Introduction

Raising taxes is a rather controversial and contentious moment in solving financial problems in the country. Without any doubt, such measures are necessary to correct the issues gathered in the American economy. Nevertheless, there are multiple cases in world history when such procedures led to chronic and structural “distortions” that pose a significant threat to economic growth in the United States and social stability. To date, there are many alternative methods and means to establish a budget balance in order to cancel tax increases.

Arguments for not Raising Taxes

Indeed, tax increases are a vicious circle that does not lead to steady growth in budget revenues. Moreover, the US government’s proposed steps are not the product of far-sighted thinking but rather a “convulsive” reaction to circumstances without analyzing them and considering possible alternatives. Based on this assumption, this paper proposes several arguments in favor of why the state should not resort to tax increases.

First of all, the US government is recommended to focus on the availability of affordable federal funding. Due to this form of establishment and spending of funds, there is an exceptional opportunity to cover the costs of social policy, security, medicine, education, and other areas of budget classification. Using the article by Snow and Burke (2019) as an example, one should note that unbalanced, incorrect budget management and the adoption of temporary measures cause significant damage to both municipalities and notion’s citizens. Additionally, the state requires thinking about expanding the tax base (in particular, canceling all kinds of benefits and exemptions) or changing the tax structure and only then raising rates if necessary. Therefore, competent investment of resources and funds stimulates the growth and development of monetary income as a compensating instrument for continuously growing expenses.

Secondly, another and no less critical choice for solving the complex financial issues is temporary or long-term reductions in programs, labor force, and employees’ wages. Despite this theory, even in such cases, there are dilemmas. On the one hand, savings would help fill some economic gaps. On the other hand, the reduction of funding for educational, medical, and other vital programs is fraught with problems in the life of the whole society. In this case, Bifulco and Lewis (2020) are sure that there are many other alternative ways to balance the budget. Based on this provision, raising taxes is only an extreme case.

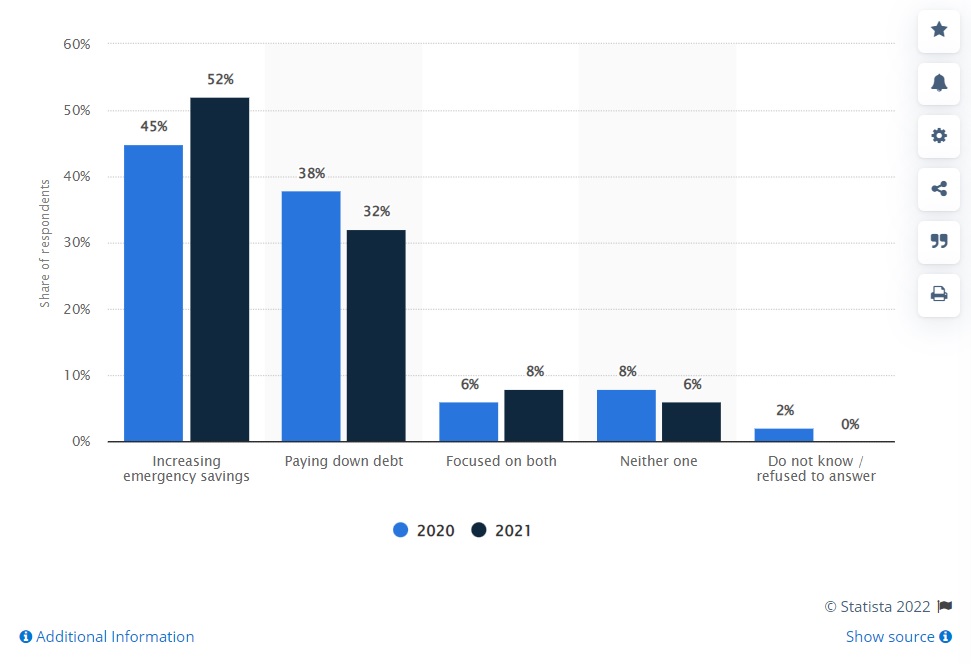

Moreover, due to unfriendly and unfavorable circumstances, developed countries and their residents may have a stable budget without raising personal income taxes. According to Auerbach et al. (2020), most taxpayers are faced with the need to put up with various types of limitations due to restrictive measures against COVID-19. In addition, not every nation’s citizens will be ready for new decisive steps by the governance in taxation growths. The unemployment rate is rising, many public sectors are suffering, and according to Republicans in Congress, tax increases are “unpopular” (Greenblatt, 2021). Due to the pandemic, the need for higher taxes will remain at the same level. However, for example, every time there will be needs in healthcare and labor, they will also cost much more – the impasse and the hopeless situation is manifested again in this position. Furthermore, according to the statistics, approximately 52% of US citizens (including taxpayers) are forced to monitor their money turnover carefully and increase savings (Statista Research Department, 2021). As a result of this fact, most likely, an increase in taxes will only be able to “cripple” people’s already shaky financial condition even more.

Conclusion

In conclusion, an increase in taxes from the number of individuals is not a compulsory measure, but only one of the options for solving the country’s financial problems. Today, there are many other alternative options for maintaining balance and stability in economic terms. Thus, one of the most effective ways is the introduction of federal funding, reducing some programs, positions, and income, as well as other similar options.

References

Auerbach, A. J., Gale, W., Lutz, B., & Sheiner, L. (2020). Effects of COVID-19 on federal, state, and local government budgets. Brookings Papers on Economic Activity, pp. 229-278. Web.

Bifulco, R. & Lewis, M. (2020). The impacts of COVID-19 on the New York state budget: A preliminary assessment. Municipal Finance Journal: The State and Local Financing and Municipal Securities Advisor, 41(2/3), pp. 75-85. Web.

Greenblatt, A. (2021). State finances. CQ Researcher, 31(8), pp. 1-28. Web.

Snow, D. & Burke, B. (2019). The practice of state budgeting in Massachusetts: The long-term effects of tax limitations and structural imbalance. Municipal Finance Journal, 40(1/2), pp. 77-100. Web.

Statista Research Department. (2021). Main financial goals of U.S. citizens 2020-2021. Statista. Web.