Introduction

Stem cell research is a branch of medicine that focuses on harvesting stem cells from living organisms for purpose of disease treatment (Ncbi.gov, 2010). It was first feasible in 1981 when stem cells were successfully isolated in mice; however, a breakthrough in isolating stem cells in a human was achieved seven years later in 1988 (Zullinger and Brown 2008). With this breakthrough, scientists have since been advancing and refining stem cell treatments which today can successfully be carried out to cure diseases that were previously considered incurable. Stem cell treatment employs a procedure where cells harvested from other organisms are introduced to subjects suffering from a disease for treatment purposes. Because stem cells must be harvested from an existing living organism, this has led to a controversy that has dogged stem cell research and fueled debate since its evolution and which continues to be the major obstacle in the adoption of stem cell treatment in many countries as a viable option for treating presently incurable diseases (Zullinger and Brown 2008; Vestal, 2008).

The purpose of this paper is to explore the broader issues that impact clinical trials of stem cell research and treatment in general, the relevant regulations that govern these trials, the feasibility of cost-effective stem cell innovations, the potential of stem cell treatment, and analysis of existing market share among other factors that impact on embryonic stem cells products.

Study Objectives

- The financial outlook and capabilities of Stem Cell Companies to deliver cost-effective embryonic stem cells products

- The ability of Stem Cell Companies to deliver stem cell-based products that have been clinically tested and which are acceptable to end-users.

- Analysis of the existing market segment and demand level for stem cell-related products that are currently feasible.

- An evaluation of challenges posed by issues of patent license owned by Geron and WARF Stem cell Companies and how this arrangement impacts on other players interested in joining the stem cell industry.

- Financial analysis of major global companies in the stem cell industry currently running clinical trials and analysis of economically viable merger prepositions between various players in the industry.

Literature Review

Stem Cell Clinical Trials

Like all medical research studies, the purpose of clinical trials in stem cell research are threefold; one, they are designed to provide scientific evidence on key questions of interest that are at the center of the development of the medical product that is being ascertained (Bert, 1984). Secondly, clinical trials are used as the basis of verifying the efficacy of the drug that is being tested and finally clinical trials provide valuable insights regarding the mechanism of the disease condition while at the same time ensuring that quality is achieved in the manufacture of drugs and the pharmaceutical industry at large (Bert, 1984). In general, there are four standardized stages under which clinical trials are done which are referred to as phases that range from I to IV; for each of this phase, the purpose of the clinical trial is aimed at accomplishing a particular objective as we shall in see in the following discussion (Bert, 1984).

Phase I

Phase I of the clinical trial is primarily concerned with establishing the safety of the medical drug that is being tested (Cancerhelp.org.uk, 2011); apart from this the researchers in this stage of the clinical trial will also be evaluating two other components of the medical product, that is the determination of what the safe dosage should be for the dug and also an investigation of any side effects that the drug might pose to the target subjects (Cancerhelp.org.uk, 2011; (Bredeson, and Pavletic, 2004). Since this is only exploratory research with a very clear objective of determining the medical product safety, a very small research group is used in this stage, ideally between 20 and 80 persons (Bredeson, and Pavletic, 2004).

In clinical trials of stem cell-based products, this phase is designed to be done on actual patients who are considered to be ideal control subjects (Bbc.co.uk, 2010). But despite this measure, the objective of this phase has proven to be very challenging where stem cell therapies are concerned given their unique nature. For one, the methodologies of measuring the toxicity posed by stem cell grafts in host human organs or determination of the general safety issues that stem cell procedures pose have not been perfected which means they cannot be accurately determined (Bretzner, Gilbert, Baylis and Brownstone, 2011).

Furthermore standard assays that are routinely used in assessing the safety of drugs such as analysis of blood chemistry, liver enzyme levels, and so on are strictly not applicable in this case (Bretzner et al, 2011). Finally, the fact that phase I stem cells cannot be designed to adhere to the dose-escalation model means that the results of this phase cannot be interpreted in the standard manner like other clinical trials (Bretzner et al, 2011).

All these factors mean that the design of phase I clinical trials in studies that involve stem cell-based products are expensive, hard to implement, and even harder to interpret. So far, Geron Company has already initiated a phase I clinical trial that was approved by the FDA in which the Company is targeting to develop stem cell therapy for treating spinal cord injuries (Geron.com, 2011; Popsci.com, 2009; Stemcellresearchcures.com, 2011); this is in the backdrop of the challenges of designing an effective phase I clinical trial for stem cell therapies as we have seen so far.

