The proposed business plan presents an entry strategy into the Belgian market and an effective marketing plan for penetration and sustainable business for the auto insurance policy product. This means that the company should select an effective internationalization strategy for business survival and sustainability in the short and long term. The plan involves a comprehensive business environment analysis, financial estimation, and a focused marketing plan. The report concludes by presenting recommendations for effective business practices.

Local Alliance Partner and an Entry Strategy

Belgium as a Product Market and Site for Value-Chain Activities

Belgium has a relatively strong score in the Hofstede insights in terms of indulgence, uncertainty avoidance, individualism, and power distance. The Hofstede score ranges between 54 and 94, which is an indication that the country has a high GDP, stable living standards, and an effective economy (Arnold, 2004). Belgium has a strong legal system and an organized business licensing procedure. There are stable labor-related laws that protect business and laborers in equal measure. However, these laws are not as strict as is the case in the US where Progressive Corporation has excelled for more than three decades, and thus, the company is positioned to operate smoothly without any major hindrances. The ethical and cultural standards in Belgium encourage good living, courtesy, and honesty in business practices and general interactions. This means that the country has a population of strict citizens who would not tolerate business practices that are perceived to be deceitful or immoral. Cultural and ethical standards are risks to Progressive Corporation, especially in an event of public lawsuits. Over the years, the company has experienced a public backlash in the US related to claim handling. In order to manage this risk, Progressive Corporation should consider being transparent and engaging a successful business partner of Belgian origin to avoid the challenge of facing the backlash associated with viral legal suits.

The external business environment in Belgium is attractive for Progressive Corporation. While the digitization of services may reduce the need for a complete relocation, some activities in the value chain have to be moved to the country. The claims department, payments processing, and some customer service workers need to be relocated to adhere to the standards of the new placement. Some parts of the sales management can also be moved to enhance the understanding of the local market. In order to gain a competitive advantage in Belgium, the company should consider using its strong business position and the attractive auto insurance policy product to quickly penetrate the market. Moreover, the company should make minor adjustments to the current international and local laws to fit into the Belgian context, especially on taxation (Ghemawat, 2001). The smooth transition into Belgium could be facilitated by a strategic alliance with an insurance company that does not offer the same product.

Profiling the Potential Partners

Progressive Corporation could consider alliances with strategic insurance companies already in the Belgian market such as Allianz Belgium, Almarisk, and Belfus. The Allianz Belgium is a company that concentrates on the asset management and general insurance. The company has been in the market for more than 25 years and is currently one of the leading underwriters. The company has operations spread across Belgium with a strong financial standing and an estimated market share of 4% (Barbara, Cortis, Perotti, Sammut, & Vella, 2017). The other company that might be considered by Progressive Corporation is the Almarisk NV. Founded in 1980, the company has been active in the risk management and insurance brokerage services within Belgium. The firm is headquartered in Ghent. The company has a strong market presence and stable capital structure. Over the years, Almarisk NV has managed to penetrate the market and is currently valued at $13 billion (Barbara et al., 2017). The third company Progressive Corporation should consider an alliance with is Belfus. This company concentrates on the financial service insurance and has been in the market since 1996. The business is owned by Belgian State and controls 12% of the market (Barbara et al., 2017). The firm is the most stable insurance company in Belgium. The government currently owns a 25 % stake (Barbara et al., 2017).

Selecting the Ideal Partner and Benefits of the Alliance

The ideal company would be Allianz Belgium because of its interest in the real estate and general insurance services. This will avoid a potential conflict of interest since Progressive Corporation will be viewed as a strategic partner promoting the business growth for Allianz Belgium. At present, Allianz Belgium only offers a limited motor insurance policy. Therefore, the input of Progressive Corporation will be welcomed by Allianz Belgium because it is placed to gain through increased business by financing the purchase of this product. Specifically, the unique auto insurance policy could be introduced and quickly expanded in Belgium through the well-developed Allianz Belgium’s value chain network (Arnold, 2004). In addition, Progressive Corporation is positioned to gain from the market experience of Allianz Belgium, thus, avoiding potential risks associated with entering into a new market.

