Executive Summary

The restructuring of Google is an important step that can bring many positive consequences and significantly improve the company’s performance. The redistribution of the core functional capabilities of the company will give an expanded view of brands and services and allow them to be brought into full-fledged subdivisions. However, despite all the positive aspects of this solution, there are certain disadvantages that must be considered.

One crucial point that has become less clear in the division of companies under Alphabet is the ‘Other Bets’ category, which does not indicate any particular focus. In this regard, many employees who previously worked at Google may experience confusion and misunderstanding about which division belongs to which part of the company (U. S. Securities and Exchange Commission, 2019). In this way, management and business communication become much more difficult.

Another problem is the fragmentation of the business, which involves the creation of a CEO post for each specific division. Thus, each company within the holding creates its products without relying on how one typical ecosystem of Alphabet products should look. This means that different components may be different in their design, which violates the overall concept of the company. Another aspect that was affected by the restructuring and division of the company into separate sectors is the corporate ethics and morale of the team. Due to the fact that many employees think that the company has lost the general direction that was clearly identified before the restructuring, they lose motivation (Jacobs & Crockett, 2021). This ultimately reflects increased staff turnover and a decrease in the efficiency of work.

Inside Google, a big problem when creating Alphabet was that many employees who were engaged in non-core business began to leave the company due to the restructuring and its consequences voiced above. Thus, the holding began to lose qualified persons who had been employees of the company for many years and had gained significant experience in the fields of Alphabet and Google. In connection with this current situation and the side problems that have arisen, it is necessary to create a set of actions that could stop the negative consequences.

Issue Statement

Identification of Specific Challenges Faced by the Company

The restructuring of Google has broken it into several divisions that have different strategic directions and organizational goals. This means that each division individually requires proper strategic planning that can improve the overall situation in the holding and align the direction of development. The diversification of the companies is somewhat successful, as this operation helped to separate the responsibilities and services provided by Google and Alphabet.

Google faced many problems that eventually became global and required cardinal decisions from the directors. Problem situations can be traced primarily to a wide variety of businesses that have significantly gone beyond the search engine that Google was originally. Due to the dispersal of Google’s attention to many non-core subsidiaries, attention to the core business has decreased significantly. In this regard, the further scale of management could be ensured only through restructuring.

Communication Challenges in Alphabet Inc.’s Financial Reporting

One of the main problems of Alphabet Inc. was the issue of communication of the financial part of the company (Flew et al., 2019). The reporting of non-core enterprises can become a severe obstacle to the development and improvement of the organization. Without a clear return and understanding of the funds of all companies that are part of the Alphabet Inc. holding, they cannot invest in standard startups and thereby absorb more reliable startup companies.

Escalating Competition in the Technology Industry Post-Reorganization

Increasing competition in the technology industry is another major problem that, after the reorganization, began to form much faster. Competing companies took advantage of the moment that they had due to a hitch in the work of the Alphabet system during the creation of one holding group (Jacobs & Crockett, 2021). In addition, every year, an increasing number of companies appear on the market for technological devices and Internet services. This means a direct thunderstorm for Google and many other companies in the holding. Without continuous sustainable development, it will be impossible for them to systematically develop in such a way as to maintain current levels of innovation for competition. A company’s emphasis on innovation should be a critical factor in its business. Otherwise, it would be impossible for it to exist.

Challenges in Brand Perception and Alignment with Alphabet Inc.’s Mission and Goals Following Restructuring

In addition, after the restructuring of all the company’s brands, some difficulties arose with the perception of the organization as a whole, as well as its mission and goals, to achieve which the primary efforts are aimed. This can significantly damage Google in the future since merging under one Alphabet sign does not guarantee that all companies in the holding will be able to organically merge into one concept, which will have to undergo significant changes due to what happened to the brand. This situation cannot but affect the fact that the marketing department needs to develop new directions that could become Google’s primary goal. Another significant concern regarding the operation of the holding is that it needs to focus on the core business, which is subject to severe malfunctions in its work. This is due to the restructuring that has taken place and the separation of the ideals of the company from its needs.