Phase II

Having established the safety of a given medical drug, the focus now shifts in the assessment of its efficacy, but with issues of the drug safety still being further assessed. Thus, in this case, the researcher’s main intention is to verify if whether indeed the medical product is effective in treating the medical conditions that it claims and for which it was developed, while at the same time investigating the safe dosage that is appropriate under such circumstances (Cancerhelp.org.uk, 2011). Because the major objective, in this case, has to do with verification of the medical product efficacy, a slightly larger research group is used during this phase.

This second stage of clinical trials is at times subdivided into two sections; part A and part B. In part A, the nature of the drug efficacy verification can be described as the determination of the particular medical product efficacy in general while part B of this stage is more rigorous and must incorporate control trials to accurately determine the efficacy level of the medical product and are therefore appropriately referred as pivotal trials (Bert, 1984). In stem cell research this phase mainly comprises of assessing the efficacy of stem cell therapy among the patients receiving this therapy (Californiastemcell.com, 2009). In the case of Geron Corporation, the objective of its phase II clinical trial is to evaluate the clinical activity of the imetelstat telomerase inhibitor drug (GRN164L) that is meant to treat Essential Thrombocythemia (ET) (Geron.com, 2011).

Phase III

Thus far, the medical drug that is being clinically tried must have performed very well in the two previous trials for it to make to this stage because in this phase the main purpose is to confirm the medical drug efficacy as far as treatment of the given disease conditions are concerned (Bert, 1984). For this reason, a much larger sample size is used and the study itself is even more rigorous to determine within very high accuracy the efficacy of the drug. Besides that, another purpose of phase III clinical trial is to identify if any side effects emanate from the treatment, their nature, investigate further the drug’s safety issues and all other related issues that arise from its use (Gimble, Bunnell, Casteilla, Jung and Yoshimura, 2010). More importantly, it is at this phase that the researchers undertake a detailed comparison of the drug efficacy with other previously manufactured drugs that are commonly used in the treatment of similar disease conditions.

The reason is to assess how the particular medical product that is being tested is expected to perform when compared to other commonly used drugs and for this reason the implication of this evaluation in stem cell clinical trials means that it is very hard to structure the clinical trials similarly not to mention very costly and impossible to determine the intended objectives. This is because there are currently not in the market any stem cell-based products that can be used for this purpose of comparative basis to indicate the efficacy of stem cell products that are being developed. In any case, most of the stem cell-based products that are currently being developed are pioneer therapies that are being developed for several therapies that range from treatment of spinal cord injuries to treatment of strokes and blood cancers (Gimble et al, 2010). Even more confusing is the fact that some of the stem cell-based products that are currently in the market have never been clinically tested beyond phase II which makes their use very dubious and of course useless to use as products of reference for these purposes.

Phase IV

This is the last stage in clinical trials for most drugs in the pharmaceutical industry; certification of this stage signals acceptance of the medical product as safe and effective in treatment or management of the disease condition for which it was developed (Bert, 1984). Activities involved in the Phase IV stage are described as “post-marketing studies” because they are undertaken for several years following the actual manufacture and marketing of the medical product that has been developed in this process (Bredeson and Pavletic, 2004). The major purpose of this stage of a clinical trial is to prospectively collect key information of interest that pertains to the medical product that has been developed with intention of identifying any risks associated with drug use that could have been overlooked during earlier phases of the clinical trials and also determine if there are long term side effects that are associated with the usage of the medical product (Bredeson and Pavletic, 2004).

Because this phase intends to collect a range of pertinent data that emanate from the medical product usage, it usually involves undertaking a study on a wide range of subjects who are using the product in a form of a cohort study that makes a follow up of the progress of the patients and takes records of such issues like notable side effects, duration of treatment, effective dosage, drug interaction and so forth (Bredeson and Pavletic, 2004).

Evolution of Stem Cell Research and its Legislation in the US

After abortion was first legalized in the U.S in 1973 (Vestal, 2008) the first in vitro fertilization in humans was achieved and the stage was now set for further advances in the field of stem cell research. As a result, legislations were enacted during this period to address these developments and regulate research in the use of human embryos by outlawing the use of federal funds to advance research in this field, but this alone would not be enough. With these restrictions in place and lack of long term sustained source of funding that was necessary to advance stem cell research, a panel of NIH Human Embryo Research committee was convened and wrote a proposal to the then President of U.S Bill Clinton that sought to have restriction on the use of federal funding in stem research using human embryo lifted (Vestal, 2008).

