Executive Summary

Google, a global technology company, was established by Larry Page and Sergey Brin. Despite its success in diversifying its line of goods, Google still faces intense competition and depends on advertising income, which could be changed by emphasizing investing in new services. The strategy, competitive position, performance, portfolio of the company, and multiple evaluations of Google will all be included in this report. The paper will conclude with a prediction of Google’s performance in the future and a look at its chances of transforming the markets it serves.

Introduction

Companies are founded daily due to the ability to reach various customer groups in different parts of the world. However, despite many businesses striving to enter the international arena, not every firm has the opportunity to do so. In order to become successful and widely recognized, a firm must consider not only market trends and competition but entry barriers and ways to offer unique products.

Google is among the corporations that have been conducting business for more than two decades. Its success comes from disrupting the industry by offering various technological products and services. However, despite success in product line diversification, Google is still subject to fierce competition and dependence on advertising revenue, which should be resolved by investing in new services.

Context

Google’s Competitive Position

Google conducts its business in the technological sector, specifically in artificial intelligence, software, cloud computing, and advertising. Rapid development and innovative and disruptive technology define the sector in which Google operates (Alphabet, 2022). The company is subject to fierce competition in all facets of its operations. This includes, but is not limited to, search engines and information services, online advertising platforms and networks, platforms for digital content, enterprise cloud services, digital video services, and social networks (Alphabet, 2022). Therefore, there are many factors that the company must consider for a competitive position.

The Google industry is saturated with services from limited companies of similar size. Specifically, the two companies have finally grown to comparable sizes and are now substantially undermining Google’s once-viable business strategy. These businesses are Facebook and Amazon, which have shown to be far more ambitious in their development plans than Google.

Marketline (2020) states that Facebook accounted for 19.2% of all digital advertising in 2020, compared to Google’s 36.2%. Facebook has experienced the greatest negative influence on Google’s share in particular, even if the next two competitors, Snap and Amazon, have done much to decrease the market capitalization of both businesses.

Another internet behemoth that has acted strongly against Google is Amazon. However, apart from the mergers and acquisitions that gave Amazon businesses like Whole Foods Market, the key tactic that has worked against Google is its persistent e-commerce monopolistic practices (MarketLine, 2020). Such fierce competition is a threat not only to Google but to other companies as well.

The capacity of Google to create, market, and sell cutting-edge goods and technology is crucial to its ability to compete successfully. For instance, to compete in advertising, Google must attract and retain customers based on the relevancy of the company’s marketing and the overall usefulness, safety, and accessibility of goods and services (Alphabet, 2022). The company must additionally focus on advertisers, mostly because of its capacity to produce sales leads and, eventually, customers and effectively convey its commercials through various distribution channels (Alphabet, 2022).

Lastly, effective competition depends on content providers, particularly on the caliber of the advertising base, Google’s capacity to assist these partners in generating advertising income, and the conditions of contracts with them (Alphabet, 2022). Consequently, it can be seen that Google must employ a holistic approach to its competitive advantage.

Porter’s Five Forces

A strategic tool for examining an organization’s competitive environment is Porter’s Five Forces. According to this model, there are five forces that affect a market’s efficiency and appeal (Pinto, 2020). For example, among the factors are the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitutes, and the intensity of rivalry (Pinto, 2020). As a result, these aspects can help determine the intensity, viability, and attractiveness of Google’s industry.

The first factor, the threat of new entrants, is minimal in Google’s technological sector and industry. Here, the main issue for start-up companies and potential firms is the fact that there are high barriers to entry. These usually involve substantial starting capital and cutting-edge technological skills (Brice et al., 2021). As a result, new entrants cannot disrupt the industry and cannot offer innovative services and products.

Another factor is that the bargaining power of buyers is limited as well. The artificial intelligence, cloud services, marketing, and software industry has high demand, implying that consumers have little leverage in price negotiations (García Márquez, 2022). Additionally, Google has many opportunities and alternatives in terms of suppliers. Consequently, suppliers’ bargaining power factors show that suppliers can neither lower the quality of their services nor have a strong negotiating strength.