Company’s Vision, Mission, and Strategic Framework

Alphabet Inc. is a large international company that develops and implements innovative solutions for the technology sector. The key areas of the company’s activity are online advertising, search services, and cloud software solutions. The mission of the organization is to systematize all the information available to people in such a way that it can be easily and quickly accessed. In this context, the organization’s vision is to provide people with the tools they need to lead a globalized, informed, and technologically advanced life (Page, n. d.).

At the same time, the strategic direction chosen by the management plays a vital role in the company’s activities. At Alphabet Inc., the marketing strategy is centered around the company’s core product, such as the Google search engine. In this direction, the most significant number of movements and innovations exist. Their strategy is to make Google as efficient and better as possible.

Alphabet uses many channels to promote its products, including online social media advertising and email marketing. In addition, the company constantly participates in international rallies and meetings related to economic policy. One of the features of Alphabet’s marketing strategy is the company’s focus on user experience. This category becomes the most important as it helps the company to better allocate resources to improve something that needs to be improved.

An organization’s business strategy is based on three main principles: diversification, innovation, and operational excellence. Research and development of new technological products is an area in which the company invests heavily (Page, n. d.). The diversification strategy allows a company to expand its business portfolio by adding new companies. In this regard, the excellence of all aspects of the business is a necessary model of strategic planning.

Alphabet’s mission statement is an important aspect that helps define the goals and aspirations of employees. The company’s goal is to systemize all world information available on the Internet. In addition, she is going to provide people with the tools so that they can make the world a better place. At the same time, the mission is reflected in the company’s flagship product, the Google search engine. As part of the company’s mission, it strives to improve the quality of life and the opportunities present for people in the modern technology market. The company’s vision is also clearly reflected in how it treats the opportunities that come with the development of technology and the Internet. A more informed and connected life is the Alphabet vision they are committed to and are trying to achieve.

Strategic Analysis – External

PESTEL Analysis

Economic Environment

For any business, the external environment in which it is located is of great importance. The economic environment refers to the general aspects of the economy that can affect how a business operates. This includes interest rates, economic growth, and recession. During a downturn, consumer spending can drop significantly, resulting in lower revenue for the organization (Wirtz, 2019). Demographic and environmental factors such as age, gender, or income level also strongly influence an organization’s performance. They can significantly influence the actions of consumers as a response to the built policy. Google’s advertising revenue, for example, may change due to the age distribution of its users.

Legal Environment

As a large international company, Alphabet is subject to more laws and regulations. Thus, it is possible to trace how the legal environment affects the company. Law-abiding is of decisive importance for large businesses since the violation of any rules will cause significant damage to the reputation of the organization (Wirtz, 2019). Thus, this category is also important in connection with it, which can have many financial and legal consequences. For example, Alphabet has faced several lawsuits and regulatory investigations related to its data privacy practices that have resulted in significant fines and reputational damage.

Political Environment

The political environment is also an essential element that is invariably present in all aspects of the relationship of large international companies. Since Alphabet operates in a regulated area, variables such as stability and turnover of power can affect its operation. For example, changes in trading policy may affect Alphabet’s ability to operate in specific markets, and changes in tax laws may affect its profitability.

Technological Environment

A big part of the company’s success, despite everything, is the technological aspect. Technological advances are at the heart of Alphabet’s operations, and the company is constantly investing in research and development to stay one step ahead. Technological factors such as automation, artificial intelligence, and the Internet have changed several industries, including advertising and e-commerce, which are vital sources of income for Alphabet. Socio-cultural factors such as values, beliefs, and lifestyles can significantly influence consumer preferences and purchasing decisions, which can affect Alphabet’s operations (Qumer & Purkayastha, 2017). For example, consumers are increasingly concerned about data privacy and security, which has led to a shift towards more privacy-focused products and services.

Porter’s Five Forces Analysis

Threat of New Entry

Porter’s five forces competition model is a powerful tool that can make it easier to understand what future threats a company may face. The first possible threat is the possibility of new entrants entering the market. The technology marketing industry has always had a reasonably high level of competition, and many companies are constantly emerging as new market players. However, in this situation, Alphabet should not be afraid of new competitors, as it may take a long time for them to be able to provide any competition to such a large company as Alphabet.