The Clinton administration in response allowed the use of federal funding in embryos that were not specifically developed for use in stem cell research and declined to allow funding in stem research that made use of human embryos that were deliberately made for this purpose.

The contentious issues centered on matters of ethics, sanctity to life, and morality with religious leaders opposing by voicing their concerns (Vestal, 2008). The final blow on the research of stem cells was rendered through the Dickey amendment which was signed into law in the same year by Clinton that finally put rest to the discussion.

Under the Act, it becomes illegal to use federal funding in advancing research through the use of a human embryo regardless of the source or purpose of which the embryo was made available (Liddell, 2005). This policy would, later on, be attributed to the sluggish rate at which innovation in stem cell research was to take place for the next one decade or so as a result of this policy of selective funding adopted by the federal government restrictions which effectively slowed the rate of innovation in the industry. However, this Act didn’t place a blanket ban on stem cell research that was privately financed but served to cut financial resources that had been integral in advancing stem cell research (Liddell, 2005).

With this outcome, the stage on stem cell research shifted to private corporate entities that were willing to fund the ongoing research efforts for monetary gains. In 1998 the final breakthrough in stem cell research that would eventually enable stem cell treatment occurred through privately owned research facilities. With the benefits that now came with the discovery of treatment through stem cells of previously incurable diseases such as cancers and diabetics the U.S legislators gradually started changing their hard-line stance. In early 2001 president, Bush sought to review the Dickey Act to allow a limited number of human embryos to be used for stem cell treatment and research in a government-funded initiative (Graves, 2007).

In the same year, these reviews were implemented and allowed to take place in an environment that was well controlled by other legislation that was still in place. The following year, the journal Science voted 1999 the stem cell research year noting that significant breakthrough in the field was achieved then (Vestal, 2008). In April of 2004, congress members petitioned President Bush to fast track current efforts and increase funding on the research of stem cells and treatment, but this was not enough to achieve the necessary change in legislation. In July 2006 the house senate consented to three different bills that both pertained to stem cell research and federal funding (Vestal, 2008). The first bill legalized and increased federal funding for stem cell research that used human embryos with consent from their donors. However perhaps to seal loopholes that could have resulted from this legislation another bill that made it illegal for provisions or growth of human embryos solely for research initiatives including abortion was enacted as well.

The third bill focused and allowed funding in other areas of research that would promote stem cell research to advance without having to destroy the life of human embryos. In the same year, more than 600 million dollars were used from federal money reserves in stem cell research program; in the fall of 2006, the Stem Cell Research Enhancement Act was vetoed by President Bush as well as the Fetal farming Prohibition Act which prohibited human fetal donation for purposes of stem cell research (Long, 2009).

In 2007, the California Institute of Regenerative Medicine awarded the biggest ever financial grant of $45millions towards embryonic stem cell research in absence of government legislation or a regulatory framework (Geil, 2010; Cdph.ca.gov, 2010). All the money was awarded to leading research institutions that pursued stem cell research.

In 2008, the state of Michigan affected an amendment in their state that allowed scientists in their jurisdiction to research embryonic stem cells derived from human embryos and fetuses (Long, 2009).

In March, 2009 shortly after taking office President Obama further eased restrictions that controlled the use of federal funding in stem cell research of human embryos, through a presidential executive order that scrapped opposition of federal funding to embryonic stem cell research. This would now for the first time allow federal funding on stem cell research on human embryos but still subject to certain limitations. Earlier in the year, the U.S Food and Drug Administration endorsed clinical trials in stem cell treatment thereby increasing the interest of the private sector to invest more in the industry (Technologyreveiew.Com, 2010; Fool.com, 2008).

Legislation

One of the major challenges that face the manufacture of stem cell-related products is the issue of regulatory frameworks that governs stem cell-based products and the pertinent legislation. These legislations and regulatory challenges are further complicated by the fact that stem cell-based medical products are not characteristic of mainstream medical products upon which the current regulatory framework was designed for. As a result of this, the production and manufacture of stem cell-related products have been curtailed and is the main reason that is attributed to the inability of many stem cell companies to launch clinical trials that are prerequisites before stem cell-based products can be manufactured. Indeed, a research survey done by the California Institute of Regenerative Medicine (CIRM) indicated that “regulatory uncertainty creates delays in the clinical development of pluripotent and nontransient cell therapies” (Martell, Trounson and Baum, 2010) which was identified as the main reason that makes stem cell products clinical trials very expensive.

