Introduction to Value Chain Analysis

Founded in the year 1999, the Granite City Food & Brewery has grown into a fully-fledged company t6hat has more than 34 restaurants spread across 14 states across the US. The company was launched as a medium business in the region of St. Cloud and has become a household name in creating fresh menus for customers. The business concept of the Granite City Food & Brewery is merging a casual restaurant with a brewery on site.

The Granite City Food & Brewery “restaurants also showcase an open kitchen featuring chef developed, handcrafted made-from-scratch cuisine, including innovative signature entrees, flatbreads, and more”. Among the renowned brands retailed by the Granite City Food & Brewery are Pale Ale, Bock, Double IPA, and the Stout. The business was named after its hometown in Minnesota, which is a granite capital. To have a unique brand, the Granite City Food & Brewery launched the Fermentus Interruptus brewing process, which was designed by the founder called Mr. Burdick Shawn.

At the time of its establishment, the core business of the Granite City Food & Brewery was restaurant services, which was known for the fresh menus made from local foods that the residents of Minnesota loved. The fresh menus included delicacies from different regions that were cooked and served fresh as the customer waited. As the Granite City Food & Brewery expanded, the founder introduced on-site brewery services which enable customers to place their orders and request for a specific blend of alcohol just behind the restaurant.

At present, the on-site brewery has become the main attraction because of the many “signature brews such as The Duke (Pale Ale), The Bennie (Bock), The Batch 1000 (Double IPA), The Northern (American Style Light Lager) and The Stout”. Moreover, the company offers handcrafted beers that are retailed at very competitive prices to appeal to different classes of customers. Also, the Granite City Food & Brewery has unique flavors and styles that are very difficult to find in the entire region of Minnesota and beyond.

The primary founder of the Granite City Food & Brewery is Mr. Burdick Shawn who has seen the business grow from a medium company to a household brand with thirty-four branches across the US. The founder was inspired by the need to provide fresh menus and the on-site brewing culture to suit the Minnesota way of life. The firm was founded officially in the year 2009 after a year of experimental operations. The founder is currently the chairman of the management board of the Granite City Food & Brewery.

The company’s annual revenues have grown from $120,000 in the year 2000 to more than $18.5 million in the year 2015. The growth in revenues has been accredited to business expansion, increased customers, and the creation of different products and services that appeal to the targeted customers. The net income has equally grown from -$25,000 in the year 2000 to $18.5 million in the year 2015. On average, each restaurant has 15 to 20 employees working full time and more than 30 employees on contract. The Granite City Food & Brewery has about 1,300 employees and currently controls 11.5% of the market share in the regions it operates in.

Primary Value Activities

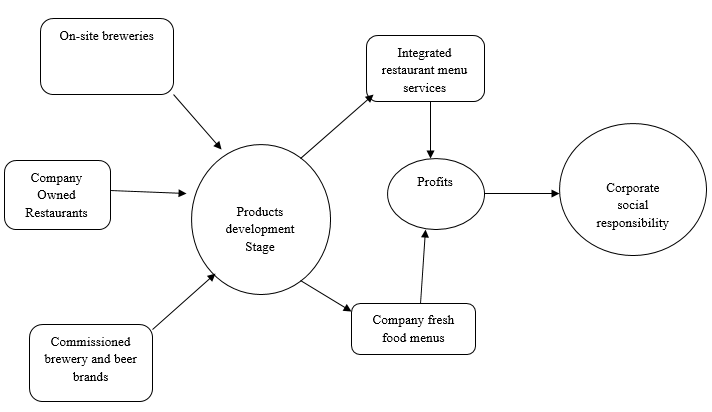

The Granite City Food & Brewery has been proactive in focusing on retailing premium restaurant and brewery services to its customers to suit their experiences and needs. The company’s restaurant premises are well furnished in an opulent manner to appeal to potential clients across the 34 branches. The Granite City Food & Brewery is committed to very high standards in observing ethical business practices in a dynamic and service-oriented value network proposed by Porter as summarized in the diagram below.

As indicated in figure 1 above, the Granite City Food & Brewery’s value chain starts with product development through its furnished restaurants and on-site breweries. As a regional brand in the US, the Granite City Food & Brewery has a strategic management team which ensures standardized production process to keep up with the demand of customers as the primary success factor. More than 70% of the Granite City Food & Brewery products and services are independently produced with only 30% being outsourced from commissioned suppliers.

