Executive Summary

Vision/Mission Statement

The mission is to minimize investment risk through a competent approach to cost forecasting and developing an investment strategy for project implementation. The company views high-quality services as the main priority and focuses on attaining high satisfaction levels among the target audience.

Company Summary

The company concludes agreements with various organizations based on which real estate objects are assessed, as well as the required preliminary and main technical examination to predict subsequent costs. It offers specific products and services to clients using effective marketing strategies. The company is managed by a board of directors. The key people responsible for decision-making are the operations manager, purchasing manager, marketing manager, accountant, and quality control.

Products/Services

The company provides clients with services and goods. The first category includes the search for real estate, evaluation, and comparative analysis. The second implies ready-made offers, buildings, and apartments purchased on the website.

Market Assessment

The market is recovering from the adverse effects caused by the pandemic. As a result, revitalization of the economy is observed. The clients’ activity also increases, meaning that the company might benefit from the growing demand and generate additional income, which is vital for further development and growth.

Strategic Implementation

The company does not produce products or goods; instead, it offers specific services to clients. Moreover, it considers existing options, analyses them, and delivers them to clients to meet their demands. The company requires stable financing and specific resources to guarantee the further development and achievement of existing goals.

Expected Outcomes

It is expected that the company will continue its evolution because of its successful and powerful strategy, the presence of loyal clients, and the recognized image.

Vision/Mission Statement and Goals

Vision Statement

The purpose of this company is to evaluate real estate, as well as to identify potential costs when designing repair and restoration work by the customer. The mission of this company is to minimize investment risk through a competent approach to cost forecasting and the development of an investment strategy for project implementation. The firm will provide the following services:

- Valuation of a real estate object when bringing a building or structure in line with its purpose;

- A preliminary survey of the main building structures, buildings, and structures;

- Basic technical inspection;

- Drawing up a conclusion based on the results of assessing the technical condition of a building or structure.

Goals and Objectives

First, the business will be aimed at interacting with clients interested in buying or renting real estate. The business will provide services for the assessment, research, and analysis of the market for buildings and offices, providing the most advantageous offers. Due to the global COVID-19 pandemic, as well as the crisis due to political complexities, the market is in excess (Christensen et al., 2018). Thus, having successfully occupied a niche, the company will be extremely in demand, which means that income and payback will be observed already three months after the start of the activity.

In addition, another advantage of the project is minimal risks. The market is revitalizing, meaning the stable income of new clients. For this reason, the company’s current objective is to consider the changing demands in the external environment and provide clients with the services they need at the moment. It will create the basis for the future company’s development and preservation of its leading positions. In such way, the goals and objectives are fundamental for the firms and its ability to survive.

Keys to Success

To succeed in the new business, the management team must understand its competitors or business rivals in the industry. Knowing the competition will help the new business benchmark the standards and performances of the business. In addition, the company could learn from its business rivals. Organization for the new business will be crucial to success (Christensen et al., 2018). For example, having a to-do list will be essential in the new company. The new business will require creativity so that the management team can develop the best ideas to ensure the business is a success.

A better understanding of clients is another success factor that should be considered. It will provide the firm with more options for planning and designing successful strategies. At the same time, it will promote stronger and more relevant relations with customers, which is fundamental for generating a competitive advantage and supporting the company’s position in the market. Using these success factors, it is possible to ensure that the firm will continue to evolve and employ the most effective and cost-saving methods, helping to achieve current goals and objectives.

Company Summary

Company Background

As mentioned above, the activity of the business is aimed at assessing and researching real estate, which is at the stage of sale or searches for customers. This company concludes agreements with various organizations on the basis of which real estate objects are assessed, as well as the required preliminary and main technical examination to predict subsequent costs. The pre-survey work includes:

- Selection, analysis, and available technical documentation;

- Clarification of the design solutions of the building (structure) and its individual elements;

- Identification of damaged and emergency sections and structures.

Basic technical examination based on instrumental diagnostics includes:

- Quantitative assessment of obvious and latent defects and deviations;

- Determination of material properties, clarification of actual loads, impacts, and operating conditions;

- 3. According to the results of the technical condition, a conclusion is made.

- 4. The results of determining the actual and predicted loads, impacts, and operating conditions;

- 5. List of permissible deviations, defects, and damages.

Resources, Facilities and Equipment

The company has extensive resources, the main of which are technology and specialists. First of all, the firm uses a large number of tools and analytical information in order to provide the most up-to-date data. This technological factor is vital for generating a competitive advantage and aligning the stable work of the company. Analytical tools are central for strategic analysis and a better understanding of the current situation in the market. Using the relevant information, the company might enhance its decision-making and planning efforts.