Legislation laws meant to regulate stem cell research and treatment in the U.S is an area that continues to elicit heated debates among lawmakers and politicians. However it is in no way limited to the U.S alone; in 1990 U.K, Britain Human Fertilization and Embryology Act was passed into law. The Act allowed stem cell research through the cultivation of embryos but placed limitations of research to areas that would generate increased knowledge in the field of in vitro fertilization of cells rather than areas that pertain to stem cell treatment per se (Legislation.gov.uk, 2011). In 2001, the same Act was amended to allow research in stem cells to enable cloning of tissues for treatment purposes; however somatic cloning of cells research was not granted within these amendments (Legislation.gov.uk, 2011).

Other changes that were made in the Act was lifting of the ban on State fund towards stem cell research and more importantly in the process allowed human embryos to be developed purely for stem cell research purposes but subject to few restrictions. At about the same time seven scientists in the U.S opened a case at the high court in Thompson vs Thompson where the Bush Administration was sued for their decisions to freeze funding on stem cell research (Zullinger and Brown, 2008).

This marked the start of heightened lobbying activity by the few stem cell companies operating in the industry by then that was keen on initiating intensive research because of the promising prospects that the innovation offered.

In November of 2001, Germany and France announced that they will agitate for an international ban on human cloning that was now possible due to breakthroughs in stem cell research. The United Nations responded by forming a committee in the auspices of an international convention that had the mandate to draft policies that sought to ban stem cell application for human cloning. In 2002 negotiations that would have seen an international ban on human cloning were suspended after the Vatican and U.S raised last-minute objections that sought to have all forms of cloning, including for treatment purposes banned which caused an impasse (Zullinger and Brown, 2008).

In 2002 Research Involving Embryos and Prohibition of Human Cloning Bill was brought to the floor of the Australian parliament and passed (Long, 2009). At the same time, the Singapore government passed laws that allowed human cloning to occur in specific stem cell research projects without effecting other legislation that would have regulated and controlled the proliferation of unethical stem cell research. In 2004, two scientists from South Korea announced successful ever human cloning in a country where debate and legislation on stem cell research are tightly controlled by the government agencies; one year later the same scientists carried out cloning of humans using somatic cells through a technology that most countries have been trying to regulate and prevent citing moral and ethical issues (Long, 2009).

Methodology

Financial Cap of two Prominent Companies in the Stem Cell Industry

Geron

Geron Company is a biotechnology firm located in California which is dedicated to manufacturing and commercializing different products in three major categories, namely; curative drugs for cancer patients meant to slow down telomerase, pharmaceutical products which triggers telomerase in the body tissues, and cell-based therapies which are generated from human embryonic stem cells usually used to treat numerous chronic diseases (Geron.com, 2011). According to a report released a few weeks ago by the company financial department, the firm has incurred “a net loss of 20 cents per share” (StockWatchcom. 2011) which is a much bigger loss than estimated but which has been attributed to higher expenses by the company in the first quarter of the year (Geron.com, 2011).

Over the recent past, the company has been undergoing a financial crisis caused by excessive expenses that have been going towards the R&D activities of its products most of which it has subcontracted to other research institutes. Its financial crisis is also facilitated in part by its inability so far to make a breakthrough in the manufacture of stem cell-based products that can be readily marketed to generate income that will enable it to recoup part of its expenses that it has used so far in developing of the stem cell therapies. However, with the recent kick start of its clinical trials, it is expected that the Company is on its path to profitability assuming that the efficacy of its stem cell based-products that it is currently developing is proven.

In the following section, we are going to undertake a detailed financial analysis of Geron Corporation’s financial base to assess the financial viability of the company in researching, manufacturing, and delivering stem cell-based products in the market under the circumstances.

Finances and Market capitalization

In 2010, 2009, and 2008 as shown in the table the management of Geron Company was not able to control research and development related costs and financing costs. The financial implications of Geron highlighted in this section will be discussed in more detail in the next section.

Advanced Cell Technology

This is a biotechnology firm based in the US that specializes in manufacturing and selling “human embryonic and adult cell technology” in specific areas of regenerative medicine for the treatment of various chronic conditions (Advancedcell.com, 2011). A recent report indicates that Advanced Technology Company is now in better financial shape and is recovering from its financial crisis that it has been undergoing over the recent past (Advancedcell.com, 2011). Financial reports also indicate that the firm has “entered a non-convertible stock agreement with Socius CG II, ltd” (StockWatchcom, 2011) which will enable the ACT Company to float most of its shares in the market and thereby obtain much-needed liquidity capital that it requires to inject in its R&D projects.