The 70% self-production capacity within the Granite City Food & Brewery is enough to cover the demand for customers, especially for the brewery products. The company’s on-site breweries are spread across the 34 branches that double up as the source of fresh menus.

As opposed to most of its competitors, which outsource the menus and beer from independent producers, the strategy to create in-house production points across the 34 branches has consolidated the company’s supply network and strengthened its long-term production capability. Besides, the evenly spread sourcing of less than 30% of products from external networks is significant in spreading the risks that the Granite City Food & Brewery might be exposed to.

The Granite City Food & Brewery has invested heavily in the corporate social responsibility initiatives across the 34 regions it operates in. In the last decade, the Granite City Food & Brewery has focused on facilitating education and health services for children within the communities surrounding its restaurants. As part of the CSR policies, the Granite City Food & Brewery has made it an annual responsibility to finance children’s education and sponsor-free medical camps within the regions it operates in.

For instance, in the year 2014 alone, the Granite City Food & Brewery in conjunction with the local education support agencies managed to restock more than 7 kindergarten centers within Minnesota. Besides the social perspective, the Granite City Food & Brewery has been proactive in engaging in sponsoring local healthcare mobile medical camps as a strategy for enhancing the image of the business within the US.

As a result of the above initiatives, the Granite City Food & Brewery has been able to increase its profits and sales as clear product differentiation, customer proximity, and strategic segmentation of its brewery and fresh menu brands. Specifically, the strong brand image as a result of quality services and CSR initiatives have expanded the company’s market from Minnesota to other 33 regions. Besides, the company has increased its branches in the last 15 years and is currently present in 14 states.

The vivid presentation of the brands retailed by the Granite City Food & Brewery through image and store ambiance has anchored the differentiation perception held by its customers, who have developed brand loyalty towards the customized on-site breweries and fresh menus. Also, the establishment of a strategic management team has led to the exponential growth of the Granite City Food & Brewery into a multi-branch organization.

However, the excessive focus on quality and on-site services has to some extent compromised the ability of the Granite City Food & Brewery to integrate the views of some customers in the final products. For instance, a section of the clients thinks that the Granite City Food & Brewery should be more flexible to the customers who are in a hurry by making some fresh food that is available on order without having to wait for 15 to 20 minutes. Also, the Granite City Food & Brewery has ignored the low-end market.

Supply Chain Management

By definition, “supply chain analysis is the examination of the management of the flow of information, inventory, processes, and cash flows from the earliest supplier to the ultimate consumer, including the final disposal process through value chain analysis”. The Granite City Food & Brewery’s supply chain is based on the belief of minimal cost strategy suggested by Porter as a strategy for guaranteeing optimal competitive advantage in the dynamic market.

This approach integrates consistent and clear performance objectives that facilitate excellence and reduce complexity in the supply chain functionality. Specifically, the low-cost principle has been ideal in managing the 30% of the outsourced supply chain function to ensure that the Granite City Food & Brewery is in a position to not only align the targets but also expectations of the suppliers, irrespective of the market dynamics that might increase the cost of managing the supply chain.

To execute the low-cost strategy, the Granite City Food & Brewery has been proactive in eliminating potential risks that are associated with the outsourced function of the supply chain, especially at the raw material acquisition stage for the fresh food and brewery brands. For instance, in the on-site brewery section, where the principle of low-cost management is directly proportional to failure or success of the brand, the Granite City Food & Brewery relies heavily on its technical knowledge of the market dynamics and strategic procurement process to create compact contract agreements with the suppliers. As a result, the company has been able to build a successful brand that is not over-dependent on the supplier forces.

Through excellent facilitation in the supply chain procurement, the Granite City Food & Brewery does not solely rely on the market swings that prevail in the regions that supply its raw materials such as barley, different ingredients, and exotic menus. Rather, the company uses the no-late delivery as a performance evaluation matrix besides the year-in-year-out cost reduction formula. The Granite City Food & Brewery has been in the forefront in creating mechanisms for accumulating cost reduction from different economic risks from the primary barley suppliers from Greece.

As a strategy for realizing the desired sales merging and focused revenues every quarter, the Granite City Food & Brewery’s supply chain function has been modified to incorporate the aspects of market entry, competitive advantage sustainability, and strategic market segmentation since the current competitors are very strong. To minimize the effect of strong competition, the supply chain has been customized to operate as an efficient, proactive, and dynamic system that tracks the potential challenges and address them as they arise.

