Introduction

In the dynamic organizational operational environment, organizations face various unhealthy situations that influence their ability to achieve strategic plans, goals, and objectives. To deal with such situations, it becomes necessary to embrace the concept of risk management. In this paper, the author is a consultant who has been engaged by Pepsi Company to assist in the development and implementation of a risk management strategy.

The aim entails reducing the company’s risk of any criminal liability and reputational damage that may arise from fraud or corruption in its procurement activities and relations with suppliers. In this paper, I will assume the position of a consultant who has been engaged by Pepsi Company to help in the development and execution of a risk management strategy. The goal of the strategy is to reduce the company’s risk of criminal liabilities and threats that result from fraud, corruption, and other unsuitable activities that may arise in the company’s procurement activities and relations with suppliers.

Pepsi Company Background

Pepsi Company is a Philippines-based soft drink bottling company that specializes in canned products. The company produces, sells, and distributes soft drinks that belong to the non-carbonated (NCB) and carbonated soft drinks (CBDs) category (PepsiCo Inc. 2016). The categories comprise the main two business segments of the company. The products are distributed to wholesale, retail outlets, bars, and restaurants. With each segment of the products being manufactured by the company, several product brands exist.

In the CBDs segment, brands such as 7Up, Mug, Mountain Dew, Pepsi Cola, and Merida are available. Pepsi Lipton, Gatorade, Propel Fitness Water, Twister, and sting energy drinks lie in the NCBs segment. When producing these products, the company must source various materials from different suppliers. Consequently, PepsiCo endeavors to reduce risks, especially in its procurement process. Indeed, this process underlines why the company has consulted me to propose mitigating risks in the purchasing and/or procurement department.

Conceptual/Theoretical Framework

To guarantee effective operations, Pepsi Company must embrace risk management, which can be regarded as a strategy where raw materials are availed just whenever they are required in a manner that can sustain the increased number of products that need to be availed in the market. Tricker (2012) defines risk management as the method of classifying, investigating, approval, and/or alleviation of insecurity or misconduct in the procurement unit of any organization.

According to Tricker (2012), interactions with suppliers through procurement processes involve developing a chain of supplies. The chain requires effective management to minimize risks of fraud through activities such as overpricing or the supply of products that are never delivered to an organization. Supplies and procurement fraud constitutes one of the most important ways in which Pepsi Company’s investors can be deprived of their right to leap the benefits of their investment. This situation reveals why regulations have already been incorporated in the Philippines and across the globe to curtail internal corporate misconduct and fraud.

Fraud is an extensive idea that commonly denotes a deliberate deed that is committed to attaining an unmerited or illegitimate gain (Cox 2009). It is important to note that no particular methodology of mitigating fraud risks fits ardently in all organizations. Thus, it is necessary to narrow down to a case in context: Pepsi Company. To determine the extent of this risk, the company has to embrace risk assessment.

According to Tricker (2012), risk assessment is a technique where one discovers a danger, fraud in this case, and seeks to estimate the risk that such a danger poses with the view of establishing the most apposite methods of eradicating or managing the vulnerability. Acts of misconduct in the context of organizational susceptibility to risks involve the violation of set-out regulations, market anticipations, the ethical and just business conducts, and the established laws and internal policies of an organization.

The discussion of procurement and supplies risks of fraud does not imply that Pepsi Company experiences or employs people who participate in fraudulent activities. The emphasis is that fraud is an undue risk that may occur within the organization. Therefore, some mechanisms for mitigating fraud are necessary if Pepsi is to become fraud risk resilient.

Organizations adopt various procedures in the quest to guarantee an adequate response to risks. Borodzicz (2006, p.115) argues that a means of responding to risks is critical since no organization is immune to them. However, before deriving such a means, it is necessary to quantify the organization’s capacity to tolerate risks. This goal may be accomplished by determining the company’s position on either side (tolerance and appetite) of the neutral point of the risk scale.