Threat of Substitution

The next threat is the threat of changing the products or services that the company provides. For many years, Alphabet has competed with other companies providing their services in the field of software and devices. The company’s main competitors are Apple, Samsung, Facebook, Amazon, and Microsoft. In this case, a diverse product package can help the company survive even if competitors become much better off. The division of goods into many different categories is an indisputable advantage that others do not have.

Supplier Power

The bargaining power of suppliers is of great importance to Alphabet as the company manufactures many devices that require components and essential parts. In this way, suppliers are a vital link as they play a significant part in the success of the company. At the same time, this aspect is not a threat to the company since it is too large and, in case of problems, will be able to replace suppliers with others. The organization can, based on force, negotiate with suppliers on more favorable delivery terms or cost reductions.

Buyer Power

The bargaining power of consumers for Alphabet is also relatively low, as its products have become deeply integrated into many things people use. In addition, by having a solid brand and sufficient resources, a company can strengthen its position and provide its customers with many options for online services. The intensity of competitive rivalry is an aspect that needs to be studied in more detail since the field of high technology is characterized by great competition. Many companies provide services similar to Alphabet in software and the production of various gadgets. However, the robust product line diversity helps the company soften the effect of competition.

Competitive Rivalry

Alphabet Inc. may face competition from various companies, including social media developers, e-commerce platforms, and cloud service providers. Some of its main competitors include Facebook, which is the largest social network in the world and competes with some services of Google, a subsidiary of Alphabet, for online advertising revenue. Facebook’s massive user base and advanced targeting and data collection capabilities make it a serious competitor.

Amazon is the largest e-commerce platform in the world. In addition, this company is expanding into other areas, such as cloud services and advertising, in which Alphabet also operates. Amazon’s dominance in e-commerce and its growing presence in other industries make it a severe competitor for Alphabet, as many of the companies’ fields overlap. Microsoft is another tech giant with a wide range of products and services, including cloud services. Wide competition with Alphabet is due to the fact that both companies develop operating systems and software. Microsoft’s large customer base and reputation for reliability and security make it a strong competitor to Alphabet.

Strategic Analysis – Internal

Evaluation of Leadership Strategies

An internal strategic analysis is conducted to examine the operations and resources of a company that are held within the organization. This type of analysis can help a company determine the competitive position that will be the most effective in the market for its products and develop effective strategies to achieve its goals. Thus, internal strategic analysis is vital to understand how a company can compete and withstand threats. A company’s internal strategic analysis can be conducted by evaluating its leadership strategies in terms of cost, differentiation, and focus, as well as its strategic leadership and tactical approach.

Differentiation and Focus

Alphabet actively uses various differentiation and focus strategies. The first option aims to make unique products and provide different options for using technology. At the same time, they must have sufficient differences from competitors so that the audience wants to switch to Alphabet products. By following this strategy, a company can create products that suit different people for different purposes.

Competitive advantage is also an important differentiation goal that ensures product development with one-to-one distinguishing features (Qumer & Purkayastha, 2017). The way to achieve this strategic goal is to offer high-quality products and provide all customers with quality service.

Focusing, in turn, ensures the company’s orientation to a specific sales market and a specific target audience. This approach allows the company to better meet the needs of customers and increase competitive advantages.

Cost

As the primary strategy, the company uses cost leadership to offer goods or services at lower prices. Thus, the organization can attract new customers and receive certain benefits in the form of a larger market share than it could cover with the previous prices. Price-sensitive customers will be able to use the products, which means that the number of people interested in the company’s services will grow.

Strategic Leadership

Alphabet uses strategic leadership as its main approach, which requires the development of unique strategies and their achievement according to the planned schedule. Thus, the organization can accurately plan its schedule of actions so that unforeseen situations do not arise in the work of the company. This can significantly help in improving performance and job achievement. This approach focuses on aligning a company’s resources and capabilities with its mission and vision discussed earlier. In addition, it is also important to pay attention to the creation of a strategic direction that determines the decision-making process (Page, n. d.).

