JCB’s Strategic Initiatives and Decisions

The impact of the global recession and JCB’s strategic initiatives on the accounting performance of the company

The global recession that started in 2008 had devastating impacts on many companies. Before the recession, JCB had witnessed rapid growth in its portfolio. The company achieved a historical increase in the volume of sales, profitability and market share. It recorded global sales of £2.14bn in 2007 with £120m after-tax profit. All of its continental segments recorded improved growth in units produced and sold. The onset of recession had a great impact on JCB’s financial performance. The sales volumes succumbed to the recessionary effects in 2008 with a drop of around 13,000 units from 70,000 units recorded in 2007. This led to a drop in profit to £91m. However, the company started recording positive increases in profitability in 2009. The after-tax profit was £116m and £103m in 2009 and 2010 respectively. However, it recorded remarkable profitability from the year 2011 after the recessionary trends eased. JCB reported an aftertax profit of £176m in 2011, which was followed by a record of £212m in 2012 after the profits were taxed.

Secondly, JCB has pursued several strategic initiatives in the last ten years that have significant impacts on its financial and strategic performance. The company has undertaken these initiatives to increase its market share with a chief aim of enhancing shareholders’ value. For instance, its strategic initiatives began in 1999 after building the first overseas plant in Georgia, USA. Furthermore, the company launched its first new engines in 2003 to pursue internal growth and innovation strategies. To meet the increasing demand for heavy construction machinery, JCB announced plans to invest in a new factory in Uttoxeter, Staffordshire, as well as an additional development of a wide range of products. Also, the company continued its Asian expansion through several developments of plants in India and China.

The company’s strategic initiatives have also involved expansion into Latin America. Recently, the company has built a manufacturing plant in Sao Paolo, Brazil. The strategic takeover of Vibromax Company in Germany in 2005, highlights the strategic objectives of JCB. In the same year, the JCB also overstepped its business norms and entered a $230m contract with the United States Army to supply high-speed excavation equipment. These initiatives underline JCB’s attractive accounting statistics in recent years.

Company profitability has steadily increased from 2004 to 2012. The company recorded after tax-profit of £43m, £57m, £95m, and £120m in 2004, 2005, 2006 and 2007 respectively. This period coincides with JCB’s strategic initiatives aimed at increasing market share and becoming more competitive at the global level. Despite the global recession effects, the company was able to record slightly significant profits in 2008 and 2009. Owing to its strong strategic initiatives of 2005, the company records showed high profits of £103m, £176m and £212m in 2010, 2011 and 2012 respectively.

From JCB accounting data we can calculate ratios to determine its profitability ratios to identify its efficiency. For instance, returns on assets and return on equity ratios can be calculated to determine JCB efficiency and shareholder value in 2012.

Returns on assets (ROA) = Annual net income ÷ Average Total Assets = 212,500,000 ÷ 826,100,000

ROA = 0.257*100 = 20%

From this ratio, it can be inferred that JCB is converting its investment into profits more efficiently. On the other hand, liquidity ratios can be used to determine the ability of JCB to pay its short term liabilities. The current ratio is used to calculate JCB liquidity

Current Ratio = Current assets ÷ Current liabilities= 925,800 ÷ 551,900= 1.677

From the above calculation, we can infer that JCB, as a liquid company, can meet its short term liabilities. On the other hand, the capital structure of JCB can be calculated using the debt-to-equity ratio

Debt-to-equity = Total liability ÷ Shareholders equity= 693,000,000 ÷ 826,100,000= 0.838

This shows that JCB is using debts to finance its strategic initiatives.

The benefits and drawbacks of the company’s decision to remain a private limited company

About the case study provided, the JCB Company operates as a private organization. The company’s shares are not traded in the stock exchange. This denies the organization an opportunity to improve its performance and gain a competitive advantage. From the case study, it is evident that the organization can currently be described as a blue-chip one because it enjoys a big portion of the market share. The JCB Company is considered to be among the top seven manufactures of construction and farm equipment in the world. It is the first one in Europe. Listing to this organization in the stock exchange will attract potential shareholders because the organization has a good brand image. The capital gained from the stock exchange can be channeled in the expansion of the organization, thus increasing its profit. However, there are several drawbacks associated with the registration of JCB in the stock exchange.

One of the drawbacks is a waste of time caused by the procedures involved in the registration. Furthermore, the capital raised through this method is given with the conditions regarding its use, thus limiting the organization on the use of the acquired capital. The organization will also have a lot of shareholders, thus reducing the earning per share of each shareholder, especially if shares are offered as ordinary ones. Lastly, some of the shares in the stock exchange allow shareholders to redeem them at any time. This can leave an organization in a financial crisis.

