Executive Summary

Globalisation has opened new market opportunities in other countries that corporations can utilise to expand their businesses. However, in recent years, promising equity-based partnerships, IJVs and M&As, have failed to prosper. Scholars cite differences between the local and host cultures as the key success or failure factors (Khilji 2012).

Due to cultural differences, international alliances often encounter challenges related to HR integration, which affects the development and execution of a successful corporate strategy. The purpose of this paper is to examine how cultural/institutional differences affect integration in mergers, acquisitions, and international joint ventures. This paper analyses two case studies to identify elements of equity-based alliances relevant to HR integration in cross-cultural contexts. It reveals that cultural awareness and trust are the critical success factors. The paper provides recommendations that managers can apply in cross-cultural HR management to increase the success of cross-border alliances.

Introduction

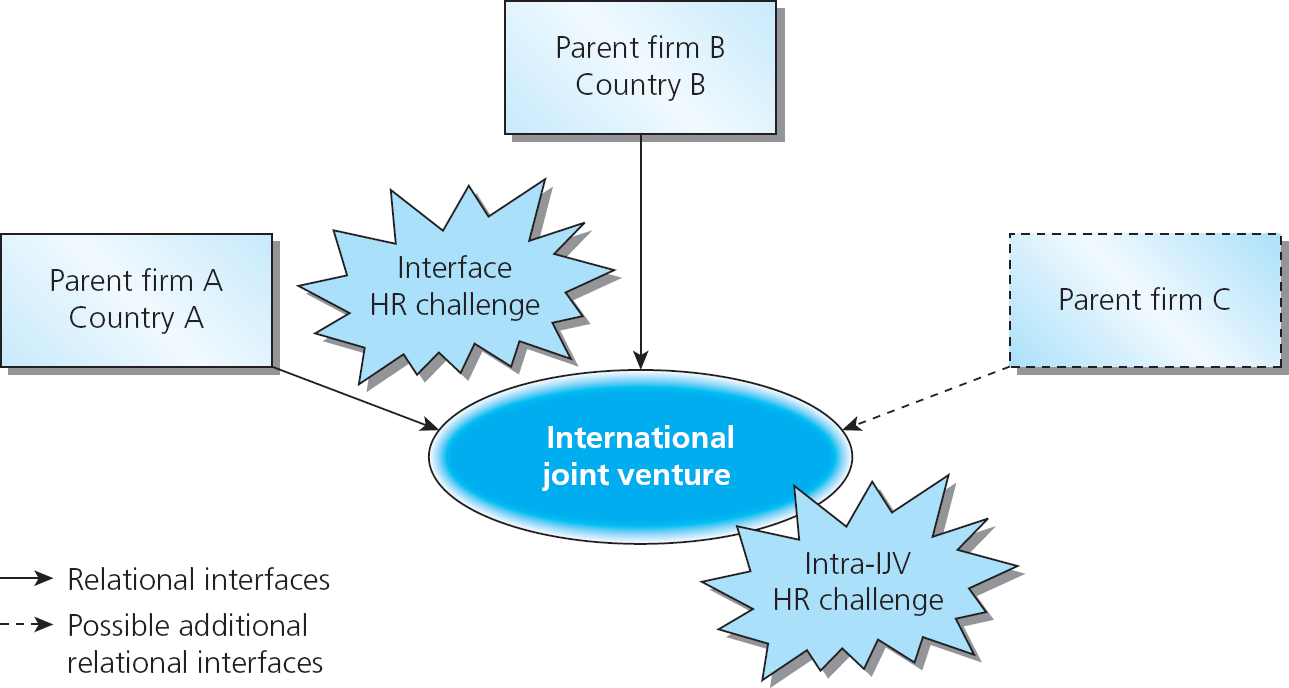

In the current global economy, more big firms are stepping up efforts to internationalise their businesses as part of their growth strategy. Among the common external organizational modes firms use to expand into new markets include mergers and acquisitions (M&As) and international joint ventures (IJVs). The two external equity-based alliances offer benefits like transfer of new knowledge/skills, cost cutting, and resource sharing that minimise operational risks (Child & Faulkner 1998). They help firms grow rapidly in new locations.

