Introduction

Puma SE is a German corporation that manufactures casual and athletic apparel and footwear. With $6.8 billion in revenue and more than 16 thousand employees, the company is the third-largest sports brand worldwide (Puma, 2022). Significant challenges, such as the COVID-19 pandemic, and economic and environmental issues, enabled Puma to diversify and update its strategies towards an optimized and more sustainable production. The sportswear manufacturer had not achieved significant growth, similar to other industry representatives; however, it maintained a stable workflow (Andal et al., 2020). This report aims to discuss Puma’s future outlook as it will grow through sustainability-based initiatives, its profitability options, and potential risks such as the uncertain economic situation. The central arguments are that as a strong brand, Puma SE is recognizable worldwide, yet it still has less income, operating margin, and ROIC percent, a lot smaller than its main competitors. However, its latest sustainability and supply chain optimization campaigns demonstrated that the company could remain a significant part of the market regardless of the unpredicted challenges.

Business Model

Puma is a well-known sports apparel manufacturer with more than 70 years of history; thus, it has generations of loyal customers worldwide. Moreover, the industry is highly competitive, and having such rivals as Nike and Adidas enables the corporation to innovate and improve their products’ quality. Morningstar (2022a) states that “nearly a quarter of the company’s sales are direct to consumers through Puma’s retail stores, factory outlets, and online channels” (para. 2). The firm’s business model includes marketing through participation as sports teams and events sponsors, apparel distributors, and collaborations with famous athletes. Consequently, Puma’s competitive advantages are strong branding, broad and loyal clients, and unique sponsorship strategies.

SWOT Analysis

Puma’s strengths are brand recognition, sponsoring famous sports teams, and a low employee turnover rate. Indeed, their logo and Forever faster slogan are well-known and aligned with their target consumers’ values. Puma manufactures race suits for Formula-1, sponsors diverse sports and soccer teams such as BVB and Manchester City, and has millions of loyal clients among sports fans (Junghagen, 2018). The weakness is that the firm has significantly lower revenue than Nike and Adidas (6.8 billion euros compared to Nike’s 36.53 and Adidas’ 21.23) and might lack recourses to innovate and stay competitive (Statista, 2022). Another weakness is that Puma is a European corporation; thus, its taxation and logistics are complicated and require additional recourses for proper legal regulation. Opportunities are the company’s latest sustainability-related initiatives, such as the 10FOR25 strategy to decrease manufacturers’ environmental harm by 2025 and their expanding range of lifestyle wear (Puma, 2020a). Threats are the competitors’ innovations and the consequences of the current political and economic situation in Europe, which would harm Puma’s supply chain and logistics, influencing products’ costs and prices.

Puma’s SWOT analysis displays that the company is not competitive with its main rivals on the market, yet it has sustainable revenue streams, which allow it to remain a significant sports apparel and footwear brand. According to the report’s thesis, an uncertain economic situation is a crucial aspect of the firm’s development. SWOT analysis revealed that the challenges are threats for Puma and require its executives to use emergency measures or optimize the workflow. However, the danger is equal for all market representatives; thus, Puma can turn it into an opportunity to increase its competitiveness through sustainability initiatives and product line expansion (Puma, 2020a). Threats and opportunities are the most important SWOTs which support the thesis that the company can grow through the programs and campaigns it creates and can benefit from the risk of the uncertain economic situation.

Puma’s Annual Report

Puma’s 2019-2020 Annual reports displayed how the pandemic influenced the corporation’s assets and what were the emergency funds used to address the decreased demand. For instance, the company’s operating income dropped from 436.100 thousand euros in 2019 to 208.800 thousand in 2020, yet increased to 554.600 thousand in 2021 (Yahoo! Finance, 2022). Puma’s current assets also progress positively as the rate grew by 5.3% between 2019 and 2020 with the prevalence of cash (Puma, 2020b). These changes suggest that the corporation has broad profitability options and is capable of addressing emergencies.