To ensure its sustainability in the market the firm will need to utilize this capital to fund its current clinical trials and thereby hope to put the stem cell-based products in the market before it runs out of capital. Currently, the company has sold most of its shares to Optimus Life Science Capitals and used the money to settle most of its debts (Advancedcell.com, 2011).

In this section, we shall undertake a detailed financial analysis as above to determine the financial viability of the Company and the implications that this has in its area of business which is stem cell-based manufacture. The firm profitability was at stake in 2010 when compared to 2009 this means that Advanced Cell Technology managers’ were not able to control the cost of research and development and other operating expenses.

Pfizer Inc. and Subsidiaries companies

Unlike the two other companies, Pfizer has been in the stem cell industry for quite a long time now. Our interest, in this case, is to evaluate the financial capital base of Pfizer Corporation which is one of the major companies in the industry with the ability to acquire cash-constrained companies such as Geron ACT companies. In 2010, Pfizer Incorporation and its subsidiaries as shown increased their revenue by 36% or $17,800 to $67,809 compared to the financial year 2009 (Pfizer.com, 2011). The gross profit margin decreased by 8% in 2010 when compared to 2009; this was as a result of an increase in the cost of sale by 83% or $7,391 in 2010 (Pfizer.com, 2011).

Market Analysis of Stem Cell Industry

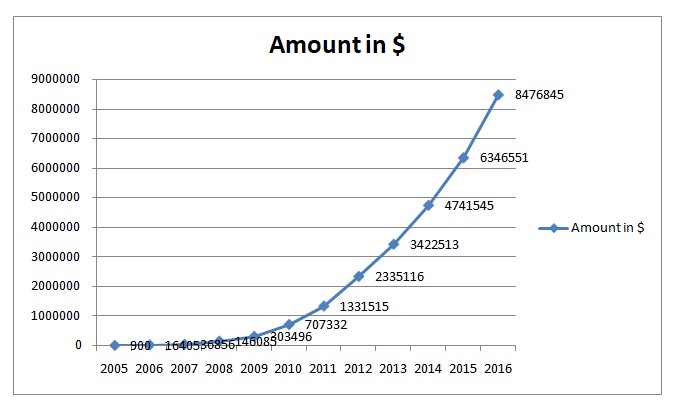

So then after all this discussion on the financial viability of the two stem cell industries that are very promising in as far as the manufacture of stem cell-based therapies are concerned given that they have already initiated clinical trials, the question then becomes if whether the benefits of investing in stem cell-related initiatives exceeds the costs. To determine this let us review some statistics; since 2005 when earlier research on stem cells started paying off, the revenues attributed to this industry have been increasing upward at an unprecedented rate. In 2005 for instance the estimated revenues by stem cell companies in the US alone where the data is available is as shown in the table below and was less than 1 million dollars, but just one year later this figure has surpassed that many times over (Stemcellsummit.com, 2007).

Discussion

Geron

Based on the above financial analysis the corporation did not utilize capital or investment to generate returns to the providers of the funds. In 2010, the corporation seemed less profitable than the previous years as a result of the ratio decrease compared to 2009 and 2008; this implies that the management efficiency deteriorated (Bloomberg.com, 2011). The company margin has improved in 2010 when compared to the fiscal year 2009 and 2008 and this implies that the management was able to control the research and development costs and other operating expenses. It could also mean that Geron was able to put into the market and sell most of its stem cell-based products more than the previous years. Revenue generated can cover fixed assets 0.1, 0.03, and 0.35 times in 2010, 2009, and 2008 respectively which indicates an upward trend in the ability of the corporation to use its assets efficiently in 2010 compared to the other years.

The corporation was able to meet its short-term obligation in all three years as a result of a high ratio which was more than one; a ratio of one represents the margin of safety (Pamela, 2009). But in 2010 the company liquidity decreased when compared to 2009 and 2008, with a current ratio of 4.8:1 this implies that the current liabilities would be covered 4.8 times. Therefore, the creditors will be less confident with the firm due to the change in a ratio that represents a reduction from 15.8 times to 4.8 times. However, no company should be very liquid (Meir, 2008; Liraz, 2008) for example, in this case, Geron’s current assets can cover current liabilities 21.8 or 15.8 times in 2008 and 2009 respectively. This makes it very liquid implying that the corporation had a lot of cash in hand in those two years which was not being invested or used to finance research and development. This as we have seen could be because of the regulatory requirements that were making it difficult for most companies in the industry to undertake prerequisite clinical trials needed before the manufacture and marketing of stem cell-based products.