However, what is noteworthy is that due to the availability of alternatives for products and services, the threat of substitutes is significant. The cloud services and artificial intelligence industry sees a growing demand since modern issues jeopardize the safety of many individuals and businesses (García Márquez, 2022). Among the problems frequently faced by customers are “data leakage, compromised apps, data misuse, privacy concerns, data location, protection at the device level, and data replication” (García Márquez, 2022, p.26). Finally, the intensity of rivalry is significant since, as seen above, the existence of several strong competitors in the technology sector can undermine the position of Google.

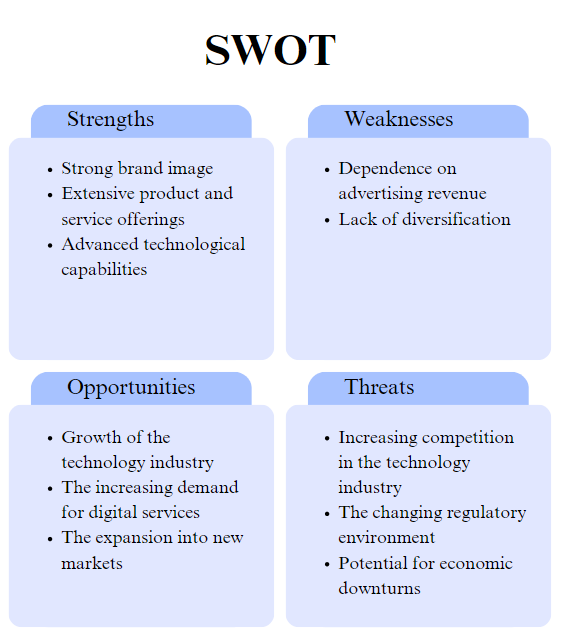

SWOT

Google’s strengths, weaknesses, opportunities, and threats can be analyzed using the SWOT analysis. As seen in Figure 1, while Google has several strengths, providing it with competitive advantages, there are still major industry-related threats. For example, the company’s strengths are its well-known brand, a wide range of goods and services, and cutting-edge technological skills.

Meanwhile, among the weaknesses is Google’s high reliance on advertising revenue, which will be emphasized further in the report. This dependence on advertising revenue additionally contributes to the lack of diversification. Google mainly focuses on its marketing services, which decreases the differentiation of goods, making it vulnerable to changes in global trends (Google, n.d.a). However, when using the SWOT analysis, it is crucial to consider such aspects as threats and opportunities.

Regarding opportunities, the first one that should be emphasized is the growing demand in the technology industry. Currently, there is macroeconomic uncertainty, making technology companies experience growth challenges (Deloitte, 2023). However, as indicated above, the demand for artificial intelligence, software, and cloud services increases due to heightened security breaches.

Moreover, there are opportunities for Google to expand into new markets and grow the industry. According to a well-known consulting firm, Deloitte (2023), the IT industry is expanding into other sectors in search of new economic opportunities, employing technological improvements to foster innovation and change. Real estate, manufacturing, and commerce are among the many industries that IT businesses are attempting to change while increasing efficiency and fostering innovation (Deloitte, 2023). Therefore, Google has several possibilities to increase its revenue and recognition.

Nevertheless, there are threats that can put the growth and demand for Google’s services at risk. The most significant threat is the fierce competition in the industry. At the moment, Facebook and Amazon are Google’s largest rivals, owing to their rapid growth and mergers and acquisitions that gave them leverage (MarketLine, 2020).

Another threat to the industry is the potential for an economic downturn. Despite outperforming through the pandemic challenges of 2020–2021, the IT industry was the driving force for significant stock market falls in 2022 (Deloitte, 2023). During economic uncertainty, companies must learn how to adapt to a future economic slump by cutting expenses, improving efficiency, and raising revenues (Deloitte, 2023). Finally, it is necessary to pay attention to the changing regulatory environment. Considering the growth and mergers and acquisitions, issues concerning market monopolization can arise.