According to Borodzicz (2006, p.128), ‘The objective value of an organization’s faith in a positive outcome denotes its risk appetite’. Tolerance is the degree or the extent to which a particular organization attempts to transfer its risk volatilities to external parties, for instance, the insurers. Organizations approach volatile situations that may result in their exposure to risks from the dimension that no negative impact may arise.

Depending on the degree of the volatility, the volatility of the situation may produce various impacts (positive or negative) on an organization. Through the incorporation of innovative strategies, Pepsi anticipates volatility in some unpredictable situations such as the likelihood of professional malpractices, for instance, engagement in fraudulent activities, particularly with the overwhelming embracement of integrity as part of its organizational culture and values. For Pepsi to ensure that all its stakeholders are subtly protected from imminent risks, the organization recognizes the need for preventing all volatile situations that are likely to result in negative effects on the company. Such effects include legal liability and loss of the organization’s financial resources through corruption.

The purchases and procurement department of any organization needs to define its operational framework as an important aspect of enterprise risk management. Such a definition should incorporate risk appetites (tolerable risk levels), types of risks encountered, the necessary risk measurement tools, and the mechanisms for calculating their impacts (Alexander & Sheedy 2005). Through governance strategies, an organization can ensure that the accountability processes established within the purchases department are followed. This procedure helps in tracking risks and/or the establishment of their mitigation plans. The appropriate plan depends on the type of risks in the purchases department.

In the event of fraud, the main subject that feels the impact of a risk is the shareholder who is also the owner of an organization. Several events may lead to the surfacing of the risk of fraud within Pepsi Company’s purchases and procurement department. One such event is the occurrence of a fraudulent procurement financial reporting system. The fraud may entail procured supplies statement, liability understatement, and the recognition of revenues in an improper way (KMPG 2006).

The purchases department can also face events such as supplies misappropriation, including external theft, embezzlement, counterfeiting, payroll fraud, and loyalty fraud. The third event involves the gaining of assets and/or revenues illegally.

The event involves suppliers overbilling, bogus revenue flow between the organization and the suppliers, and deceptive procurement behaviors. An event of illegal expense avoidance through tax fraud and falsified information provided to law regulators and enforcers also exposes the organization to fraud risks. Fraud risks are likely to develop deeper roots when the fraud monitoring system within the Pepsi Company is not checked regularly. Such ignorance creates chances or loopholes through which fraudulent events occur.

All organizations experience some risks of fraud and/or misconduct. Pepsi Company’s procurement department is not immune to this risk. Thus, the company needs to conduct a fraud risk assessment to help the ‘management to understand the risks that are unique to its business, identify gaps or weakness in control to mitigate those risks, and/or develop a practical plan for targeting the right resources and controls to reduce those risks’ (KMPG 2006, p.12).

An organization remains competitive by retaining its shareholder confidence and security. However, this case is improbable without the appropriate fraud risk mitigation strategies because incidents of fraud create a phenomenon that is favorable for loss of the Pepsi owners and other stakeholders’ level of confidence in the performance of the organization in the short and long term.

PepsiCo risk management strategy applies comprehensively to all departments. No specific codes cover the unique needs of each department. The company also tends to focus on specific risks after it has occurred. The case in which the company faced criticism in 2010 concerning its use of water in the Indian plant’s evidence of this assertion. The company deployed a reactive approach to risk management by developing strategies for water recycling.

However, the company has elaborate corporate governance frameworks that seek to ensure that all employees remain committed to the core values, vision, and aims of the company. While it is a crime to participate in fraudulent activities at the company, it is necessary to have a clear framework for preventing and responding to such risks. This plan can incredibly help in addressing fraud or corruption risks in the future, especially in the purchases and procurement department.

Considering that challenges of involvement of employees in the purchases and procurement department in fraud or corruption cannot be ruled out now or in the future, PepsiCo must adopt new approaches to the management of the risk of fraud or corruption. One of the possible strategies involves positioning a risk management team in the department. Such a team will help to track the daily operations of the employees, especially when dealing with suppliers.

