Abstract

In the present day rapidly changing market environments, it has become critically important for investors to take a deliberate approach for capturing opportunities to enhance returns and at the same time to manage their portfolio volatility efficiently. While prudent investing calls for taking calculated risks a disciplined asset allocation aids the process. Alternative investments have increasingly been looked at as one of the effective ways to reduce portfolio volatility. Alternative investments of late have come to mean every investment category other than long-only – publicly traded stocks and bonds, real estate, venture capital, private equity, natural resources, commodities, distressed debt, private fixed income, absolute return strategies, event-driven strategies – and any other asset hedged or levered. Of these assets, real estate has been considered a ‘hard asset’ and has been preferred as an attractive alternative asset till the subprime crisis started. The objective of this paper is to analyze the reasons why alternative investments have become a significant segment in the asset allocation strategies of investment and fund managers. The paper also presents a detailed review of the impact of the subprime crisis on the asset allocation of alternative investments.

Introduction

“The financial market crisis that erupted in August 2007 has developed into the largest financial shock since the Great Depression, inflicting heavy damage on markets and institutions at the core of the financial system.”

International Monetary Fund, World Economic Outlook, 2008.

[George Soros] noted, the financial crisis is beginning to have serious effects on the real economy, adding: “The extent of that is not, in my opinion, yet fully recognized.”

Reuters (New York), 2008.

It has been observed during the recent past, that the globally prevalent investment scenario necessarily called for an asset allocation that invariably includes various alternative assets. From an efficient investment perspective, this has made a modern investment portfolio unthinkable without alternative investments as they have encompassed a wide range of assets as attractive investment products. The importance of these assets has increasingly been felt as this asset class has the capability of diversifying a portfolio with their inherent character of not getting linked to the performance of the traditional class of assets. For instance, in the case of hedge funds and private equity funds, it has been often the case that the investments are limited to a few qualified investors representing individuals with a particular level of income or net worth. However depending on one’s own net worth, liquidity needs, and risk tolerance the investor would like to consider diversifying his/her portfolio with suitable alternative investments. However, it needs to be considered that this scenario has evolved during the past decade only as there was the generation of various classes of investment vehicles to enhance investment variety during this period only. The objective of this study is to analyze how the alternative investment segment became one of the important and powerful elements in asset allocation. The study also explores the impact of the subprime crisis on alternative investments.

Asset Allocation – an Overview

For quite some time traditional asset classes like stocks, bonds and cash or cash equivalents were the main class of assets on which the investors focused their attention. Out of these traditional classes of assets investments in equity have been regarded as most aggressive and the investments in equities were able to provide attractive returns to the investors in the form of dividends as well as capital appreciation. Bonds as against the stocks though provided lower returns were having lower volatility. Cash in dollars as deposits or other forms of cash equivalent investments produced still lower returns. With the expansion of the economies and increase in the disposable surplus of the individuals and corporations there emerged the necessity to find alternative investments for increasing the returns and at the same time to invest with reduced risks.

With the evolution of new and innovative investment vehicles, it was made possible to change the investment portfolio with the overall objective of increasing the return and reducing the risks.

This has made the investors choose among all available alternatives that led to the development of the concept of ‘asset allocation’. Asset allocation is the process of distributing investment capital across various classes of assets. In this, the distinct possibility of the different asset classes behaving differently at various points of time needs to be taken into account. Through adopting the process of asset allocation the investors would be able to “diversify their portfolios and reduce their dependence on the performance of individual investments.” The objective of the process of asset allocation is not only to protect the downside of the investments but also to reduce the volatility of the investments and thereby to increase the compounded return.

Asset allocation has been considered as a wise strategy all along for efficiently monitoring the investments. During recent periods this has become even more essential amidst a growing array of international and domestic investment options which has made the process of constructing the portfolio more complex. At the same time expanding choices of investments opportunities offer potential ways to optimize the returns. With a better and proper understanding of asset allocation, it is possible to enhance the efficiency of risk management so that the investment goals can be achieved with maximum effectiveness. With this background, this study through an exploratory approach analyzes the significance of alternative investments in the asset allocation process. A descriptive note on the impact of the recently occurred subprime crisis on alternative investments is also presented as a part of the paper.

Aims and Objectives

The broad aim of the study is to examine the role and significance of alternative investments in the asset allocation process and the impact of the recent subprime crisis on the efficiency and adaptability of the alternative investment asset classes. Through exploratory research, while finding plausible answers for the main research questions the study also extends to present a full picture of the alternative investments examining the history to arrive at the current significance in the asset allocation. This is done with a view to providing a wider view of the diversity of alternative investments. The other objectives of the study include the analysis of issues relating to the subprime crisis including the consequences of the crisis with respect to hedge funds and other financial service products and services that resulted in the most serious financial crisis of the century.

The rationale behind the Study

With the present-day economic meltdown can easily be traced back to the aftermath of the subprime crisis which rocked not only the US economy but many of the world economies during the second half of 2007. While there is every attempt to regain control over the economic conditions, it is necessary that detailed knowledge is acquired on the development of the situations that led to the present-day economic crisis. From that perspective, the objective of this study in analyzing the asset allocation and alternative investment strategies and the impact of the subprime crisis on the alternative investments would bring out the root causes of the worst economic crisis after the Great Depression. This study is expected to provide the reader with descriptive knowledge on alternative investments and the impact of the subprime crisis on them.

To ensure a comprehensive presentation this presentation is structured to have different chapters with the first chapter providing an overview of the topic along with the aims and objectives of the study. The second chapter is devoted to presenting a detailed review of the available literature to enable the readers to get an in-depth understanding of the topic under study. In chapter three the methods adopted to conduct the study are described with the fourth chapter dealing with the findings and analysis of the study. Chapter five concludes the paper with a few remarks as a recap of the issues dealt with by the text and a few recommendations for further research on the subject. This chapter also details the limitations faced by this study.

Literature Review

The objective of this chapter is to provide a detailed review of the available literature in published documents, papers, presentations in professional journals contained in print and electronic media. Since there is an abundance of literature available on the topic this paper strived to present the most relevant information without sacrificing the focus on different viewpoints.

The term alternative investments would convey a different meaning for those people outside the financial investment community. It might be so that even within the financial investor groups not all of them would be aware of these new vehicles of investment that is available in the hands of the fund’s managers and investment managers. With the rapid increase in the number of investment opportunities and vehicles available a number of investors including high net worth individuals have started realizing the significance of the alternative investments and their ability in compounding the returns at reduced risk levels. With the advancement in information technology, the information gap gets narrowed down and this leads to enhancement in the level of investor sophistication. As a consequence, there is more number alternative investment opportunities develop. It has been observed that during the last five years alternative assets class has been found to be the fastest-growing asset class with five to seven percent of allocation going towards this class of assets. In the case of endowments and funds, this percentage is found to be more with the percentage allocation reaching 20 at times.

