Mike bike advanced (MB-A) is a stimulating system business that entirely deals with computers. It can also act as an interactive tool that can be used in learning business subjects. Its practical decisions are based on real-world modeling. MB-A is a bicycle-making industry in Evehwon which manufactures real cool and mountain top cycles. This business plan is written to act as a guide to help the business to come up with various methodologies of organizing its activities to ensure that it meets its goals and objectives in the manufacturing of bikes. Following is a summary of points that are incorporated in this plan.

- The vision of the start-up of this business in this location basically was to boost the economic growth of that country, to invest in the bicycle industry, and also to create employment for the people of Evehwon.

- The business’s main mission was to build up competence in the market with a high margin niche which could result in to increase in profit made by the business.

- The business had goals and objectives to fulfill by establishing a business in this area since it wanted to satisfy the people in that region with instruments for exercising due to the high rate of outdoor activities and health-conscious of the people in the region. The consumer market in Evehwon had a huge demand for bicycles and therefore MB-A’s goal was to satisfy the growing demand for bicycles in the region. Another thing with this region is that consumers could purchase any bicycle that suits their needs despite the price since they had a high income. Therefore, this was another goal for them to capture the market with high prices.

- A balanced scorecard can be used by this business to evaluate its financial performance of the business. The business used the scorecard as a means of measurement and as a strategy to control business both financially and none financially.

- Financial evaluation of the company is quite important since it helps in determining whether the company is running at a profit or loss. Therefore by evaluating strategies and tactics of the company that they use in marketing their bicycles one can determine their financial status.

- Risk factors and management principles are other key issues that the company focuses on in its process of evaluating the financial status of the company since they can directly or indirectly affect the financial status of the company (Handy, 1997).

- In the good running of the business, monitoring, and evaluation of the business give a basis for running the company since through monitoring and evaluation the weakness and strength of the business are realized so that they can be addressed. MB-A monitors the progress of their bicycle market since they faced a lot of limitations from the government hard key performance is used in MB-A to show their success factors.

- Initial financial analysis of this venture showed that the business has promising results. The government policy made the competence and the strengths of the company. The company for the first year has been operating at a profit.

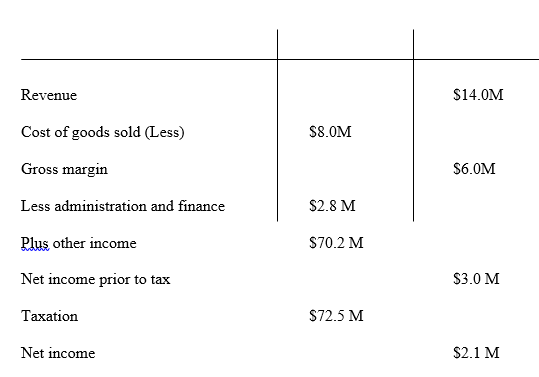

In conclusion, the following highlight of the table showing the income statement.

If this plan is implemented coupled with comprehensive and a well-detailed marketing plan, it’s certain sure that MB-A will definitely become a profitable venture for the owners and it will definitely boost the people of that region.

Goals Objectives

The main goals and objectives of this business plan are to:-

- To provide a well-written guide that will help in managing and operating the MB-A bicycle industry and to establish a good framework that will help in developing a tactical marketing plan for the business.

- The intended audience in this plan is the owner of the bicycle-making industry, and it’s not drafted as an aid of obtaining financing from outside sources.

- The plan is also meant for providing details of the company’s progress and its financial status.

The main goals and objectives of MB-S business

- Demand- The country of Erehwon had people with a lot of earning and had a high demand for exercising facilities such as bicycles due to these high earnings they could purchase these facilities which made the owner of MB-A establish their industry in that particular country so that they can capture the markets in that region.

- Profit- They had the desire to generate enough profit which could be used to finance the company’s future growth and to provide enough resources needed by the company for expanding the business so that they can meet the growing demand for bicycles in the region.

- Growth- The plan is meant to enable the business to grow in challenging and manageable ways which can lead to innovation and adaptability of the market (Ginn, 1931).

Mission

The MB-A mission is quite straightforward:

- Purpose- MB-A exists in order to provide bicycles to the growing demand of people of Erehwon in abundance and of different types to suit their needs.