As a consequence, the corporation was maintaining idle cash without adding value to the owners of the funds; however, in 2010 the corporation had less idle cash as it is investing more in marketable securities and R&D as well (Bloomberg.com, 2011). This makes sense since it is on this year that the Company started initiating the phase II clinical trials. Based on the same analysis, shareholders expected to generate ($1.14), and ($0.8) per share in form of earnings for every share invested in the firm in 2010 and 2009 respectively. In 2010 the shareholders received fewer earnings than in 2009. This indicates that Geron was less profitable in the year ended December 2010 on a per-share basis which is because it was mostly investing in R&D, financing of clinical trials, and the production of stem cell-based products that it has lately been pursuing.

Geron shares listed on NASDAQ closed at $4.96 on 13th May 2011 after a decrease of 0.6% when compared to 12th May 2011 closing share price, with a market capitalization of $639.8 million and outstanding of 129 million on the same date. The corporation does not pay dividends thus the shareholders have to utilize the market price movement to earn capital gains (Mysmp.com, 2011), this implies that the corporation uses all the cash generated to finance growth but it is currently operating at a loss with no retained earnings.

This means that the firm has to seek more financing from external financiers who might be interested in financing its projects or partnering with it; some typical examples of a common source of funding, in this case, would be federal funding or financial institutions and mergers prepositions. Given that Geron Corporation has over the recent past not been making a profit it means that it is not in a position to carry out further R&D or even finance further clinical trials that are needed before it can put it stem cell-based therapies that it is developing in the market. This financial position also means that Geron Corporation is exposed to acquisition takeovers and can be the target of merger takeovers by more established and stable companies in the industry.

Advanced Cell technology

The return on assets for instance decreased in 2010 from a high of (49.79%) in 2009 to a low of (679.29%); but the return on shareholders’ funds was high in 2010 than in 2009 (Advancedcell.com, 2011).

Gross profit margin increased in 2010 by 8.51%; in 2010 fixed assets could be covered 0.2 times when compared to 2009 with 0.58 times (Advancedcell.com, 2011). This means that in 2010 there was a decrease in revenue probably because the organization did not utilize its assets efficiently to generate earnings. Current assets could be covered 1.4 times which was an increase of 1300% from 0.1 times, this implies that the organization was more liquid in 2010 when compared to 2009. Every share held by the investors was expected to yield ($0.04), ($0.07) and ($0.14) in 2010, 2009, and 2008 respectively; as a result investors in 2010 incurred a lower loss on their investment in shares held when compared to the year 2009 and 2008 (Actcblog.com, 2011).

Advanced Cell Technology market capitalization on 13th May 2011 dropped by $154,296 to close to $316.30 million, this means that the market price per share decreased by 0.05% to close at $0.205 while the shares outstanding were 1.54 billion (Dailyfinance.com, 2011). In conclusion, just like Geron, Advanced Cell Technology seems to be of the same financial position which means it is financially constrained to undertake further R&D initiatives or complete clinical trials of stem cell-based products with its current financial base. The indication is that both organizations have fully exhausted the internal sources of funds which means that they should therefore seek funding from external sources, to bring stem cell products to the market.

Pfizer

The net profit margin decreased from 17% to 12% which implies that the company was not able to control the cost of sales, operating and financing cost, which includes the acquisition-linked underway research and development cost including other acquisition costs undertaken in 2010 (Pfizer.com, 2011).

Pfizer efficiency with which a firm uses capital employed to generate a return to providers of funds remained constant in 2010 and 2009; which represented a drop of 5% from 10% in 2008. Return on Equity at the same time dropped by 1% in 2010 compared to 2009; this means that the firm profitability has dropped in the fiscal year 2010 compared to 2009 and 2008 (Pfizer.com, 2011). This may be a result of an increase in charges needed to finance the acquisition of Wyeth which is now one of its subsidiaries (Investopedia.com, 2011). Earnings per share have also reduced from $1.23 to $1.03; this means that returns expected by the investors have reduced by 16%. Pfizer is not highly geared as its debt-equity ratios in all three years are not more than 100%; this implies that the company’s financial risk is very low (Pfizer.com, 2011).

