be noted that non-economic factors, such as epidemics affect stock indices. March 25, 2020, The US Senate has adopted a package of urgent assistance and economic incentives totaling $ 2 trillion to combat the consequences of the coronavirus pandemic (Boone et al., 2020, p. 47). In March 2020, trading on the US financial exchange was stopped several times for more than a week. It is an unusual case: previously, this happened only once in 1997.

The stock index in Hong Kong, South Korea, and Australia is falling by more than 5% daily (Better Policies for Better Lives). In China, it is about 3%, and in the UK, the stock index collapsed by more than 10% on March 12, 2020, which was the lowest since 1987 (Boone et al., 2020, p. 50). On the Japanese stock Exchange, the decline in stock indices was more than 20% compared to their peak values in 2019 (Boone et al., 2020, p. 50). Stock markets around the world have shown colossal volatility, never seen before. Due to the coronavirus epidemic, the Chinese consume less foreign goods (Zhang, 2020). This problem is particularly acute for American automobile manufacturers. The negative effect of the reduction in the production of American interests in China is very noticeable.

Sharp changes in the stock market resulted from news about the COVID-19 outbreak in the United States in mid-February-early March 2020. The subsequent fluctuations in March – late April 2020 were associated with the stock market’s reaction to the political decisions taken by the US government in connection with the spread of the pandemic. It is expected that by the end of 2021, the decline in world trade will be 13-32%, as the COVID-19 pandemic disrupts regular economic activity and life around the world (Baker et al., 2020). Due to the Covid-19 outbreak, there was a serious disruption of the labor and trade markets, which led to a rapid increase in unemployment in many countries. Unemployment negatively impacts world trade, as the level of tension among the population is growing, the middle class is decreasing, and people’s real incomes are falling.

The immediate goal is to bring the pandemic under control and mitigate the economic damage to people, companies, and countries. Politicians should start planning for the consequences of the pandemic. Global trade was already slowing in 2019, even before the outbreak of the pandemic, due to rising trade tensions and slowing economic growth. World trade in goods recorded a slight decrease in 2019 by -0.1% in physical terms after an increase of 2.9% in 2018 (Khatatbeh, Hani, & Abu-Alfoul, 2020, p. 510). Meanwhile, the dollar value of world commodity exports in 2019 fell by 3% and amounted to $ 18.89 trillion (Khatatbeh, Hani, & Abu-Alfoul, 2020, p. 510). The growth rate was slower than in 2018 when trade in services grew by 9% (Khatatbeh, Hani, & Abu-Alfoul, 2020, p. 508). It is difficult to assess the scale of the economic shock caused by the global pandemic.

Discussion

COVID-19 caused a blow to the world economy, demonstrating the inability of politicians, economists, and scientists to cope with such a global challenge. It seems that the countries of the world, as the virus spreads, should adopt the most successful solutions from each other (Klose & Tillmann, 2021). Such measures include the allocation by the European Union of more than 35 billion euros to protect the economy from the influence of Covid-19. This amount was used to support enterprises and companies that suffered heavy losses due to the pandemic. The UK has increased the loan size, while people have the opportunity not to pay interest during the first six months. The impact of the COVID-19 pandemic itself is likely to be less than the impact of extreme restrictive measures taken to prevent large-scale infection (Klose & Tillmann, 2021). Although the virus is very contagious, its lethality is not higher than seasonal flu in most cases.

The policy measures such as reducing trips and flights, closing various industries and shops for quarantine, and reducing the social activity of citizens may harm the economy. If it is not effectively managed with the help of competent economic policies, a pandemic can develop into a global financial crisis that can hinder globalization (Ashraf, 2020). After the stock market crash in the spring of 2020 in the United States, the Federal Reserve System announced a zero interest rate policy. The UK government has introduced a package of policy measures in response to COVID-19, such as the job preservation scheme (Phan & Narayan, 2020). It reduced working hours to zero without laying off employees, minimizing the future costs of finding and re-hiring staff.

Conclusion

COVID-19, which has spread to more than 200 countries, has enormous consequences for the economy of both individual countries and the whole world. Public policy measures taken in respective countries to mitigate the economic costs can have significant adverse effects in the long term. The COVID-19 outbreak has created an imbalance in the global economy due to the disruption of the supply chain due to the closure of production in China. Quarantine measures imposed by countries to smooth the spread of the pandemic continue to affect the economic situation in the world negatively.

Surprisingly, the pandemic has shown much fewer negative consequences on the global economy than the radical measures taken by governments. However, due to the virus, there was a sharp and significant drop in global stock markets. All countries need to work together and coordinate their actions to cope with the negative consequences of the pandemic and restrictions as quickly and effectively as possible. It is imperative to direct medicine and the economic efforts, reduce the unemployment rate, and restore all trade supplies. Fiscal measures aimed at supporting the manufacturing sector will also be required to accelerate the economic recovery. Another step may be to reduce the tax burden on businesses and the population.

References

Ashraf, B. N. (2020). Economic impact of government interventions during the COVID-19 pandemic: International evidence from financial markets. Journal of behavioral and experimental finance, 27, 100371. Web.

Baker, S. R., Bloom, N., Davis, S. J., Kost, K., Sammon, M., & Viratyosin, T. (2020). The unprecedented stock market reaction to COVID-19. The review of asset pricing studies, 10(4), 742-758. Web.

Better Policies for Better Lives: Global financial markets policy responses to COVID-19. (2020). Web.

Boone, L., Haugh, D., Pain, N., & Salins, V. (2020). Tackling the fallout from COVID-19. Economics in the Time of COVID-19, 37. Web.

Khatatbeh, I. N., Hani, M. B., & Abu-Alfoul, M. N. (2020). The impact of Covid-19 pandemic on global stock markets: an event study. International Journal of Economics and Business Administration, 8(4), 505-514.

Klose, J. & Tillmann, P. (2021). COVID-19 and Financial Markets: A Panel analysis for European countries. Jahrbücher für Nationalökonomie und Statistik, 241(3), 297-347. Web.

Liu, H., Manzoor, A., Wang, C., Zhang, L., & Manzoor, Z. (2020). The COVID-19 outbreak and affected countries stock markets response. International Journal of Environmental Research and Public Health, 17(8), 2800. Web.

Nicola, M., Alsafi, Z., Sohrabi, C., Kerwan, A., Al-Jabir, A., Iosifidis, C., Agha, M & Agha, R. (2020). The socio-economic implications of the coronavirus pandemic (COVID-19): A review. International journal of surgery, 78, 185-193. Web.

Ozili, P. K., & Arun, T. (2020). Spillover of COVID-19: impact on the Global Economy, 8(2), 177-196.

Phan, D. H. B., & Narayan, P. K. (2020). Country responses and the reaction of the stock market to COVID-19—A preliminary exposition. Emerging Markets Finance and Trade, 56(10), 2138-2150. Web.

Zhang, D., Hu, M., & Ji, Q. (2020). Financial markets under the global pandemic of COVID-19. Finance Research Letters, 36, 101528. Web.