Strategic leadership enables a company to develop a long-term vision, anticipate trends and changes, and adapt to the external environment. Thus, the organization will always be able to control the changes made in its structure and adapt to conditions that can be influenced from the outside. This approach promotes the innovation, creativity, and risk-taking required for sustainable growth and success.

Tactical Leadership

The company also uses a tactical approach to achieve its goals. It involves developing and implementing specific actions and plans to achieve short-term goals. By using this approach, a company can effectively implement its strategies, track performance, and adjust its tactics as needed. A tactical approach is critical to achieving operational efficiency, increasing productivity, and meeting customer needs.

Business Plan and Success Indicators

Alphabet has a defined business plan that outlines its mission, vision, values, and strategic direction. A business plan is also necessary for defining the target market, the company’s products and services, and marketing strategies. The operational plan defines the actions and plans necessary to achieve the goals set out in the business plan. The operational plan includes resource allocation, budgeting, planning, and performance monitoring.

The leading indicators a company uses to measure success include customer satisfaction, product quality, revenue growth, market share, and employee engagement. These metrics allow a company to evaluate its performance, identify areas for improvement, and make strategic decisions (Flew et al., 2019). Financial considerations are critical to a company’s success. Alphabet uses financial metrics such as ROI, profit margin, cash flow, and revenue growth to evaluate its financial performance. The analysis of these indicators can allow a company to measure profitability, liquidity, and solvency and make sound financial decisions.

Core Competencies

Alphabet’s core competencies include innovation, quality, and customer service. Innovation is the most valuable element in strategic plans and must be timed so that the organization can invent new technologies. This competence is precisely what allows the company to develop unique solutions and stay ahead of its competitors. Quality is the second most important aspect, which is a core competency that allows a company to provide high-quality products and services that meet the needs and expectations of customers. By maintaining a certain high level of quality control, the company can achieve a better sales rate and interest in the company’s future products. Customer service is a core competency that requires a company to provide excellent support and build strong relationships with users of its products and services.

Diversification Level

The Alphabet organization has a moderate level of diversification. A company may cover several areas with its products, including technology, advertising, and autonomous vehicles. This level of diversification allows using resources and capabilities in various industries, as well as influencing risks in order to reduce them and use new opportunities. However, it will also increase the complexity of the company’s operations and require effective management of its diverse business portfolio.

International Strategy

The company’s international strategy is aimed at expanding Alphabet’s presence in new markets in other countries and developing localized products and services. In addition, an important aspect of the organization is the focus on building solid partnerships with local businesses (Page, n. d.). In the context of expansion, such cooperation will have a beneficial effect since links with local representatives can facilitate some operations within the region. A company’s international strategy differs from its domestic strategy in several ways, such as its vision for entering a new market, product localization, and adaptation to local culture. The company tends to take a step-by-step approach to international expansion. To do this, Alphabet conducts extensive research and due diligence on local audiences. This can then lead to smoother integration and better results when getting started.

Company Goals

The goals of Alphabet are important as a foundation that reinforces its mission and contributes to its fulfillment. As such, the company prioritizes goals that are critical to achieving its long-term goals, such as innovation, quality, and customer service. In this regard, the company’s strategy is designed to achieve its goals through the use of core abilities and competencies in the field of growth and optimization of the activities of various subsidiaries. Flexibility and adaptation to the external environment are factors that allow the organization to respond in a timely manner to new trends and directions.

The BCG Matrix Analysis

On the BCG matrix, the company’s products and services are predominantly categorized as stars and cash cows. In the first case, it characterizes products that retain a significant market share and are expected to grow significantly in the future (Ye, 2022). At the same time, cash cows are those goods or services that are popular and in demand in the short term now but not in the future.

The Google search engine, for example, can be called a star as this product has been popular for a long time, and there are no signs that this will change in the future. This product has a significant market share and, accordingly, a high growth potential since it is used by a large number of people, which is necessary for the development of technology.

To maintain its competitive advantage, however, this product requires a large investment since Bing has now made significant progress in the development of its search algorithms. The cash cow of the company can be called the advertising business, which is in high demand at the moment but does not have the potential for development.

SWOT Analysis

Table 1 SWOT Analysis.