Pros and Cons of Market Entry Modes and Recommended Mode

The main entry modes in Belgian market that could be pursued by Progressive Corporation are joint venture, contractual agreements, and wholly owned subsidiaries. The joint venture approach involves entering into an agreement with another company already in Belgium in order to smoothly penetrate the local market. In the case of Progressive Corporation, the joint venture strategy will involve partnering with the proposed Allianz Belgium under a negotiated share from sales and operational networks (Thomson et al., 2013). The benefits of joint ventures include risk sharing, joint product development, and ease of conformity to government requirements.

However, conflicts might occur as a result of mistrust and asymmetric business modeling in addition to cultural clashes or performance ambiguity (Arnold, 2004). The other entry strategy is the wholly owned subsidiaries in the form of acquisition. For instance, Progressive Corporation could consider acquiring Allianz Belgium. The benefits include quick market entry due to the inheritance of an already developed network. However, this option is very costly and laden with challenges such inability to transition into the acquired business model (Arnold, 2004). The last option is the contractual agreement with the Allianz Belgium outlining the operational module and expectations from each partner. This strategy is laden with benefits such as affordability, flexibility, and progressive management of the business operations. However, failure to honor the contractual agreements might result in the complete collapse of operations since it is dependent on the goodwill of the third party.

Based on this analysis, the ideal entry strategy would be a joint venture with the Allianz Belgium to ease the market penetration process and facilitate quick and stable business operations in Belgium. Since the Allianz Belgium has been in the market for more than 2 decades, the joint partnership alternative would give Progressive Corporation optimal results and cushion it from unpredictable market risks (Thomson et al., 2013). Moreover, the US-based company will have the upper hand in monitoring the market entry and penetration since the joint venture deal will create an environment for close supervision. In addition, Progressive Corporation would save a lot of resources that could have been spent in developing a new value chain network and general business infrastructure. Thus, the business will save time associated with the process of acquiring licenses and meeting other legal and economic requirements.

Financial Requirement for the Entry Strategy

Under the proposed joint venture entry strategy, the estimated financial investment required by Progressive Corporation includes licensing fees, search, partnership goodwill, and direct investment (see table 1).

Table 1. Estimated financial investment in joint venture entry.

Organization’s Degree of Fit with Belgium

Making the Strategic Alliance Work

In order to make the joint partnership with Allianz Belgium work, it is important to merge the laws governing the two businesses with Belgian commercial laws. The legal merger should address taxation, accounting reporting standards, and a joint advisory board. The ideal legal entry for Progressive Corporation into Belgian market would be a joint advisory board to ensure that the company’s operational model is aligned with the local laws (Ghemawat, 2001). This is necessary to ensure that taxation laws and other licensing regulations in Belgium do not have negative impacts such as avoidable legal suits, government interference, and conflict with the regulatory authorities.

Operational Roles and Activities of Partner

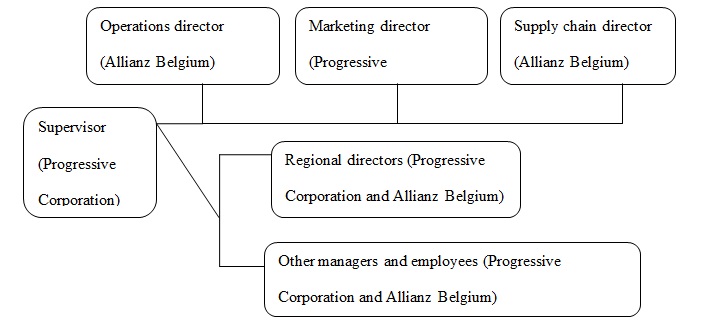

Under the joint partnership model proposed, the Allianz Belgium will be assigned the role of performing due diligence, expanding the physical infrastructure, and tracking the progress in different regions using their existing network. On the other hand, Progressive Corporation will provide the financial requirements in addition to regulatory or management duties that are unique to the proposed product (Thomson et al., 2013). The proposed dynamic organizational structure is informed by the need to create a self-functioning business management model for short and long term sustainability (see figure 1).