Asset Allocation and Alternative Investments

It is interesting to note that institutional investors have been increasingly exposed to issues relating to ‘Liability Driven Investment’, ‘Alpha Transportation’ and the role of alternative investment in the asset allocation. (Pierre Sequier, 2006) These topics have come to the fore due to the changing institutional landscape in the recent past. The reason for the exposure of the institutions to these newer ideas can be traced primarily due to two reasons.

- The combination of lower interest rates and below-average equity performance that prevailed at the start of this century has created a number of bona fide funding issues for a large number of pension funds. This was the result of the mismatch between the risk exposure of the liabilities of these funds and their relative assets. This has also caused a number of countries to alter their regulatory positions with respect to the valuation of liabilities which ultimately had an impact on the investment and asset portfolio of these funds relative to their liabilities. In order to integrate into this new regulatory regime, the pension assets had to be deconstructed into a hedging portfolio. This separation of assets is the root cause for the development of the concepts of ‘liability-driven investments’. Performance enhancement objectives of these investment requirements led to ‘alpha transportation techniques’ and an enhanced role of the alternative investments.

- Another change that occurred during this period is the significant development of alternative investments. The rapid growth of the private equity sector and the hedging fund industry has opened up a number of performance sources that is available to investors to choose from. The strong development in these sectors coupled with lower rates of interest and poor performance of the equity market led to a considerable increase in demand for alternative investment strategies. (Pierre Sequier, 2006)

It has been found that the asset allocation framework has to necessarily adapt to this new context. It has also been observed that the traditional way of separating the strategic asset allocation to manage the beta from the tactical asset allocation (this method uses the concept of generating alpha within an asset class) was found to be ineffective to handle the new investment opportunities which are spread over various asset class. In addition, the traditional basis cannot address the strategic role of alternative investments within an institutional portfolio. It is important that alternative investments are to be used only as opportunistic positions as they do not offer any exposure to traditional betas. (Pierre Sequier, 2006)

Alternative Investments

Alternative investments in general are those investments that are a departure from the traditional form of investments. A traditional investment, on the other hand, can be defined to include an investment strategy or asset class that is mainstream and in most cases, the asset is traded in major exchanges of the world. Examples of traditional assets include domestic large-cap stocks, small-cap stocks or bonds. It may be remembered that sometimes back ‘Real Estate Investment Trusts’ (REITS) and international bonds and equities were considered as alternative investments. However, with the advent of globalization and increased use of the internet, there has been tremendous improvement in investor sophistication. This improvement in sophistication has enabled the investors to invest more in early forms of alternative investments like REITs. As such the early class of alternative investments has become mainstream investments in due course of time. With the new class of assets gaining recognition from a large number of investors, and more research has been made available, more and more new investors have started looking for alternative investments to make extra earnings. Another impact of the increase in the number of investors was the decline in the profits for large fund managers to some extent which made them look for more profitable alternative investment avenues. With every new find of such investment strategies, they get added to alternative investments.

Objectives of Alternative Investments

Generally the alternative investments are resorted to by the investors with threefold objectives. They are: (i) to attempt to diversify an investment portfolio by engaging innovative investment strategies, (ii) to aim for higher than normal returns that they can expect from other forms of investments and (iii) to reduce the volatility and risk in the investment portfolio through low or negative correlation of returns with the traditional asset class or by correlating returns within inflation. One major source of attraction that may be associated with alternative investments is the complexity in their nature which makes it difficult to be analyzed thoroughly. This results in market inefficiencies which are exploited by firms having the mindset and willingness to employ time and efforts to undertake the required research to bring out a financial asset that is acceptable as an alternative investment. Diversification thus is the primary benefit that the alternative investments extend to the investors in comparison with the traditional class of assets. It has been found that many of the alternative investment strategies are embedded with extremely low correlation to the price movements in the more traditional forms of financial securities. Under circumstances when the financial markets remain overvalued, from the overall risk perspective, maintaining a portfolio the returns which are independent of the financial market can really be enticing. While there are abundant opportunities available for making higher returns with alternative investments, such investments are looked at favorably even from the angle of risk control and diversification.

Forms of Alternative Investments

Although newer investment strategies and products are developed and introduced in the market every now and then the following are some of the common types of alternative investments recognized by the financial investment community. Even though these investment strategies are generally classified as alternative investments, each one of them possesses unique characteristic features.

Hedge Funds

Hedge funds cannot be defined as a particular alternative investment strategy since the funds constitute different investment vehicles that are employed by many types of non-traditional investing strategies. Hedge funds have the flexibility to invest in any asset class they wish. The hedge funds are limited by their own creativity and the willingness of the investors to part with their money with the confidence placed on the funds. Hedge funds are usually structured as limited partnership interests and the hedging funds sell these interests to qualified investors. Therefore these funds enjoy only limited flexibility. They remain largely unregulated which is quite contrasting to the operations of mutual funds. (IIM Calcutta)

Private Equity

This investment strategy involves a kind of equity investment in non-public companies. Although this alternative investment is practiced in many different ways, buyouts and venture capital are the most important forms of investment adopted by this strategy. Buyouts take place when the investors indulge in purchasing all or a part of a firm exclusively with the intention of reselling in the future with a profit margin. Leveraged Buyout (LBO) is one of the important variants of this investment strategy where the debt to equity is very low and the success of such deals is largely dependent on the capabilities of the management team to create value for the firms. Venture capital is another large variant of this alternative investment strategy which involves investing in the companies that are in the start-up or early stages but with a high potential for growth. (IIM Calcutta)

Other Types of Alternative Investments

There are other types of alternative investments like commodities, direct real estate, arbitrage strategies, market neutral, managed futures, global macro, distressed securities, fund of funds and the like with each one of them having its own characteristics in terms of associated risks and returns. (IIM Calcutta)

Causes of Financial Crisis

Recent crisis in the financial sector in the United States as well as in other parts of the world including Europe clearly prompts a reassessment of some of the principles and practices in the policymaking with respect to the financial sector. Such changes could result in further crucial changes in the structure and oversight of the financial system worldwide. Abundant liquidity that existed for a longer period of time and the prevalence of lower interest rates are the important causes that led to the global search for higher yield and under-pricing of risk by the investors.

