Introduction

An appraisal is the opinion of an expert to estimate the value of a residence. This will definitely vary from domicile to domicile with regard to the material and subject of construction and mainly not into a great deal the beautification as compared to the fabric of the structure. What the appraiser will work on will be giving a detailed report in regards to the size, state of the house on its quality and the purpose of the house. The comprehensive particulars produced by the appraiser will be in use to the comparisons, with the price of the other similar like houses in the market, of the same area. Comparison can be made in terms of the square footage, the exterior manifestation, the services of the facilities and the general condition (Ringhof 261). The market value at some point can be of lower regard when it comes to the comparison of the selling price of some properties owned to homes, in the neighborhood. This causes an adjustment to the value of the home when this comparison is put into consideration. It becomes logical to say that a house of three bedrooms will carry a higher value, than that of two bedrooms that have its condition pettily higher. The same will go apply when we try selling a house that has its exterior recently refurbished, will sell higher, as to that one that has not been modernized keeping all other conditions of the house similar.

Home buying and selling require that those involved take part in the inspection and appraisals of their property being sold, with real estate structural inspection forms and papers that will help in the estimation of the property’s market value as well as determining which price the property is to be sold at. According to the National Association of Independent Fee Appraisers, most of the lenders of property possession appraisals will necessitate the seller to procure and obtain a loan against the real estate property in order to ensure and get indemnity so that the property is sold at its real market worth (Ringhof 261). The difference between a home inspection and a home appraisal is that a home inspection involves the inspector checking the conditions of the major parts of the house being sold, such as the roof, chimney, and other structural features, while real estate appraisal involves the valuation of both the land and the property itself, requiring the appraiser to develop an opinion of the value of the estate through the use of the current market value estimates. According to an interview with a home appraiser:

Field Research and Interview

- Interviewer: What made you get into this type of work?

Interviewee: I wanted to start a part-time business that I could work at my own pace and make extra money in the hopes of someday doing this after I retire. - Interviewer: What is the most difficult to appraise?

Interviewee: The most difficult to appraise would be if the house/subject has unique features that cannot be found in many other homes and also if a house is in a rural setting and there aren’t many sales to compare it to. - Interviewer: What is the easiest to appraise?

Interviewee: The easiest to appraise would be a “Cookie Cutter House” to where it is similar to a lot of other houses in the neighborhood and that there are many recent sales to use as comparables. - Interviewer: How long does it take to do an appraisal?

Interviewee: This varies depending on the complexity of the house. Multi-families take longer than single families. Usually takes anywhere from 6 to 15 hours of work to finish an appraisal. - Interviewer: What determines the fee you charge?

Interviewee: The fees are somewhat standardized for each area but you make adjustments for the distance you would have to travel for the appraisal. A typical single-family home would be around $350 and a multi-family could be around $450 to $600. - Interviewer: Who are your clients?

Interviewee: My clients include primarily Financial Institutions, Attorneys, Municipalities, and Homeowners just wanting to know the value of their home. - Interviewer: Do you like it?

Interviewee: Yes.

There are three parties with a stockholder, whose interests it two things in common, the home and the value. After visiting a home of interest the last question will always be how much? The same goes for the owner who is trying to sell it. They want to get the highest bid possible and the question goes back as to how much should we get for the house? Finally, we have the real estate broker, who at the end of the day he/she is there because of the broking commission, meaning his main interest is the value of the home. All the three parties are doing their best so as on each end of everyone they finally get a good deal, may it be in terms of money or a good house worth of the money spent on it.

This is where the appraiser is introduced in the cycle of the value. A property appraiser is licensed professional personnel with the capability of carrying out property evaluation. They assess the state of the house, the upgrades made to the house and will compare the value arrived at to the market value of the other house in the area (Quinn 47). The appraiser will be an imperative figure in the process of buying and selling homes. His work will also be significantly needed when it comes to getting a home equity loan. He is the person that ensures that there is a relatively fair deal in terms of money and value to the buyer and seller respectively. This process is mainly requested by the banks so as to get a comprehensive report, so as to know the value of the security so that they can compare the value intended to be borrowed and the standby security. There is also another kind of appraiser that is intended to merely get the primarily commercial value of the property and compare it with the neighboring houses and also to know the value of replacing another one.

Single Family House Appraisal

A single-family or detached home is a free-standing residential building that houses only one single nuclear family and is built on a lot that is only slightly larger than the building itself (in order to add a small area around the house). Garages are a common feature for these single-family houses, which are typically detached and stand separately from the main building. According to the Federal Housing Administration (FHA), the construction industry is characterized by these kinds of small-scale houses, which are geographically dispersed all over the establishments, with only the largest players competing nationally. The appraiser at this point goes down to the basement to inspect the foundation of the subject also noting the type of heat supply and hot water tank. After all that is done, that completes the physical part of the appraisal process for a multi-family house. Since this house was a 2 story house 2 interior sketches for each floor layout are required.

