Business Problem

In budgetary financial matters, extensive consideration has been given to comprehend the relationship between returns, instability, and exchanging volume. Price-volume relationship and investors’ attention is imperative since this observational relationship helps in contending hypotheses of trading behavior and market trend. The analysis enhances the development of the test and its legitimacy. This relationship helps in surveying the exact dissemination of profits as money related models depend on an accepted circulation of return arrangement. Investments packages can only attract investors when they possess business information and statistics. Thus, information gathering affects investor’s attention and stock market activity. Previous surveys conducted on investor’s attention revealed that constrained investor’s attention connected with moderate data dissemination and under-responsive to news. When analyzing the effect of constrained speculator attention on value response to data, it is vital to separate retail speculator attention from institutional spectator consideration.

In sharp differentiation, institutional speculators have more noteworthy assets and grounded motivating forces to stock news. Accordingly, institutional speculator consideration is critical in encouraging information gathering in stock price activity.

Introduction

The significance of investor consideration in money related markets depends on a hypothetical level. Consequently, few intermediaries for financial specialist have been considered in previous literatures. A survey conducted on Google Search revealed that market volatility influence an investor’s trade volume. This approach perceives that the Internet has turned into a standard stage for the generation, intermediation, and data utilization. Web indexes are an instinctive research apparatus that gives access to gigantic measures of data at reasonable cost. Financial specialists consider investors’ attention as an important intellectual asset. By implication, investors who pay attention on stock or market trends frequently scan for new data. Concentrating on speculator attention is of most extreme significance, since past studies have reasoned that it is a determinant of stock action. By implication, investor’s attention is a transmission channel of monetary emergencies in business markets.

The present study shows that investor’s consideration is a determinant of securities exchange unpredictability. Thus, this study will analyze the Indian Google search volume. To begin with, this examination explores the impact on the securities exchange instability of information attention at both the individual stock and general market levels. Second, the study proposed to test whether this relationship stays stable across different market environments. Thus, we will analyze the correlation of price, volume, and attention effects of two Indian stocks. We will evaluate the significance of investor’s searches on market volatility and the influence of attention level on trading behavior. Finally, we will draw inferences based on the macro and micro factors affecting investor’s attention.

Understanding the correlation between returns, instability and exchanging volume in money related markets is vital for merchants, investors, and policy makers. The circulation of profits has suggestions for different budgetary models and risk management techniques. Stock returns and exchanging volume affect market volatility. Likewise, capacity of exchanging volume to conjecture instability helps operators like brokers, with a fleeting speculation skyline and portfolio chiefs that may have a long-term investment. In developing markets of Indian securities exchange, not many studies have been accounted on the relationship between returns, instability, and exchanging volume. This study will evaluate investor’s attention on trading behavior and market dynamics.

Significance of the Study

This study will show how speculators’ consideration and market volatility affects the market dynamics and investments. The model predicts that volatilities and investors trending behavior increases with consideration and instability. These expectations are upheld by our exact examination. Besides, speculators’ learning produces a connection between attention and instability. We have demonstrated that this element can yield “freeze states,” when stock prices are unpredictable and financial specialists request a high-risk assessment.

Technical Questions and Hypothesis

Increments or abatements in stock costs will decide how much a financial investor’s income will contract or develop in the share trading system. One arrangement of vital variables that affects money markets is macroeconomic pointers, similar to a news announcement. The CPI and PPI are among the most critical measures of price increases general financial conditions. Thus, this study will ask technical questions about news announcement, market dynamics, price volatility, and investors’ attention. Previous literatures revealed that increments in both PPI and CPI influence stock price volatility. Consequently, we will moderate the hypotheses for the study to align with the research questions.

Technical research questions

- How do the investor’s searches affect market volatility?

- How do attention levels affect an investor trading behavior?

- How do investors change the attention level allocated to stocks?

- When does information gathering happen?

- What is the impact of information gathering?

Based on the research questions, we hypothesized that investor’s attention affects stock market volatility and trading behavior.

