Over the past few years, the global real estate market has been at the center of dynamic economic and social changes. Accordingly, its players have faced new risks and opportunities. While most of these trends can already be tracked and analyzed, investors and developers still underestimate their impact on their field of activity. Since real estate is a business with a long cycle, Ratcliffe et al. (2021) note that it is necessary to consider these trends and plan appropriate changes nowadays. There are several significant megatrends, the effect of which provokes transformations in the real estate segment. Among these trends are the development and expansion of cities, demographic changes, competition in developing markets, sustainability, technical innovations, and green construction.

Cities Development and Expansion

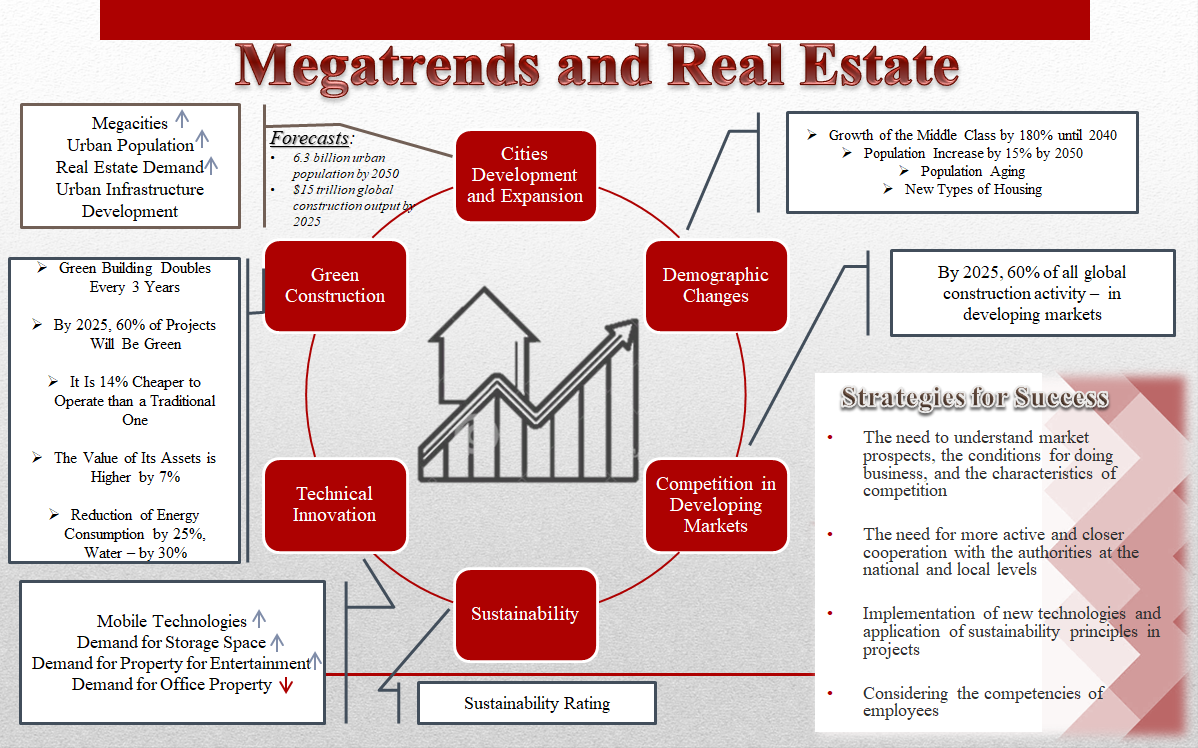

The migration of people will provoke an increase in the number of megacities, of which there are 23 nowadays. According to Clerc (2019), by 2025, their number will reach 37. Moreover, Petermann (2021) predicts that by 2050 the proportion of the urban population will increase by 77% to 6.3 billion, up from 3.6 billion in 2015. It is expected that the growth of the urban population will trigger several trends in the real estate industry. Firstly, the growth in demand for housing and, as a result, the intensification of construction activity. According to Clerc (2019), by 2025, compared with 2012, the global volume of production in the construction sector will almost double and reach $15 trillion. Secondly, the rise in the cost of premium real estate and the modification of more affordable housing. Thus, developers will become more inventive in designing and building commercial and residential properties and using space more efficiently. Thirdly, the change and development of urban infrastructure to meet the needs of the growing urban population.

Demographic Changes

The main demographic changes that will affect the real estate segment are the growth of the middle class and the aging of the population. In particular, it is predicted that according to the results of the period from 2010 to 2040, the size of the middle class will increase by 180% (Deloitte, 2021). Cities are attracting a young middle class who will create demand for housing and change it with their demands and preferences, for example, in terms of floor space and apartment layouts. Clerc (2019) asserts that by 2050, the world population will be 9.3 billion, which is 15% more than in 2021. The number of people over the age of 60 will exceed the number of people under 15 (Clerc, 2019). Developing countries will have the youngest populations.

Demographic changes will lead to the need for new types of real estate. Residential real estate will become more specialized, with local and cultural characteristics. For example, urban apartments for young professionals may be smaller in size, without a kitchen. Moreover, it is possible to develop such a direction as housing for pensioners. It is noteworthy that some families will prefer living outside the city in fenced areas.