Background to the Crisis

The longer duration of the liquidity that was available with the financial institutions and other investors in general, rising asset prices especially the real estate prices and continued lower rates of interest amidst international financial integration and innovation has resulted in serious global macroeconomic imbalances. Bates, Kahle and Stulz (2007) have documented the abundance of cash held by the non-finance firms prior to the crisis. According to the authors, “the net debt ratio (debt minus cash, divided by assets) exhibits a sharp secular decrease and most of this decrease in net debt is explained by the increase in cash holdings. The fall in net debt is so dramatic that the average net debt for U.S. firms is negative in 2004. In other words, on average, firms could have paid off their debt with their cash holdings.”

As a consequence, the US current account deficit had swelled with capital inflows from Asian and oil-producing nations. In addition, there was a general trend of a global search for higher yield and this led to the underestimating of the risk factors in the alternative investment opportunities. Regulators on the other hand took policy decisions that either facilitated the imbalances or were ineffective in some cases to be a proper response for the adverse impact of the imbalances.

The abundant liquidity resulted in a rapid expansion of credit both in developed as well as emerging nations. The mortgage financing was found to be one of the high growth areas not only in the United States but also in many other countries which contributed to a bubble in the real estate prices. (World Bank)

Financial innovations in the form of alternative investment strategies have created systematic vulnerability in different ways. The best fitting example is the growth of the mortgage market which took the form of ‘originate and distribute’ – implying the creation of mortgages for the purpose of selling them in the market. This model was overwhelmingly supported by new innovations in structured finance and credit derivatives. In addition, there existed an active secondary market for mortgage-related securities. The most serious part of the crisis is the becoming interconnected of both regulated and unregulated financial institutions through OTC markets. In fact, these institutions because of the interconnections had established bilateral clearing and settlement arrangements. (World Bank)

On the other hand, the favorable macroeconomic conditions that existed like the enhanced competition, advancement in technological standards and rising asset prices prompted the financial institutions to focus down-market. In order to maximize their earnings, the financial institutions indulged in practices like lowering credit underwriting standards, engaging in riskier trading activities with security mismatches and relying excessively on quantitative risk models. To meet these objectives the financial institutions also practiced the wrong principle of funding long-term investments using short-term instruments. (World Bank)

All these factors have created complacency among the capital market investors. As a result, they failed to employ adequate monitoring of the risks and proper reexamination of their investment portfolios. The slowdown and the subsequent decline in the US home prices since the year 2005 led to the unraveling of the “highly leveraged and unsound lending” practices that have been built over the period of time. These weaknesses in the lending practices were brought to light first in subprime lending. The other market segments like prime mortgage loans, commercial real estate, leveraged loans, etc were subsequently subjected to the brunt of the financial crisis.

According to Bloomberg (June 2008), the total write-offs since January 2007 on account of financial crisis stood at $ 245 billion with much more to follow. Dr. Jeffrey R. Bohn (2008) identifies the following factors as responsible for the creation of the subprime crisis. They are (i) Faulty risk assessment systems (VaR), (ii) flawed ‘originate and distribute’ business model, (iii) ineffective credit rating given by the rating agencies, (iv) lax regulators who failed to anticipate the repercussions, (v) manipulative bankers who used the faulty systems to their advantage, (vi) fraudulent brokers taking the borrowers and lenders for a ride, (vii) mark-to-market accounting practice, (viii) greedy borrowers interested in getting free finance, (ix) greedy lenders interested in only higher returns, (x) faulty market structure, (xi) weakly structured finance, (xii) complications created by the derivatives and (xiii) lax monetary policy that proved ineffective to monitor the financial sector. Thus the crisis has been found to be the culmination of several factors; some of which are interrelated to each other.

Role of Hedge Funds in Subprime Crisis

An article entitled ‘Subprime: Tentacles of a Crisis’ by Randall Dodd, a senior financial expert in the IMF’s Monetary and Capital Markets department has examined the role of hedging funds in the subprime crisis that unfolded recently. He is of the opinion that the Fitch ratings forewarned about the risks of hedge funds even as early in the year 2005 by stating “Hedge funds have quickly become important sources of capital to the credit market,” but “there are legitimate concerns that these funds may end up inadvertently exacerbating risks.” According to Dodd there are obvious reasons for the warning issued by Fitch rating as the hedge funds making investments in largely high-risk ventures are not basically transparent as they need to be. There are no public disclosures of their assets, liabilities and trading activities. Moreover, the hedging funds are found to be highly leveraged in that they make use of several derivative instruments or heavily borrowed funds to make their investments. It is very hard for other investors and regulators to know much about the activities of these hedging funds and because of their higher leverage, their impact on the global credit markets is higher in proportion than the total assets under their management.

Dodd has identified a number of weaknesses that contributed to the market failure. The impact of the crisis is that it resulted in a 3 percentage point increase in serious delinquency rates on a subsection of US mortgages. This in fact has thrown the $ 57 trillion US financial system into turmoil and has caused economic shudders across many countries of the world. (Randall Dodd, 2007). They are

- The first call of the turmoil arose at the point where the highest-risk tranches of subprime debt were placed with highly leveraged investors. Hedge funds were one among them with no capital adequacy requirements (since they remained unregulated in this regard) and the industry practice of investments with high leverage has prompted them to take excessive risks.

- Another reason for the busting of the market is due to the reason that the unregulated and undercapitalized financial institutions were the primary liquidity providers to the OTC markets in the form of subprime collateralized debt obligations (CDOs) and other forms of credit derivatives. At the moment when trouble ensued in the solvency of those markets, those assets became illiquid and it led to the seizure of trading in them ultimately.

- The presence of unregulated and undercapitalized mortgage originators was also responsible for the crunch. The originators like hedge funds were operating with a lesser amount of capital and they mainly used monies borrowed on short-term for funding the subprime mortgages they originated which were expected to be held by them only briefly. However, when a situation arose that it was no any more possible for them to sell such mortgages to those firms who packaged them into securities, many of these originators had to close down their shows which added to the crisis.

- Lack of transparency in the transactions of OTC markets still exacerbated the crisis situation. Since the market participants were unable to identify the nature and location of the subprime mortgage it led to a sudden shift in the assessment of associated risks. At one point in time, the investors were overly optimistic about the risks associated with a subprime mortgage. With the turn of events in the negative direction in the subprime sector, those investors who were optimistic became scared and confused. As the result, the investors panicked and overestimated risk and shunned even senior investment-grade opportunities.

