Executive Summary

The North Field Expansion project is an enterprise undertaken by QatarEnergy with the support of the government of Qatar to expand the country’s liquefied natural gas (LNG) extraction and output by 67%. It will be constructed in the period 2022-2027 and will feature several new platforms, LNG trains, storage facilities, processing plant, and other technological and industrial components. The NFE will serve to strengthen Qatar’s positions in global energy markets as demand increases with many countries transitioning off oil and gas to LNG as a jumping off point for sustainability prior to renewable energy. Furthermore, high energy prices and Qatar’s budget heavily dependent on LNG exports, this will stimulate tremendous economic growth. The project itself is the largest in scope for the industry and involves many moving parts and stakeholders. This paper discusses relevant internal and external stakeholders that have influenced the project from its inception into the future. It has been identified that the business, political, and economic contexts for the project are highly beneficial and will serve to significantly boost economic growth, job prospects, industry diversification, and talent migration to the country. CSR and ethical components of the NFE project were investigated, particularly in the context of environmental impacts, which remain a primary concern. However, both government policy and QatarEnergy approach to sustainability are making this project as environmentally friendly as possible at an unprecedented scale. The company and the project meet relatively strong standards of CSR and position themselves as an ethical entity.

Introduction

The North Field Expansion (NFE) project is a significant attempt by Qatar to expand its liquified natural gas (LNG) production to be used for the country’s energy security and export needs. While the government actively pursues its strategies in diversifying the economy and renewable energy sources under Vision 2030, hydrocarbons remain undoubtedly a major driver of the global economy. More than 50% of the government’s revenue stems from hydrocarbon exports, and the global market is demonstrating increased demand for the foreseeable future, generating the opportunity to further increase Qatar’s export revenue that could be reinvested into economic diversification and social support (International Trade Administration, 2021). Qatar has been a leading exporter of LNG for over a decade, and this has contributed to the country’s rise in prominence. Its proven natural gas reserves make up 12% of global known reserves, placing it third in the world, with the current output rates allowing for over 100 years of continued production (Dargin, 2021).

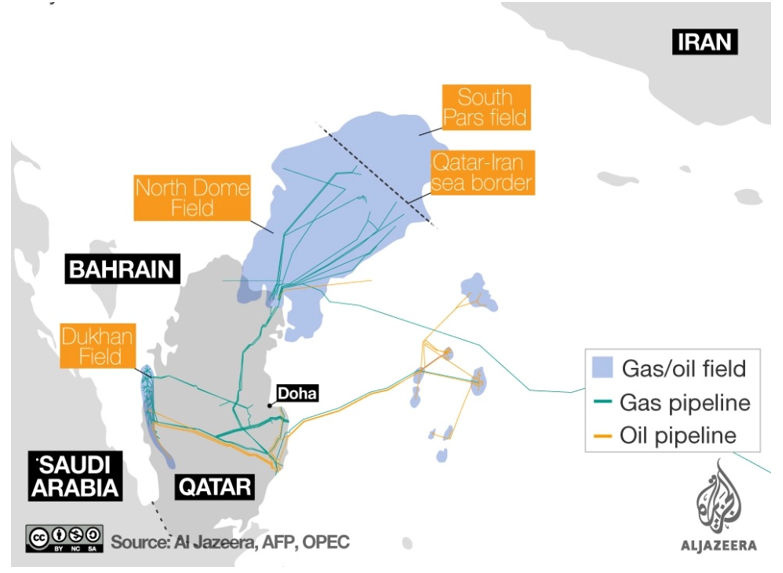

NFE is overseen by QatarEnergy (formerly Qatar Petroleum), a government-owned monopolist entity headed by the Minister of State for Energy Affairs Saad Sherida al-Kaabi. The firm operates on a business-to-business (b2b) model, selling energy to private and other nationalized energy companies worldwide to fulfil energy needs. The North Field is the world’s largest non-associated natural gas field in the waters north-east of the Qatar peninsula as can be seen in Figure 1. Qatar nationalized the North Field in the 1970s and became primarily and oil producer until both demand and technological possibilities allowed for investment into LNG, making it the primary hydrocarbon supporting the national economy. Despite initial rapid development of the North Field in the 1990s and early 2000s, Qatar placed a moratorium on further development. However, it now realizes that this puts it unfavourably in the competitive LNG market, and has lifted the moratorium on development after 12 years (Dargin, 2021).