Besides, as a strategy for increasing credibility and maintaining ethical business conduct, the Granite City Food & Brewery’s outsourcing plan encompasses features and processes that are responsible for affiliating and facilitating a healthy interaction between the business and suppliers. For instance, the Granite City Food & Brewery has created successful distribution, redistribution, and quality tracking systems to ensure that the suppliers meet the minimum requirement on quality and pricing. As a result, the current relationship between the company and the suppliers can be described as functioning on confidence and professional contractual networks.

Within the Granite City Food & Brewery, there is an organized supply chain management system that coordinates the purchasing functions from the local and international suppliers. This system is programmed to identify the appropriate suppliers, need for supplies, quality and quantity to order, and the price guide to ensure that the low-cost strategy remains functional. Besides, the system is strategic in evaluating the general effectiveness of the current supply chain management practices at the Granite City Food & Brewery.

Since mechanization and capacity expansion of the production matrix requires a proper balance between production efficiency and sustainability of the supply chain function, the Granite City Food & Brewery has created systems for matching the two variables as proposed by Porter in the inbound logistics and procurement model. Specifically, the company has automated its supply chain management function to ensure that decisions that are made are not only reliable but also consistent and relevant to the production needs.

At the Granite City Food & Brewery, all the inputs from each production section for the brewery and fresh food menu are processed in line with the trend of a reliable supplier in terms of timeline in delivery, quantity, and quality over a specified period. This supply chain quality guide has been instrumental at the company towards minimizing the risks associated with product rejection due to the poor quality of the raw material used. The entire process is described as a primary proficiency since “improvements in delivery time, price, and product line-ups can add significant value to a business’ offering and can help it to find a true niche in even the most crowded markets”.

As a result, the Granite City Food & Brewery has been able to reduce delivery delays, thus, boosting complete process efficiency on the side of the suppliers. In most cases, the management of the Granite City Food & Brewery has become proactive agents who facilitate the inventory planning to ensure that the customers at the base of the supply chain pyramid get optimal value from their purchases. In tracking the success of this competency process, the supply chain management agents of the Granite City Food & Brewery are always in the forefront in measuring logistics processes, supplier contentment, and supply chain efficiency.

This course of action is taken at the company in a bid to create sustainability strategies in the general supply chain function such as cost reduction and revenue growth. For instance, the suppliers’ satisfaction is measured by the company from their live feedback with the integration of special IT tools such as PACK, Epod, and Aramex. Also, the Granite City Food & Brewery often conducts supplier reliability surveys that mare aimed at getting information that might help the company to track the quality of items that are procured from external suppliers.

To remain competitive in the dynamic market, the Granite City Food & Brewery’s supply chain management strategy has been customized to incorporate logistics outsourcing and benchmarking of the entire supply chain function. Under the logistics outsourcing, the Granite City Food & Brewery has been relieved of fixed costs as a result of dynamics on the supplier’s source and market demand. For instance, the company has outsourced its barley supplier and menu ingredients to several agents who are expected to compete based on prices, reliability, and quality. These outsourced units have enabled the Granite City Food & Brewery to develop a strategic control system that is sustainable, in terms of dependability, costing, flexibility, and general efficiency.

The outsourced units have also offered a rationalized scientific management approach in supply chain management at the company since it is possible to general data from trends observed by the management. Since the outsourcing function is well balanced, the Granite City Food & Brewery has been able to achieve efficiency in the general supply chain management.

The aspect of benchmarking of the management processes within the supply chain function at the Granite City Food & Brewery has been organized into cost monitors that control the logistics involved in procuring raw material for the restaurant and brewery product brands. This means that the primary success puzzle for the Granite City Food & Brewery’s supply chain management functions on the ability to balance the soft skills such as organization culture, business values, and production-distribution channel.

Also, the company has created efficient contracting rules such as the “Contract Manufacturing (CM), Third-Part Logistics (3PL), and Business Process Outsourcing (BPO)”. These rules have ensured that the Granite City Food & Brewery is in a position to track the reliability of the suppliers at specific contractual standards through the supply chain optimization process.

Operations

In the last three years, the Granite City Food & Brewery has opened six new branches in Arizona, Chicago, Illinois, and Missouri. As a result, the total number of branches grew from 30 in the year 2012 to 34 in the year 2015. The expansion through the opening of the new branches can be related to the Granite City Food & Brewery’s ability to experience uninterrupted growth in revenues since its establishment in the year 1999. The performance of the Granite City Food & Brewery about its primary competitors, in terms of physical expansion, is summarized in the table below

The Granite City Food & Brewery has experienced the highest physical expansion as compared to its competitors with 6 new branches in the last three years. This was followed by AppleBee International at 4 new branches and Carlos Restaurants with only two additional branches. This is an indication that the market share of the Granite City Food & Brewery is likely to increase shortly if the above trend continues.