On 13th May 2011 Pfizer shares which are listed on NYSE closed for $20.92 with a gain of $0.03 for the day; on the same day, the market capitalization was at $167.18 billion (Pfizer.com, 2011). The company is in the maturity stage and for it to survive in the industry it has to acquire other firms as a strategy for its growth; this makes both Geron and ACT Company very vulnerable to takeovers initiated by Pfizer Incorporation. It is also paying dividends to the shareholders which means that the company is not retaining all the income earned for future activities (Pfizer.com, 2011).

Geron corporation as discussed earlier seemed to be more profitable than Advanced cell Technology. Based on the rations it seems that Geron’s management was able to control the cost of sales, operating costs, and financing costs compared to Advanced cell Technology. Geron’s share price closed at $4.96 and that of Advanced Cell Technology closed at $0.205 on 13th May 2011. This means that an investor would be willing to invest in Geron whose shares have high value and high market price variation which implies that the shareholders will make high capital gains as price varies by a huge amount. Geron and Advanced Cell Technology market capitalization was at $639.8 million and $316.30 million respectively as of 13th May 2011, therefore Geron has a high market capitalization compared to Advanced Cell Technology.

In consideration of the above scenario, Pfizer has a high market capitalization than Geron and Advanced Cell Technology since it has a financial base that is enough to acquire both these companies combined which in total have a market capitalization of $956.1 million. To acquire Geron, Pfizer will have to part with more dollars than if it acquired Advanced Cell Technology; this is because in any acquisition transaction the acquiring company (Pfizer) will acquire all the target (Geron or Advanced Cell Technology) company’s assets including the shareholders (Microstrategy.com, 2011). Because Pfizer profitability in 2010 was not desirable as it was decreasing compared to 2009, I would recommend Pfizer to acquire Geron as this would improve its profitability and enable Geron benefit from the much-needed liquidity capital to fund its current clinical trials whereas Advanced Cell Technology can be considered as a future target for merger or acquisition.

Stem Cell Market Analysis

Based on the financial analysis that we have so far done on the two major US-based companies it would appear that the estimated values of $8.5 billion in the US by 2016 is very conservative at best considering that this study was done around 2007. The most recent estimates of stem cell global market worth as of 2010 pegged it at $88 billion by the year 2014 which could be the most accurate so far (McCusker, 2010). This is more so when you consider that at the time there were about 200 stem cell companies globally that only focused on research and manufacture of three types of stem therapies, today that figure has more than doubled and the range of stem cell-based products that are being developed have more than quadrupled (McCusker, 2010).

At around the same year, the estimated market for stem cell-based products in the US alone was pegged at more than 2.5 million which we can only assume has been increasing over the years globally in tandem with the estimated revenues of these companies derived from stem cell-based products (Stemcelldigest.net, 2009.). If the current trend in legislation and regulatory framework that pertains stem cell research industry which has been easing over the recent past is anything to go by, then the stem cell industry can only get robust as ethical issues and controversies that affect the stem cell industry are addressed. California which is one of the States that have undertaken huge steps towards this end has enacted legislation that has allowed it to fund various stem cell projects of which “28% has been allocated to cancer, 23% to neurological diseases, and 13% to blood/immune disorders” (Sbwire.com, 2011; Forbes.com, 2011).

Conclusion

With these developments, the future of stem cell research still hangs in the balance with the majority of countries still fumbling with legislation to address the advance in the science of stem cell research. As documented previously the U.S has so far the most comprehensive legislation that regulates and controls stem cell research for cloning and therapeutic purposes. Another country that has legislation in place is Britain which incidentally is the first country in the world to give out the first license that allowed cloning for stem cell treatment. With the current restricting legislation on stem cell research that is in place future decisions that might lift most of these restrictions and allow cloning from U.S lawmakers will be delayed and minimal. However, with the direction that the current legislation in the field has been taking it is more likely that the hard-line stance would continue to soften over the coming years as has already happened.

Besides, the future and the benefits that stem cell research provides are immense and a matter of urgency to the many persons who need the technology that would relieve their conditions. The ever increasing cases of persons with a disease that modern medicine cannot treat would be just one area that would be continuously agitating for favorable legislation. This means that the governments and lawmakers in the future will encounter increased resistance to legislations that are seen to restrict the use of stem cell research for treatment purposes. This is not to mention members from the research fraternity that have always been at the forefront of pushing for amendments in legislation that would legalize stem cell treatment and research as was the case in Thompson vs Thompson federal suit.

