Summary

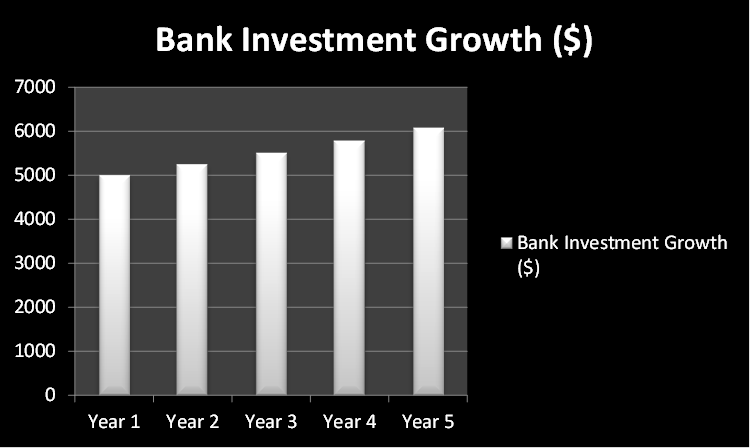

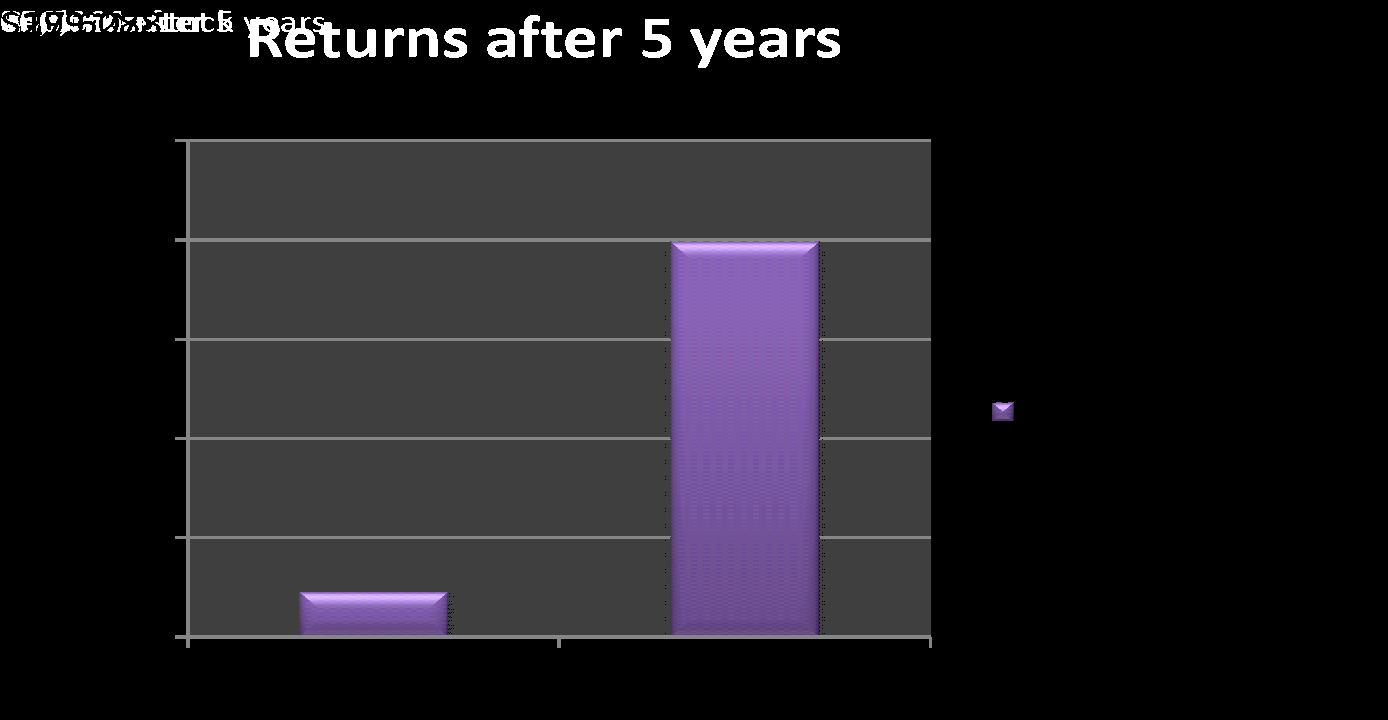

Financial investment is an important part of any comprehensive financial growth. Without financial growth, it is hard to achieve financial growth. In this case, my objective is to identify a financial investment option for my client. The client has $100,000 to invest in either a bank account or a common stock in the Amazon Company listed in S&P 500 index. However, my problem is how to make an informed decision for the client. To solve this, I would figure out how investing in a common stock in Amazon Company is more viable than investing in a bank account. As shown in Figure 6, through a bank account, my client would get a return of $27,627 and $199,088 for investing in a common stock after five years. Using this information, I will show why my client should invest in the common stock.