The scientific management approach is informed by the need for efficiency and strict compliance with the Belgian labor laws to guarantee constant value addition and tracking the skills of general skill sets. The diverse human resource as a result of the joint venture will guarantee a competitive advantage through a quality service charter. In addition, the use of locals to provide labor resource will reduce the risk of language barrier and effectively fit the business to Belgian employment laws.

Impact of Belgian Culture and Geography on Progressive Corporation

The unique and dynamic Belgian culture and geography will have impacts on Progressive Corporation. The multilingual nature of the country demands additional efforts from the company to appeal to all language groups. Thus, it is vital to introduce products in French, Dutch, and German, along with the English version for immigrants and international workers living in Belgium (Ellsworth, 2002). The documents should also be processed in multiple languages to avoid problems for customers. In addition, the dynamic regional demarcations should be put into consideration to ensure that products targeting each area are aligned with the cultural dynamics (Arnold, 2004).

Marketing Strategy

Target Markets

The customer segments are divided into private and commercial clients (Ghemawat, 2001). The private policy holders consist of owners of automobile used for private purposes. The commercial segment consists of owners of automobiles using their vehicles for business purposes. The ideal customer should be able to spend at least $300 and above as an annual insurance policy. Nearly all families in Belgium are potential customers since more than 75% own an automobile (Barbara et al., 2017). However, the business will concentrate on the youthful and mid-age customers for the private cover and all clients for the commerce policy cover. In terms of geographical location, the potential customers are evenly spread across Belgium. The psychographics of the targeted market includes interest in an automobile insurance cover driven by quality, trend, taste, and general perception (Arnold, 2004). These expectations should be aligned with the proposed auto insurance policy product to ensure that Progressive Corporation effectively serves the customers. The demographic market variables are organized into all genders, ages, economic classes, cultural, political, and religious affiliations (Ellsworth, 2002).

Marketing Strategy

Competitors

The biggest competitors of Progressive Corporation in Belgian market are the state-owned Belfius and ING Belgium. The Belfius has been in the market for more than two decades and has more than six product lines including automobile insurance coverage. This means that the company enjoys full support of the government and has unlimited access to capital funding. In addition, the company is the sole insurer of government automobiles and other organizations aligned to the state. The company has a current capitalization value of 6 billion Euros (Barbara et al., 2017). Apart from issuing insurance policies, the company also finances the purchase up to 100%.

The competitive advantages of Belfius are product diversification, flexible payment plan, and integration of technology in the business channels. Another competitor is the ING Belgium founded in 1972 and has grown into a fully functional diverse insurance provider with more than 1,000 products within the automobile insurance sector (Barbara et al., 2017). The company is currently focused on the automobile, investment, and financial insurance products. The ING Belgium’s competitive advantages include a strong brand image, long market experience, affordable products, and stable loyal customer base. In order to survive this competition, Progressive Corporation should consider selling its product as a fully technology-based service that guarantees customer convenience and quick claim payment.

The actual and potential size of the market

The Belgian Insurance Industry is subdivided into five sectors consisting of health, automobile, property, litigation, and general insurance. At present, there are more than 1,000 registered insurance companies and about 20,000 underwriter firms (Barbara et al., 2017). The Belgian industry report indicates that the industry is valued at about 300 billion Euros and the figure is projected to grow to 450 billion Euros by 2030 (Barbara et al., 2017). Over the years, the annual revenue for the industry has grown by 7% with the exception of the global financial crisis of 2009 and 2009 when the industry recorded a conservative growth of 3%. The expanding market is an opportunity for Progressive Corporation’s market penetration and expansion upon entry.