This strategy may go far in helping to identify risks before they occur. The fraud detection personnel can be in charge of auditing to ensure any contract for the supply of materials is consistent with the current market rates. This plan can reduce incidences of inflation in the future in case suppliers and personnel of the company participate in fraudulent activities that seek to embezzle PepsiCo’s financial resources.

Procurement Department

Given the wide range of products that the Pepsi Company produces, it has to determine the most appropriate product mix in an attempt to attain optimal profitability. When a firm achieves the best possible profitability, it implies that the risks to investors (shareholders) are optimally mitigated. Hence, one of the plausible risks that Pepsi Company endeavors to mitigate involve shareholder protection against undue losses from the investment.

To this extent, Pepsi’s mission is to ‘seek to produce financial rewards to investors as it provides opportunities for growth and enrichment to its employees, its business partners, and the communities in which it operates’ (PepsiCo Inc. 2016, Para. 1).

Risk managers within Pepsi Company have been determined to come up with strategies for mobilizing all resources within the organization to ensure that the business improves its profitability continuously. Consequently, they have ‘discovered that respecting employees can have a positive impact on workers and disability costs’ (Myshko 2009, p.122). The introduction of a new risk management strategy for Pepsi Company involves a process of organizational change. Successful change requires the participation of different organizational stakeholders in the change process (APICS 2014).

This participation is risky, especially if one of the stakeholders has hidden plans of engaging in illicit conduct at the expense of the company. However, Oxtoby, McGuiness, and Morgan (2008) confirm how this strategy is important since it involves all parties that are also affected by the change. Hence, the change affects all parties that are involved in the day-to-day running of Pepsi Company’s procurement and purchasing departments’ affairs. The suppliers of the company need also to change or be prepared to report any conspiracy that seeks to increase the cost of supplies artificially. This case presents a major challenge. It requires the possession of strong value and ethics to refrain from engaging in activities that may have direct personal financial gains.

Establishing a new directive or strategy within an organization faces the challenge of non-compliance due to the perceived fears about the purposes of the strategy. This outcome is especially the case where employees may consider the new strategy for dealing with fraud risks as threats to their status quo.

For example, having an audit team specifically positioned in the procurement and supplies department may develop perceptions of too many follow-ups on how employees at the department execute their professional responsibilities. It may also make some employees perceive the organization as lacking trust in its capabilities and professionalism. Consequently, the new strategy may face high criticism accompanied by rejection by some employees from the purchases and supplies department who have been accustomed to reporting to only one audit committee.

The new strategy requires the hiring of additional staff members who will perform some tasks that were previously performed by the overall audit committee. Although the focus is to enable the purchases department to scrutinize all transactions or dealings between the employees of the department and suppliers, issues of duplication of work may arise. This case has two main challenges. Audit teams, which have been auditing the entire organization, may consider the new strategy as threatening their job security and/or minimizing the scope of work. Secondly, it increases the cost of running the Pepsi Company.

Cost is an important aspect of any profit-making organization. High costs translate into reduced profitability. However, the new strategy is important in the event of the occurrence of the risk of fraud or corruption. More money may be lost through the risks.

Recommendations and Suggestions

Cases of fraud within Pepsi Company’s purchases department have not yet been reported on a mega scale. However, the risk management team of the company needs to prevent such occurrences in the future. Currently, this noble duty is the responsibility of the audit committee. Indeed, the company has established an audit committee. With the help of the board of directors, the audit committee takes the responsibility of ensuring that acts of misconduct and fraud are proactively mitigated through the deployment of appropriate fraud monitoring and control strategies. This strategy leads to the establishment of ‘institutional support at the highest level for ethical and responsible business practices’ (KMPG 2006, p.9). Consequently, Pepsi Company has established an audit committee that has the following responsibilities among other duties:-

- Reviews and discusses issues that come up during misconduct and fraud risk assessment.