In addition, the company has a large number of specialists, among whom there are clearly delegated obligations. For this reason, highly motivated and skilled human resources can be viewed as an essential advantage of the firm. The HR department realizes the significance of this factor and introduces numerous regulations to improve delegation and cooperation between departments and specialists. It contributes to establishing high-performance teams and their ability to resolve a wide range of tasks.

Marketing Methods

Despite the fact that the company does not directly indicate the profitability per year, it is possible to draw conclusions about its effectiveness from other data. The firm employs 94 employees, with a total value of $61.8 million. Based on this information and the fact that the cost per employee is $150,500, it can be calculated that the average annual income is $29.2 million. The company often enters into strategic alliances with other organizations as well as third-party banks. The most common method of concluding a deal is drawing up a futures contract that will enable to reach a joint decision leading to a negotiated agreement.

The company also employs social media as a way to popularize its services and ensure that clients are ready to cooperate. The popularity of various platforms provides a high level of attention and discussion. For this reason, using the outlined marketing strategies, the company acquires the chance to broaden the target audience and create the basis for the generation of additional benefits. The approach’s effectiveness is evidenced by constantly increasing revenue and the ability to find new partners ready to engage and cooperate. In such a way, employed marketing methods support the company’s rise and help to achieve current goals.

Management and Organization

The company is managed by a board of directors responsible for salaries, performance review, and delegation of tasks among workers. The educational background of the management team members is that everyone has a master’s degree in their respective areas of specialization. The reputation of the management team in the community is that it has corporate reputation management, which will ensure the success of the new business. Some of the special skills and abilities of the management team include leadership, innovation, and results-oriented. The additional skills needed by the management include decision-making, problem-solving, and emotional intelligence.

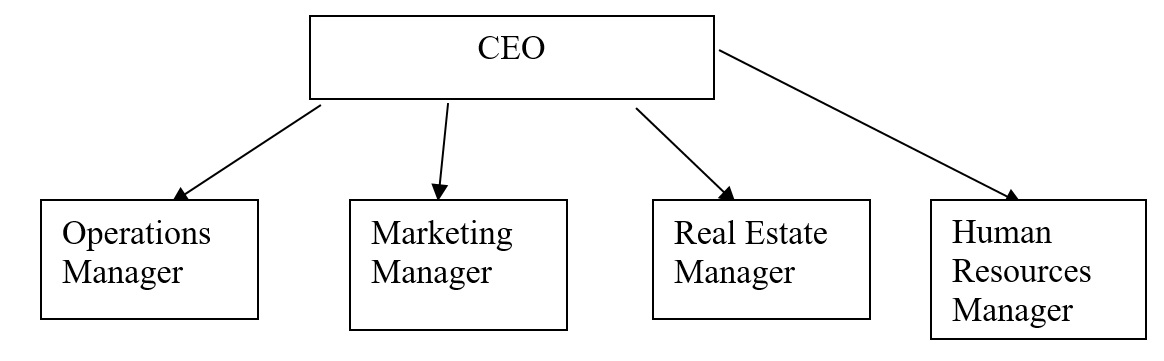

The key people who make the business run include the operations manager, purchasing manager, marketing manager, accountant, and quality control (see Figure 1 for the structure of the CEO). In this business, there are two people who advise and support the company in a big way. These include the lawyer and the accountant. In the new business, the management and employees have avenues for personal development. It should be noted that each branch of business has its own manager, namely marketing, personnel management, real estate valuation, and quality control.

Ownership Structure

The main stakeholders in a business are investors, customers, and employees. The general structure is a corporation, where specialists are located in different states within the country, as well as in other states. The given structure has several specific advantages. First, departments in different areas acquire a certain level of independence, allowing them to make decisions while cooperating with new partners. It is vital for the further brand’s evolution and for making new deals focused on long-term relations and cooperation.

In such a way, although such units are managed from the headquarters, each division has adjustable autonomy, which allows for increasing the potential number of transactions in a certain period of time. At the same time, the given structure requires an effective and aligned management system supported by practical tools to delegate and distribute tasks. For this reason, the company devotes much attention to aligning the cooperation between departments located in various areas and data transfer to improve decision-making and planning.

Social Responsibility

It is worth noting that the organization follows environmental standards and is responsible to society. Primarily, each employee is instructed and familiarized with safety precautions during work. In addition, the company studies and selects those objects that cause minimal harm to the environment and are located in unpolluted areas. The company strives to offer only those properties that meet environmental and technical standards.