- Vision- They established the industry to boost the economic growth of the country. They had a desire to invest in the bicycle industry and to create employment opportunities for the people within that region since they will employ them to assist within the company.

- Mission- Their main mission is to build a competitive market for this business which will have a high margin niche that will otherwise maximize the profit made from the sale of the bicycles.

Vision

- Country: MB-A bicycle company basically established the industry in Erehwon since they had a desire to boost the economy of that country which was growing at quite a high rate due to their proper income.

- Investment: By investing in bicycles in those areas where the economy is good the income is normally quite high and thus why the owners of this company had this big desire to establish their company in this region.

- Employment opportunity- By establishing a business in this country they created a good opportunity for people within this region to get jobs which consequently ended up boosting the economy of the whole country.

Balanced scorecard

In dealing with measurements and strategic control of the business, MB-A drafted a balanced scorecard which covered both financial and non-financial aspects of the business so that it could help in determining whether the business was running and a profit or loss and also other progress or the tied business stock towards implementing its future plans (Statt, 2004). Their purpose was to start up the business with simple measures and so that they can establish ways to coming up with other measurements later. It’s used by MB-A to evaluate the way the company is performing both financially and non-financially. It’s also an essential tool to be used by MB-A to facilitate the execution of strategy in a company. It usually evaluates customer/internal process, learning, and growth of a company.

Financial scorecard effectiveness

Sales

MB-A should develop a financial scorecard so that it can be used as an evaluating tool to measure the sales of the bicycle. The company has various market segments. They have segment centers that satisfy the whole segment. Selling price in MBA is determined by the price which met various needs of the segment. By using a financial scorecard which shows the sales for MBA, it shows that even if their products are better they could not sell the same way at those meeting the needs of the markets segment. Since if it does not meet the needs of the segment basically the customers do not desire it.

Demand

Apart from the selling part of the financial scorecard, the scorecard should indicate the demand of the product since it’s the one that can either increase or reduce the sales of the company (Statt, 1994). According to MB-A, there are many factors that contribute to the attribute of their bicycles. These factors include pricing, quality, advertisement, and distribution. MB-A is doing quite well in selling their bicycles especially the mountain bikes which customers are ready to pay very high retail prices which range from $500 to $4000. The company also meets the demand of leisure customers who purchase a lower-spec stylish bike which is normally sold at lower prices of $100 to $600.

Profit

The MB-A company makes a lot of profit since they are known to be vendors of the most quality bikes in Erehwon. Apart from producing quality bikes, they are the most expensive vendors but people within that area have high earnings and therefore they prefer purchasing high-quality bicycles. Their shapes mainly rely on high margins so that they can make considerable high profit from their sales and therefore they least discount their stocks.

Shareholders value

MB-A has come up with changes of shareholders value which is to make the wealth for shareholders in case of the other company’s value of shareholders. Therefore, for them to create wealth for their shareholders they:-maximize their net profit, minimize the investment of the shareholders and also minimize the risks that they can encounter.

Raising/Repaying debts

This is out of the earliest ways that a company can raise funds in order to increase profitability. MB-A can decide to raise their finances by acquiring debts such as debenture notes and mortgages since interest is usually charged in long term based on the risks that the company has decided to take.

Nonfinancial scorecard effectiveness

A nonfinancial scorecard basically helps the company to plan and control all the systems of the company.

Management control

This ensures that the company carries out its strategies effectively and efficiently. MB-A found it important to draw and pursue its strategies effectively and efficiently. They drew functional strategies which must be internally constituent with other strategies MB- A drew a five-year strategy that included some elements such as 2.1.0.0 vision and overall strategy. Vision and overall strategy which portrayed the intended plans of MBA which were to be a leading bicycle producing company which produced quality bicycles with affordable prices and also they aimed at capturing the market in Erehwon due to increase in leisure activities within that region.

Marketing Strategy

MBA developed various modes of marketing strategies whereby they established market segments. This strategy was focused on improving the market shares of the company since through these segments they would increase brand awareness by coming up with various modes of advertisement (Vernon, 2002). Through this strategy also, they would develop a good relationship with vendors and other shops which distributed their bikes. By viewing the market price MB-A could position its core products at high prices but maintaining itself within the price range so that it can target a wider market.