- Hypothesis 1

Investors’ attention affects stock market volatility and trading behavior. - Hypothesis 2

Google searches and news announcement affect the investor trading behavior.

Methodology and Tools

Google Trends gives access to online scan volume for any inquiry by Internet clients to Google. Google seeks information is accessible regularly for any period and formed the primary data for the analysis. The aggregate number of searches per district standardizes the search volume. At that point, every search term is standardized with the greatest of ventures. The scaling method makes Google search information helpful and distinguished as the Google Search Volume Index (GSVI).

The GSVI rises when the real number of pursuits increases per number of quests. In this way, an expansion does not really suggest an ascent in irrefutably the quantity of online inquiry questions. Furthermore, because of the scaling methodology, the GSVI’s of any two watchwords are not practically identical. The pursuit term used to recognize a stock on Google is of urgent significance when utilizing Google Trends. A financial investor uses the Google trend to find data concerning a particular organization either’s name or stock ticker image. The paper utilizes the GSVI of firm names as opposed to ticker images to catch the attention paid towards specific stocks. We trust that the Indian retail financial investors who are the center of this study will probably enter a firm name to search for stock-particular data on Google. We also look at the recurrence of ticker images that are lower in number contrasted with firm names.

Data-Collection and Cleaning

A number of studies have linked search queries in an attempt to assess their prescient capabilities. Consequently, search queries have been associated with attention biases of investors. Proxies for investor attention used for the study include trade volume, investment returns, advertisement costs, and the day-to-day disparity in bid-ask spreads. Based on these proxies, if there is an unexpected increase in stock return or if the volume traded were high, it would probably mean that investors were attentive. However, the earnings can be impelled by elements that are not linked to attention, whereas news articles do not guarantee investor consideration. This is particularly true in our contemporary society where a lot of information do not attract attention.

This report utilizes Google search volume index as a proxy of gauging investor attention. This is because Google is the leading source for search queries across the globe. Google search accounted for 65 percent of the total global search queries in 2015. As a result, the search volume conveyed by Google represents the search behavior of investors. In addition, search volume can be a straightforward measure of attention, especially when they are linked to a specific stock.

Analysis and Results

In utilizing Indian stocks, we dissected the profits and volume relationship, concentrating on the connection between supreme returns and exchanging volume, the unbalanced conduct of exchanging volume based on value changes and the relationship between returns and trade volume. Our discoveries showed confirmation of the positive connection between price regime and trade volumes in Indian securities exchange. The results revealed that the Indian stocks demonstrated skewed conduct, which was influenced by market volatility and investor’s attention. The study revealed the significant relationship between returns and trade volume. By implication, the news announcement stimulates the investors’ attention on market dynamics. Consequently, we discovered positive relationship between trade volume and price instability.

Correlation between Investor Searches and Market Volatility

The study analyzes the S&P BSE-500 (S&P Bombay Stock Exchange Sensitive Index) to capture the attention of retail investors. Consequently, searches of “S&P BSE-500” have an impact on the volatility of the index. The variables used are conjointly determined in accordance with standard procedures. By implication, the S&P BSE-500 is the best representative of the Indian market. It comprises of the top businesses and its volume represents around 93 percent of the traded stocks that covers 20 major industries. In addition, the majority of the Indian venture capitalists keeps a close watch of S&P BSE-500 (BSE India, 2015). The impact is noticeable in figure 1 and 2 below.