Historical Analysis

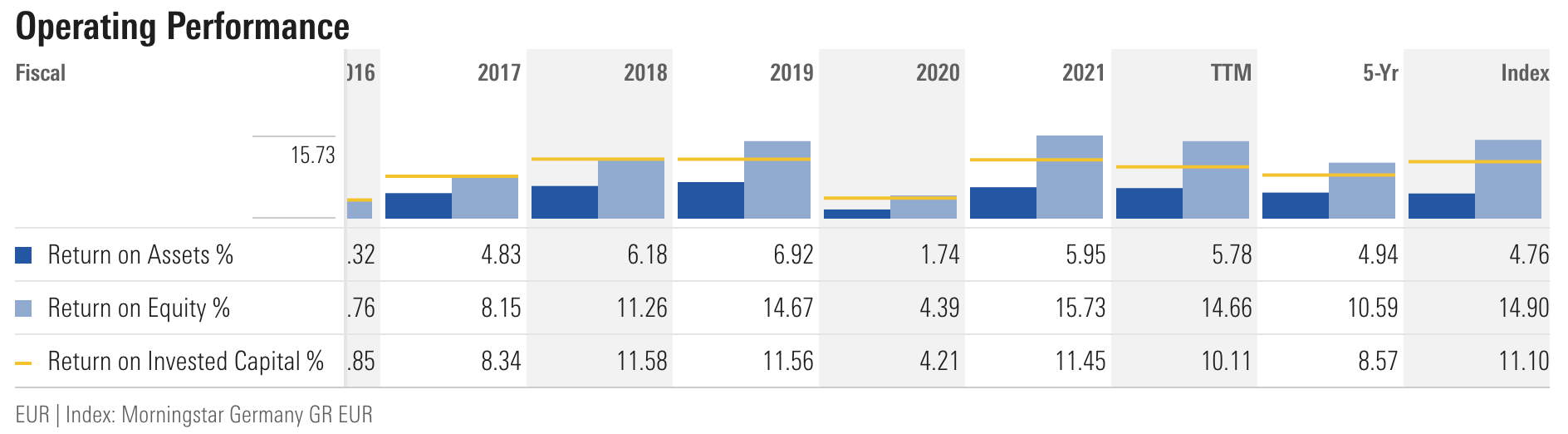

Horizontal analysis helps identify key changes in Puma’s finances throughout its history, and taking the last 3-4 years into account is the most appropriate way to draw credible conclusions. Indeed, the corporation’s gross profit changed rapidly in response to global changes in the industry: 2,249 in 2018 to 2,686 in 2019, and 2,458 million euros in 2020 (Yahoo! Finance, 2022). The rate is lower than of the main competitors, yet also is significantly higher and more sustainable than of the smaller market members, such as Under Armour and Reebok. Furthermore, Figure 1 displays that Puma SE sustains stable growth of its stock operating performance and increases its return on equity percentage (Morningstar, 2022c). Puma’s operating profit also displayed a relatively high difference yearly as it was 337 million euros in 2018, 440 in 2019, and 209 in 2020 (Morningstar, 2022b). The numbers reflect the measures such as credit lines implementation the company used to sustain their business operation in difficult 2019 and display the decreased demand for the industry’s products during the challenging period.

Puma’s net income rates are also the crucial rates to analyze the company’s operations and performance during the last 3-4 years. The statistics displayed a 69% decline in 2020 as a consequence of pandemic-related risk addressing measures. In millions of euros, the values were 262 in 2019, only 79 in 2020, and 310, the significant 292% growth, in 2021 (WSJ Markets, 2022). However, Puma’s general sales growth is positive, and the corporation has already gotten out of a declining period when the value was -4.87% in 2020 to +30.01% in 2021 (WSJ Markets, 2022). A historical overview of the company’s financial statements proves that the German sportswear manufacturer is competitive and can address inevitable challenges.

Industry Analysis and Assessment of Risk

Puma is the third largest sportswear manufacturer, and its rivals are Nike, Adidas, Reebok, and Under Armor. The former two have the highest share, and hundreds of smaller companies operate in the market, making it diverse and highly competitive. Consequently, the sports footwear and apparel industry are in demand, and competition drives innovation, enabling brands to improve their products’ quality, optimize costs, develop a strong marketing presence, and address sustainability challenges (Andal et al., 2020). Puma addressed all the aspects by launching various marketing campaigns, establishing the 10FOR25 initiative to decrease their harm to the planet, and maintaining balanced prices.

The industry faced the significant challenge of addressing the COVID-19 pandemic consequences, such as delays in production, decreased demand for athletic equipment and footwear, and the absence of sports events. However, the biggest players, such as Nike, Adidas, and Puma, stabilized their ROIC percentage and financial statements after the decline in 2019. For example, Puma’s value grew from 2.99 during the pandemic’s outbreak to 10.29 by 2021 (Gurufocus, 2022). Sustainability initiatives are also a considerable part of the industry as its biggest companies have thousands of employees and manufacturings worldwide, impacting countries’ economies, environments, and cultures (Pegan et al., 2022). According to 2021 reports, Puma’s workforce includes more than 16,125 individuals, Nike has 75,400, and Adidas – has 57,016 (Jaworek & Karaszewki, 2020). These differences display that although Puma has a lot less employees, it is still competitive and is the third sports apparel and footwear firm by revenue. The industry has a significant impact on the planet; thus, addressing environmental challenges became a part of its key players’ values.

Sports apparel and footwear is a global industry, and events that might disrupt its companies’ operations are tied to their key manufacturers’ and distributors’ conditions, such as economic crises or environmental problems. Aside from the COVID-19 pandemic’s outcomes, the risks are sourcing and supply chain changes, information technology, currencies instability, and macroeconomic developments. Along with its main rivals, Puma significantly depends on Asian countries’ economies because most of their production and raw material manufacturing hubs are located in Vietnam, Cambodia, China, Indonesia, and India (Puma, 2020c). The industry’s risks are economic instability in these regions, changes in wage costs, and environmental cataclysms that might occur. Puma is in a better situation than its competitors because it is generally smaller and has a shorter supply chain that can be optimized quicker than Adidas or Nike (Jiang, 2019). Moreover, the company can consider the bigger rivals’ examples in a crisis before taking action.