Strengths

One of the company’s greatest strengths is its strong reputation as an organization that manages several large companies such as Google and Waymo. Thanks to this, users develop a positive perception of the company. Innovation is also vital as Alphabet hosts Android, Google Cloud, and search engine companies. A diverse portfolio of businesses means that the holding has great potential and can do business in most industries.

Weaknesses

The organization’s shortcomings are determined primarily by a strong dependence on advertising. Alphabet generates more than 80% of all revenue from ad sales alone (Alphabet Inc., 2021). This also affects the limited geographic diversification as most businesses are oriented to the US market. Due to the concentration of many organizations within the holding company, the company may face antitrust organizations, indicating regulatory problems.

Opportunities

One of the most significant and key opportunities for the holding is the potential entry into new markets, which will expand sales. Mergers and acquisitions also have significant potential financial implications for the company, as an increase in the diversity of activities can positively impact profits. An example of a successful acquisition is Fitbit, which helped Alfabet develop the wearables business. Another important opportunity is the development of new products and investments.

Threats

Despite all the opportunities, the holding has some threats that may adversely affect the company’s future development. One of these risks is the intense pressure of competitors constantly developing their capacities. Increasing scrutiny by government regulators could also become a significant risk by limiting certain activities. One of the most dangerous threats to an organization is potential cybersecurity gaps. Since all company products and services are connected to modern technologies, this can lead to extensive data leakage and deterioration of the general condition.

Financial Overview

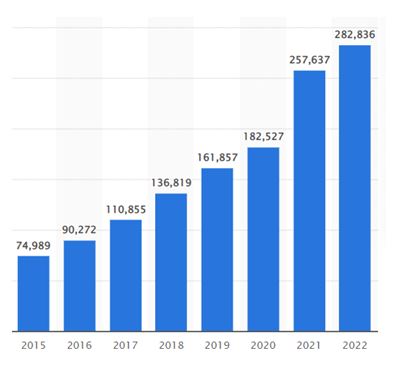

Alphabet Inc. is an international holding that includes multiple companies engaged in innovative technological solutions. The company consistently demonstrates high performance in the context of profitability, which is one of the most important financial indicators. Since the merger of several companies under Alphabet Inc. in 2015, revenue has constantly been increasing, as can be seen in Graph 1.

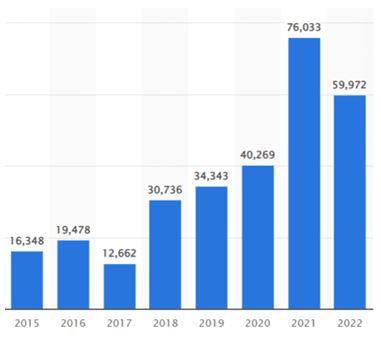

By calculating the figures shown in the graph, the result of a 19.7% compound annual growth rate (CAGR) can be achieved, which is a high indicator. At the same time, the net income of the company also tends to constantly increase (Graph 2). Thus, we can say that every year, the profit of the holding increases by an average of 19%.

In terms of financial strength, Alphabet has a fairly solid financial position backed by a large number of stocks and bonds. According to Macrotrends (2023a), in 2022, the company had total assets of $365.264B, which is a 1.67% increase compared to the previous year, 2021. At the same time, the company’s total liabilities for 2022 are $109.12B, which means a 1.38% increase from 2021 (Macrotrends, 2023b). Thus, it can be said that the company’s financial reserves greatly exceed its obligations.

Regarding the cash flow, we can say that based on the studied data, the Alphabet company has generated a large amount of money throughout the years of its activity. The company’s operating cash flow tends to grow steadily throughout the years of the organization’s existence. However, in 2022, the indicators of this characteristic amounted to $91.495B, which demonstrates a 0.17% decline from 2021 (Macrotrends, 2023c).