- The liquidity crunch also affected the operations of the OTC markets. “Instead of showing resilience in the face of greater price volatility, these markets ceased trading as counterparties became untrustworthy and buyers fled.” (Randoll Dodd, 2007)

Thus hedge funds and other high-yield investors played a critical role in spreading the impact of the crisis to nations across the world. With the downfall in the prices of high-risk tranches, the investors could not trade out of their long positions. This made them resort to selling other assets, especially those with large unrealized appreciation such as equities in emerging markets to meet their obligations of margin calls or to offset the losses made in subprime deals. With the result the equity markets allover the world met a declining trend though they recovered quickly. The effect was there on the currencies of the emerging markets also. (Randoll Dodd, 2007)

Impact of Sub-Prime Crisis on Alternative Investments

The subprime crisis has taken the toll with at least 25 large subprime lenders declaring bankruptcy and substantial losses being announced by many financial institutions, bond insurers and special purpose enterprises. The impact on the US economy has been found to be significant resulting in lower levels of consumer spending, subdued levels of consumer confidence, lessened asset prices, and a significant decline in the projected growth levels and considerable rise in unemployment level. (AMUNC Background Paper, 2008)

When the crisis hit the subprime mortgage and credit markets the impact on the credit markets was that the markets dried up with deal volumes going to significantly low levels and this made the financial services firms to start thinking on their alternative moves. One of the victims of the crisis is Lehman Brothers which was made to file bankruptcy. Other institution like Washington Mutual had to increase the loan-loss reserves up to $ 2.2 billion to cover the mortgage exposure. Same is the case with some of the major financial services firms with five of them (Merrill Lynch ($ 3.4 billion), UBS ($ 3.3 billion), Citigroup ($ 3.1 billion), Deutsch Bank ($ 2.4 billion) and Morgan Stanley, JPMorgan Chase and Bank of America put together $ 3 billion) made to write-down $ 17 billion collectively. (Berkshire Capital Securities, 2007)

While the impact of the subprime crisis on the traditional long-only assets market is mixed, the biggest impact was felt on the alternative investment vehicles of hedge funds and private equity.

Impact on Hedge Funds

Theoretically hedge funds is to derive benefits from financial volatility as they are designed strategically to make their earnings both from rising and declining prices of assets. Of course, those hedge funds which were not overexposed to the subprime mortgage debts behaved according to this theory. But hedge funds that indulged themselves in more subprime mortgage debts have been found to be the prime victims of the liquidity crisis created by the crisis. The collapse of several hedge funds had a cascading effect on various banking and other financial institutions connected with them.

Just as the private equity funds the hedging funds are also subjected to the disadvantage of frequent reporting obligations and they also provide the investors the facility to withdraw their money with ease. “Nervous investors are awaiting monthly numbers, which most hedge funds provide. If the investors want out, and they have fulfilled any requirement to keep the money in the fund for a certain amount of time, they can pull their capital. Too many redemptions can force funds to sell [assets] into a bad market, resulting in worse losses.” (Jenny Anderson, 2007)

One of the biggest casualties of the subprime crisis happened in the case of UBS a leading bank in Switzerland. UBS after making a first-quarter (2007) loss of $ 123 million on US subprime mortgage investments had announced the folding of Dillon Read Capital Management back into its investment banking arm. This move cost the bank an additional $ 300 million by way of restructuring charges. The bank also indicated very weak profits for the second half of 2007. (Financial Times 17th August 2007)

It was in mid-June 2007 it appeared that the investment banks that lend money to two of the hedge funds managed by Bear Stearns Asset Management were preparing to seize the assets in the process of recovering the monies advanced by them. The funds with heavy borrowing were supposed to have invested funds in highly rated debt products. These debt products in turn were exposed to a large extent to bonds backed by subprime mortgage debt. After a month the investors in the funds were advised that they would be getting nothing from one fund and only 9 cents for a dollar in another due to enormous losses made by the funds. As a bailout measure, Bear had to grant $ 1.6 billion in emergency financing being one of the biggest attempted bailouts since the collapse of Long-Term Capital Management LP happened in the year 1998. (Financial Times 17th August 2007; Bloomberg 13th August 2007; BBC News 31st August 2007)

In August it was Goldman Sachs Group Inc the New York-based hedge fund ranking second largest in the world had to introduce $ 2 billion as its own capital and an additional $ 1 million from outsiders to shore up its Global Equity Opportunities Fund since the assets value of the fund dropped by $ 1.4 billion to $ 3.6 billion during the previous week. The decline was due to the sudden decline in stock prices worldwide. (Bloomberg 13th August 2007) According to Hedge Fund Research the hedge fund industry as such generated the worst performance since the year 2000 with the average fund declining more than 3%. Quantitative funds took a severe blow.

However, financially stronger firms found the crisis as an opportunity. The credit dustup has resulted in a pronounced shift of capital to brand-name firms and managers and there was increased merger and acquisition activity witnessed in the financial services sector. There are hedge fund operators like SAC capital, Gartmore Investment Management and Man Group who found their business increasing during the period of crisis. “The experiences of SAC, Gartmore and Man are indicators that even in the face of a financial crisis, institutions and wealthy individuals continue to view alternatives as a necessary ingredient in a balanced portfolio, rather than a risk factor.” (Berkshire Capital Securities, 2007)

Impact on Private Equity

The biggest beneficiary of the lower interest rate regime the private equity had the largest impact of the subprime crisis with the volume of trade reduced to 14% of the total worldwide deal value in the second half of 2007 as against 27% in the first half of the year. (Thomson Financial)

Private equity funds mostly thrive on borrowed funds. (The Independent 26th Aug 2007). Therefore they were the worst hit by the subprime crisis. It has become more difficult and difficult and expensive for private equity funds to borrow from different sources for the purpose of investing in various companies. When the economy slows down the cash flow of the acquired companies will also decline to make it difficult for the private equity funds to repay the borrowed funds.

Volatility in the share markets will not also allow the private equity funds to re-sell companies, especially in a situation where the buyers themselves are already facing the brunt of the credit crunch. It is not only the private equity funds but all merger and acquisition activities that will be facing a slowdown because of the tighter credit, financial volatility and the resultant economic uncertainty prevailing all over the globe.

On the other hand, unlike the hedge funds, the investments in private equity funds are fairly for longer periods. This, therefore, does not place them in a position to report as frequently as the hedge funds and in this way they get more leverage to plan their future buyouts by properly restructuring the buyouts relying on more of the investor’s funds and less on borrowed funds. The immediate impact of this may be reduced returns but there is always the opportunity of refinancing the deals at a later stage when the liquidity increases and the credit situation eases out. It is to be noted that ultimately the performance of private equity as an alternative investment will be evaluated by comparing the results with the other traditional assets rather than with their own past performance. Besides though the volatile share markets may make reselling more difficult, it may provide more opportunities for buying at cheaper levels.