Competition in Developing Markets

Real estate is the leading segment that contributes to the economic growth of developing countries. And even if this growth slows down, developing market construction activity remains strong, providing investment opportunities. Thus, according to Ratcliffe et al. (2021), by 2025, more than 60% of all global construction activity will be concentrated in developing markets, compared with 35% in 2015. That is why such countries attract attention and become the object of competition between investors and other players in the real estate segment. However, developing markets are creating new players who can take a stronger position than their foreign counterparts and take full advantage of local opportunities with connections to local and regional institutional investors.

Sustainability

Given the growth of the world’s population, by 2030, humanity will need 50% more energy. How strong the pressure of energy issues on the real estate segment will depend, in particular, on resource prices. Alternative forms of energy can reduce this pressure. And yet, in developed countries, by 2025, all buildings will be required to have a sustainability rating (Seyler, 2020). Already nowadays, developers are actively applying sustainability principles in their projects – whether they are commercial or residential buildings. Furthermore, several eco-cities are currently being implemented around the world, designed in such a way as to reduce waste and carbon emissions to zero.

New opportunities and risks are opening up for management companies. The price of an asset is increasingly dependent, among other aspects, on the sustainability indicator. Therefore, if building sustainability requirements evolve faster than the real estate market as a whole, this will lead to a decrease in the value of assets that will be offered at a significant discount when sold.

Technical Innovation

In the long term, technology can change the economy of the entire real estate sector and the activities of developers and investors. First of all, we are talking about mobile technologies. Ratcliffe et al. (2021) affirm that due to mobile technologies, the need for physical space is decreasing, particularly in the segments of retail and office real estate. For example, some chains selling household appliances and electronics are closing stores as their customers shift to online shopping. At the same time, the demand for storage space is growing. This is due to a reduction in the delivery time of goods ordered via the Internet and, as a result, the need to locate storage facilities closer to consumers. Of course, you should not expect the complete disappearance of stores, but some goods will still be sold mainly online – these are books, music, and videos.

Such sectors as health and beauty and household goods will be more resilient to the changes brought about by technological advances. Shopping centers with restaurants, entertainment, and social activities will also remain attractive to customers, which is not the case for office real estate. Video conferencing has become more commonplace and accepted by companies and employees instead of traditional meetings, and electronic documents replace paper documents. Thus, people increasingly spend their working hours in remote offices or at home. Along with social networks, these trends will affect real estate to a greater extent than is currently expected.

Green Construction

The focus of green buildings is on reducing the negative impact on the environment and human health, reducing consumption and efficient use of energy and material resources throughout the entire life cycle of a building. According to Deloitte (2021), the global green building continues to double every three years. Developing countries such as Brazil, India, Saudi Arabia, and South Africa will be the engines of green growth over the next five years. Moreover, the expansion will continue in such developed countries as the US, Germany, and the UK. Petermann (2021) predicts that by 2025 more than 60% of their projects will be green. Since economic factors are the most critical factors for many countries, it is essential to consider the positive financial and business implications of green building. According to Clerc (2019), a green building is 14% cheaper to operate than a traditional building, and its asset value is 7% higher. Moreover, the economic benefits of green construction include a reduction in energy consumption by an average of 25%, water consumption by an average of 30%, and a reduction in housing maintenance costs by optimizing the operation of all systems and controlling consumption.

Strategies to Success

The transformations that the real estate market will undergo in the next few years indicate the need for players in this segment to adapt and implement appropriate changes in their current activities. First, investors need to understand the outlook of the markets, their conditions for doing business, and the specifics of competition. The real estate segment is globalizing, and therefore the risks that its players face are expanding. Clerc (2019) notes that, first of all, they include country and city risks. Secondly, it is necessary to cooperate more actively and closely with the authorities at the national and local levels, which will help to understand their plans and ambitions regarding urban development. Nowadays, many cities compete with each other for dominance in their regions, and those that win this fight will provide attractive investment opportunities.

Thirdly, it is vital to introduce new technologies and apply the principles of sustainability in projects, which will become the main factors in creating the value of the real estate. According to Ratcliffe et al. (2021), investors and developers need to understand which types of properties will become obsolete and which will be popular and keep track of information about tenants and buyers to assess demand and thus make better investment decisions. Green technologies will play an essential role in attracting customers and buyers in both residential and commercial real estate. Buildings with poor sustainability performance will be sold at a discount, and their life cycle will be shortened. Fourth, it is crucial to take into account the competencies of employees. The emergence of new types of real estate will require niche knowledge. Thus, the above strategies are promising opportunities for business development in the real estate industry.

Reference List

Clerc, L. (2019) ‘Towards a global real estate market? Trends and evidence’, in Hot Property. Cham: Springer, pp. 63-81.

Deloitte. Real estate predictions 2021. Web.

Petermann, J. (2021) ‘Development of real estate marketing–trends for the future’, Marketing Science & Inspirations, 16(4), pp. 10-19.

Ratcliffe, J., Stubbs, M., and Keeping, M. (2021) Urban planning and real estate development. New York: Routledge.

Seyler, N. J. (2020) ‘Megatrends and sustainability’, in Sustainability and the occupant. Wiesbaden: Springer Gabler, pp. 5-23.