What Financial Information Helped You Make Your Decision-ratios, Growth Rates, Margins, Competition?

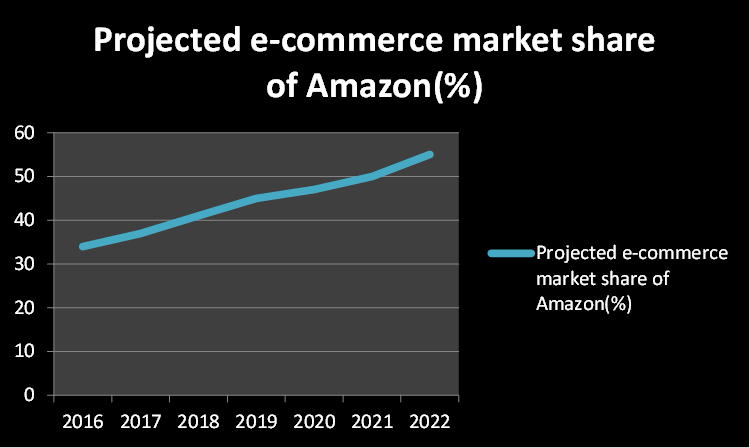

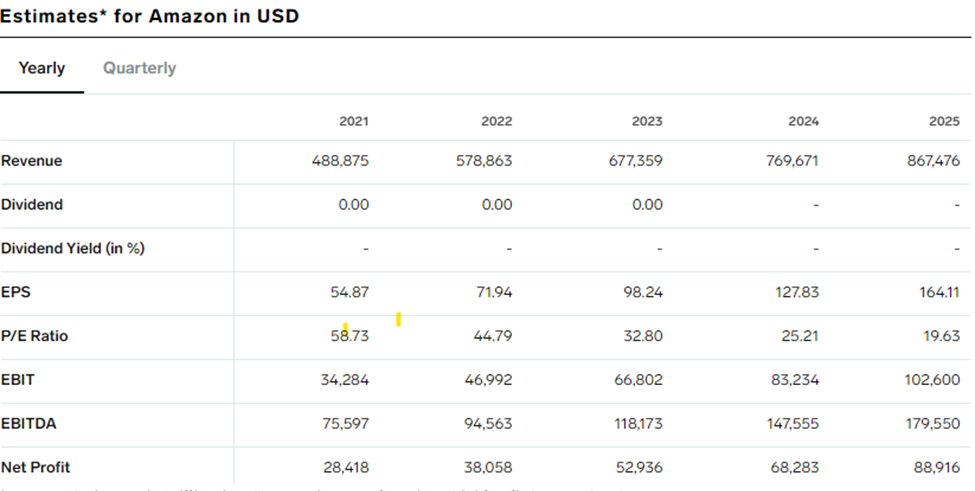

I used the growth rates, financial ratios, and competition of Amazon to decide on investing in common stock. These considerations help to determine if purchasing a common stock is a better investment than a bank savings account and whether the common stocks will continue to be as profitable in the future (Market Insider, 2021). In terms of competition, Amazon Company has proved to be highly competitive, and its market share is expected to increase, as shown in figure 4. The projections of earnings per share of Amazon Company display a steady increase. Moreover, as indicated in figure 3, in 2021, earnings per share are likely to be 54.84, while it is projected to be 164.11 in 2025. Using this information, it will be viable to invest in common stock.

What Role Does Risk Play, and How Do You Account for it in Your Analysis?

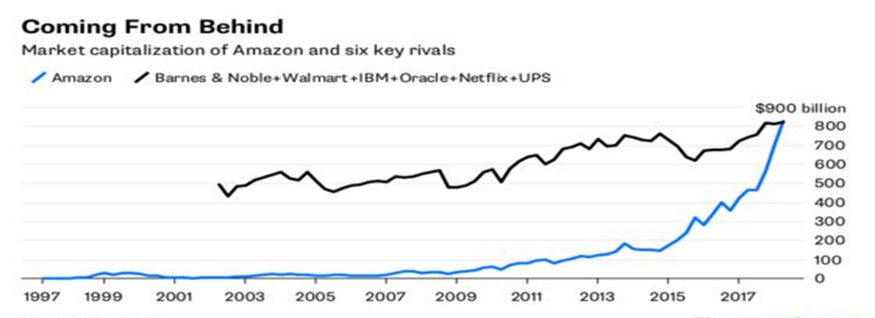

Risk is an important consideration in any investment decision. An aspect to consider is the possibility of Amazon Company falling out of the market due to extreme competition from its rivals or external market forces. However, the likelihood of the risk occurring is low because of the outright performance of Amazon. As of 2011, Amazon has shown a steady rise in its market capitalization from 100 to 800 billion (Figure 4). In addition, financial analysts have given a positive projection of Amazon’s net profit in the next five years. They have indicated that in 2021, the company will have a net profit of 28,814 and 88,816 in 2025 (Figure 3). This is an indication that Amazon is not slowing down soon hence a good choice for investment. Therefore, there is a low risk of an investor losing the investment placed on Amazon.