However, it must be remembered that the private equity firms have other lines of business than the company buyouts through the buyouts form their major business operation. “Venture capital can take up some of the buyout slack, as can, especially in sectoral or general economic downturns, the so-called distressed debt business.” (UNI and Private Equity, 2007) The merger and acquisition (M&A) activities in respect of smaller and medium segments may take the hit but the mega deals with the value of $ 1 billion or more may not get affected. There may also be a shift in the strategy of acquiring and immediately reselling individual companies. This strategy will be replaced by the practice of keeping the acquired companies longer and even restructuring and combining them may be attempted at.

It is also to be noted that the private equity firms could guess to some extent the turn of credit cycles and from the first half of the year 2007, most of these firms and institutions started adjusting their strategies to meet the eventuality. Hence it cannot be said that the subprime crisis and the subsequent credit crunch was a surprise to these firms.

Therefore in sum, it can be stated that due to the subprime crisis the M&As in general and the Private Equity buyouts in particular may slow down. However, leading private equity firms as alternative investment specialists would continue to outperform the traditional investment firms. It may also so happen that they would strengthen their positions due to the absence of less competitive firms that would have vanished due to the credit crunch.

Summary

This chapter provided a descriptive account of what an alternative investment is and the objectives and benefits of such investment strategies. The chapter also dealt with the impact of the subprime crisis on the major alternative investments of hedge funds and private equity.

Research Methodology

The objective of this chapter is to present a detailed description on the salient aspects of different social research methods more commonly employed and their relative merits and demerits. This chapter also presents a discussion on the justification for the research methods that have been used to complete this study.

In general social science uses a number of different research methods for improving the knowledge, theory and practice in different areas of social science. It can be observed that the different types of quantitative and qualitative research methods are linked to epistemological and theoretical frameworks. The research methods can be grouped under five common categories. They are:

- experimental

- correlation

- natural observation

- survey and

- case study.

The conducting of any research relating to social sciences has to find a suitable research method to accomplish the research objectives. The choice of the particular research method depends on the topic under study and the aims and objectives of the research. Although there are many ways of classifying the research methods the most popularly used distinction is between qualitative and quantitative research methods.

Common Research Methods

This section describes some commonly used methodologies in the context of social research. The chapter identifies and provides the justification for the choice of a method that is suitable for this study. The basic classification of the research methods is done into qualitative and quantitative methods.

Quantitative Methods

Quantitative research methods find their origin in natural sciences where they are used to diagnose and analyze natural phenomena. Certain commonly adopted quantitative methods include survey methods, laboratory experiments, econometrics and mathematical modeling. According to White (2000) the quantitative research method consists of an investigative process that leads to research conclusions expressed in numerical values. The numerical values represent the findings of the study and are subject to statistical analysis for presenting the results of the study.

Qualitative Research Methods

The main objective of developing qualitative research methods is to enable the researchers to make an in-depth study into the social and cultural phenomena. Action research, case study, ethnography are some of the techniques employed for conducting qualitative research. Creswell (1994) defines qualitative research as a process of inquiry that involves understanding any problem connected with social or human behavior. The qualitative research process according to Creswell (1994) is based on the views and perceptions of various informants being the participants to the study that are expressed in a natural setting. The data sources for supplementing qualitative research methods include observation and participant observation (fieldwork), structured and semi-structured interviews, focus groups and questionnaires, case study, documents and texts. The data may also be provided by the impressions and reactions of the researcher himself/herself.

A further classification of the research approach can be made into

- the deductive approach

- the inductive approach and

- the inductive-deductive approach.

The deductive approach is defined by Bryman and Bell (2007) to include the process to “collect observations in a manner that is not influenced by pre-existing theories”. There are no foregone conclusions in this approach and the research is started with a few general ideas and based on these ideas a hypothesis is formed. The hypotheses are later tested in order to support the general ideas are formed. Deductive reasoning allows the researcher to synthesize the information made available to him. The main point to consider in this approach is that it does not take into account the ‘positivist approach’.

The inductive approach on the other hand commences the research with specific occurrences based on individual perceptions and experiences. Based on the gathering of these observations a general idea about the proposed study is formed which later is subjected to tests either for approval or disapproval. This approach uses a ‘building theory’ that allows the researcher to gather the necessary information and data and then make an analysis of this data to develop a new theory. This theory enables the researcher to “better understand the nature of the problem” (Saunders et al 2007)

A hybrid of the deductive and inductive approaches is often employed by the researchers and this approach allows more flexibility in the process of gathering the information required for the study.

Though the normally deductive approach is used by most researchers this study was completed using a combination of both the approaches in view of the complexity of the topic chosen for the study. Since the topic is of more recent origin and there are enough historical information available the study proposed to use some of them (those which are relevant) for presenting as a part of the study. As a hypothesis the study considers the primary question of ‘Why alternative investments became a significant the segment in the asset allocation and how they have been affected by the subprime crisis?’

As secondary questions, the study proposed to consider arriving at plausible answers for the following questions:

- To what extent the subprime crisis has affected the hedge fund operations and private equity funds being the major alternative investments?

- What is the likely future of the hedge funds and private equity funds in the wake of the subprime crisis?

- What is the extent USB as a major victim of subprime crisis-affected?

In order to arrive at the answers for the above questions, it is necessary to use several methods to gather empirical materials using both primary research and secondary research methods.

Gathering Primary Research

In order that the chosen research method remains flexible and enable easy gathering of information and data required to find the answers for the research questions, the study proposed to use a combination of both primary research and secondary research methods. A brief description of both the research methods is presented in the following sections.

Semi-Structured Interviews

Semi-structured interview is the most common form of interviewing technique in which the interviewer has determined the set of questions he/she intends to ask in advance but still allows the interview to flow more conversationally. In order to have the flow of conversation the interviewer can change the order of the questions or the particular wording of the questions. The interviewer has the option to leave out the questions that may appear to be meaningless with reference to the context. The main objective of the semi-structured interview is to get the interviewee to talk freely and openly so that the researcher would be able to obtain in-depth information on the topic under study.

Semi-structured interviews were conducted with two senior executives of leading hedge funds and private equity fund operators.