Operations Strategy

In their operational strategy, MB-A mainly aims at increasing the number of bicycles in the market as a core product and also launches a product in the leisure segment and therefore, they found out that they can accomplish this by purchasing more plants for their company and increasing the number of staffs.

They also wanted to increase the batch size so that they can reduce the setup cost during the packaging of bicycles and also to increase efficiency. They also wanted to focus on the quality of bicycles that they manufactured so that re-work can be reduced which consequently improves suppliers’ relation and their commitments (Thierauf, Hector, 2003). They also established ways and means of eliminating idle times so that they can increase the productivity of their products. They established ways of eliminating maintenance costs and downtime by committing themselves to preventative and maintenance methods.

Finance Strategy

They established different ways by which they ensured that long-term debts are paid and shareholders receive their dividends in due time.

Product development strategy

They accomplished this since they first established the untapped leisure market which made them produce this new product so that they could tap the market segment. This was done by developed low-cost and specification bikes.

Budgeting strategy

MB-A budgeted for their business basing their budget on their revenues of the company cost that they will incur during production and marketing of their bicycles and also on the profit they get after the sale of their products.

Therefore, since it was a five-year strategy for MB-A is results showed that the shareholder’s value increased drastically from $8.85 in 2003 to 50.07 by the end of 2006.

Financial evaluation of the company

Financial evaluation of a company or business helps in determining whether the business is running at a profit or loss. In MB-A this is done by determining a balanced scorecard, financial reports of the company in these areas they used different tactics and strategies to accomplish this. They also evaluated the risk factors that they face and management principles to use in order to attain the required financial status of the company.

Strategies and tactics of the company

The company drafted many strategies which could help the company to reach great heights. These strategies have been discussed in the previous number i.e. 2.2. The company also uses different tactics in evaluating its finances such as the use of a balanced scorecard as discussed earlier. The company has also drafted some financial reports which could be used to portray how the finances of the company are spent, income, and their relative expenditure.

MB-A company drafted their financial report based on shareholder’s value raising debts, purchasing equity, investors relations, cooperate takeover Elkin, 1998). These factors enable the company to determine its income and expenditure. The tactics used by MB-A made it possible for the company to capture a wide market as a result of good products that they produced and dividing the market into segments which enabled them to operate in a wide range of markets.

Risk factors and management principles

MB-A analysis their risks which in return determines the value of a share.

These facts are affected by how much the investors know and his basic understanding of the company concern in regard to the relationship of the investors. Risks can also result from the perceptions of the way the firm is managed. MB-A to overcome these risks has management principles that ensure that the investors and their main advisers are always aware of clear information about the firm’s situation and the plans they have in place so that they can take necessary caution if risks arise. The effort required to accomplish this depends on the size of the company. In management principles, MB-A decides to own another firm which will help them in improving their productivity. It also allows takeover 4.0 monitoring and evaluation of the company’s performance.

Monitoring and evaluating company performance is very essential in all aspects of any company (Thierauf, 2001). This helps in determining whether the company is running at a profit or loss or how its fairing in the market. This can be done by carrying out evaluation using indicators such as hard or soft key indicators.

Hard key and soft key performance indicator

A company uses this type of indicator so that it can drive performance. This helps in setting the effectiveness of the company. Therefore MB-A used various ways of meaning their performance using these indicators.

Map the core processes of your business

Before driving any business process of a company, one needs to have a clear picture of the core processes that take place in a company. One needs to come up with a few diagrams that show steps followed in order to generate revenue. In MB-A they should have followed steps such as taking inquiry whereby they should enquire of a new market, improving the quality of their bicycles to sit the needs of the entire Erewhon community, and also they should inquire on possible methods of acquiring new suppliers in the market which will enable them to produce up to date bicycles which will capture a wider market.

MB-A in their core business processes should order supplies that will enable them to assemble those parts that are essential for manufacturing bicycles. They should also assemble their orders together so that they can be able to determine which market segment to supply with each type of bicycle since this bicycle captured the market in different segments and therefore orders were being placed for different types of bicycle. So in the evaluation of company’s performance, orders should be assembled so that one can know the best selling places. Orders should also be delivered to their respective market segments in various stores which dealt with the bicycles.