The firm also adheres to sustainability ideas requiring minimizing harm done to the environment of individuals affected by the work of various units. Under these conditions, it offers specific programs to compensate for potential risks linked to working in such environments. Moreover, it sponsors incentives aimed at addressing nagging social issues and ensuring certain progress is achieved. It helps to improve the brand’s image and the company’s reputation as social responsibility is an essential factor in attracting new clients and helping to build trustful relations.

Internal Analysis

Each section of the firm has some relative strengths that make the entire business competitive. For example, every area, such as marketing and procurement, places the customer at the top of the priority list. Therefore, all departments value customer attraction and retention because they understand that clients happen to be the backbone of the business (Christensen et al., 2018). In addition, all departments understand the need for benchmarking against our competitors. Some of the core competencies doing better than other firms include innovation, quality control, customer services, and standardization. Strong aspects might include work ethic, knowledge and work, financial position, productivity, resources, and lifestyle. For example, the company will ensure that it always has a stable financial position to undertake its business objectives for the future.

Products and/or Services

The company’s products are divided into two groups, services and goods. The first category includes the search for real estate, its evaluation and comparative analysis, and the study according to the criteria and wishes of the client. The provision of unique services requires specific training and a correct understanding of the current clients’ needs and requirements. At the same time, it is a valuable product ensuring a high level of client’s interest and their readiness to continue cooperating with the firm.

The second group comprises ready-made offices, apartments, and buildings, which can be purchased on the company’s website. The uniqueness of the corporation’s products lies in the fact that they are selected individually for each client. It significantly increases their value and contributes to higher satisfaction levels among the customers. Fulfilling its major needs, the company manages to increase their loyalty and the desire to use its services again. In such a way, the existing products and services help the brand to evolve and attract new clients, which is critical for attaining long-term and short-term goals.

Market Assessment

Examining the General Market

The real estate market is a system of legal and economic relations based on the action of monetary and commodity circulation of objects. Real estate is both an investment object and a source of budget increase (Ullah & Al-Turjman, 2021). Real estate transactions have an investment nature, since they are carried out with the aim of withdrawing income. It should be noted that the return on investment in real estate is greater than on the allocation of funds on credit. Therefore, in foreign countries, the purchase of residential properties is financed by borrowed funds.

The return on investment in real estate consists of the following elements:

- Increase in the value of the real estate on the market over time;

- Current income (rent, rental payments);

- Reinvestment of income in the current moment.

It should be noted the presence of features of investment in real estate:

- Long-term nature of investments;

- Long time period for the turnover of invested funds;

- Low liquidity;

- The need for significant capital to operate in the market;

- The need for state registration of the purchase and sale of an object;

- The need for real estate management, the presence of costs for maintaining facilities;

- High return on investment.

There are some relevant customer needs that the market is currently not fulfilling. These needs include price, convenience, reliability, efficiency, information, transparency, and control. In this case, this new business aims to fulfill a considerable proportion of the customer needs. For example, it will be the company’s duty to ensure that the customer has the correct information concerning the products and services at all times. Each market segment has a lot of potential to grow in the new business structure (Ullah & Al-Turjman, 2021). Having a selected component (market niche) will ensure the business outperforms its competitors in the industry. Moreover, diversification of offerings will contribute to the increase in the demographics and emergence of new types of clients. It will promote the establishment of better conditions for the firm’s growth and help it become more powerful. The segment of clients with specific needs will grow, introducing new opportunities for the company to evolve. The firm faces various opportunities and threats that positively or negatively affect the business.

Some of the opportunities include increased global demand because real estate is one of the most sought properties in the world. In addition, another opportunity is that real estate has a high probability of attracting new businesses and investors. Therefore, it is a sector with considerable growth and development potential (Christensen et al., 2018). Some of the threats the firm faces include economic recession because of various factors, such as the COVID-19 pandemic. Most economies in the world are experiencing recessionary pressures because of the COVID-19 epidemic, which will affect the real estate industry. Another threat is pricing falling due to less demand because of the uncertain real estate market.

Regarding Porter’s Five analysis, the firm will experience extreme rivalry among existing players in the industry, and the competition makes the firm vulnerable. In addition, the real estate firm will experience strong bargaining power because of the many players in the industry (Kritchanchai et al., 2021). As a result, it will tend to drive property prices down. This industry’s competitors are similar firms that sell properties such as houses. New entrants and existing competitors will pose a threat to the business. One of the most prominent trends in the real estate industry that concerns the firm includes the effects of the COVID-19 pandemic.