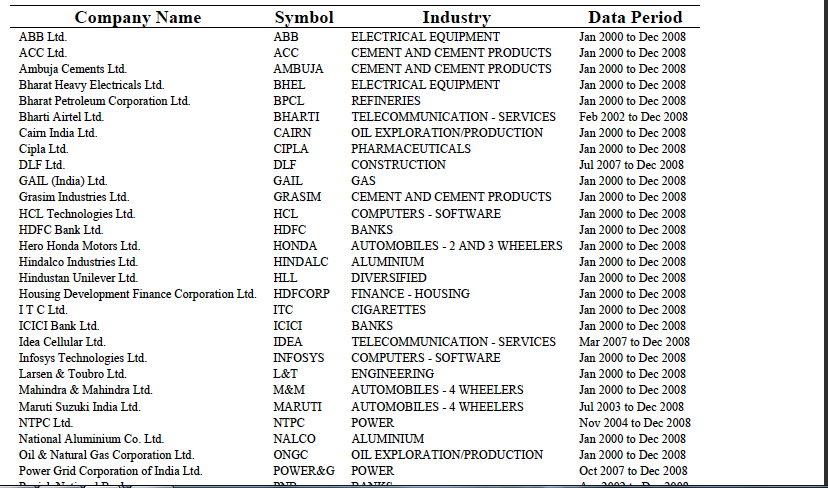

The data gathering procedure was separated into three segments. First, the weekly search frequency data for S&P BSE-500 was compiled. Second, companies with null values were expunged from the sample. It should be noted that Google search volume index was not presented in absolute term, but rather as a figure concerning the aggregate number of searches on Google. Ticker symbols were used as an alternative to the companies, actual name because company names can be spelled in different ways.

The correlation between the search frequency (SVI) and the S&P BSE-500 index realized volatility (RV) is considerably high (0.5921). On the other hand, the correlation between the search frequency (SVI) and the volume of trade are 0.3211 and 0.2874 in logarithm.

Attention Level and Investors Trading Behavior

The results revealed that attention affects the trading conduct of the investor. By implication, attention prompts many investors to invest stocks in favorable periods and hold stocks during unfavorable market conditions. In addition, the effect of attention is widespread across the financial market. As a result, the aggressive trading by individual speculators prompts institutional trading behavior and affects market prices.

To establish the impact of attention level on the trading behavior of investors, the study analyzes the capability of a market-wide attention-snatching event to prognosticate trading patterns. The results showed that high attention causes abnormal trading among investors, resulting in noteworthy changes in short-term market prices and volume of trade.

The data analysis results show that major events in the Bombay stock market affected the total order flow. The coefficients BSEt was negative for individual trading, suggesting that investors have a tendency to sell more stocks after news announcement.

Investors’ Attention and Seasonality

We found that speculator attention demonstrated a solid regularity design; it is lower on Fridays and summer months. Financial specialist attention arises when there is full-scale level news, proposing that speculators respond to information shocks by expanding their consideration and effectively preparing data to overhaul their convictions about the firm prospects. However, the impact is grounded for substantial firms. The result proved that financial specialists deliberately designate their constrained attention. Financial specialists move their attention from the firm to the market dynamics. Stocks income declarations around the same time divert financial specialists and result in lower consideration regarding every declaration. Ultimately, trade volume on income declaration days is fundamentally lower when there is simultaneous large-scale news. These outcomes affirm the expectations of speculator attention models and the verifiable suspicions made by past observational work on financial specialist attention. The study recommends that speculators effectively deal with the level of attention that they pay to the share trading system. Consequently, investors designate their attention deliberately to process data and trade appropriately. It is intriguing to develop the investigation to inspect the advantage of attention allotment.

The study revealed that Indian stocks traded better when investor’s attention is lower than the market dynamics. By implication, the results, confirms previous analysis on investor’s attention. The analysis revealed that inattentive speculators fail to utilize firm-specific announcement. However, noise investors influence market volatility and unrelated trade volumes. The outcomes give support to the thought that attention requirements are connected to the co-variation of stock returns. They are reliable with the possibility that speculators comprehend which news will be more vital and distribute their attention as needs be. Specifically, the study dismisses the view that financial specialists react to an adjustment in securities exchange attention by scaling their consideration regarding the news components.