The Strategic Information Alignment framework for adding business value of the company

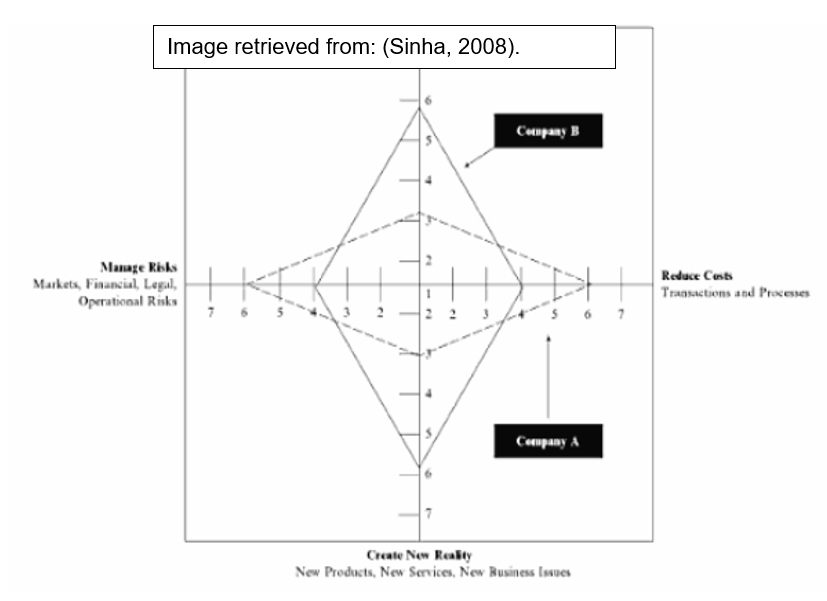

Information is an important tool in the creation of business value. There exist four ways of using the information in doing this. About Marchand (2000), companies that use the information to compete in markets require keen decisions while making choices (Marchand, 2000). This helps them develop capabilities in every axis of the SIA framework. The first way is to manage risks associated with a business. This is done through the evaluation of risks. Risk refers to the variation of the actual returns from the expected return. Evaluation of risks can be done using the standard deviation method or the coefficient of variation. The second way of using the information in the creation of value is through reducing costs. This involves the use of information to come up with innovation to ensure that products are friendly economically.

The third aspect is using the information in terms of the products and services that are offered to customers. When using this concept, companies need to develop close relationships with their customers. This enables them to learn and produce goods that meet their needs. For instance, the JCB Company can come up with strategies that ensure that customers are satisfied (Morabito, 2013). The fourth way of using information is by creating loyalty and making customers ready to offer new information. This is done by recognizing and rewarding customers. Thus, the JCB organization should undertake an initiative of rewarding potential customers. Customer loyalty enhances the retention of customers. This can also be achieved by lowering the price of their products, which will encourage consumers to stick to their products. In the JCB Company, this has already been achieved. The company consistently looks for ways of delivering products that are economical to the customers. The approach of using the information to create value is summarised in the pyramid below.

The JBC Company can use this knowledge by implementing it to conquer other competitors that deal with the delivery of the same products. To conquer other organizations, the JBC Company needs to deliver the right products at the right time. This involves gathering information concerning what customers prefer and coming up with the products that meet their requirements.

The second way of utilizing information in adding value to services that customers receive is through offering products that lead to customer satisfaction. This involves setting up mechanisms that deal with customers efficiently. It also involves offering products that are economical and reliable (Sinha, 2008).

Beyond Budgeting Approach

The reasons to replace ‘traditional budgeting’ as a performance control system

Traditional budgeting is a type of budgeting where commands come from top management to other levels of management (Dibb & Simkin, 2008). Budgeting is centralized with those at the executive level. The beyond approach budgeting has replaced traditional budgeting approach. Business executives motivate and coach decentralized teams that are closely linked with consumers and changes in markets. The traditional budgeting needs to be replaced because of the following reasons. The command and control approach of traditional budgeting is not effective in getting the best out of employees. A traditional scheme of budgeting approach is mostly focused on short term profits of an organization, rather than long term profits. Second, the operation of traditional budgeting can be said to be centralized to the top management who have the mandate of making decisions. Centralization of budgeting makes them (top-level managers) corrupt because of conflicts that arise between them and shareholders.

The last reason is that traditional budgeting has targets that are fixed. These fixed targets are then assigned to specified business units that are expected to deliver the results. Setting fixed targets does not take care of other factors that are likely to be experienced in the market. Such factors include unforeseen shifts in the economy, new competitors joining the market and the constantly changing market environment. As a result, performance analysis contributes to erroneous data and conclusions (Hope & Fraser, 2003).