Due to the effects of COVID, most people have been relocating from large cities to suburbs or rural areas. This has reduced the demand for real estate properties. Some drivers of change in the real estate firm include new competition, science, technology, and digitalization. Some political and legal issues include the government’s regulatory framework, compliance standards, and rent restriction issues. From the point of view of Porter’s Five Forces, the company is in the most profitable and successful position (Ullah & Al-Turjman, 2021). First, competitors do not pressure the company due to the great prestige and quality of its products. In addition, the critical direction is premium real estate, and the competition does not have high rates in this niche.

Customer Analysis

It is important to note that there is only one criterion for identifying a firm’s target audience, namely income. The campaign is aimed at interacting with people whose earnings are above average. However, additional nuances, in the form of having a family, the sphere of work, age and gender, are not observed. Retaining a client is not difficult due to the fact that real estate is a special commodity that has no alternatives.

For this reason, choosing the correct target audience is vital for the company as it helps to promote the further rise of the company. The customer analysis should also focus on the current relations status and other demographic peculiarities such as gender and social class. It would help to increase the effectiveness of the firm and its work and avoid mistakes in planning specific services and providing them to clients. The investigation shows that the loyal audience has the necessary resources and opportunities to cooperate with the brand, which is vital for its further evolution.

Industry Analysis

As noted above, now the business environment is the most favorable for the organization. This is explained by the post-pandemic trends in the real estate sector, namely the increase in demand. The target audience demonstrates several important behaviors vital for the industry and its revitalization. First, clients return to the pre-pandemic level of interest in the real estate sector and want to buy housing. It introduces new opportunities for the companies working sector and creates the basis for their growth.

In such a situation, the profit of the company grows, and the analysis of the entire market is easier. At the same time, the revitalization of the sphere and the increased activity of clients promote growth in the level of rivalry. It means the company should devote more attention to the closest competitors to avoid losing potential clients and decreasing sales. The free funds can be used to sponsor additional promotional activities.

Strategic Alternatives

The company does not use many strategies to achieve its goals; however, the existing ones are the most effective. First, it is necessary to highlight the focus on the client and their needs (Christensen et al., 2018). This allocation of an individual contributes to the development of comfortable cooperation and increases people’s loyalty to the company. In addition, management creates a system of incentives for employees in the form of bonuses, salary increases, and career opportunities.

At the same time, the company has the alternative of making its offerings more attractive compared to those offered by rivals. It can be achieved by analyzing the market and considering making better proposals. It requires the improved work of teams and better collaboration between departments. For this reason, the given strategic alternative is linked to the company’s focus on people’s loyalty and readiness to continue working with the firm. Furthermore, by attaining higher client satisfaction levels, the company can ensure a more stable position in the market, which is one of the best strategies to attain long-and short-term goals.

Strategic Implementation

Production

It is essential to underline that the company does not plan to produce its product. However, it processes and edits existing ones. For example, when it finds buildings that are not in demand but have potential, the company invests in their repair. After that, the property is placed in the database and corporation’s website, which appears as a client’s recommendation. The given scheme helps to generate a stable income and avoid overspending, which is critical regarding the high level of rivalry.

In addition, the company uses GPS technology, which can clearly show products’ location and convenience on a map. This innovative and technological product increases the client’s satisfaction levels and ensures they enjoy a higher level of comfort. In such a way, refusing from traditional production, the company still offers specific and unique products meeting the customers’ needs and providing them with the desired level of diversity.

Resource Needs

Human

As noted above, the basis of the corporation’s activities is human resources. Accordingly, to maximize their performance, specific skills are required. The company’s reliability and quality are guaranteed by the actions of qualified specialists with extensive experience in assessing the technical condition of buildings, as well as a proven methodology with a deep scientific approach.

Financial

The financial resources required for real estate appraisal will be significantly high because such finances are vital in recurrent expenditures such as professional fees, maintenance fees, overhead costs, and marketing costs, among others. The projected finances for the business are estimated to be 500,000 US dollars for a start. This amount will rise gradually to acceptable levels as the business grows.

Physical

The next advantage of the company is the lack of physical needs. The only subtlety is the need for more technical vehicles that will allow demonstrations and travel from one site to another. However, now, cars are coping with demand, but in the future, they will begin to be missed.

Sourcing/Procurement Strategy

The corporation searches for suppliers via the Internet. This saves the cost of moving to other cities and time for negotiations. When purchasing a particular real estate for its subsequent finishing and sale, the organization is guided by several criteria. First of all, specialists analyze the potential of the project and its compliance with the possible requirements of customers.

Second, the reliability of the partner and reputation is analyzed. It is unacceptable to work with real estate involved in illegal schemes or manipulations. For this reason, the company devotes much attention to investigating this aspect and guaranteeing all products meet the highest quality standards. This approach to sourcing promotes the brand’s reputation and helps to avoid possible conflicts with clients, which is critical for the companies working in the sector.