Current output of LNG by Qatar stands at 77 million tonnes per annum (mtpa). QatarEnergy with the support of the government is planning to invest $30 billion into NFE with the aim to ramp up Qatar’s liquefaction capacity to 126 mtpa in gradual increments by 2027, generating a 64% increase (International Trade Administration, 2021). The project encompasses the construction of 8 wellhead platforms that would be used to drill 80 new wells. In addition, 4 new LNG intra-field pipelines will be laid at the bottom of the Persian Gulf. It is a tremendous and highly sophisticated project, with QatarEnergy awarding multiple contracts to successful engineering, procurement, construction, and installation (EPCI) firms which can provide their expertise and technologies to QatarEnergy to fulfil this critical energy project in a the most competent and sustainable way possible.

Objectives

There are several key objectives for QatarEnergy’s North Field Expansion Project. First, to explore and develop untapped hydrocarbon reserves in Qatar’s territorial waters. Next, it is necessary to increase Qatar’s LNG output significantly to fulfil domestic and global demand and bringing stable revenue sources for the government. The aim is to meet LNG export targets to finance government policies and diversification of the economy. Finally, it is vital to ensure energy and economic security for Qatar for the foreseeable decades.

Project Stakeholders

Internal Stakeholders

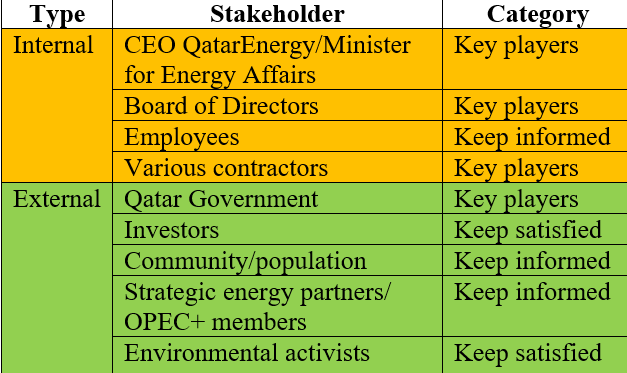

Internal stakeholders consist of various QatarEnergy key positions and influential groups as well as those directly involved with the project.

- CEO of QatarEnergy and Minister of State for Energy Affairs Saad Sherida al-Kaabi – joining then Qatar Petroleum as just a student in 1988, al-Kaabi climbed the ranks and was appointed President and CEO in 2014 as part of major re-organization. Under his influence, QatarEnergy has become an efficient and profitable organization, and with his appointment as Minister in 2018, he has been able to push forward the NFE project. He is a vital decision-maker on all major elements of the project as well as any supporting aspects for QatarEnergy such as developing partnerships and creating the infrastructure to extract, process, and transport LNG for domestic use and exports.

- QatarEnergy Board of Directors – Although QatarEnergy is not a publicly held or traded company, it maintains a board of directors that contributes to the management and strategic direction of the company, including on major projects.

- Employees – with the firm maintaining over 10,000 employees, the majority based in Qatar, these individuals at all levels of management and work are strong contributors to the project. A project of such complexity and intertwining elements requires significant coordination and expertise. The CEO has continuously thanked the teams in the respective departments in being critical in achieving milestones on the NFE project. Their collective influence holds weight in regard to the execution of this project in the next 5 years.

- Various contractors including Chiyoda Technip joint venture – Major contractors have been attained by Qatar Energy for EPCI work. These contractors are often trusted partners of the firm, and they bring the technological and industry-specific expertise that Qatar itself may lack in achieving such technologically complex projects. They hold significant value to the fulfilment of the project and may influence its direction or scope.

External Stakeholders

External stakeholders are entities, groups, and organizations that are outside of the direct project but may have an influence to some extent on the project development, management, or outcomes.