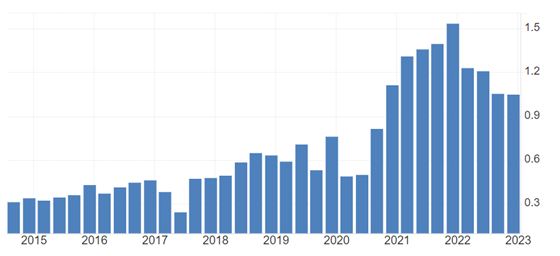

Alphabet Inc. has a high asset turnover due to multi-threaded activities. To generate income, the company uses the maximum amount of free resources, which allows it to maximize profits. This makes it possible to obtain a certain threshold of efficiency from the assets, which, however, does not have a stable trend and constantly decreases and increases depending on the company’s activities. As shown in Graph 3, in 2022, the efficiency percentage fell to 25.3 from 27% in the previous year, 2021. However, the most substantial drop can be traced to 2019-2020 during the coronavirus pandemic.

An important indicator for the company is earnings per share, in which Alphabet has unstable fluctuations. As shown in Graph 4, Alphabet noted that in December 2022, the price per share was $1.06. This represents a significant decrease from the same reporting period a year ago. At the same time, it is worth noting that the company’s most significant decrease in earnings per share occurred during the coronavirus crisis, especially at its height in 2020.

Alphabet’s overall financial performance compares favorably with the industry averages of its competitors. As shown in the report earlier, the company’s revenue growth rate averaged 19%, above the average of 6.9% (Alphabet Inc., 2021). These conclusions relate to such parameters as profitability, net income, asset turnover, and return on investment. Thus, based on the analyzed data on the company’s financial activities, we can conclude that Alphabet is on the right track and that management is making profitable decisions.

Strategic Direction

Alphabet set the strategic direction for the development of the holding with a focus on innovation, profit growth, and focusing on products across various industries. The company constantly invests in significant projects, thus striving to improve its technical equipment. Acquisitions and takeovers of many small organizations Alphabet has the ability to adapt its evolving technology, allowing it to improve its designs. This strategic focus has enabled the company to maintain leadership in the search engine industry.

Diversification is also of great importance in the strategic planning of the holding, as it brings together many different projects, allowing them to exchange developments and technologies profitably. The company has acquired many organizations in order to expand its sphere of influence and services. Nest, Waymo, and Fitbit have joined the holding in recent years through mergers (Arora & Sood, 2021). In part, such steps are due to the rather productive growth of the holding and its financial capabilities. As previously researched, one of the main directions in this area has become the advertising business, which brings the company most of its profits.

Strategic Alternatives

Despite the company’s clearly articulated strategic directions, there are some alternative ways to build planning for Alphabet. One such strategy is to focus on international expansion and expanding influence into new countries. In many parts of the world, it is possible to strengthen the presence in order to develop financial profit growth. This can be done using the method that the holding uses quite successfully – mergers and acquisitions. Buying companies in new markets can significantly help Alphabet enter new countries, as their efforts will allow them to better understand local specifics, culture, and traditions. This may have a beneficial effect on adaptation to the new environment.

In addition, a suitable alternative strategy for Alphabet could be to focus on the development of artificial intelligence services. Recently, many companies have relied on this tool in their business. An example is Microsoft, which has implemented artificial intelligence into its search engine to facilitate information searches (Hervieux & Wheatley, 2021). Thus, by focusing on this industry, Alphabet will be able to significantly improve its competitiveness in relation to its main field of providing search services on the Internet. In addition, this area of activity can be relatively easily mastered by the holding since before that, and the company had created some developments in this direction, such as Google Assistant.

Strategic Implementation

In the context of the implementation of the company’s current strategies, it is making some progress. This can be said based on the analysis of financial indicators and inspection of companies that were bought up or absorbed by Alphabet. The goals of developing innovation and increasing the growth of the organization in this context are successfully achievable.

With regard to new alternative strategic directions, the organization could succeed in entering new markets by continuing to buy small organizations and accumulate their knowledge. In addition, however, an important aspect is the study of the local market and preparation for specific new conditions. This can be achieved most effectively through the analysis of SWOT and Porter’s five forces (Birru et al., 2022). They will make it possible to reveal the potential weaknesses of the holding in the best possible way in order to modernize them and prevent risks.

For an alternative strategy for the development of artificial intelligence, the most effective implementation is to invest in the development of new technologies. This is a good decision as it resonates with the current strategic directions of the holding. In addition, such a solution will allow the company to reduce its dependence on advertising and make artificial intelligence one of the main areas through its integration with other subsidiaries.