What are the Critical Factors that Led You to Choose the Option You Chose?

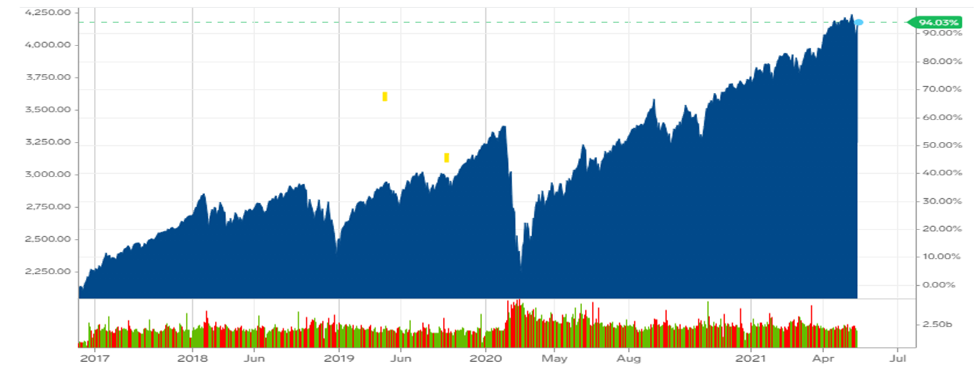

The factors that influenced my choice are competition, earnings per share, and S&P 500 index. The competition helped me determine Amazon’s competitive advantage by comparing its market capitalization with that of its key rivals in the market (Winkler, 2018). This knowledge was useful in deciding whether to invest in Amazon’s common stock (S&P 500 index) common stock. I also used estimates of Amazon’s earnings per share to determine the viability of investing in common stock. As shown in figure 3, it is estimated that Amazon will have a steady increase in its earnings per share. I used Amazon’s stock value in S&P 500. Figure 5 shows that the value of Amazon’s stock has a positive projection. This indicates that the investor is likely to get more returns through common stock investment.

What are You Assuming about the Future based on Your Analysis of the Current Situation?

I assume that Amazon’s stock value and dynamics would continue to increase, allowing the client to earn notable investment returns that will allow him to retire peacefully and with a sizable amount of money (Market Insider, 2021). I hope that the stock market does not crash and the investor loses the funds. This will tarnish my image as an investment advisor, and the client would find it hard to trust my future decisions. However, I should have thoroughly examined the company’s financial background before making a forecast. I also assume that the company’s stock dynamics improve the value and that more clients join (Market Insider, 2021). As a result, the investor would trade more on the stock exchange, resulting in higher revenues. I also hope the investor understands how to analyze the stock market efficiently and when to invest in stocks and when not to invest in stocks.

What Decision Analysis Tools Helped You to Make Your Decision?

The interest rate, the viability of the investment, and the remaining time before the investor retires are the factors that contributed to the decision. By the time the investor retires, the amount of return he would have gotten from a savings account is much less than what he would get from a common stock investment (Market Insider, 2021). The investor would not be able to afford a comfortable life after retirement with interest from a bank account. As a result, I needed to investigate an investment platform that would allow him to retire and live a comfortable life during retirement. The risk factor also played a role in the decision I made. Low-risk investments seldom turn into good profit. On the other hand, high-risk investments can be extremely profitable (Market Insider, 2021). I also looked into the viability of this company’s stocks and discovered that they could grow steadily. As a result, the investor would benefit more and more from his $100,000 investment in common stock in Amazon (S&P 500 index). An investment is made with the aim of making the most money possible.

Exhibits

If the client invests in common stock,

The client buys at $54.87 and sells at $164.11 in 2021 and 2025, respectively

Number of shares the client gets with $100,000 = 100000/54.87

= 1822 shares

In 2025, the client can sell the shares at $164.11 = 164.11 x 1822 = $299,088

Returns after 5 years would be = ($299,088 – $100,000) = $199,000

References

Market Insider. (2021). S&P 500 Index. Insider. Web.

Winkler, M. (2018). Amazon as a value stock? Believe. Bloomberg. Web.