- Qatar government – The Qatar government is the direct owner of the state-owned QatarEnergy enterprise which is overseeing the project. The relationship between the two is essential as the government essentially uses the firm as an extension of its energy policy. The government creates policy which directly impacts energy projects, such as lifting the 12-year moratorium on North Field development. It also engages in trade relations with other governments to secure vital contracts for LNG exports.

- Investors – Although not publicly traded, QatarEnergy has released limited jumbo bonds for funding. Investor interest is peaking with support for the NFE project, suggesting further potential opportunities by the company to raise funds for its projects.

- Qatar population – the NFE will impact the population in many ways, by providing more jobs and opportunities, increasing economic prosperity, but also influences the future of the country in terms of potential environmental impact and its strategic direction. However, there is generally support from the population for the project seeing it as critical to the country’s future.

- OPEC+ strategic partners – Although OPEC+ are organizations of petroleum producing countries, many of these are also large natural gas producers. Unlike oil, there are no strict controls on extraction of natural gas. These countries and their respective state energy firms are both competitors for QatarEnergy but also strategic partners common endeavours.

- Large global energy firms – QatarEnergy has purchased shares in major global energy firms such as Total and Shell and have outlined major investments with them into future energy research. Some of the global energy firms are providing the technological expertise for the NFE project and have expressed interest in purchasing and distributing some of the hydrocarbon exports as a result of it.

- Environmental activists – As with any major scale infrastructure project, particularly in the hydrocarbon industry, there are significant environmental concerns. Although LNG is environmentally safer and beneficial than oil extraction and use, there are concerns for disrupted ecosystems and that the energy is not fully sustainable. It is unlikely that such activist groups will create problems for the project, but it is best to address their concerns as NFE development begins.

Project Environment

PESTEL Analysis

Political Factors

All energy projects in Qatar are approved by the government and driven by appropriate policy. NFE was in the planning for decades but only went forward in 2017 after the moratorium on North Field development was lifted. The NFE project is funded by QatarEnergy through the government budget and subsidies. It fully depends on government control. Government policy is driven by ensuring strategic interests and fulfilling objectives outlined in Vision 2030, which the NFE contributes to. International politics which heavily influence the energy market may play a role, for the benefit or consequence for Qatar as some moves may place the country in an optimal position as a supplier while others may potentially bring some sort of sanctions which would limit Qatar’s access to the market (Cahill & Tsafos, 2020). The other GCC countries have a difficult relationship with Qatar, and given a record of some potential human rights abuses occurring in Qatar, Western nations may be reluctant to conduct business in the country.