Macro and Micro Factors Affecting Investor’s Attention

Investors acknowledge that venture hazard and expected stock return affects profit maximization. Consequently, time series analysis is a vital measure of stock performance. Macroeconomic information is often used to analyze the impact of market-wide shocks on investor attention. Given the fact that macro news is publicized prior to the trading hours, they are matched with abnormal investor attention.

The macro event that causes uncertainty includes social changes, legal regulation, market trends, foreign supplier, foreign market, money markets, and capital markets. The micro factors include suppliers, resellers, customers, competition, and the public. However, macro factors include economic, technological, political, and physical forces. By implication, investor’s attention varies with macro events such as demographics, and income status. Thus, news announcement encourages stock market volatility and market dynamics. We analyzed 20 stocks from the Indian securities and exchange. The stocks include Ambuja cement, Bharat Heavy Electricals, Bharat Petroleum Corporation, Cipla pharmaceuticals, GAIL gas, HDFC bank, Larsen & Toubro Engineering, Mahindra & Mahindra Automobiles to mention a few. The analysis reveals that early announcements facilitate trade volumes for corporate organizations. However, investors rely on news and announcements to evaluate stock returns. For example, the retail rush in 2014 showed the influence of news and announcement in trade volumes. As a result, macro events affect the price-volume dynamics. Investor’s attention is at its peak when announcements close the financial market. As a result, investors are willing to buy high-risk stocks based on market volatility. For example, Tata Tele, and Nu Tek India sold more stocks in October to complement top gainers. The results revealed that news and announcements affect invention’s attention at the end of one financial period.

Robustness Test

Robustness test is a strategy of approval that is performed amid technique advancement. It assesses the impact of various technique parameters (variables) based the reactions after data collection. This section portrays the distinctive strides required to set up a robust test and its outcome.

Conclusion

The result revealed that investor’s attention affects the Google search frequency and trade volume. Consequently, search frequency is low when the market volatility is high. Investors use stock announcements and news to buy and hold investments. Thus, news and announcement are key indicators of market volatility, thus, investors rely on Google search to improve the decision-making process. This study demonstrated that the stock market responds steadily to the profit declaration in pre-event than post-event In any case, the outcome expressed that most AAR is measurably unimportant amid occasion window, which proposes that acquiring data has a lower effect on money markets.

This paper inspected investor stock-particular and market-related attention and its relationship to securities exchange unpredictability. As an intermediary for financial specialist attention, we utilized a measure of Internet scan volume for the catchphrases of stocks exchanged in Indian stock markets. As reported in past experimental studies, Google search volume is a solid intermediary for speculator attention. Additionally, the model assessments of Indian six stocks demonstrated that Google seeks volume is a huge determinant of contemporaneous securities exchange unpredictability. The impacts are powerful for varieties in market return and market volume.

The study analyzed the impact of stock-specific Google search information on acknowledged unpredictable changes as indicated by the market state. As indicated by the model gauges, the effect of financial specialist attention was significant. Finally, as the specimen period March 2006 to February 2014 incorporates a time of monetary downturn, we played out extra steadiness tests. The outcomes demonstrated that the effect of Google search information on instability became grounded amid times of emergency.

Recommendations and Business Solution

These discoveries add to a superior comprehension of movement in the Indian securities exchange. As the GSVI is affirmed as a dependable intermediary for financial specialist attention, future studies could break down the effect of speculator consideration on various factors of securities exchange movement. For example, returns, unusual returns, volume, strange volume, and liquidity are components of market dynamics. In addition, a shorter example period would permit the incorporation of the full arrangement of 20 stocks in examinations. Future studies could likewise investigate the estimating capacities of GSVI information. Finally, financial specialist attention could be utilized as a marker of systemic risk.

Feasibility and Limitations of the Study

An examination that has been made about various expressive qualities has demonstrated our example with financial specialists in the Indian securities exchange. It is vital to consider these restrictions before summing the outcomes of the study. First, a potential bias may exist because we considered participants that visited the listed websites. However, we failed to use the entire Google searches from various locations. Second, a potential non-reaction bias may exist because speculators were not interested in the poll.