Outline

The economic stimulus plan as introduced by President Obama is expected to have a budget provision of up to one trillion dollars. It will primarily be directed towards the creation of more jobs and for the installation of infrastructure, which are the two essential requisites for rapid economic development. Some theorists have disapproved of the plans but there will always be people who will observe shortcomings however constructive a plan may be, which though is an inherent characteristic of a democratic country where the government is always answerable to the criticism that it will invariably face regarding its plans and actions. Obama’s economic stimulus plan envisages spending in areas that will ensure positive effects in the long term. If implemented correctly the stimulus plan will have a positive impact in making the economy bounce back to its old days of economic supremacy.

The body

The main objective of President Obama’s stimulus plan for 2009 is to create 2.5 million jobs by the year 2011. Obama was categorical in commenting that the two-year plan will be implemented throughout the nation in making a jump start for the creation of jobs. He also said that people will be put back to work, bridges and roads will be rebuilt, schools will be modernized and solar panels and wind farms will be installed in giving the required boost to infrastructure. Tax cuts will be an integral and essential part of the reforms but will not be in the form of rebates. Obama and his advisors believe that tax cuts, and not rebates, will have an immediate impact on the economy. Obama’s main emphasis will be to provide tax relief to the middle class but he will refrain from revoking the tax exemptions started by President Bush that tended to favor the wealthy; those that made more than $250,000 a year.

Other proposals include the suspension of income tax and penalties concerning premature withdrawal from IRA and 401(k) accounts. A temporary credit of tax amounting to $3000 will be offered to organizations for every full-time employee that they hire within the country. Unemployment benefits will be extended by a thirteen weeks period without any income tax liability on them. Foreclosures will require a 90 days moratorium for homeowners. Obama’s Make Work Pay tax credit will benefit individuals and married couples by $500 and $1000 respectively after the implementation of the Social Security payroll tax exemption. Low-income workers will stand to benefit from the expansion of the Earned Income Tax Credit.

Although the stimulus package can prove to be very expensive for the country since it could exceed the $700 billion fund set aside for the TARP fund, it will become a reality because of the booster already given from the fund to US banks and American International Group (AIG). As per figures provided by the government, of the one trillion dollars that have been targeted to be spent on the stimulus plan, $540 billion will be spent on infrastructure and the remaining $460 billion will be directed for tax exemptions and cuts. There will also be a basis to reduce rates of corporate and capital gains tax since companies require support by way of the tax cuts to hire more people. By reducing the capital gains tax, the investment will be encouraged which will further boost economic development.

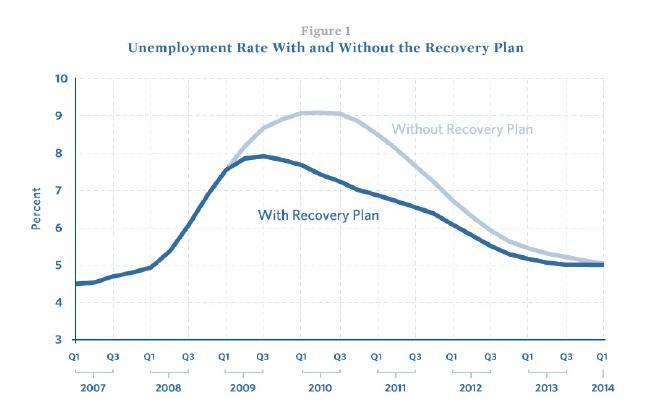

The stimulus plan will facilitate the recovery of the economy at a faster rate by helping in the worker support in public sector companies, teaching, and law enforcement. An economic analysis of the Obama Plan has revealed the following forecast:

It is quite evident that without the fiscal stimulus plan the rate of unemployment across the country would have been much higher during the years 2009 to 2013. In lowering unemployment, the fiscal stimulus will further foster economic growth at a faster rate thus reducing the adversities for the economy.

Recessionary times are known to end on their own if left to themselves, but if no corrective measures are taken on an urgent basis, America will become a bit looser in terms of economic growth and falling income levels. The stimulus plan will not only stimulate the economy but the government spending will carry the country forward and away from the recession. Several economists are of the view that tax cuts are a sure and quick means to create more jobs and to cause the economy to bounce back and get better.

Works Cited

Jason Simpkins, Obama Unveils Economic Team, Plans 2009 Stimulus Package, Web.

Susan Jones, ‘Obama-Limbaugh Economic Stimulus Plan of 2009’ Now Get A Closer Look, Web.