Economic Factors

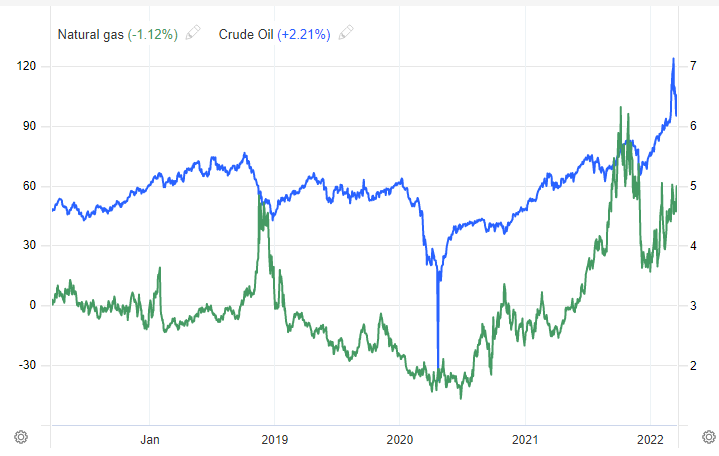

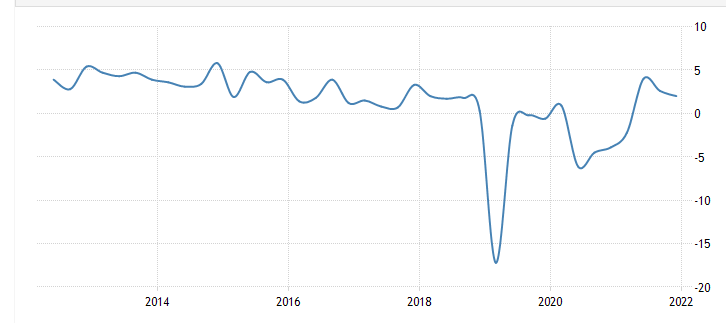

The project is expected to exceed $40 billion by completion, and while QatarEnergy is covering the majority, it is seeking foreign shareholders to cover up to 35% of the project’s equity (Economist Intelligence, 2021). Due to a range of unstable factors ranging from COVID-19 to geopolitical conflicts, many firms are reluctant to make major investments. Although the government has indicated it will cover missing investments and the NFE will continue in its full scope regardless. The economics of NFE focus on that Qatar needs to find new buyers for its increased production, as well as maintain its existing clients on long-term contracts, many of which renew before the mid-decade. Based on the highly volatile principle of supply and demand, global energy prices have fluctuated dramatically in the last 5 years but are seeing an upwards trend (Cahill & Tsafos, 2020). The NFE project is ultimately able to provide a return on investment only if there are viable buyers and appropriate prices on LNG for exports.

Social Factors

One of the major social factors to consider in the context of the NFE is the education and skill level of the population. For such complex and sophisticated projects, Qatar may not have enough specialists or the level of expertise among its professionals to confidently achieve the feats of engineering and technology that will be required. Foreign experts may be brought in by contractors to achieve the optimal results. Another aspect to consider is class structure and hierarchy in society. The wealth that will be brought to the country by the profits from NFE, will it be spread among the population, 88% of whom are expats and foreign workers. The class-wealth divide may become a prevalent issue of attitudes for the country.

Technology Factors

The NFE is a project of significant technological complexity and sophistication. It will include mega LNG trains, LNG tanks, loading bergs, associated pipes, lines, loading lines, and storage. The hydrocarbon industry is consistently evolving and involves high-tech infrastructure, machinery, electronics, and materials. Qatar relies heavily on foreign firms and contractors to conduct the majority of its engineering, procurement, and construction for new LNG infrastructure. These technological elements must all come together to build the complex offshore platforms and achieve operational efficiency to maintain QatarEnergy’s reputation of safety, reliability, and excellence.

Environmental Factors

A major hydrocarbon extraction and infrastructure project will potentially have extensive environmental impacts. However, in both, self-interest and to attract greater foreign direct investment for the NFE, the project “encompasses a number of concrete environmental investments” and strong commitment to environmental standards” according to Minister Al-Kaabi (Murray, 2021, para. 4). The NFE will have a range of environmental protections built-in, including a carbon capture and storage system, one of the largest of its kind. Furthermore, the project will procure power from Qatar’s power grid, which is increasingly being powered by solar, with plans to increase its solar portfolio to more than 4GW by 2030. Qatar’s environmental investments with this project demonstrate that LNG suppliers are placing more focus on mitigating carbon emissions as part of CSR as well as for Qatar itself, Vision 2030 which emphasizes a “green” economy.

Legal Factors

As with any major projects, there are a plethora of legal issues that must be considered. This includes proper regulations and permissions, certifications, licences, and approved designs for construction by government entities. Offshore development typically follows specific legal frameworks along with consideration of various prohibitions and liability issues. Taxation on the hydrocarbon extraction and sales must be considered within the legal codes of Qatar and its state-owned enterprises.

External Environment

The NFE is a significant milestone for Qatar’s economic development. It will create significant businesses opportunities both internally and externally. It is the largest known LNG project sanctioned in world history and one of the largest across global upstream business. A starting $13 billion contract awarded for EPCI work to the joint venture of Chiyoda Technip, reliable contractors who have worked with Qatar in the last decades on various energy projects. The project is a reflection of Qatar’s focus on global efforts to combat climate change with environmental efforts and specialized professional services that will bring significant commercial opportunities to the country over the next decade. The expansion of LNG export capacity will allow the transition of countries to green energy production as it transitions from coal and oil. Furthermore, in the context of the current 2022 conflict in Ukraine and one of the world’s leading energy producers Russia being heavily sanctioned, demand for alternatives, including LNG, is at an all-time high. In March 2022, the leading European industrial economy, Germany, has signed a multi-year deal with Qatar to supply LNG (Wintour, 2020). The demand for the exports that will increase as a result of NFE will remain high, also supporting a consistently profitable price for the natural gas.

