Pricing strategy

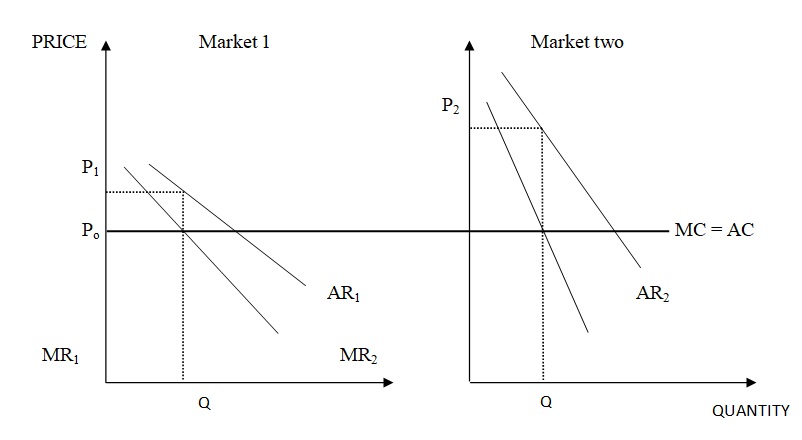

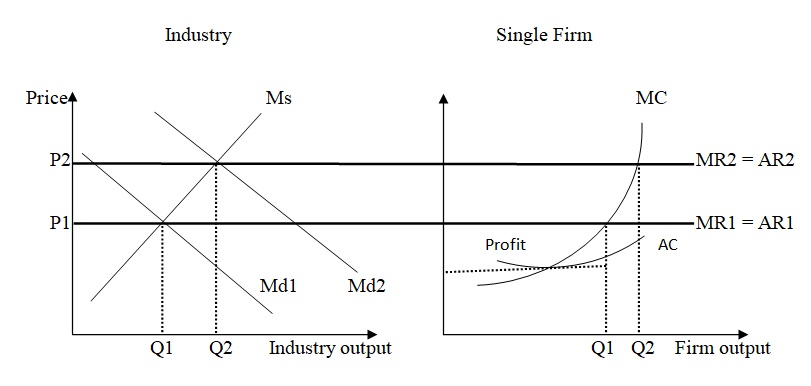

Price discrimination is a practice where different customers are charged different prices on goods and services that are identical. While single pricing is charging the same prices to all customers for all the goods and services being sold, in this case, customers are sure of the price and their expectations. Price discrimination, in this case, will be possible since there exists a difference in the price elasticity of demand. Students are known to be sensitive in price; elastic demand is high while visitors have a lower elastic demand schedule. The strategy to use is the one for time separation where I will have students buying during the peak hours characterized by early and late shopping, while visitors with elastic demand will be buying during off-peak. Assume they are two markets (Tucker, 2008, p. 46).

MR1 represent demand curve for the student during peak while MR2 is that one of the visitors during the off-peak. The assumption underlying the graph is that the marginal cost of providing the goods and services to both customers is fixed. The price charged to both will be maximizing profit for the shop, but revenue will be received in market two, where consumers are charged highly.

Price ceiling

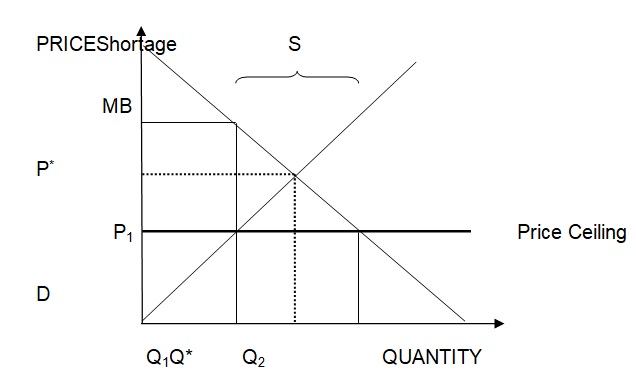

Price ceiling is when the government sets a maximum price of goods and services in the market (Carbaugh, 2010, p.66). It is normally below the market equilibrium price.

Where: Q* and P* are equilibrium quantity and price respectively. Q1and Q2 are quantity producers are willing to supply to the market, and quantity consumers are willing to purchase, respectively.