Establishing roles, responsibilities, and critical factors

MB-A should allocate each role step in its core processes. For it to understand its performance and evaluate, it should first establish its roles which according to the company is the provision of bicycles which meets the needs of people of Erewhon. They should also take their responsibilities regarding the position of each person (Adams, 1986). For example, the manager of MB-A should ensure that the working staffs are organized so that they can produce quality bicycles, which meet the needs of the entire erehwon country and suit their activities such as leisure. Critical success factors should also be evaluated so that the company can realize its potential in order to apply more efforts to aim at a higher profit percentage.

Choosing the basis of key performance indicators (KPI)

MB-A should try and establish 1-2 key performance indicators per role these should be included in discussing the company’s progress and in the decision-making process. In determining KPI first one should feel obligated to accomplish the role of achieving KPI for example manager of MB-A should get quote backs to customers not longer than 24 hours. This also needs one to have hard objective data which is used to measure the KPI.

Setting the key performance indicator

After identifying the KPI to use, one should try to establish that which is critical for the business’s success. Like in the case of MB-A they found out that acquiring another store where they could establish a branch company, would boost their profit. Therefore they should target completing their dreams to enable them to make a profit.

Setting target and review date

In determining and evaluating the performance of the company, performance level should be set, and also the review date which will enable the evaluator to judge whether the company has reached its target. This should be aligned with the goals of the company and should be achieved by the team members. In setting these goals it should be in consultation with people meant to achieve them. Like in MB-A they should set the target of meeting the high demand for bicycles in the area and this should be determined by other team members such as workers in the company, advertisers? and marketers.

Summary

Management Summary

The company (MB-A) needs to set its management goals so that can aim at accomplishing them effectively for the good running of the company. The main goals of MB-A are to ensure that the shareholder’s values are maximized. Therefore the management should ensure that the business decisions are carried out effectively (MacLean, 2002).

The company should come up with various ways which can determine the effectiveness of business decision making which helps in the management of the business.

First businesses need to analyze their information which shows their aims objectives and how to accomplish them.

Then the alternative course of action should be identified which helps the business to diversify and to be more innovative. These alternatives need to be evaluated so that you can decide whether they are better than those which were being used before or to determine how they can boost the company’s profitability.

In management final decision from the firm should be considered which determines the necessary changes that have been done to the company and what it has decided in order to run its activities effectively. According to MB-A, they found out success is usually determined by how well the company is managed and organized in a stable, efficient, and enterprising way of manufacturing bicycles.

Financial plan

A financial plan, therefore, should be drawn so that it can help in evaluating different business transactions of the company. According to MB-A in their financial plan draft they should indicate shareholders value which should show that the net profit is maximized, shareholders investments minimized, and also minimized risks so that the company can create wealth for shareholders (Kay, 1996).

It should also come up with ways of repaying debts which will help to retain the profit of the company. Raising equity is another way that MB-A uses to ensure that they acquire profit for their company. Investors relations should also be taken into account in evaluating the finances of the company since they are the main profit makers of the company.

Reference

Thierauf J, (2001), Effective Business Intelligence Systems, Westport.

Kay J, (1996), The Business of Economics, Oxford.

Patricia Mclean, (2002), Studying Business at University: Everything You Need to Know, St. Leonard. N.S.W.

Gerard Adams, F, (1986), The Business Forecasting Revolution: Nation, Industry, Firm ; Oxford University Press.

Paul Elkin, (1998), Mastering Business Planning and Strategy: The Power of Strategic Thinking, ; Thorogood, London.

Thierauf, J, Hoctor, J, (2003), Smart Business Systems for the Optimized Organization; Praeger,, Westport.

Mark Vernon, (2002), Business: The Key Concept; Routledge, New York.

Statt, A, (1999), Concise Dictionary of Business Management; Routledge, New York.

David A. Statt, A, (2004), The Routledge Dictionary of Business Management; Routledge, New York

Lewis H, Ginn, (1931), Business Forecasting: The Principles and Practice: Boston, United States.