Situation

Another aspect that must be considered when analyzing Google is its current situation. Google is an international technology firm focusing on electronic goods, advertising, computer software, cloud computing, quantum data processing, and search engine technologies (Google, n.d.b). It was founded by Larry Page and Sergey Brin in 1998 in California (Google, n.d.b). As a result of such an extensive period of conducting business, Google could achieve significant financial results.

Assessment of Portfolio of Businesses

First, it is noteworthy that Google has a specific portfolio of businesses that includes Google Services, Google Cloud, and other bets. Building practical items that can enhance the quality of life of millions of people globally has always been a priority for the given business. Ads, Android, Chrome, hardware, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube are some of the leading platforms as well as services offered by Google Services (Alphabet, 2022). These goods and platforms are widely used by consumers all across the world.

Furthermore, Google was a cloud-based firm from the beginning and still makes investments in Google Cloud products. These products mainly include Google Workspace and Google Cloud Platform (Alphabet, 2022). Google Cloud Platform offers advanced software in the areas of infrastructure, information, statistical analysis, artificial intelligence, and machine learning (Alphabet, 2022). Its cybersecurity tools assist users in identifying, defending against, and responding to various cybersecurity threats (Alphabet, 2022). Therefore, Google’s open, dependable, and simple software gives clients the flexibility and safety to operate applications on different devices.

Lastly, in Google, technology attempts to address significant issues that impact a wide range of businesses, from enhancing health and transportation technologies to looking into ways to combat global warming. Companies in various growth phases, from those in the research and development stage to ones that have just started to commercialize, are included in the organization’s investment in the portfolio of Other Bets (Alphabet, 2022). Google wants them to grow into vibrant, prosperous companies. Other Bets are autonomous businesses that run their own boards made up of impartial members and outside investors (Alphabet, 2022). Although there is a lot of uncertainty around these early-stage enterprises, they remain an essential part of Google’s portfolio due to the revenue they make and advancing the industry.

Evaluation of Google’s Performance

As for Google’s performance, it can be seen that the company experiences sustainable and healthy growth despite macroeconomic trends and fierce competition. For example, as seen in Table 1, the company revenue increased by 106%, from $136,8 billion in 2018 to $282,8 billion in 2022 (SEC, 2020). Similarly, a growing trend can be seen in the corporation’s net income.

However, after looking closely, one can see that growing from 2018 to 2021, Google experienced a decrease in its net income in 2022 (Alphabet, 2022). This can be explained by looking at the company’s debt. Compared with 2021, Google doubled its debt repayment in 2022, repaying $54 billion and, thus, decreasing its net income (Alphabet, 2022). Therefore, Google’s growth is organic and sustainable, and no outside factors have significantly influenced its financial results. This is why between 2021-2022, as seen in the Appendix, the Net Profit Margin Ratio of Google remained over 20%, implying that for each $1 in revenue, it retains $0.20, which is an indicator of health.

Table 1. Google revenue and net income: A five-year timeframe (in millions).

Source: SEC (2020) and Alphabet (2022).

Table 2. Google’s repayment of debt 2018-2022.

Source: SEC (2020) and Alphabet (2022).