Besides this, the moral and ethical issues that surround stem cell research, treatment, and cloning are not about to disappear. When certain core values are enshrined in a constitution, then future legislation Acts and constitutional amendments should not be seen to contradict this. The U.S constitution guarantees the right to live, the pursuit of happiness, and sanctity of life, if stem cell research that allows fetal harvesting and growth for the sole purpose of research were allowed, it would be in contradiction to the sanctity of life and right to live as enshrined in the constitution since it will be endorsing the destruction of the life of the fetus. But on the other hand, if stem cell treatment was to be declined then the right to the pursuit of happiness and health care as guaranteed in the same constitution would be contradicted; this is the catch 22 scenario that any modern government legislation must address.

References

Actcblog. 2011. Advanced Cell technology announces 2011 first quarter results. Web.

Advancedcell. 2011. Advanced Cell Technology Secures $25 Million Funding Commitment. Web.

Bbc.co.uk. 2010. First trial of embryonic stem cells in humans. Web.

Bert, S. 1984. Guide to Clinical Trials. New York. Raven press.

Bloomberg.com. 2011. Geron Corp. Web.

Bmj.com. Web.

Bredeson, C, and Pavletic, S. 2004. Considerations when designing a clinical trial of hematopoietic stem cell transplantation for autoimmune disease. Journal of best practice & Research Clinical Haematology. 17(2): pp. 327-343.

Bretzner, F, Gilbert, F, Baylis, F, and Brownstone, R. 2011. Target Populations for First-In-HumanEmbryonic StemCell Research in Spinal Cord Injury. Journal of cell stem cell, 11(2): 1-11.

Californiastemcell. 2009. FDA Clinical Trials. Web.

Cancerhelp.org.uk.2011. Phase 1, 2, 3, and 4 trials.200. Web .

Cdph.ca.gov. 2010. California Department of Public Health Guidelines for Human Stem Cell Research. Web.

Dailyfinance. 2011. Advanced Cell Technology Inc. Web.

Fool. 2008.Obama can’t save stem cell companies. Web.

Forbes. 2011. Company Stem Cell. Web.

Geil, J. 2010. California Law Permits Stem Cell Research. Web.

Geron. 2011. Geron Initiates Phase 2 Clinical Trial of Imetelstat in Patients. Web.

Geron. 2011. Geron posts wider loss. Web.

Graves, L. 2007. US Federal Stem Cell Legislation. Web.

Gimble,J. Bunnell, A. Casteilla, L. Jung, J. and Yoshimura,K.2010. Phases I–III Clinical Trials Using Adult Stem Cells, Journal of stem Cells International, 10(1) : pp 20-24.

Investopedia.com. 2011. Diversification. Web.

Legislation.gov.uk. 2011. Human Fertilization and Embryology Act 2008. Web.

Liddell, K.2005. Emerging Regulatory Issues for Human Stem Cell Medicine. Journal of Genomics society and policy, 1(1): PP 54-73.

Liraz, M. 2008. Financial ratio analysis. Web.

Long, C. 2009. Timeline of Stem Cell Debate. Washington Post, 65. Web.

Martell, K. Trounson, A. and Baum, A. 2010. Stem Cell Therapies in Clinical Trials: Workshop on Best Practices and the Need for Harmonization. Journal of Cell Stem Cell, 7(1): pp 451-454.

McCusker, H. 2010. The Global Stem Cell Market. Web.

Meir, L. 2008. Financial ratio analysis. Web.

Microstrategy. 2011. Financial Analysis. Web.

Mysmp. 2011. Fundamental Analysis. Web.

Ncbi.gov. 2010. Step cell international. Web.

Sbwire.com. 2011. US Stem Cell Market to Witness Splendid Growth. Web.

Stemcelldigest.net.2009. Stem cell market analysis fact sheet. Web.

Stemcellresearchcures.com. 2011. First clinical trial using embryonic stem cells underway. Web.

Stemcellsummit.com. 2007. Stem Cell Market Analysis Fact Sheet. Web.

StockWatchcom. 2011. Asset classes. Web.

Pamela P. 2009. Financial ratio analysis. Web.

Pfizer.com. 2011. The World’s Largest Research Based. Web.

Popsci. 2009. FDA approves first ever stem cell clinical trail. Web.

Researchfoundation. 2010. Wisconsin Alumni Research Foundation. Web.

Technologyreveiew. 2010. FDA Lets Human Embryonic Stem Cells Trials Resume. Web.

Vestal, C. 2008. Stem Cell Research at the Crossroads of Religion and Politics. Pew Forum Paper, 13(6). Web.

Zullinger, J and Brown, K. 2008. Stem cell market analysis fact sheet. Garland Science 57. Web.