However, the international business environment has cross-cultural management challenges. This led to high failure rate among many M&As and IJVs in the recent past. While most external modes fail, others grow into successful businesses. This paper aims to show that culture plays a role in determining the failure or success of international businesses. In this view, it examines cultural dimensions, such as power distance, acculturation, and collectivism that shape the national culture, which influences organisational culture and management styles. It examines different cultural contexts with an aim of finding the negative or positive effects of cultural differences on HR integration.

It is evident that culture influences the integration outcomes of international strategic alliances. Expatriate managers introduce new HRM practices, including recruitment, training, and compensation, into local firms. Scholars contend that, in firms, organizational culture dominates over the national culture so that the effects of individual subcultures are neutralised (Drouin, Bourgault & Saunders 2009). However, both external and organisational cultural contexts converge in a firm to modulate organisational culture.

Thus, it is important to examine how cultural differences in IJVs and M&As affect HR practices and performance. The purpose of this paper is to analyse the role played by cultural and institutional differences in the integration processes using a sample of IJVs and M&As. The analysis will cover different dimensions of culture and relate them with organisational performance. Based on the findings of the analysis, a conclusion and recommendations will be given.

Findings

Formation Stages of M&As and IJVs

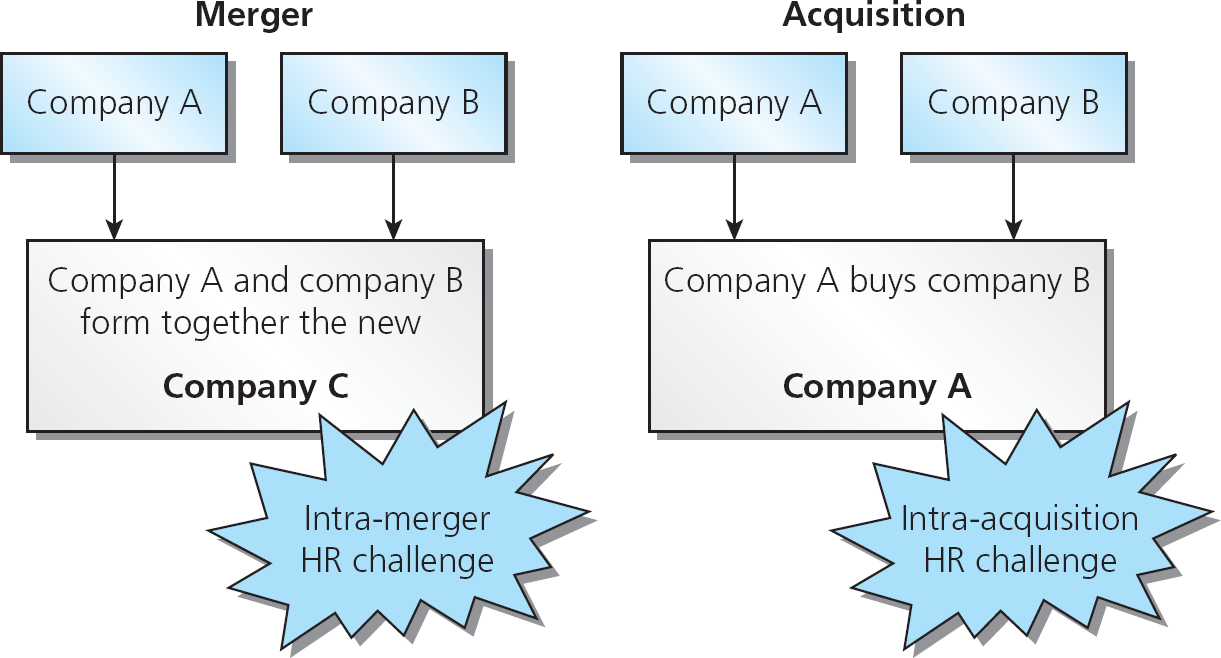

One corporate strategy firms use to internationalise their operations is M&As. Mergers involve an amalgamation of two firms into one business while acquisitions occur when one firm takes up the operations of another. Firms also form cross-border alliances with similar businesses in other countries through international joint ventures. Since these approaches involve people from diverse cultural backgrounds, HR challenges are inevitable. Dowling, Festing, and Engle (2008) highlight high turnover of top executives and personnel issues as the factors that prevent M&As from meeting their objectives. In this view, cultural competence is important among expatriate managers.