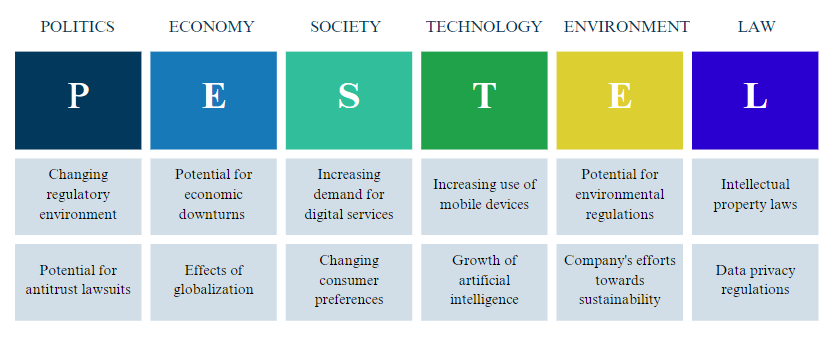

PESTEL

The following strategic tool worth considering is PESTEL, which can be seen in Figure 2. It covers the external environment of the company, focusing on politics, economy, society, technology, environment, and law (MGT9706M, 2023a). In the case of Google, the political issues include the possibility of antitrust actions and the evolving regulatory landscape. As was mentioned in MarketLine (2020), Google’s monopolistic practices are significant risks for the company.

Moreover, the likelihood of economic downturns and the results of globalization are two examples of economic factors. As was emphasized by Deloitte (2023), macroeconomic trends necessitate actions to maintain and protect companies’ operations. Furthermore, the growing demand for digital services and shifting consumer preferences are two examples of social parameters (García Márquez, 2022).

As for technological aspects, the adoption of mobile devices and the development of artificial intelligence are two examples (García Márquez, 2022). Then, the likelihood of environmental legislation and the company’s commitment to sustainability are two examples of environmental variables. Finally, laws governing intellectual property and data privacy are the final legal considerations.

Problem

Pros and Cons of the Strategy

Lastly, it is vital to consider Google’s strategy and the business’s main problem. A firm’s strategy outlines a plan for generating greater value for consumers and outlines how its assets will be used to provide the desired benefit to customers, which clarifies why the organization matters in the market (MGT9706M, 2023b). Google’s strategy is based on a broad differentiation strategy, where the company offers several kinds of products and services that still pertain to one sector. The mission of Google is to assemble all information and ensure that it is valuable and reachable (Google, n.d.a).

In light of this, there are several areas on which the company focuses. The corporation concentrates on the provision and availability of information, privacy maintenance, advertisement promotion, online creator encouragement, and presenting data in the most practical manner possible. Nevertheless, several pros and cons of Google’s strategy must be mentioned.

The first advantage of Google’s chosen strategy is its ability to focus on innovation. Since the beginning of its operations, the corporation has proven its desire to revolutionize the market and introduce groundbreaking developments. For example, as can be seen from the company’s 2010 10-K form, research and development (R&D) in 2010 cost Google $10,417 billion (SEC, 2010). In contrast, the figure almost tripled, with the costs of R&D in 2022 amounting to $39,500 billion (Alphabet, 2022).

Another advantage of the strategy is the ability to diversify. As was seen previously, Google’s services and products include Google Cloud and Google Services, which can be used not only by the public but also by companies. The organization assists individuals, media outlets, and companies of all sizes in prospering and being discovered by others in order to create a thriving ecosystem of new and helpful information in all languages. As a result, various products’ availability decreases dependence on only one good.

However, the company’s main problem is still competition, which is supported by several disadvantages of Google’s strategy. First, the corporation cannot compete with a social media giant like Facebook, which limits Google’s potential in this area. A particularly significant instance of Facebook acting strongly toward Google was its acquisition of Instagram in 2012 (MarketLine, 2020). Facebook took ownership of another wildly popular social media network, thus reducing Google’s advertising market share while gaining significant marketing property (MarketLine, 2020).