- Discusses and reviews results obtained during the assessment of the company’s quality of various antifraud programs coupled with their control with both external and internal auditors.

- Establishes procedures appropriate for treatment and receipt of queries that emanate from accounting audit.

The above responsibilities encompass attempts to put in place a mechanism for fostering accountability. The company needs to establish audit committees that focus principally on the purchases and procurement department. The top management should coordinate the work of the committee. This situation makes it possible to mitigate fraud. Indeed, ‘a robust fraud strategy is the one that is sponsored at the highest level within a firm and embedded within the organizational culture since fraud threats and fraudsters consistently develop new techniques to exploit the easiest target’ (Robison 2010, p.13). The senior fraud risk management and oversight committee should ensure that acts of fraud and misconduct are mitigated through:

- Coordination of the Pepsi procurement department efforts of risk assessment.

- Enactment of the necessary standards of accepting the preferred business practices in the procurement and purchases department.

- Designing and overseeing the mechanisms for antifraud program implementation and control within the purchases and procurement office.

- Reporting to the company’s overall audit committee and/or the board on the proceeds of the company’s activities of risk assessment.

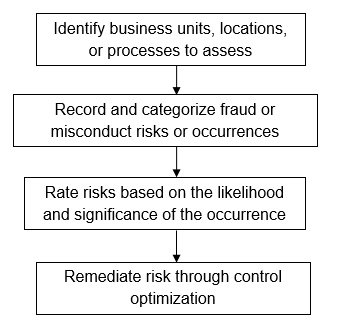

The following procedure is hereby recommended for use at Pepsi Company’s purchases and procurement department to help it in assessing the risk of fraud.

Conclusion

All activities within an organization present some degree of risk. Risks are attributed to the existence of certain events, which deliver value to an organization. Certain factors must exist for volatile situations (events) to take place. Organizations must endure and mitigate risks in an attempt to meet the needs of stakeholders. The paper has discussed fraud or corruption through the procurement and purchases department of Pepsi Company as a volatile situation that is presenting a risk.

The risk may emanate from employees in the department’s participation in conspiracies to embezzle funds from the company by acts that include inflation of supplies’ contract prices. Instead of relying on the overall audit committee of the entire organization, Pepsi Company should establish an audit committee, which can track the value of the procured supplies when compared to the prevailing market prices.

Mitigating fraud risk in the procurement department is significant to ensure that the organization manages its operational costs effectively. The more expensive the inputs, the higher the company would sell its final products. This plan may result in a lower competitive advantage when compared to major competitors such as Coca-Cola.

References

Alexander, C & Sheedy, E 2005, The Professional Risk Managers’ Handbook: A Comprehensive Guide to Current Theory and Best Practices PRMIA Publications, New Jersey, NJ.

APICS 2014, Procurement Contract Risk Management: An extensive and revealing study of procurement contract management practices, risks and controls, Routledge, London.

Borodzicz, E 2005, Risk, Crisis and Security Management, Wiley, New York, NY.

Cox, A 2009, ‘Managing with Power: Strategies for Improving Value Appropriation from Supply Relationships’, Journal of Supply Chain Management, vol.37, no. 2, pp. 42-47.

KMPG 2006, ‘Developing a strategy for prevention, detection and response to fraud’, Fraud risk management, vol.1, no. 2, pp. 1-32.

Myshko, D 2009, ‘The Pepsi Challenge: Succeeding with Employee Advocacy’, Journal of risk management, vol. 2, no. 3, pp. 121-125.

Oxtoby, B, McGuiness, T & Morgan, R 2008, ‘Developing Organizational Change Capability’, European Management Journal, vol. 20, no. 3, pp. 310-320.

PepsiCo Inc. 2016, Our Mission and Vision. Web.

Robison, R 2010, Organizational Fraud in the Wake of Mega Scandals, Financial Services Authority, London.

Tricker, B 2012, Corporate Governance: Principles, Policies, and Practices, Oxford University Press, Oxford.