Conclusion

The company has some significant limitations, such as regulatory issues, reliance on advertising, and lack of geographic diversification. The company faced many problems with regulators that arose from overactive takeovers of small businesses. Some negative aspects of the activities of the organization are also related to the fact that it receives more than 80 percent of the profit from advertising on its sites. This may lead to the holding losing part of the profit due to the fact that the market for advertising offers will change or be subject to dumping. The third significant limitation of Alphabet’s business is the limitations associated with geographic diversification. They may adversely affect the company’s capabilities, as it will not be able to gain greater access to all the possibilities of foreign markets.

It is worth noting that we can recommend Alphabet expand in the field of cloud computing. The development of new products and services in this direction can have a positive impact on the future of the company due to the rapidly developing technologies in this direction. The company, due to frequent acquisitions and acquisitions, has accumulated sufficient potential to develop the areas of cloud computing.

In addition, a subsidiary of Google has multiple developments in the area that can be adapted and developed to provide a wider range of services. This will significantly reduce the existing disadvantage in the strategic development of the holding, which is that the main profit comes from the sale of advertising. Diversifying revenue streams is important to reduce a company’s reliance on advertising. This should have a positive impact on Alphabet, as the holding will be less influenced by the market and advertising platforms. This is a strategic motive that can quickly change and fall under the possible risks of losing profits.

An important improvement for Alphabet could also be the improvement of the legal norms of work since, in the past, the holding had legal problems with the antimonopoly committee. The company must plan expansion and development in such a way that it does not restrict the rules of competition in the market. This can greatly help developing companies that can become reliable partners in the future. This strategy is able to reduce the control of regulators, which could put significant pressure on Alphabet due to the continuation of the policy of buying out emerging competitors.

References

Alphabet Inc. (2021). FORM 10-K. Web.

Arora, K., & Sood, H. (2021). Analysis of Various Market Research Services With Special Focus on Title Generation Through Use Cases. Web.

Birru, A. C., Sudarmiatin, S., & Hermawan, A. (2022). Competitive strategies in the lodging service sector: Five porter analyses and case study SWOT analysis. Journal of Business and Management Review, 3(1), 001-017. Web.

Finbox. (2023). Asset Efficiency for Alphabet Inc. Web.

Flew, T., Martin, F., & Suzor, N. (2019). Internet regulation as media policy: Rethinking the question of digital communication platform governance. Journal of Digital Media & Policy, 10(1), 33-50. Web.

Hervieux, S., & Wheatley, A. (2021). Perceptions of artificial intelligence: A survey of academic librarians in Canada and the United States. The Journal of Academic Librarianship, 47(1). Web.

Jacobs, J., & Crockett, H. (2021). Designing Exceptional Organizational Cultures: How to Develop Companies where Employees Thrive. Kogan Page Publishers.

Macrotrends. (2023a). Alphabet Total Assets 2010-2022. Web.

Macrotrends. (2023b). Alphabet Total Liabilities 2010-2022. Web.

Macrotrends. (2023c). Alphabet Cash Flow from Operating Activities 2010-2022. Web.

Page, L. (n. d.). G is for Google. Alphabet. Web.

Qumer, S. & Purkayastha, D. (2017). Case 1: Alphabet Inc.: Reorganizing Google. IBS Center for Management Research.

Statista. (2023a). Annual revenue of Alphabet from 2011 to 2022. Web.

Statista. (2023b). Annual net income generated by Alphabet from 2011 to 2022. Web.

Trading Economics. (2023). Alphabet | GOOG – EPS earnings per share. Web.

U. S. Securities and Exchange Commission. (2019). SCHEDULE 14A Proxy Statement Pursuant to Section 14(A) of the Securities Exchange Act of 1934 (Amendment No.). Web.

Wirtz, B. W. (2019). Digital business models: Concepts, models, and the alphabet case study. Springer.

Ye, J. (2022). Analysis of Menu Design in the Food and Beverage Industry using the BCG Matrix Method. Highlights in Business, Economics and Management, 2, 333-340. Web.