Introduction

Tax is a primary method used by most governmental organizations to collect revenue. Tax cuts are the depletion and changes made to taxes paid by citizens, saving taxpayers money (Martinez, 2017). The government implies many forms of tax cuts, including on assets, revenue, sales, and profit. Expansionary fiscal policy is a form of tax cuts commonly used to end a recession. The pessimistic side of tax cuts is that it reduces government income in the short run, but the trickle-down policy argues that tax cuts pay themselves in the long run. This article will discuss in detail some of the methods used by the Laffer curve to differentiate the interconnection between the proposed tax, current tax, and the anticipated economic growth.

Laffer Curve

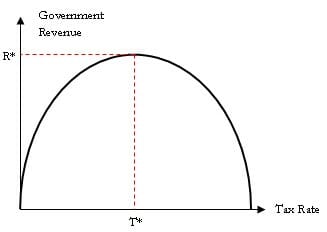

Economist Arthur Laffer introduced the Laffer curve and argued that it explained the link between government tax rates and tax revenue accumulated on the tax rate. The above represents the government revenue on the vertical axis and the tax rate on the horizontal axis. The government earns no revenue at the origin, and as soon as it escalates its tax rates, the government proceeds to increase until point Escalation of tax rate beyond point T, which results in a decrease in revenue. Taxes above level T usually appear ineffective, deriving reduced total tax revenue. Motivation to work hard for the citizens of such a country decreases since they feel that the government is exploiting their income (Amadeo, 2021). At a point where the tax is 100%, the economy’s tax base will be zero, and this will develop to the taxpayers not seeking employment since all of their earnings will be taken by the government (Dobrescu, 2018). The government must keep its superlative tax rate at level T.

A Historical Perspective

A historical perspective on the balance of tax burdens and revenue generation can be given. According to Mitchell (n.d.), throughout American history, there has been a consistent pattern: as taxation is cut, the economy’s rate of growth rises, and the standard of living rise. A well-designed tax system has a variety of unexpected secondary consequences. For example, when marginal income tax rates are reduced, tax revenues increase, and affluent people pay more tax. As a result, lower-income residents suffer a smaller percentage of the tax burden, which should motivate politicians to advocate lower income taxes. Higher tax rates, on the other hand, are connected with poor economic performance and stagnating tax collections.

Examining several instances of tax rate decreases in the United States might provide important information regarding the aforementioned problem. For example, tax rates had been drastically reduced during the first quarter of the twentieth century, falling from more than 70% to less than 25% (Mitchell, n.d., para. 4). Despite the lower rates, personal income tax collections climbed significantly during that time. Back then, Treasury Secretary Andrew Mellon described the situation. He claimed that taxing history reveals that taxes that are intrinsically exorbitant are not received (Mitchell, n.d.). The high rates obviously put pressure on citizens to remove their cash from productive businesses and reinvest it in tax-exempt assets or find other legal ways to avoid realizing a taxable gain. As a result, taxation streams are drying up. Income is failing to bear its fair part of the tax load, and capital is being redirected into streams that provide neither revenue for the government nor gain for the people. Thus, decreased tax rates clearly do not mean lower tax revenue for the US government.

This argument is supported by other historical events. In the 1970s, inflation forced millions of people into increased tax tiers, despite the fact that their inflation-adjusted wages were not growing. President Reagan suggested comprehensive tax rate cuts to help balance this increase in taxes and strengthen the incentive to work hard, save, and spend. As a result, overall tax collections increased by 99.4%, and the figures are much more striking when personal income tax receipts are considered (Mitchell, n.d., para. 7). Income tax collections increased considerably once the economy obtained a clear tax cut.

Another sequence of circumstances in US history clarifies the issue of taxation balance. As a fact, during the previously reported tax reductions of the 1920s, the rich’s portion of the tax burden increased considerably as tax rates got slashed (Mitchell, n.d., para. 1). The same situation occurred during the Kennedy cutting of taxes. After which, “the rich saw their portion of the income tax burden climb from 11.6 percent to 15.1 percent” (Mitchell, n.d., para. 16). Therefore, when the incentives to conceal income are diminished, the wealthy pay more.

Proposals and Arguments for the Tax Cuts

There are also recent proposals and arguments for the tax cuts in tax reform. As such, according to Reed (2019), if corporate investment drives economic growth, one of the smartest things the state can do is remove barriers to investment by decreasing taxes. Workers from across the nation will profit from the employment and income created by new businesses, offices, industries, and other types of productive entrepreneurship. The Tax Policy Center (2020) supports this argument and makes a proposal that reduced taxes boost household demand by raising workers’ take-home income. Thus, tax cuts may increase company demand by raising the after-tax income stream, which can be used to return a profit and extend the activity, as well as by making hiring and investment more appealing.

Politics of Tax Cut Discussions

However beneficial tax cuts might seem, there is a considerable dispute regarding them in tax reform. There are disagreements, for example, over how discriminatory legislation will be and how much focus should be laid on tax cuts over reducing the deficit (Enten, 2017). Most Americans do not prioritize tax reform, which may make it less polarizing than health care. Tax reductions for the rich are controversial, whereas tax cuts for the poor are extremely popular. Outside of a middle-class tax reduction, the public appears to like the notion of a tax cut for all. One of the key issues that Senators are grappling with is how to slash taxes without inflating the budget deficit. Thus, politics make the discussion more about the needs of the different classes and parties rather than public benefit or damage.

Judeo-Christian Analysis

The Bible states that taxes should be paid to the authorities whatever the legal sum is required. The reason for this is that the government is seen as the manifestation and implementation instrument of God’s will. However, it must be borne in mind that the officials, in their turn, should obey God’s law and, thus, protect the well-being and prospering of their people. Hence, it can be argued that tax cuts should be viewed not as a populist political move but as an appropriate measure to increase the equality and affluence of all people.

Conclusion

To conclude, lower tax rates are crucial, but they are not the only problem. Both the amount of government expenditure and how that money is spent are critical. Even when solely considering the taxation system, tax rates are only one element of the issue. If certain sorts of revenue are susceptible to several levels of taxation, as is the case in the existing system, low rates will not alleviate the problem. Similarly, an overly complicated tax structure will impose significant expenses on the productive part of the economy.

References

Amadeo, K. (2021). What is the Laffer curve? The Balance. Web.

Dobrescu, E. (2018). Functional trinity of public finance in an emerging economy. Journal of Economic Structures, 7(1), 1–27. Web.

Enten, H. (2017). The politics of tax reform: 101. FiveThirtyEight. Web.

Mitchell, D. (n.d.). The historical lessons of lower tax rates. The Heritage Foundation. Web.

Reed, E. (2019). 5 arguments for and 5 against tax cuts. TheStreet. Web.

The Tax Policy Center. (2020). How do taxes affect the economy in the short run? Web.