Case Studies

M&As

Most M&As failures are attributed to cultural differences. The critical success or failure factors for mergers and acquisitions are not uniform because of cultural contexts vary widely. Brouthers and Bamossy (2006) contend that firms should plan well for the merger. The formation stages of M&As are four, namely, the pre-M&A, due diligence, integration planning, and implementation and assessment phases (Dowling, Festing & Engle 2008).

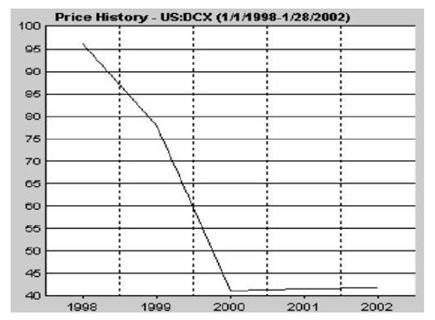

A case study involves the failed 1998 merger between Daimler-Benz and Chrysler. The merger was motivated by the need to unite technical knowledge and production models and capitalise on a broad distribution network to gain a strong competitive advantage over rivals. However, cultural differences contributed to the failure of the partnership. The differences in corporate culture between the two firms affected performance of the new company leading to failure.

Appelbaum, Roberts, and Shapiro (2009) note that Daimler, a German firm, had a culture of “efficiency, safety, and conservativeness” whereas Chrysler, an American company, was characterised by a “daring, diverse, and creating” approach (p. 44). Although there were efforts to facilitate the integration of two organisational cultures through workshops, the fact that the alliance was considered a “merger of equals” led to a cultural clash (Appelbaum, Roberts & Shapiro 2009, p. 37).

Evidently, there were huge differences between the two firms’ corporate cultures. The first difference relates to organisational structuring. Chrysler’s culture tended to be team-oriented while Daimler favoured a hierarchical organisation with a strict pecking order. The second cultural difference relates to values. While Daimler emphasised on quality and efficient vehicles for its clients, Chrysler valued trendy designs for the cars. Thus, the managers of the firms could not lead towards the same direction due to conflicting values and goals.

Besides corporate culture, mistrust among the employees contributed to the failure. The American executives felt short-changed by their Germany counterparts and thus, could not work together (Appelbaum, Roberts & Shapiro 2009). This may have stemmed from lack of planning in the pre-M&A phase, which affected organisational integration. As a result, several of Chrysler’s executives quit their jobs after feeling mistreated. Therefore, cultural differences played a role in the failure of this merger in three ways:

- created conflicting goals and values

- caused mistrust among the workers

- hampered collaboration

In this case, cultural factors hampered performance of the merger. The stock prices of the new merger plummeted between 1998 and 2000 due to unresolved conflicts that affected the firm’s productivity. Although the merger involved leading car manufacturers, differences in culture contributed to its downfall. The HR should have launched initiatives to sensitise staff about the cultures of the two firms before the entering into a merger.

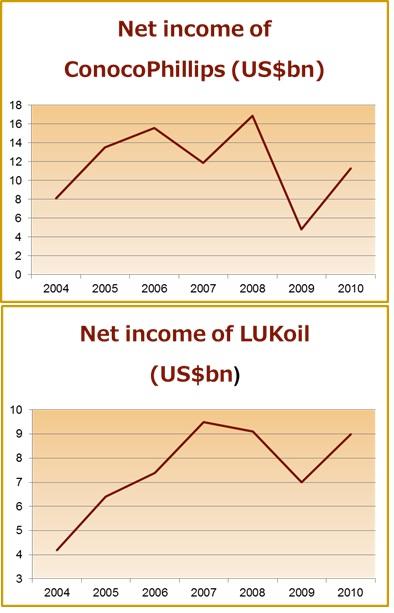

International Joint Venture: Lukoil and ConocoPhillips

An IJV between two corporations, Lukoil based in Russia and ConocoPhillips in the US was successful because the companies addressed the cultural differences between them. ConocoPhillips, aware of the cultural differences, developed a guideline on how to cooperate with their Russian partners. This proactive step allowed the firm to identify the characteristics of the Russian culture, including “individualism, fatalism, decision-making, and teamwork” as well as socioeconomic factors like unemployment rate and generation gap” (Legler, Osborn & Whitehorn, 2008, p. 26). Thus, ConocoPhillips’ employees learnt aspects of the Russian culture and potential integration pitfalls beforehand.