QatarEnergy has made the NFE investment as highly opportune time period, which will allow it to capture significant market share and potentially attain a foothold in new markets. There are no other LNG projects of similar scale worldwide. The NFE will reinforce QatarEnergy’s competitive advantage, because of Qatar’s position, it has a strength in negotiations and strategic considerations when operating in the global energy market. The country’s structural cost advantage allows it to maintain a pre-eminent supplier position while allowing for flexibility in contract pricing. Furthermore, as Qatar is the leading producer of LNG by efficiency, the NFE project further increases not only its output but economies of scale as the modern and highly sophisticated technologies and methods of LNG extractions are utilized (Malesa, 2021).

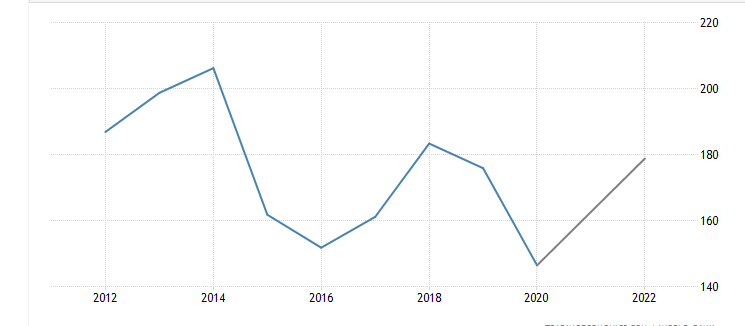

The NFE project will not only bring up natural gas during extraction, but a range of other valuable hydrocarbons for potential export. Associated hydrocarbons include as much as 260,000 b/d of condensate and 11,000 t/d of LPG annually, an increase of 65% and 36.5% in comparison to 2020 exports. Even using on-average low 2020 prices, these hydrocarbons would be worth at least $3.05 billion annually. In addition, as much as 4,000 t/d of ethane would be available for the petrochemical sector both domestically and for export (Malesa, 2021). Furthermore, the project will attract a range of other investments into Qatar including finacnial institutions, asset managers, along with growth of industries such as manufacturing, construction, and high-tech. The NFE is expected to boost real economic growth and fiscal surpluses by high single digits on average over 2021-2027. Meanwhile, non-hydrocarbon real GDP growth through higher investments is expected at 1.5ppt per annum reaching an average of 5% in the 2022-2027 period (Deep, 2021). The main drivers are high energy prices, a blended LNG export price, and balanced fiscal spending by the government with a significant surplus balance after the COVID-19 pandemic.

Impact of Corporate Social Responsibility

CSR Application

The North Field Expansion project has been a competent application of corporate social responsibility by QatarEnergy and by extension, the government. First, government policy placed a moratorium on North Field development. This was done to ensure sustainable development of energy resources in the country and to prepare a plan for the expansion, which has been years in development. It also allowed for more time in order for sustainable technologies to mature in the sector, making the large infrastructure project more viable. As discussed throughout this paper, the NFE is actively promoted by the Qatar government as a central national project that will bring tremendous economic and social benefits, while having long-term effects on environmental transition. First, LNG is a significantly better alternative than coal or oil in terms of hydrocarbon extraction, and with technologies on carbon capturing being implemented, the environmental impact will be minimized. Next, the revenue that will be generated over the next decades from the NFE has already been outlined as to be invested in diversifying Qatar’s economy, including the energy sector towards sustainable technologies and being less hydrocarbon reliant (Ugal, 2021).