In a free market where there are no regulations by the government, equilibrium in the market is attained at a place where quantity supplied by the cable TV industry is equal to quantity demanded by consumers. Although the price might be higher for consumers, they are willing to purchase, and the market clears. When the government introduces price ceiling, the price of the goods and services is now below equilibrium at point P1. At point, the cable TV industry is willing to supply fewer quantities, that is Q* – Q1 while consumer is willing to purchase more TV, that is Q2 – Q*quantities. The market will experience a shortage in the quantity of cable TV supplied due to the increased demand. Since the marginal benefit is greater than the marginal is cost, there is inefficiency in the market that is called deadweight loss (Carbaugh, 2010, p.436).

In the introduction of a new programming will lead to increased production of TV cables in order to meet the demand. This will off set the increased demand Q2 and reduce it to equilibrium where both the consumers and producers are satisfied. The prices and quantities may eventually return to the previous equilibrium since the forces of demand and supply are in action without influence of the government.

Perfectly Competitive Market

Perfectly competitive market is a market where: there are many suppliers and buyers, free entry and exit, information is free and available, factors of production are equal and same, externalities are less and goods and services are homogeneous (Carbaugh, 2010, p.99). Due to large numbers of the firm, the industry is at equilibrium in both the prices and quantity produced. All the firms make profit depending on their short-term cost.

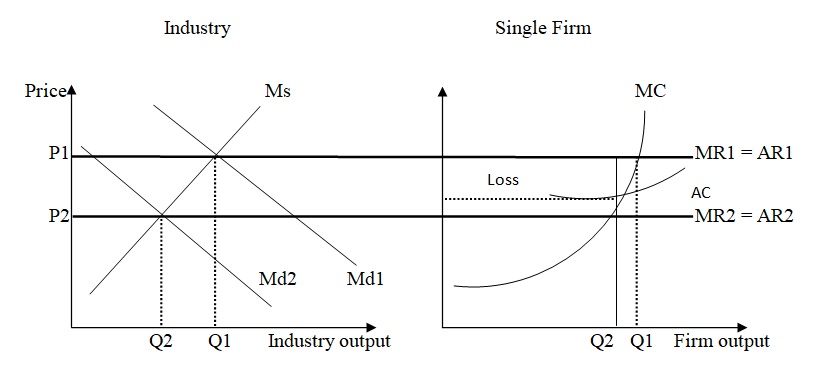

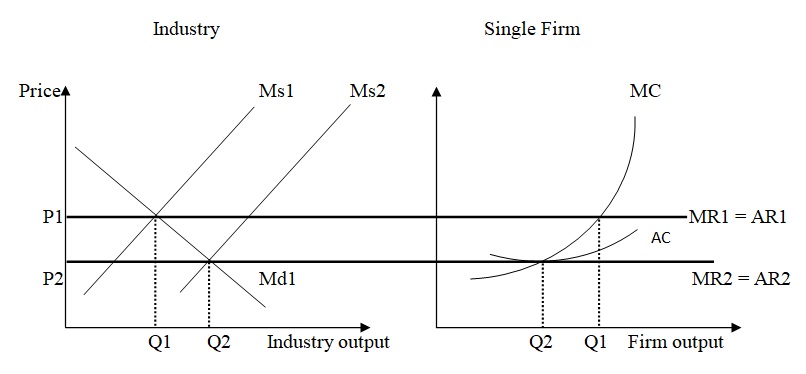

A fall in demand of the product leads to a fall in industrial output as well as individuals firm hence a decrease in the prices of goods and services (O’Sullivan, Sheffrin & Perez, 2010, p. 89). Individual’s firm experiences losses because marginal revenue is less that average cost. The assumption is that supply curve does not change.

Effect when demand for the product falls is shown in the diagrams below: short run

These will hold in the short run and due to continuous loss, some firms will exit the industry in the end. Holding demand constant, the supply curve will move to the right as shown below:

Although the quantities of a single firm have decreased, the output of the industry has increased while price decreases. In the long run, the firms will make normal profit since marginal revenue is equal to average revenue. Later due to exit, remaining firms will make super normal profit.