Valuation, Future Outlook, and Conclusion

Puma’s valuation displays that the corporation’s revenue overcame 2019’s decline and entered the growth stage. Its stock price is relatively stable and maintains between 62.38 and 115.40 euros per share in the 52-week range (Yahoo! Finance, 2022). Based on the industry analysis, Puma is the third largest manufacturer, yet there are more than 30 billion euros of income differences compared to Nike, the market leader (Statista, 2022). Puma’s P/E ratio changed within the last five years, with the lowest 33.60 rate in 2018 and the highest, 174.19, in 2020 (Gurufocus, 2022a). The abnormal increase of 2020 is similar to Nike and Adidas’ numbers, displaying that the industry faced the COVID-19 pandemic’s outcomes with relatively equal damage.

Corporation successfully obtains e-commerce strategies, participates in recent sports events as a sponsor and distributor to enforce their marketing, and optimizes their operations towards more sustainable production and labor. Puma’s brand recognition, loyal customer base, and strong competitiveness enable the company to keep innovating and address the inevitable challenges (Pegan et al., 2022). Valuation supports the report’s thesis as it demonstrates how the firm remains an important market representative through timely addressing the challenges and improving their consumers’ experiences.

Future Outlook

As a global corporation, Puma’s manufacturing and distribution depend on the macroeconomic changes and overall tendencies in sports-related industries. For instance, the conflict in Ukraine and the consequent logistical issues and costs increase might slow the company’s growth and influence its share price. However, Puma has a well-developed sustainability program which will help the company maintain its competitive advantage. The corporation also invests in innovation to remain a crucial member of the thriving sports footwear and apparel industry, expanding with the growing interest in sports and healthy lifestyles worldwide (Jaworek et al., 2021). The ratios of stock price and revenues Puma had in 2020, and 2021 displayed that the company combatted the COVID-19 pandemic’s economic consequences and switched toward growth. The future outlook displays that although the world is unstable today, the company has sufficient profitability options to address the risks and, as per the report’s thesis, grow through its sustainability initiatives and campaigns.

Conclusion

Puma is a strong brand valued by millions of clients worldwide, and its recognition through sports events and teams sponsorships, innovations, and high-quality products. Although its revenue growth depends on the global circumstances and industry’s challenges, the corporation manages to have effective manufacturing and distribution strategies and sell its goods in hundreds of countries. Puma has less income, operating margin, and ROIC percent than its main competitors, Nike and Adidas; however, their success is equally dependent on consumer demand and external factors. Corporation has a long history of development, values, and risk addressing strategies that will help them remain a significant part of the industry regardless of the changes in the market.

References

Andal, D. V., Suganya, D. S., & Shree, V. (2020). Financial performance analysis of Puma. International Journal of Management (IJM), 10(6), 239-246. Web.

Gurufocus. (2022). Puma SE ROIC % historical data. Web.

Gurufocus. (2022a). Puma SE PE ratio. Web.

Jaworek, M., & Karaszewki, W. (2020). The largest athletic apparel, accessories and footwear multinational companies: Economic characteristics, internationalization. Journal of Physical Education and Sport, 20(5), 3053-3062.

Jaworek, M., Karaszewski, W., & Kuczmarska, M. (2021). Source of success of the most valuable sportswear brands in the world. Journal of Physical Education and Sport, 21, 1050-1056. Web.

Jiang, W. (2019). Sustainable development of supply chain in footwear industry–take Nike as the case. Asian Business Research, 4(3), 86. Web.

Junghagen, S. (2018). Football clubs as mediators in sponsor-stakeholder relations. Sport, Business and Management: An International Journal, 8(4), 335-353. Web.

Morningstar. (2022a). Puma SE – Stock analysis. Web.

Morningstar. (2022b). Puma SE – Stock financials. Web.

Morningstar. (2022c). Puma SE – Stock operating performance. Web.

Statista. (2022). Global revenue of Adidas, Nike and Puma from 2006 to 2021. Web.

Pegan, G., Schoier, G., & de Luca, P. (2022). The importance of consumer perception of corporate social responsibility to meet the need for sustainable consumption: Challenges in the sportswear sector. In Research Anthology on Developing Socially Responsible Businesses, (pp. 1812-1835). IGI Global.

Puma. (2022). This is Puma. Web.

Puma. (2020a). Puma’s 10FOR25 sustainability strategy. Web.

Puma. (2020b). Net assets and financial position. Web.

Puma. (2020c). Risk and opportunity report. Web.

WSJ Markets, 2022. Puma SE: Financials. Web.

Yahoo! Finance. (2022). PUMA SE Income Statement. Web.