QatarEnergy under the leadership of Minister Al-Kaabi is taking an open and proactive approach in addressing any public and environmental concerns, and focusing on a constructive dialogue to build trust. LNG has been touted as being a bridge fuel for power generation as the world transitions from highly pollutant sources of oil and gas towards renewable energy. QatarEnergy and all of its partners, contractors, and stakeholders are engaged not only to fulfilling minimum environmental standards and social responsibility, but actively seeking means to reduce emissions, reuse 75% of the plant’s tertiary water, and source sustainable power sources (Adler. 2021). Furthermore, there are tangible economic effects that will be felt, as discussed with tremendous GDP growth. Qatar’s society benefits as well from the project, with increased social safety net support that will now be available due to surplus budgets as well as billions in jobs available across a range of industries and services that are associated with a project of this scope.

Taking into consideration the CSR stance matrix, QatarEnergy with NFE best represents “enlightened self-interest” as its strategy, but it does veer into the next section in some parts. It is definitely a sound business sense for QatarEnergy to maintain CSR and environmental strategies, some of its rationale is partially based on sustainability and long-term considerations. Its leadership is supportive to the issues, open to dialogue, and seeks improvement, but does not necessarily champion any initiatives. However, beyond just have systems in place to support the good CSR practices, Qatar Energy has made it an organizational issue with monitoring and executive decision-making (Kirat, 2015). It is proactive in the sense that, for example, policies and means of environmental sustainability were built in the project during design and development, that it was not just a reactionary issue to public criticism (Nair, 2021). Finally, the company maintains an interactive relationship with its stakeholders, but that is largely due to its state-owned structure, but it keeps the public and relevant participants consistently involved and informed. Overall, no evident unethical decision-making is seen within the organization and the project. There are extensive systems of monitoring and checks to ensure that there are no ‘cut corners’ and all managerial decision-making meets high standards of CSR and Qatar’s law for the benefit of the country and its people.

Conclusion

The North Field Expansion is a crucial and strategic energy sector expansion for Qatar under the government owned QatarEnergy entity. The project has been approved and is in progress of being completed at a highly favourable time as energy prices are high and LNG demand is rising. This project will guarantee significant profitability for Qatar’s fiscal budget and the general economic growth for the next decades. An all-around viable business environment, advanced technologies, and significant government support make the NFE a strategically competent project. Furthermore, significant efforts are made by QatarEnergy along with other stakeholders to ensure that the NFE project meets the utmost CSR standards, with government policies to support it. The NFE is the largest economic project in Qatar and the energy industry at this time, making it a globally impactful venture with considerate interests involved both for Qatar and other key energy players.

Reference List

Adler, K. (2021) Qatar Petroleum commits to low-carbon LNG in latest expansion. IHS Markit [online] Web.

Cahill, B., and Tsafos, N. (2020) Qatar’s looming decisions in LNG expansion. CSIS [online] Web.

Dargin, J. (2021) Crossing the Rubicon: Qatar’s journey to natural gas dominance. Al Jazeera [online] Web.

Deep, A. (2021) Qatar’s LNG expansion is expected to boost GDP growth. Foreign Investment Network [online] Web.

Economist Intelligence. (2021) Qatar Petroleum makes decision on North Field expansion. [online] Web.

Frederick, S. (ed.) (2021) NFE project milestones: jacket installations completed and mega trains contract awarded. The Pioneer [online] Web.

International Trade Administration (2021) Qatar – Oil & Gas North Field Expansion (NFE) Project [online] Web.

Kirat, M. (2015) Corporate social responsibility in the oil and gas industry in Qatar perceptions and practices. Public Relations Review [online] v.41(4), 438-446. Web.

MacroTrends. (2022) Crude oil vs natural gas – 10 year daily chart. [online] Web.

Malesa, T. (2021) North Field Expansion’s Economic Implications for Qatar. Linkedin [online] Web.

Murray, J. (2021) Profiling North Field East, the world’s largest-ever LNG project. NS Energy [online] Web.

Nair, S. (2021) Qatar petroleum launches sustainability strategy. Offshore Technology [online] Web.

TradingEconomics. (2022) Qatar GDP. [online] Web.

Ugal, N. (2021) North Field Expansion fuels Qatar’s LNG quest. Upstream [online] Web.

Wintour, P. (2022) Germany agrees gas deal with Qatar to help end dependency on Russia. The Guardian [online], Web.