Marketing Strategy

In this case, the most effective marketing strategy is advertising, which will help create awareness of the real estate business. Based on the actions of potential clients in search systems and social networks, the most profitable offers of the firm will appear as recommendations (Ullah & Al-Turjman, 2021). This will allow management to find a different audience and identify items of interest to potential buyers.

The marketing strategy also focuses on diversifying the target audience and attracting new potential clients. This goal is achieved due to advertising, focusing on client’s needs, and considering their feedback. The given approach ensures the ability to attain long- and short-term goals and creates the basis for further evolution and development.

Hedging, forward pricing, and options

In order to reduce possible risks in the company, the most effective tool is forward pricing. This will allow management to get the most profit from trading and interacting with shares and assets for both management and shareholders.

Contracting

To reduce risks, it is necessary to use manufactured contracts that act as an airbag. The fact is that agreements have a legal value, which means that the prescription of the conditions frees the firm from responsibility. When qualitatively drawing up contracts with suppliers, it is necessary to indicate any force majeure and fairly distribute responsibility between the parties.

Insurance

For the analyzed category of goods, it is worth highlighting a separate form of insurance. It allows for securing both customers and the company. This is extremely important since this product is a luxury item, expensive, and, therefore, the risks in case of damage or death are high. In order to protect the company from major losses, it is necessary to implement real estate insurance.

Performance Standards

Some performance standards to be used include outcomes, quality, efficiency, output, and input. In this case, the outcome will determine how a core function, service, or activity has impacted its targeted audience. On the other hand, quality will ensure meeting customer expectations (Ullah & Al-Turjman, 2021). Such expectations may come in various ways, such as courtesy, regulatory requirements, accuracy, and timeliness. Adhering to the performance standards, the company will avoid clients’ claims and preserve the high satisfaction levels among the target audience.

The acceptable performance standards will include competency and scope of work. For example, competency will ensure the necessary skills, experience, and knowledge to complete the real estate assignment. The ratio study method will be the most appropriate way to appraisal performance. The employees will be informed about the existing performance standards and encouraged to function within the outlined field. It will guarantee the ability to continue the evolution and remain one of the leaders in the selected sphere.

Financial Plan

Financial Projections

Outside investors will not be used for equity capital for a start. However, these investors could be used later when the business becomes fully fledged. In this case, the real estate company will encourage the management team and other leaders to buy shares in the company as part of financing the projects to be undertaken by the new venture. At this point, outside investors could further increase the risks of the new business, which could reduce any personal guarantees.

Some measures that will manage the new business’s financial risks include limiting liability, buying insurance, and controlling growth. For example, by limiting liability, the business owner should not be held liable for the debts or liabilities of the company (Christensen et al., 2018). It is essential to monitor such aspects as net profit margin, gross profit margin, current ratio, and working capital. In the case of monitoring business performance, benchmarking will be the best means through which feedback regarding the performance of the business will be vital.

Management will set goals for the year and five years to unleash the potential for investors and get them to make a favorable decision on financing. Based on this, profit should exponentially increase by 128% in a year and five years. In monitoring the effectiveness of financial activities, it is necessary to introduce a highly qualified accounting department.

Contingency Plan

In case of non-fulfillment of the plan or the occurrence of a dangerous force majeure, the company has capital. Its function is to provide reserves in the event of a drop in corporate income. The given reserve can help to reconsider the existing strategy and focus on new projects topical at the moment. Additionally, the capital can be used to continue working with loyal clients and support the employees to avoid growing dissatisfaction and preserve high motivation levels.

In addition, the corporation has long-term contracts with other banks with high loyalty (Christensen et al., 2018). It will guarantee that the company will preserve its main sources of financing and continue working in the market. Additionally, stable relations and contracts with solid banks ensure the avoidance of critical failure and the ability to continue working regarding the current market conditions. Therefore, the organization can remain on the market if unforeseen circumstances.

References

Christensen, P. H., Robinson, S. J., & Simons, R. A. (2018). The influence of energy considerations on decision making by institutional real estate owners in the U.S. Renewable and Sustainable Energy Reviews, 94, 275–284.

Kritchanchai, D., Doung, P., Khem, C., & Srisakunwan, S. (2021). Innovative Practice and supply chain resilience during COVID-19 pandemic: A case study in Thailand. The Impact of COVID-19 on Supply Chain Management.

Ullah, F., & Al-Turjman, F. (2021). A conceptual framework for Blockchain Smart Contract Adoption to manage real estate deals in Smart Cities. Neural Computing and Applications.