One of the cultural dimensions that exist between the two cultures was individualism versus collectivism. While the Americans emphasise on individual orientation, Russians tend to like groups as opposed to working alone (Legler, Osborn, & Whitehorn, 2008, p. 26). The decision-making process was also different between the two firms. Americans treasure risk taking in business and therefore, decision-making is fast. In contrast, Russians require data to support their decisions. In this regard, analysing the differences between these cultures can help overcome the barriers to a smooth integration due to enhance cultural awareness/competence.

The Effects of Cultural Differences on Integration

Parent firms often influence the corporate culture of overseas subsidiaries (M&As) through expatriate managers. On the other hand, IJVs involve international partners whose national culture is different from local culture in the host country. According to Schuler, Jackson, and Luo (2004), the presence of expatriate employees in an IJV creates a ‘unifying’ culture that guides behaviour and procedures in the subsidiary. However, it can be argued that the convergence of cultures in M&As and IJVs creates an internal culture that is different from that of the parent firm or foreign partners. Thus, in this case, the new culture masks the effects of cultural differences.

The full effect of cultural differences emerges when very dissimilar cultures converge in an IJV or an M&A. This process, which is called cross-culture, causes a cultural shock to expatriate managers, which alters the work climate and impedes integration (Schuler, Jackson & Luo 2004). Cultural collisions are more intense in situations where the cultural distance between the managers is large. As Dowling, Festing, and Engle (2008) put it, the success of cross-border alliances and IJVs depend on partner compatibility.

Thus, on the surface, firms may look compatible, but they need to develop strong relationships so that cultural differences cannot stifle the integration process. IJVs usually create stress and anxiety related to cultural convergence. This could breed unhealthy employee behaviours resulting in lower efficiency and productivity (Meyer et al. 2008). Due to anxiety, employees may waste work hours talking about the venture. Additionally, due to uncertainty about their future, employees may lose morale or quit the organisation leading to reduced overall productivity.

Similarly, in M&As, larger cultural distances between organisations cause cultural ambiguity (Khilji 2012). In addition, cultural conflicts arising from cultural differences do not inspire investor confidence because of a collision of the management styles that hinder M&As from reaching the set objectives. It is important to note that these conflicts arise from the differences in national cultures, which tend to be rigid and unalterable compared to corporate cultures. The effects of cultural differences on integration are compounded by the absence of conflict resolution mechanisms and effective pre-M&A planning.

Research also indicates that some cross-border alliances have many benefits. Dowling, Festing, and Engle (2008) observe that M&As involving firms from different cultures reap benefits like improved performance, cultural innovation, and skills that are unique to a particular culture. Organisations entering new markets also benefit from work practices and behaviour that depend on the national culture. According to Briscoe, Schuler, and Tarique (2012), cultural competence in M&As can foster collaboration leading to better productivity. Additionally, as people become culturally competent, cultural conflicts are likely to decline.

Cultural differences affect three aspects of M&As and IJVs’ performance, namely, trust, post-M&A skill transfer, and attrition rate. These factors hamper the development of a unique organisational culture. An organisational culture embodies the “expectations and assumptions” shared by all employees (Hitt et al. 2000, p. 451). However, without trust and knowledge transfer, the turnover would increase, affecting organisational performance. Organisational culture is a product of the national culture. In this view, cultural differences can affect its development in M&As, resulting in disunity and lack of shared values and practices.

In M&As, it is often difficult to build trust between the two parties when the cultural distance is large. In addition, it is difficult to develop a sense of common identity in M&As involving firms from different cultures because of differences in attitudes and values (Hoskisson et al. 2013). In this regard, building trust among employees of the new firm is a difficult task.

