Financial crisis 2008 is a critical debate today due to its significant effects on the economy. Most importantly is the fact that there exists a close connection between financial crises and liquidity of banks. The study will demonstrate that before the crises the banking sector experienced an unusual positive creation of liquidity which was contrary to crises that affected marketing institutions in the sense in which they recorded abnormal negative trend in creation of liquidity. The purpose of this study is the assess the extent to which financial crisis in the United States of America contributed to the liquidity crash in the (MBBGs) Major British banking group.

Financial Crises 2008

In which extent did financial crisis in the United States of America contribute to the liquidity crash in the (MBBGs) Major British banking group?

In 2007, there emerged uncontrolled market rise on advancement of loans for subprime mortgage in the United States. It is held that most sub-prime loans did not fulfill the standard principles for quality credit procedures, for instance, historical background of the borrower in terms of ability to repay the loan and analysis of his income et cetera (Edey, 2009).

Further research indicates that by September 2008 the fall of Lehman’s Brothers aggravated the crises. This led most creditors to incur serious losses (Reinhart, 2003). Moreover, financial institutions in Europe and US destabilized as a result of rapid nationalization of the American International Group (AIG). This situation also led to price instability considering the fluctuations (Edey, 2009). As a remedy the government restricted lending processes in banks and financial institutions; suffice to mention that the gravity of the crisis increased hence spread to other parts of the world.

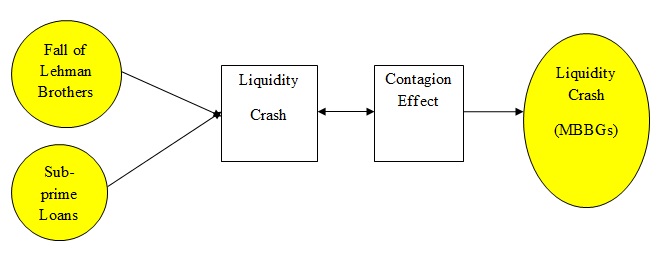

So, even if there is gap in research on how financial crises of 2008 led to liquidity crash of MBBGs still the study can arrive at such conclusions based on the principle of contagion effect. This may be demonstrated in figure 1 below:

The researcher will use two cases as follows:

- Fall of Lehman Brothers

- Subprime Loans

Assumption: The two phenomena resulted to liquidity crash within banking institutions in the United States

Just to reiterate the yellow pattern represents effects of liquidity crash in the two phenomena which in turn spread to other parts of the world or institutions. Therefore, the yellow pattern appears again in MBBGs showing that the risks of liquidity crash due to the fall of Lehman brothers or sub-prime mortgage extend to it.

The demonstration above is to cover research gaps mentioned earlier in that there lacks sufficient literature on how financial crises might have affected Major British banking group. Therefore, the researcher has developed a conceptual framework that may be used as an analytical approach to understand the proposed topic. However, the next few paragraphs will look at other literature resources and subsequently provide another analytical approach.

Research has shown that United States succumbed to several financial crises. In most cases, such crises were occasioned by existent liquidity provision deriving from the banking sector as well as financial markets (Acharya, Shin, and Yorulmaze, 2007). As the reader may be aware the crisis associated with subprime lending led to the annihilation of liquidity in the banking sector thus reducing their capacity to advance credit to individuals, institutions or the depression of loan securitization (Berger & Bouwman, 2009). Theory of financial intermediation asserts that liquidity crises are the main goals for existence of banks. A cross section of research studies have argued that banks achieve liquidity when they finance illiquid assets, for instance, loans advanced to businesses in possession of liquid liabilities (transaction deposits) (Bryant, 1980; Diamond and Dybvig, 1983; Holmstrom and Tirole, 1998, Kashyap, Rajan, and Stein, 2002).

It is worth mentioning that liquidity creation increases fragility of banks not to mention susceptibility to runs (Berger & Bouwman, 2009). In the course of it, runs translate to crises through contagion effects. Other effects emerge if financial crises are the cause of liquidity creation. In this study it is vital to note that an exploration of the relationship between financial crises vis a vis creation of bank liquidity may pose major economic insights which may be used to shape financial policy in the future.

In the past research has paid attention to issues of contagion. It has been held that a minor liquidity shock may lead to contagion effect across the economy (Allen and Gale 2000). Other researchers have assessed the factors which influence financial crises as well as their policy implications (Lorenzoni, 2008). Last but not least, other works have examined the impact of financial crises towards the real sector. Research shows that prior to the crisis creation of liquidity shifted from a “negative abnormal value” to a “positive abnormal value” (Berger & Bouwman, 2009). However, when the crisis took place creation of liquidity dropped significantly. But then after the crisis, liquidity creation began having a positive trend (Berger & Bouwman, 2009).

Discussion and Conclusion

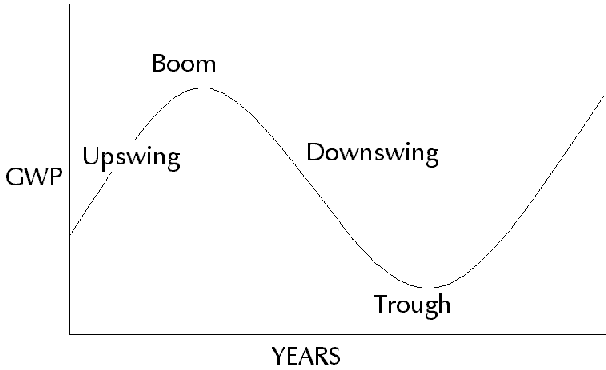

As can be seen from the findings above there seems to be a correlation between financial crisis and creation of liquidity. Essentially, it confirms as a matter of principle that financial crisis lead to a downward creation of liquidity in the banking sector and that a stable and growing economy points towards positivity of the same. Therefore, the reader can anticipate what would be the expected outcome for a study which examines the effects of financial crisis in the United States in relation to liquidity crash in the Major British banking group. Well at this juncture the researcher cannot provide valid conclusions as there needs to be more empirical verifications and data quantification. However, through insights of the above findings and boosting the thought with the trend of financial crises (see figure 1) the following may be asserted.

It can be argued that the upswing trend indicates the recovery mode of the economy or what the researcher would refer to as decrease of financial crisis. At this point there would be an upward trend of liquidity creation. On the contrary, downswing trend represents the movement for increased financial crisis thus a downward trend in creation of liquidity.

That said the following proposition hold:

Proposition 1: An increase on financial crisis in the United States of America caused liquidity crash in the (MBBGs) Major British banking group.

Or

Proposition 1A: Financial crises in the United States caused a downward trend to liquidity creation in Major British banking group

Proposition 1B: Decreased financial crises in the United States caused an upward trend to liquidity creation in Major British banking group.

References

Acharya V. et al. (2007). Fire sales, foreign entry and bank liquidity, CEPR Discussion Paper 6309

Allen F. and Gale, D., (2000). Financial contagion. Journal of Political Economy, 108: 1-33.

Berger A. & Bouwman C. (2009). Financial Crises and Bank Liquidity Creation. Journal of Financial Intermediation. Web.

Edey, M. (2009). The Global Financial Crisis and Its Effects. Economic Papers, Vol.28, No.3, pp.186-195

Holmstrom B. and Jean T., (1998). Public and private supply of liquidity. Journal of Political Economy 106:1-40.

Lorenzoni G. (2008). Inefficient credit booms. Review of Economic Studies 75: 809-833.

Reinhart C. and Rogoff K. (2008), Banking Crises: An Equal Opportunity Menace. NBER Working Paper No.14587, December