The case Study

Several research studies have used case study as a research methodology. “Case study is an ideal methodology when a holistic, in-depth investigation is needed” (Feagin, Orum, & Sjoberg, 1991). Various investigations particularly in sociological studies have used the case study as a prominent research method to gather pertinent knowledge about the subjects studied. When the case study procedure is followed the researcher will naturally be following the methods which were well developed and tested for any kind of investigation. “Whether the study is experimental or quasi-experimental, the data collection and analysis methods are known to hide some details (Stake, 1995)”. But the case studies on the other hand are capable of bringing out more details from different viewpoints based on a multiple source of data. Different types of case studies have been established to be used in varying circumstances. They are ‘Exploratory, Explanatory and Descriptive’. Stake, (1995) included three others: “Intrinsic – when the researcher has an interest in the case; Instrumental – when the case is used to understand more than what is obvious to the observer; Collective – when a group of cases is studied.” Case study research can not be considered as sampling research. However, the selection of the cases is of crucial importance so that the maximum information can be gathered for the completion of the study within the time available. “The issue of generalization has appeared in the literature with regularity. It is a frequent criticism of case study research that the results are not widely applicable in real life. Yin, in particular, refuted that criticism by presenting a well-constructed explanation of the difference between analytic generalization and statistical generalization “In analytic generalization, the previously developed theory is used as a template against which to compare the empirical results of the case study” (Yin, 1984)

Primary Research Methods

Having described the general outline of the primary research methods in the following sections the actual research techniques employed for the study is detailed

The Case Study

As a case study this research examines the impact of subprime crisis on USB a Switzerland based bank which was one of the worst affected victims of the crisis. Because of a high involvement in the US subprime mortgage deals this bank has to write off close to $ 38 billion which is very large sum considering the impact of the crisis. Therefore this bank is chosen as the best candidate for making the case study. This study has used various articles and news items for making the case of the UBS Bank to assess the impact of the subprime crisis on its funds and functioning.

Interviews with Industry Specialists

The impact of the subprime crisis on alternative investments is too heavy and even the industry experts may not be in a position to assess the exact total impact of the crisis on the financial markets. However with their knowledge and experience in the industry they are in a position to provide some basic ideas on the extent of the impact and the ways in which the crisis has affected the future of alternative investment strategies. Therefore it is decided to conduct interviews with some of the industry experts who had hands on experience in the financial services industry especially from the private equity firms and hedging fund firms. The following is the list of interviewees who consented to offer their views on the impact of the subprime crisis on the alternative investments and the future of such investments.

- Mr. John Morris Senior Portfolio Manager at Peterson Hedge Funds

- Mr. Rosner Pennington Partner Silverland Investment Funds

Statistical Approach

Any research in the field of finance cannot be considered complete without a presentation of statistical information and data. Statistical approach to researches has always been considered as one of the important methods of presenting valuable information for the readers. Through the statistical approach, the theory evolved during the research can be made more illustrative. Any information presented in the form of statistical charts and graphs will for sure make the comprehension of the reader more vivid and faster.

Secondary Research Methods

This research method also called as ‘desk research’ is the most common method employed by a majority of researchers in their social research studies. This research method involves the processing of information and data previously collected by other people. Under this method, the researcher consults the findings of the previous studies in the form of reports, press articles and previous research studies in order to arrive at a decision. The chief advantage of this method is the low costs involved in the data collection as against the primary research method. However, this method suffers from the disadvantage that the data used may be outdated and unreliable making the results of the current study inaccurate. Another problem with this method is that previous studies might not have attempted the exact issues that the current research wants to study.

For conducting this study the researcher relied on secondary research sources of previous research reports, press releases of companies and various financial media, literary publications, online sources, and journal articles.

Difficulties encountered in the Research

The preparation for and conducting of this research had to face many challenges. The foremost challenge is confidentiality issues. With the huge volume of the impact of the subprime crisis it was not possible to precisely identify the exact extent of the damages caused. Moreover, even the industry experts who were interviewed were unable to exactly pinpoint the extent of the damages. Another serious issue was getting access to the senior industry executives who would be able to offer more reliable information. Due to their pre-occupation, it was virtually impossible to get the interviewees on the telephone, especially with the current economic scenario which made them tackle so many important issues on priority. The information and data gathered via various media were to be taken with a pinch of salt to the bias in the sources offering the information. This was another serious limitation faced by the study.

Findings and Analysis

Due to wider financial irrationality the US mortgage market experienced a turmoil that sparked a deep crisis in the credit markets worldwide. It also resulted in meltdowns of a number of hedge funds. On the part of private equity funds, some of the funds which have made buyouts out of higher debt exposures have crashed. The subprime crisis also would deter the completion of the pending buyout deals of the PE funds. The activities in the M&A segment have come to a standstill. There are no mega-buyout deals for the time being and the often related activist hedge funds also were silent. The only areas where some activities are to be witnessed are the private equity funds which were involved in the long-term restructuring strategies and distressed debt dealings and secondary transactions. The subprime crisis brought to the fore problems in regulatory measures and the lack in monitoring both public and private financial institutions. This analysis made on the basis of the literature reviewed and on the basis of secondary research conducted will look at the origins and scope of the crisis. The analysis also outlines the response of central banks and other public authorities in the aftermath of the subprime crisis. The consequences of the crisis are also dealt with in this chapter.

How the Credit Crunch Started?

At the end of July 2007 the market witnessed serious difficulties in the major buyouts of Alliance Boots (UK Pharmacy Chain) and US auto major Chrysler. Though these two deals were entered by the biggest private equity firms they had problems of liquidity which sent waves of fears in the markets about a looming credit crunch. Stock markets were the facing hard hits in the weeks followed on concerns of potential tighter credit conditions which might be having the effect of derailing the buyout boom. Earlier the expectation of the buyout boom had boosted the stock values of almost all companies in the market which went in the opposite direction now. The news also made the participants of the capital markets world-over that large banks are likely to have potential credit problems.(Financial Times 17th August 2007)

Cheap credits which were available earlier enabled the private equity firms to enter into larger buyout deals with large borrowings. The action of the private equity firms enticed the pension funds and other institutional investors to apply their cash resources in alternative investments. This boosted the business of the private equity and hedge funds which moved away large companies as the most valued clients of banks. In the months after the initial discovery of the crisis the investors who previously offered lower rates and easy credit terms were no more willing to extend those attractive terms. This resulted in the investment banks keeping about $ 300 billion of debts in their balance sheets as they were unable to distribute them to the pension funds and other large investors. “If market conditions do not improve, banks will be forced to mark down the value of that debt, triggering heavy losses,” noted the Financial Times (22 Aug ’07)

Role of Subprime Mortgages

Subprime mortgage crisis in the US was the main reason for tightening of the credit conditions. It may be noted that subprime mortgages are higher risk housing loans offered to people with very poor credit ratings or with low incomes. At a certain point of time, the subprime mortgage market was at its peak. But things started moving in the opposite direction with a series of rises in the interest rates which made the monthly repayments by borrowers expensive and difficult. Since the borrowers were unable to make the payments, they have started defaulting on the loans. The statistical information from the Federal Deposit Insurance Corporation the defaults on loans at US banks rose 36% which in absolute terms amounted to $ 66.9 billion in the second quarter of year 2007 alone. This figure is the highest for the quarter in 17 years and most of the defaults were on account of mortgage defaults. (BBC News 23rd August 2007)