Effect when demand for the product increases in short run

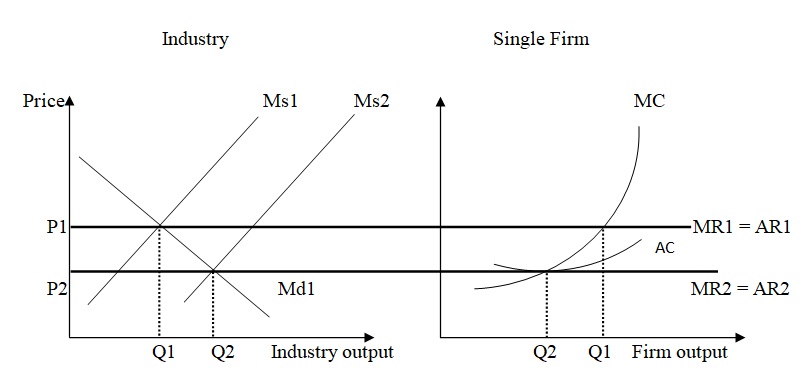

In the short run, an increase in demand will lead to an increase in price to P2 from P1 while the quantity will change from Q1 to Q2. The assumption is that supply curve is held constant. Individual firm will attain a profit in the short run. The profits will lead to new entrants into the market. This will have an effect in the supply curve to shift to the right. Its effect will be:

The increase in supply will lead to a reduction in price from P1 to P2, which reduce individual firm output from Q1 to Q2. The effect of this is to lower the profit hence equilibrium price and quantity is attained. At this point, there are no incentives for new entrants and exits from the industry (Carbaugh, 2010, p.104; Tucker, 2008, p. 128-44).).

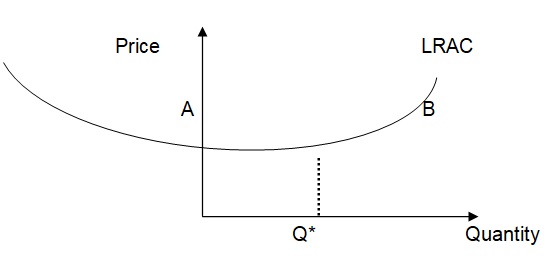

Long run average cost curves

The long run average curve shows the cost in the long run of each output unit. It shows the returns to scale including increasing, decreasing and constant. Point A represents increasing returns to scale, while B shows decreasing returns to scale. However, the lowest point on the curve represents equilibrium, which is the constant returns to scale. Most long run average cost curves are steeper on the downward side because at this point the firm is increasing its production with a declining average cost. When the firm reaches its maximum production, the slope is almost zero depicting a constant return. Point B is not steep compared to A because the there is a diminishing returns since average cost is on increase (O’Sullivan, Sheffrin & Perez, 2010, p. 123).

Price discrimination

When one purchases a new model of a digital camera, he/she pays more due to price discrimination. New model comes with advanced technology, information problems and personalization of it. At the beginning, the firm will be acting like a monopoly where it will be charging high prices due to the new inventions; thus, it will be making super normal profit by practicing the first degree of discrimination (Carbaugh, 2010, p.101). This will enhance new entrants into the market. Similar model will be produced cheaply by other firms and will be sold cheaply since there is already an established market and information dispersion is easier. Hence, there discrimination in price in the time schedules of purchasing.

Mergers

The reasons for mergers include:

There will be a better understanding of merging. It assists firm in understanding the advantages and choosing the right mergers depending on the role they play in the market. It will be possible to evaluate the effect of mergers that are harmful to the firm and those that are beneficial (Blaisdell, 2008, p. 180). Thus, it will be possible to make the right decisions with proposed merging.

It will enhance market power and share by the proposed mergers. With right merging, firms will be able to increase market share especially if proposed mergers where main competitors. The merger market power is high since they use the combination of work force, process and leadership with improved quality. This is so especially, where there is product variety, innovations due to the advanced, and a combination of technology.

There will be enhanced efficiencies especially internally one. This is due to combined competition and increased incentives because of lowed prices, differentiation of products and prices, high quality and improved services. The conditions for proposed mergers will be determined in the efficiency level of the product, process, distribution and the market share (Blaisdell, 2008, p. 300).

However, proposed mergers can lead to price discrimination especially if it is from two firms with a higher proportion of the market share. They might decide to sell their products differently depending on the geographical region. On top of that, it might lead to assets failing and its existence since they are not guaranteed of market share. They will tend to concentrate in their best selling products which will eventually see the others existing.

References

Blaisdell, T. (2008). The Federal Trade Commission: An Experiment in the Control of Business. New Jersey, NJ: Lawbook Exchange Ltd.

Carbaugh, R. (2010). Contemporary Economics: An Applications Approach. 6 Ed. Armonk, NY: M.E. Sharpe.

O’Sullivan, A., Sheffrin, S. & Perez, S. (2010). Survey of economics: principles, Applications, and tools. 4 Ed. London, UK: Pearson.

Tucker, I. (2008). Survey of Economics. Florence, KY: Cengage Learning.