Considerations for a Merger and Acquisition strategy

- Software developing companies requiring high levels of internal structure integrity.

- Companies who want to defend their assets from external influence (retain full control).

- Management of intellectual property data requires clarity of a business structure and subordination.

- Opportunities for expansion and growth as opposed to entering a foreign market as a smaller entity.

- Calculation of ROI needs to be conducted to establish the feasibility of the endeavour (Almor, Tarba, & Margalit, 2014).

Advantages of Merger and Acquisition Strategy vs. Joint Venture

- Allows to retain control over all key strategic decisions while not interfering in operational management.

- The broader scope of integration due to more similarities in business activities.

- Acquiring new skills, knowledge, local practices and managerial wisdom through the internal exchange (Almor, Tarba, & Margalit, 2014).

- Increased commitment in partners, managers, and employees due to increased, almost permanent partnership duration.

- More significant reduction in costs of transition as local companies usually have infrastructure and connections established.

- Economies of scale apply and allow to decrease the cost of services.

- Taxation discounts and bonuses.

Advantages of M&A vs. Franchise Agreement

- No need to establish rules, regulations, training procedures to create essentially the same business.

- Better control over managerial decision-making.

- Increased information safety and security (Brueller, Carmeli, & Drori, 2014).

- The nature of a product (software solutions) does not adhere well to the franchise agreements.

Advantages of M&A in terms of Risks

- Safeguards from potential disagreements.

- Prevents capital mismanagement due to inadequate role interpretation (Brueller, Carmeli, & Drori, 2014).

- Establishes clarity of objectives due to their unchanging nature.

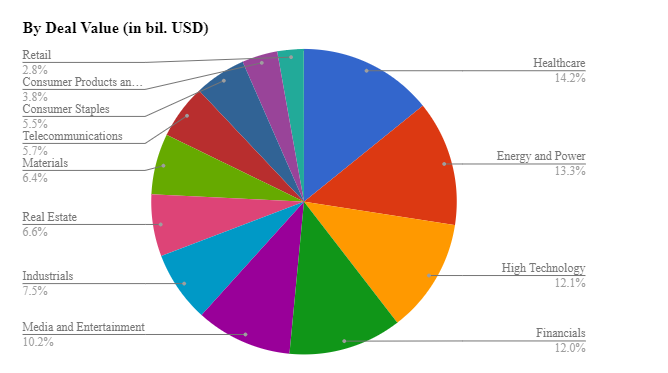

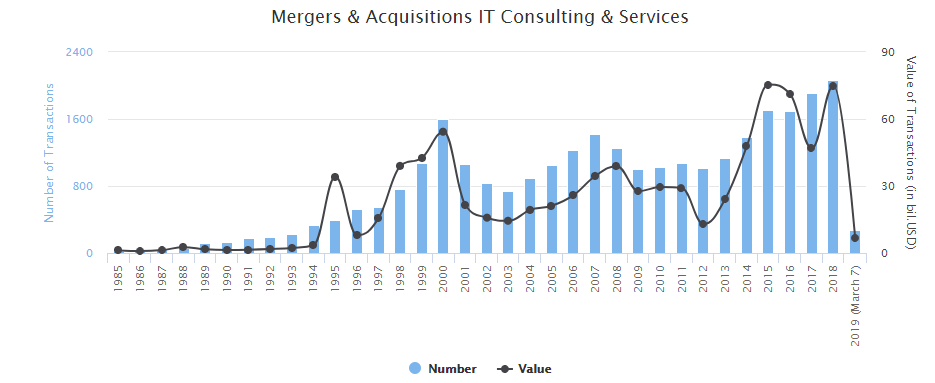

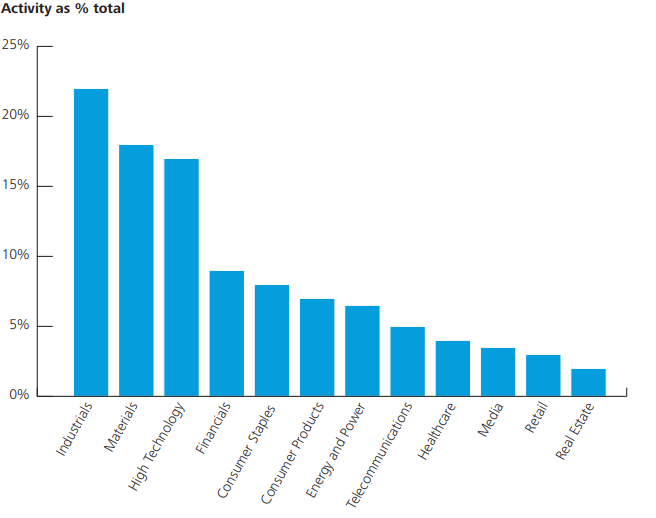

As one could see, there is a steady increase in acquisitions and mergers as opposed to joint ventures in the sphere of IT and High-technology, which also speaks to the advantages of this entry mode.

Successful examples of mergers are Nokia and Siemens or United Technologies and Rockwell Collins which turned out to increase the value of these firms (NASDAQ 2017).

However, on average, about 83% of mergers fail. The key constituents of the M&A failures to consider are as follows:

- the absence of risk management procedures;

- wrong pricing strategy;

- the emergence of cross border cultural issues;

- Inadequate choice of a company CEO (Bradt, 2015).

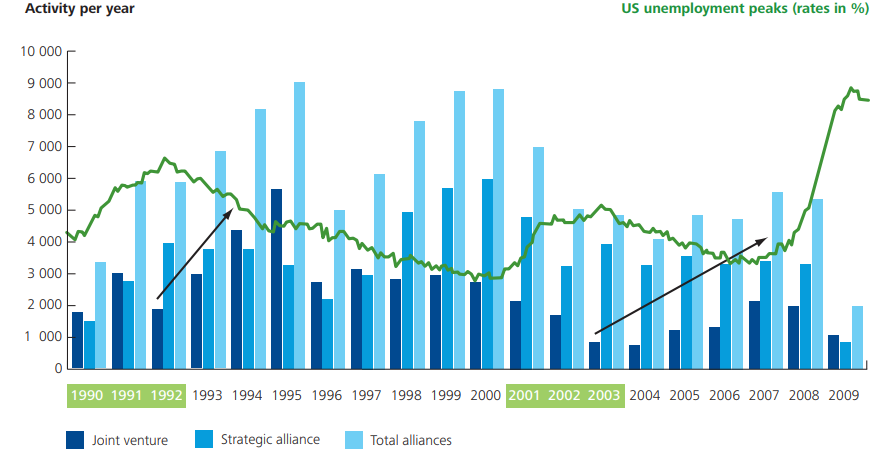

According to Insights (2017), Joint ventures, on the other hand, have two times better value growth (see figure 1).

References

Almor, T., Tarba, S. Y., & Margalit, A. (2014). Maturing, technology-based, born-global companies: Surviving through mergers and acquisitions. Management International Review, 54(4), 421-444.

Bradt, G. (2015). 83% of mergers fail – leverage a 100-day action plan for success instead. Forbes.

Brueller, N. N., Carmeli, A., & Drori, I. (2014). How do different types of mergers and acquisitions facilitate strategic agility? California Management Review, 56(3), 39-57.

Deloitte (2010). A study of joint venture: A the challenging world of alliances.

Insights, B. (2017). The secrets to successful joint ventures. Forbes.

Institute for Mergers, Acquisitions, and Alliances. (n.d.). M&A statistics.

NASDAQ. (2017). 15 of the best mergers & acquisitions of 2017.