Same-Store Sales

The same-store sales for the Granite City Food & Brewery for the last three years are summarized in the table below.

From the above table, the estimated sales for the Granite City Food & Brewery grew since six more stores were added in the last three years. The sales grew from $10,700,000 to $18,500,000. This is an indication of an upward trend in sales. If this trend persists in the next two years, the Granite City Food & Brewery is likely to expand its market share. The estimated sales for the Granite City Food & Brewery against that of its competitors are summarized in the table below.

From the above estimations, the Granite City Food & Brewery experienced the highest sales increase in the last three years because of the rise in the branches from 28 to 34 followed by AppleBee. The Rock Bottom Restaurant experienced the least growth. The above results indicated that the Granite City Food & Brewery is well-positioned to increase its market share and become number two if the above trend remains constant in the next three years.

Other Metrics

Internal Assessment

IFE Matrix

The IFE Matrix for the Granite City Food & Brewery is summarized in the table below.

SPACE matrix

Bibliography

Barney, John. “Firm Resources and Sustained Competitive Advantage.” Journal of Management 17, no. 6 (2009): 99–120.

Bodily, Emile and Allen, Michael. “A Dialogue Process for Choosing Value-Creating Strategies.” Interfaces 29, no. 6 (2009): 16-28.

Bowman, Samson. “Corporate Restructuring: Reconfiguring the Firm.” Strategic Management Journal 1, no. 4 (2006): 5–14.

Cohen, Samson and Roussel, James. Strategic Supply Chain Management: The Five Disciplines for Top Performance. New Jersey: McGraw-Hill, 2008.

Cox, Arnold. “Managing with Power: Strategies for Improving Value Appropriation from Supply Relationships.” Journal of Supply Chain Management 37, no. 2 (2009): 42-47.

Dolgui, Amos and Jean-Marie, Paul. Supply Chain Engineering: Useful Methods and Techniques. New York: Springer Science & Business Media, 2010.

Hilletofth, Pamel and Hilmola, Osman. “Role of Logistics Outsourcing on Supply Chain Strategy and Management: Survey Findings from Northern Europe.” Strategic Outsourcing: An International Journal 3, no. 1 (2011): 46 – 61.

Janus, Pius. Pro Performance Point Server 2007: Building Business Intelligence. Alabama: Press, 2008.

Leclerc, Yuar. “Sustainability and the Supply Chain: How to Reduce Cost and Save the Environment.” Manufacturing business technology 2, no. 1(2012): 67-71.

Liu, Zuen and Nagurney, Arnold. “Supply Chain Networks with Global Outsourcing and Quick-Response Production under Demand and Cost Uncertainty.” Annals of Operation Research 208, no. 1 (2010): 251-289.

Mankiw, Glaslow. Principles of Economics. Mason: Thomson Higher Education, 2009.

Murphy, Joseph. Organization Theory and Design. Hampshire: Cengage Learning EMEA, 2010.

Plunkett, Warren. Plunkett’s Transportation, Supply Chain and Logistics Industry Almanac 2007: Transportation, Supply Chain and Logistics Industry Market Research, Statistics, Trends and Leading Companies. Houston, Texas: lunkett Research, 2008.

Sehgal, Volyt. Supply Chain as Strategic Asset: The Key to Reaching Business Goals. Hoboken: Wiley, 2011.

Sercu, Patchyt. International Finance: Theory into Practice. New Jersey: Princeton University Press, 2009.

Stadtler, Howk and Kilger, Collins. Supply Chain Management and Advanced Planning: Concepts, Models, Software, and Case Studies. Berlin: Springer, 2013.

Swaminathan, Johne and Tayur, Siwsz. “Models for Supply Chain in e-Business.” Management Science 49, no. 10 (2010): 1387-1406.

Thompson, James and Martin, Flickim. Strategic Management: Awareness and Change. Andover: South-Western Cengage Learning, 2009.

Trompennars, Fielding. “Resolving International Conflict: Culture and Business Strategy.” Business Strategy Review 7, no. 3 (2009): 51-68.

Wood, Don. International Logistics. New York: AMACOM, 2009.