From a psychological standpoint, individuals tend to relate with people who share similar values and views as theirs. As a result, the in-group identity grows due to the cultural differences. It makes people to favour in-group members and show dislike to those of the out-group. The bias is even more intense when in-group members feel threatened by an impending acquisition or merger. Under such circumstances, hostility and resentment may arise and persist even after the takeover is complete.

Conclusion

The aim of this paper was to illustrate how cultural differences determine whether an organisation succeeds or fails in cross-border partnerships. It is evident from the analysis that some dimensions of culture, such as individualism vs. collectivism and power distance, among others, have a direct effect on the way people relate. Social values specific to a particular country influence its national culture, which, in turn, shapes the corporate culture. Although there may be other factors that contribute to failure or success of M&As and IJVs, cultural differences have a big influence because they affect the integration process directly.

In this view, cultural awareness or competency can overcome the barriers to effective integration. It promotes corporate communication and builds trust among the employees. On the other hand, failure to address these cultural factors aggravates the negative effects of cultural differences and results in failure.

Recommendations

Chrysler-Daimler-Benz

- To ensure that cross-border alliances succeed, one corporate culture must not substitute the other. In Chrysler-Daimler’s merger, Daimler-Benz used its corporate culture and model to run Chrysler like its subsidiary. This created mistrust among employees, leading to the failure of the merger. Thus, integration efforts should focus on establishing a consensus culture that contains elements of both cultures.

- In M&As, a pre-merger communication strategy is required to provide guidance on how communication and leadership problems would be handled. In Chrysler-Daimler’s merger, it is evident that the two firms were not willing to work together from the outset. They did not identify and communicate common regulations and norms to employees.

Lukoil and ConocoPhillips

- To cooperate successfully, firms must be proactive in addressing cultural differences between them. ConocoPhillips, before forming a joint venture with Lukoil, identified aspects of the Russian culture that differed with those of the American culture and developed a guide that its employees could use to enhance their cultural competency.

- IJVs should capitalise on cultural differences to bolster their collective competitive advantage. The venture between Lukoil and ConocoPhillips capitalised on the American’s risk-taking attribute and Russian’s scrupulousness to improve the venture’s decision-making processes.

References

Appelbaum, S Roberts, J & Shapiro, B 2009, “Cultural Strategies in M & A’s: Investigating Ten Case Studies”, Journal of Executive Education, vol.8, no.1, pp. 33-58.

Briscoe, D Schuler, R & Tarique, I 2012, International Human Resource Management, Routledge London.

Brouthers, K & Bamossy, G 2006, “Post‐Formation Processes in Eastern and Western European Joint Ventures”, Journal of Management Studies, vol. 43, no. 2, pp. 203-229.

Child, J & Faulkner, D 1998, Strategies of Cooperation, Oxford University Press, Oxford.

Dowling, PJ Festing, M & Engle, AD 2008, International Human Resource Management, Cengage Learning, Harlow Essex, Ohio.

Drouin, N Bourgault, M & Saunders, S 2009, “Investigation of contextual factors in shaping HR approaches and determining the success of international joint venture projects: Evidence from the Canadian telecom industry”, International Journal of Project Management vol. 27, no. 1, pp. 344-354.

Hitt, M Dacin, T Levitas, E Arregle, J & Bozra, A 2000, “Partner selection in emerging and developed market contexts: resource-based and organizational learning perspectives”, Academy of Management Journal, vol. 43, no.1, pp. 449-467.

Hoskisson, R Hitt, M Ireland, D & Harrison, J 2013, Competing for Advantage, Cengage Learning, Mason, Ohio.

Khilji, S 2012, “Does South Asia matter? Rethinking South Asia as relevant in international business research”, South Asian Journal of Global Business Research, vol. 1, no. 1, pp. 8-21.

Legler, S Osborn, E & Whitehorn, G 2008, ConocoPhillips – Final Report, Fisher college of business, Columbus, OH.

Meyer, K Estrin, S Bhaumik, S & Peng, M 2008, “Institutions, resources, and entry strategies in emerging economies”, Strategic Management Journal, vol. 30, no. 1, pp. 61-80.

Schuler, R Jackson, S & Luo, Y 2004, Managing Human Resources in Cross-Border Alliances, Routledge, London.