Effect of the Crisis

With the news of the subprime mortgage market problems spreading to world markets, stock prices in the global and regional stock markets started to tumble down in February 2007. Even by the end of August there was no sign of the subprime crisis has run its course. The defaults from the house owners in the US are expected to rise over the next several months with more and more mortgages reaching the higher payback rates. There were also growing concerns that almost $ 1 trillion of prime-grade mortgages would also become doubtful of recovery. (The Independent dated 26th August 2007) There was an increased effect of the mortgage crisis which were passed on to almost all countries of the world due to the reason that the subprime debt has been resold as other debt packages (CDOs). With a complete lack of transparency of the overall scale of the crisis, the financial operators were not sure as to whether the securities they hold are really worth or not. This uncertainty further led to the lack of confidence on the whole financial system. This also raised fears of a severe liquidity crisis in which situation the investors would prefer to keep their resources as either cash or safe securities like short-term government bonds by avoiding riskier credit lines. Such a situation will tell upon the ability of the companies and banks to raise the funds necessary for carrying on their operations.

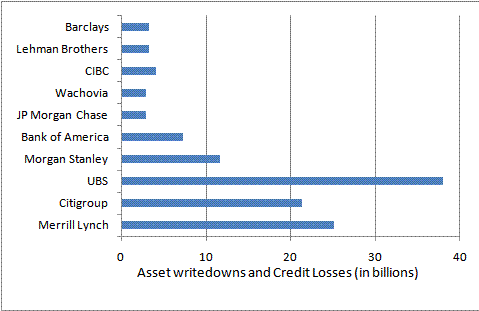

The effect of the crisis can be seen from the following table:

Table 1: Subprime related losses ($ in billions)

Source: Bloomberg 10.04.2008

Contagion Effect

Since the European banks were also in the list of institutions holding a lot of US subprime debts the evidence of contagion started to pile up. Even the German banks who normally do not get exposed to such risks also found them caught in the web. On the 24th August Bank of China revealed its huge exposure to the subprime crisis which was the highest for any bank in Asia thus far towards the losses on account of US subprime mortgage crisis.

However financial wizards like Paul Krugman opined that the problems on the US mortgage market were the immediate ones but could not be considered as the sole cause of the current financial turmoil. According to the US economist Paul Krugman “The origins of the current crunch lie in the financial follies of the last few years, which in retrospect were as irrational as the dot.com mania. The housing bubble was only part of it; across the board, people began acting as if risk had disappeared” (International Herald Tribune, dated 11-12 Aug ’07). By the end of August 2007 many of the economists and bankers came to the conclusion that the tidal waves of US subprime mortgage fiasco has come to an end. Many of them however predicted that there will be long-lasting effects that may go well into affecting the economy during the year 2008 and beyond. Their predictions have come true as can be evidenced by the present economic situation prevailing in the US as well as in Europe, Japan and many other countries of the world.

Response of Central Banks

US Federal Reserve, European Central Bank, Bank of Japan, the Russian Central Bank and Bank of Canada took active remedial measures by injecting billions of dollars of short term loans into the global financial system so that the system could go on smoothly.

US Federal Reserve on its part decided to reduce the discount which is its lending rate to the banks. It was learnt later that a group of US banks as well as some other European Banks borrowed a sum of $ 2billion from the Fed. BBC News reports

“By taking the unusual step, Bank of America, Citigroup and Germany’s Deutsche Bank among others, aim to improve access to available credit. But the move also highlights the highly fragile state of credit markets” (BBC NEWS, dated 23 August 2007)

The editorial column of the International Herald Tribune dated 18th-19th August reported

“But the main effect of a rate cut to calm the financial markets would be to protect big investors from the consequences of their bad decisions. That’s not the Fed’s job, and would violate the precept that a healthy market requires investors to accept responsibility for the risks they incur.” (International Herald Tribune dated 18th-19th August, 2007)

Although the Central Banks would offer their defense that the actions by them were purported to have taken in the best interests of the society and the people to protect their income and jobs, it is astounding to note that a financial crisis in billions could just like that prop up an able financial system which is being constantly monitored and criticized by so many experts and wizards. Even the slightest subsidy to any other part of the population is usually magnified by these people; but such a magnitude has slipped off so easily making millions of ordinary people unexpected victims of the crisis. As a consequence of the subprime crisis, the number of home repossessions in the US rose significantly in the period following. In July the number of filings for repossessions rose up to 93% in July of the number for the corresponding previous period.

The numbers raised by 9% of the June figures. (BBC News 21st August 2007) The problem was also felt in the United Kingdom where the repossession were the highest in the first half of the year and was the highest since 1999 due to increased interest rates hitting the subprime borrowers.

Role of Credit Rating Agencies

Another issue that was raised was the regulatory issues that came to the fore as there was a gross failure of the system. This started with sharp criticism of the private regulatory bodies of the credit rating agencies. Paul Krugman wrote:

“For it is becoming increasingly clear that the real-estate bubble of recent years, like the stock bubble of the late 1990s, was both caused and fed by widespread malfeasance. Rating agencies like Moody’s Investors Services, which get paid a lot of money for rating mortgage-backed securities, seem to have played a similar role to that played by complaisant accountants in the corporate scandals of a few years ago. In the ‘90s, accountants certified dubious earning statements; in this decade, rating agencies declared dubious mortgage-backed securities to be highest-quality, AAA assets.”(International Herald Tribune dated 18th-19th August 2007)

The obvious lacking on the part of the rating agencies was subjected to severe criticism by the European Commission especially by Germany partly in order to deviate the attention of the public from the deficiencies of the governmental regulations.

Case Study – USB Bank

UBS the Switzerland-based European bank the biggest by assets wrote down the value of debt securities and leveraged loans by $ 14.7 billion in the year 2007. This adds to the figure of more than $ 100 billion in markdowns and loan losses are written off by the largest banks of the world and securities firms. International Herald Tribune dated 11th January 2008 reports “After the latest writedowns, UBS said it held about $16 billion in residential mortgage-backed securities as of Nov. 30 and about $13 billion in so-called super senior securities, or AAA-rated structured debt that gets paid back ahead of other similarly rated bonds in case of a default.”