The philosophy behind a Beyond Budgeting approach and its practical reflection within the JCB company

The beyond budgeting approach, which has replaced the traditional budgeting, is built on the philosophy that revolves around setting relative targets, having decentralized teams as well as empowering and coaching. Empowering and coaching ensure that there is a collaboration between members of an organization and its management (Dibb & Simkin, 2008). Employees are empowered in the delivery of value to the customers. This results in the achievement of organizational goals. Coaching ensures that individuals in an organization are competent. For instance, if this approach is applied in the JCB Company, it will improve its productivity. Empowered employees will be more productive and innovative. This will enable JCB to come up with products that meet customers’ demands in the market. The decentralization method of the beyond budgeting approach is an essential concept of the JCB organization because it has various branches across the world, hence the possibility to develop products that meet the needs of the customers in all regions. Each group will be allowed to interact with the customers and develop products according to customers’ specifications.

Furthermore, decentralization will ease the process of making decisions. Decisions will not have to wait for approval from the central headquarter, which may take longer. This will result in the delivery of products and services that are better than before. Customers will be satisfied and become loyal to the organization. The measurement of performance using beyond budgeting approach involves setting up relative targets. This involves the comparison of team performance according to the dynamic and essential performance indicators, such as peer performance, benchmarks, and best practices. The evaluation criteria used in performance evaluation are realistic, and this will make the JCB Company know the exact actions to take (Hope & Fraser, 2003).

Knowledge Management and Learning Organisation in providing a sustainable competitive advantage

Knowledge management is a multidiscipline approach aimed at achieving organizations’ goals, by making good use of knowledge within an organization. This notion revolves around the acquisition, creation, and sharing of knowledge within a company. It also involves the cultural and technical aspects that support the sharing of knowledge. There is value in knowledge management in an organization. Knowledge management encourages innovation because of the free flow of ideas within an organization. It also improves the decision-making process, enhances employee retention rates through recognition of the value of employees’ knowledge and rewards them for their competency. This, in turn, leads to the satisfaction of customers because organizations support a culture that encourages innovation among employees (Spender, 2006).

A learning organization is another concept that is related to the knowledge management concept. It refers to an organization that has the capability of changing its behavior as well as mindset, depending on situations at hand (Sveiby, 1997). This concept is in line with the beyond budgeting approach, which involves setting goals that vary and are not fixed. A learning organization restructures its initiatives whenever the previous attempt does not achieve desired outcomes. One such organization is Nokia. This organization manages to retain its big portion in the cellphone market through learning and changing with the technological world. Nokia is among the first manufacturers of handsets in the world. Initially, the Nokia Company manufactured phones that were only used for calling and texting. However, as time went by, there were drastic changes in the design of phones that the company manufactured. This was due to changes in customer preferences.

Other than communicating, customers wanted devices that had the capability of doing multiple activities, such as playing games and taking photos as well as connecting to the Internet. This called for the manufacture of smartphones. The company could have collapsed if it had never learned what customers needed. Through its policy of action learning, the Nokia Company has managed to remain in the cellphone industry. Other organizations, such as Motorola, have been acquired because of not learning the trends that are taking place in the cellphone market. Comparing these two concepts, a learning organization concept is the best one because it enables organizations to change with the market dynamism and ensures that organizations meet the needs of the customers. It also enables employees to become innovative as they aim to meet the changes that take place in the market (Lei, 2003).

List of references

Dibb, S & Simkin, L 2008, Marketing planning: A workbook for marketing managers. South-Western Cengage Learning, London.

Hope, J & Fraser, RC 2003, Beyond budgeting: how managers can break free from the annual performance trap. Harvard Business Press.

Lei, D 2003, Competition, cooperation and learning: the new dynamics of strategy and organization design for the innovation net, International Journal of Technology Management, 26(7), 694-716.

Marchand, DA 2000, Competing with information: A manager’s guide to creating business value with information content, Wiley, Chichester.

Morabito, V 2013, Business technology organization: Managing DIGITAL information technology for value creation – Springer, the SIGMA approach, Heidelberg.

Sinha, PK 2008, Management control systems: A managerial emphasis, Excel Books, New Delhi.

Spender, JC, 2006, Getting value from knowledge management, The TQM Magazine, 18(3), 238-254.

Sveiby, KE 1997, The new organizational wealth: Managing and measuring knowledge–based assets, Berrett-Koehler, San Francisco.