Market and segment growth

The market for Progressive Corporation’s proposed product is unlimited since it targets all customers with any automobile. Fortunately, the laws in Belgium make it a mandatory requirement for all automobile owners to ensure their vehicle. This means that the company will have a market consisting of more than 2 million potential customers at the end of every financial year when the law requires mandatory renewal of the automobile insurance covers (Barbara et al., 2017). Thus, Progressive Corporation might benefit by capturing new customers at the point of renewal or owners of new automobiles.

Market and segment profitability

The insurance industry in Belgium is highly profitable because the number of major automobile accidents is less than 10% of the policy holders. This means that claims are relatively low, especially among the private and old customer segments. The highest risk is posed by the youthful customer segment whose claim rate currently stands at 16%. Despite the high business magnitude brought in by the commercial customer segment, the claim rate is below 13% (Barbara et al., 2017). Considering the high economies of scale associated with the insurance business, Progressive Corporation is posited to reach profitability within the first year of operations, if it can get 10,000 policy holders.

Underlying costs and cost structure

The costs associated with providing automobile insurance policy cover include government taxes, payment of claims, and administration. These costs are absorbed by companies in the insurance industry in Belgium. For instance, it is a statutory requirement for all insurance companies to remit monthly and annual taxes to the government besides processing claims within a month. In addition, just like any other business, the automobile insurance firms have to manage the costs associated with running the businesses, especially with regards to the market swings (Ellsworth, 2002).

Distribution systems channels

The geographical terrain in Belgium is friendly and characterized by well-developed infrastructure such as communication, security, and transport networks. This means that Belgium is more or less similar to the US business environment. For instance, as a strategic gateway to the populace European market, the government of Belgium has invested in its infrastructure to attract and retain different investors. Therefore, Progressive Corporation should take advantage of the well-develop distribution systems to institutionalize a strong and effective value chain for reaching the market and tracking feedback (Arnold, 2004). Since the product will be sold and marketed mainly over the Internet, the stable connectivity in Belgium guarantees quick and sustainable market penetration.

Assessing the Characteristics of Progressive Corporation Potential Customers in Belgium

Marketing mix in the country

The primary components of a typical marketing mix are price, place, promotion, and product. In terms of price, Belgian business environment is characterized by an open market where prices are set and regulated by the players. The average price for a similar product offered by Progressive Corporation is $400. The place element involves a well-developed effective distribution network consisting of effective transport and communication channels capable of supporting Progressive Corporation’s business. The promotion mix in Belgium integrates diverse and effective business marketing and advertisement strategies supported by diverse modern and traditional media channels available to any business at a fee (Barbara et al., 2017). Lastly, the product mix is characterized by diversification and a series of perfect substitutes differentiated by their prices and packages.

Promotional Practices, Pricing, and Branding Strategies

In order to penetrate the market in Belgium, Progressive should consider using traditional and modern media channels to run customized advertisement messages about the product. The ideal promotional strategies would include advertisements, offering discounts, and establishment of a loyalty club to reward repeat buyers. The company should consider using the ‘multiple pricing’ strategy to create different products from the auto insurance policy product. Through multiple branding it will be possible to create three sub-products sold within good, better, and best price ranges. The ordinary product could be sold at good pricing while the medium product as better pricing (Arnold, 2004). The premium brand could be sold as best pricing. The prices will vary according to the content of the insurance policy. Progressive should consider using multiple-branding strategy to create different products that can appeal to low, middle, and high income clients. The strategy will guarantee product diversification and create an environment of self-competition. As a result, the company will be able to protect its market and annex competitors segments from time to time.

Use of Web Networks and Social Media for E-Marketing

Since the proposed business platform will be supported by technology, it is necessary to integrate e-marketing through the use of social media and search engine optimization (SEO) for Progressive Corporation’s website. The use of social media will target to recruit 300,000 followers within two years on the Twitter and Facebook pages. The SEO will involve revising the algorithm for the website to ensure that it appears at the top of a Google search. In addition, the company could consider email marketing, which involves transferring of cookies to all contacts of a website visitor (Thomson et al., 2013). This strategy has the potential of improving the company’s visibility within a year.