In addition to the banking franchise, UBS is one of the world’s largest investment managers for several high net worth individuals of the world. UBS has suffered a total loss of $ 38 billion in write-downs relating to subprime mortgage losses. The business of UBS suffered a lot with the clients pulling out more than $12 billion in the first quarter of 2008 and the inflows to the bank were down by 82%.The bank had to slash its workforce drastically and the market value has reduced to 50%. (David Oser, 2008) The latest with UBS in respect of the economic crisis is that the Swiss government on 16th October 2008 announced that the government will inject $ 5.2 billion fresh capital to help the bank to set up a fund to safeguard the bank’s position against the total of $ 60 billion of problematic assets.

The figure above illustrates the relative position of UBS in the write-downs as compared to other financial institutions.

Analysis and Argumentation

On an overall analysis of the subprime crisis and its impact on the alternative investments it appears that all the parties involved are to be blamed. Though the circumstances of the abundance of liquidity and easy availability of credit is to be taken into account the way in which these were (mis)used is heartening as it has shown its effect on millions of innocent investors and weakened a massive financial system. The arrogance of human intelligence can at best be cited as one major cause for the development of such an economic scenario which could have easily been averted by certain intelligent moves on the part of the administrators and regulators. It appears that the Fed as well as most of the other central banks of different nations was closing their eyes on the repercussions of swelling economies. It should have generally been predicted as an economic abnormality and corrective measures taken to prevent the havoc.

The reports on the impact of the US subprime mortgage fallout on developing markets and emerging economies are often based on the information provided by the administrators and regulators which are not completely transparent. With the availability of total visibility through satellites and other technological aids, it is surprising that transactions running to billions of dollars are opaque. An obvious inference can be made that the crisis that was the creation of certain banks had the official sanction of the regulators. It is obvious from the action of one of the regulators in the UK coming out openly to save a bank. In the US the Fed is injecting several billions of dollars to allow some of the entrenched entities to recoup themselves with minor scratches. In a highly regulated capital market, it is quite strange that some of the regulatory actions can be interpreted to clear support of the defined entities that have behaved in a manner grossly abusing the rules.

On the alternative investments, the effect could be seen mostly on the hedge funds and the private equity funds. Of course, real estate as one of the alternative investment took the worst beating with home prices tumbling down with borrowers having no means to settle the mortgages. A number of repossessions were on the rise. This again goes to prove that the banks and financial institutions have acted in gross violation of the basic rules of the game. In most of the cases, the institutions did not bother to check the basic credentials of the borrower as to his ability to repay the mortgage. This implies the institutions have acted only out of greed of maximizing the revenue and in the process completely forgetting the procedural requirements.

Conclusion

Looking into the numbers and intensity of the crisis it can be stated that never before it was so easy for an economic crisis in one country or market of the developed world to severely impact the world in total. The subprime crisis is an example on its own to prove the effect of economic instability. When the Swiss banks jumped into the foray for advancing loans against the real estate in the US they should have realized that something obviously was wrong with the abnormal growth rates. The normal intelligence of the core of executives working for these banks dealing in other peoples’ money should have cautioned them that it was too good to be true. Such incidents are termed as ‘Black Swans’ by author Nassim Nicholas Taleb in his seminal book. A black swan can be defined as an event that possesses three distinct characteristics. They are (i) it seemed originally unlikely to happen, (ii) if and when it happened there would be major repercussions and (iii) afterward all concerned admit that one could have easily seen it coming. “The basics of economics and investment prescribe rather to invest acyclically and as a latecomer in the life cycle of the growth bubble, however, the time for attractive returns on investments was too limited.” Any economic bubble has the character of bursting soon. Top managers and senior executives of the investment banks and large funds are made to pay the price for their negligence in following the economic rule strictly. One has to admit that when such a crisis occurs in a system of interconnected economies one can run but cannot hide implying that the price needs to be paid. (Newsweek)

As observed in the study the problem started as back as in the year 2005 when the delinquency in housing loans started and the regulators had all the time in the world to take corrective measures. The problem was further magnified by falling home prices and rising debt services. This further increased the delinquencies and the consequence was that the hedging and private equity firms had to pay the price later in the year 2007.

The objective of this study was to analyze the reasons for the alternative investments to become a significant part of the asset allocation of investment managers and fund managers. In a nutshell, the availability of surplus funds due to the abundance of liquidity and lower interest rates, and the necessity for pension and other funds to increase their earnings were the main cause for the alternative investments to acquire the significance as they had the merits of lower risks and enhanced returns. However, the subprime crisis has proved that traditional assets though producing lesser returns are comparatively in an advantageous position with respect to the safety of funds. However, it does not mean that dealing in alternative investments is undesirable. It only implies considerable due diligence is to be undertaken while utilizing the alternative investment strategies to assess their risk-reward character. It would be disastrous to invest closing the eyes just to get higher returns as it happened in the case of subprime mortgages.

Recommendations

This study recommends the following few further types of research which are worthwhile to undertake to improve the knowledge in the subject.

- The impact of the subprime crisis on the Chinese economy being a major emerging economy would be an interesting study

- The causality between the current economic crisis in the United States and the subprime crisis may be another interesting area to study

- The financial situation of any one of the large private equity funds before and after the subprime crisis would throw light on the exact magnitude and extent of the crisis.

References

AMUNC Background Paper, (2008) ‘The Role the IMF can play in reducing the Fallout from the US Subprime Mortgage Market’ Asia-Pacific Model United Nations Conference 2008. Web.

Bates, Thomas W., Kathleen M. Kahle, and René M. Stulz, (2007) “Why do US firms hold so much more cash than they used to” Ohio State University Working paper

Berkshire Capital Securities ‘Impact of Subprime Crisis is Mixed for Asset Management Industry’ .

David Oser (2008) ‘Swiss Miss’.

Dr. Jeffrey R. Bohn (2008) ‘Credit Portfolio Risk and Performance Metrics: Lessons from the Sub-Prime Crisis’. Web.

Feagin, J., Orum, A., & Sjoberg, G. (Eds.). (1991). A case for the case study. Chapel Hill, NC: University of North Carolina Press.

IIM Calcutta ‘The Other Side of the Spectrum – Alternative Assets’. Web.

Newsweek ‘MBA Showcase – Europe’. Web.

Pierre Sequier, (2006) ‘The New Landscape of Asset Allocation’. Web.

Randoll Dodd ‘Subprime: Tentacles of a Crisis’ Finance and Development Quarterly Magazine of the IMF Vol.44 No 4.

Stake, R. (1995). The art of case research. Newbury Park, CA: Sage Publications

UNI and Private Equity (2007) ‘Current Financial Upheavals and the Consequences for Hedge Funds and Private Equity’. Web.

World Bank ‘The Unfolding Crisis: Implications for Financial Systems and Their Oversight’. Web.