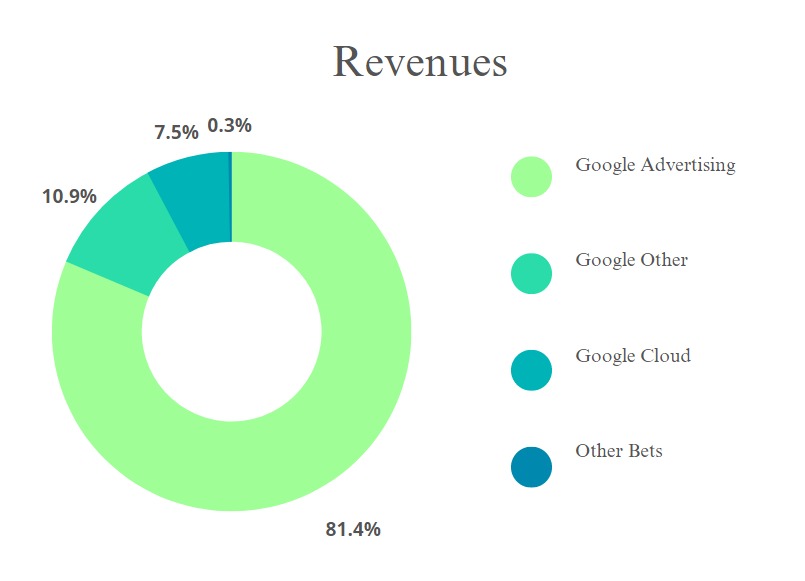

Another disadvantage of Google’s strategy is its reliance on advertising. As can be seen in Figure 3, over 80% of Google’s revenue comes from Google Advertising, with other services and investments accounting for less than 20% of its earnings. As a result, such poor diversification can significantly reduce the company’s competitive position.

The Strategy Diamond

The Strategy Diamond analysis tool can be used to delve deeper into Google’s problems and position. The primary arena of Google is its online search engine market, which millions of people use daily to find information (Alphabet, 2022). However, aside from this, as has been mentioned, advertising is a major part of Google’s operations, and the search engine is helpful in this area.

As for vehicles that are used by the corporation, AdWords, Android OS, and Google Cloud Platform are the most utilized (Alphabet, 2022). Regarding differentiation, search engines’ accuracy and quality are the main differentiator. This allows for precise results and integration of the services offered by Google. Then, its staging is incremental, with Google offering more diverse product lines. The economic logic behind its action is focused on providing free services and generating revenue through advertisements.

Solution

Hence, given its solid financial performance, diverse portfolio of businesses, and emphasis on innovation, Google’s future performance appears to be favorable. Nevertheless, considering its problem related to fierce competition and reliance on advertising revenue, Google needs to continue putting resources into R&D to produce new goods and services. As seen in its annual report, the investments in R&D have tripled since 2010 (Alphabet, 2022).

However, it must focus on the diversification of business areas. It should concentrate on enhancing its social media capabilities in order to compete with Facebook and Twitter, which is feasible considering the firm’s decreasing debt (Alphabet, 2022). To avoid any legal issues that can harm the company’s business, Google must successfully manage regulatory risks. As a result, this will help the company remain competitive and have a significant market share while hedging against the risk in case of failure in advertising operations.

Reference List

Alphabet (2022) 2022 annual report. Web.

Bryce, D. J., Jensen, R. J., Godfrey, P. C., and Dyer, J. H. (2021) Strategic management: concepts and cases. United Kingdom: Wiley.

Deloitte (2023) 2023 technology industry outlook. Web.

García Márquez, F. P. (2022) International conference on intelligent emerging methods of artificial intelligence & cloud computing. Switzerland: Springer International Publishing.

Google (n.d.a) Our approach. Web.

Google (n.d.b) Our story. Web.

MarketLine (2020) Google Inc.: revolutionary business model needs to evolve [Case Study].

MGT9706M (2023a) Analyzing external environment [Lecture].

MGT9706M (2023b) Strategy, business model & competitive advantage [Lecture].

Pinto, J. E. (2020) Equity asset valuation. United States: Wiley.

SEC (2020) Google Form 10-K. Web.

SEC (2010) Google Form 10-K. Web.

Appendix

Net Profit Margin Ratio = Net Income / Net Sales x 100.

Google 2022 Net Profit Margin Ratio = 59,972 / 282,836 = 21%

Google 2021 Net Profit Margin Ratio = 76,033 / 257,637 = 29%