Market Share Estimates and Revenue Forecast for Near Term and Long Term

The market share estimates were based on projected sales and profit margin in the short and long term. The projections are informed by the standard performance of the primary competitors and market size in Belgium (see table 2).

Table 2. Financial projections.

Evaluating Financial Requirements and Investment Opportunities

Financial Statements of Competitors

The financial statements of the three main competitors were synthesized and summarized to establish their capital standing (see table 3).

Table 3. Financial statements of competitors.

Challenges Because of Accounting Standards

Progressive Corporation will not face any challenge in financial reporting standards since Belgium uses the EU model, which is similar to the US GAAP. Moreover, the two countries share similar regulations on financial reporting sustainability and general accounting standards.

Required Investment for Relocating Value Chain Activities for Year 1, 2, and 3

The required investment to relocate the value chain activities for year 1, 2, and 3 in Belgium is estimated at $2 million. The figure was broken down and spread across the three years (see table 4).

Table 4. Required investment for relocating the value chain.

Estimated Revenue Projections

The estimated revenue projections were calculated with a conservative value of 300,000 clients over a period of three years with an average expenditure of $900 on insurance policy cover. This is equivalent to $270,000,000. The cost of doing business was estimated to be 20% of the revenues, which is equivalent to $54,000,000 (see table 5).

Table 5. Estimated revenues.

Strategic Implementation Plan

Balanced Scorecard

Monitoring and Reporting Issues

Progressive Corporation will use a comprehensive 360-degree feedback channel to monitor and report issues related to business environment and other stakeholders. This channel has an effective performance tracker capable of measuring the effectiveness against set standards. Adjustments will be made based on the feedback.

Conclusion and Recommendations

Progressive Corporation has an experience in managing business operations beyond the US market. Thus, the external business and general value chain analysis suggest that Progressive Corporation is positioned to quickly penetrate the market with its technology-based business model and gain a sizable market share over a short period. The auto insurance policy product is designed and created as an affordable, comprehensive, and flexible insurance policy for private and commercial automobile owners. The product has been fully digitized to mean that application, approval, and issuing of the automobile insurance coverage is done over the company mobile app or website using a Smartphone or any other device that can access the Internet. Due to a strong capital structure, the company is projected to effectively and quickly penetrate the new market. The marketing plan is designed to optimize sales and increase product visibility in Belgium.

Governance and Accountability Code of Conduct

Progressive Corporation should consider creating a legal unit within the organization to provide training and reinforce ethical standards for the international market. The plan should include specific actions to address cases of corruption, sexual harassment, and bribery allegations. The legal unit with integrated the local and Transparency International regulations in the form of ethical expectation contracting.

Corporate Social Responsibility Policies

Progressive Corporation should also have a strong policy on corporate social responsibility characterized by periodic activities aimed at giving back to the local community. The initiatives should be turned into policies in the form of annual activities to address local concerns such as education sponsorships, mobile health clinics, community resource mobilization, and development of infrastructure. This policy will guarantee support from all stakeholders and ensure business suitability in the short and long term.

References

Arnold, D. (2004). The mirage of global markets: How globalizing companies can succeed as markets localize. Upper Saddle River, NJ: Pearson Education.

Barbara, C., Cortis, D., Perotti, R., Sammut, C., & Vella, A. (2017). The European insurance industry: A PEST analysis. International Journal of Financial Studies, 5(2), 1-20.

Ellsworth, R. R. (2002). Leading with purpose: The new corporate realities. Stanford, CA: Stanford University Press.

Ghemawat, P. (2001). Distance still matters: The hard reality of global expansion. Harvard Business Review, 79 (8), 137–147.

Thomson, A., Janes, A., Gamble, J.E., Strickland, A.J., Peteraf, M.A., & Sutton, C. (2013). Crafting & executing strategy: The quest for competitive advantage: Concepts and cases (18th ed.). New York, NY: McGraw-Hill.