Advantages of these kinds of houses include the fact that the entire space surrounding the house is private to the owner of the building and his or her family together with the fact that, in most cases, the building allows the owner to add on to the existing infrastructure in case more rooms are needed. Additionally, there are in general no property management or organization fees that are required with these types of houses in direct comparison with the other multi-family houses such as the condominiums and posh townhouses. Disadvantages of these types of houses include the fact that all the costs of maintenance and repairing are at the expense of the single owner (Racine 421). The houses also lack the provision of such amenities as swimming pools and playgrounds since most of them are built on relatively small plots of land. Additionally, landscape setting and neighborhood upkeep are down to the owners’ cost, making them more expensive to maintain and market.

- Subject data

The first step towards the appraisal of a single-family house is to understand the subject data-the house being appraised. This is done through visiting the house in order to quantify and attain the correct square footage as well as the sketch of the property, through taking photos (of the front, the back and the street). Additionally, the interior details of the house can also be incorporated. This involves visually inspecting the inside of the house as well as any upgrades that might be required before the property can be ready for sale. When the term inspection is used in this case, it implies the visualization of the inside and outside of the house as well as its immediate area (Smith 87). - Sales Comparable Approach

After gathering the essential information on the subject matter (the house), the appraisal turns to find the right comparable to allow the house to be sold. This involves finding homes that have recently been sold within the same region (generally not more than 1 mile away), so as to correctly justify the asking price (Quinn 65). In some cases, comparables can be listings of other houses that have been put into the market for sale but have not been bought yet. The comparables need to be in the same neighborhood as the house being sold as well as be in the same condition in terms of building materials, square footage, their respective designs as well as the facilities therein. - Cost Approach

This involves considerations that have to be put on the price of the land, its depreciation as well as any costs of advancements that have to be made before any new home construction is sold. As he begins to observe the entire exterior conditions the roof, siding, gutters, windows, noting the materials and condition they are in. Then he takes a photo of the front-rear and both sides of the subject. Now it’s time to enter the subject and create a sketch of the interior room layout showing walls, hallways and fireplaces and noting the condition of them also taking photos of all rooms. This is closely needed since the interiors and the condition will directly affect the cost approach despite the prices of the other cities. - Income Approach

These are considerations that have to be made when the property being appraised is a leasing property and is used to provide income for the owner (Racine 421). Accordingly, the income and operating charges are put into consideration when calculating the gross and net cost of the sale of the property. After the comparables are made about the sale price of other houses, the appraiser forms an opinion of the market value of the current property.

Interview Statements with a Single-Family House Appraiser

Single Family House

Start Time: 9:43 am on 11/13/10

End Time: 10:38 am on 11/13/10

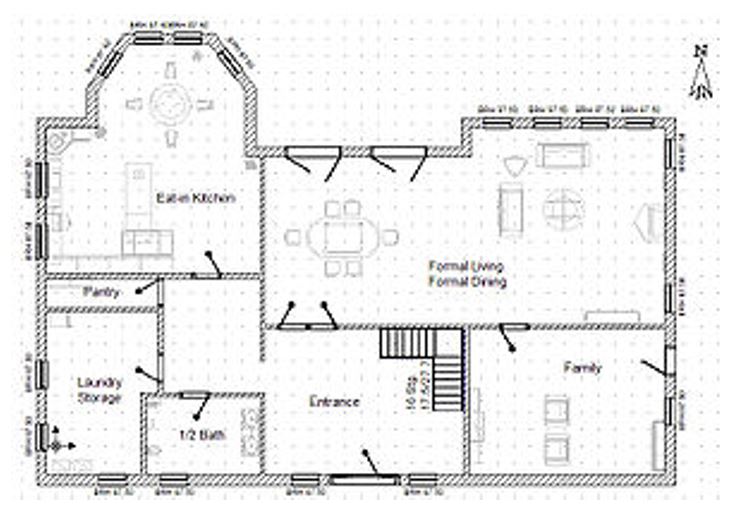

I observed the appraiser take a photo of the street in both directions while in the subject’s driveway then began to measure the exterior dimensions going around the house from front to back creating a sketch of the perimeter. Then he began to observe all the exterior conditions the roof, siding, gutters, windows, noting the materials and conditions they are in. Then he takes a photo of the front-rear and both sides of the subject. Now it’s time to enter the subject and create a sketch of the interior room layout showing walls, hallways and fireplaces and noting the condition of them also taking photos of all rooms. Since this house was a 2 story house 2 interior sketches for each floor layout are required. Then the appraiser went down to the basement to inspect the foundation and flooring of the subject also noting the type of heat supply and hot water tank. After all that is done, that completes the physical part of the appraisal process for a single-family house.

Multi-Family House Appraisal

A multi-family home is tentatively defined as a house containing a number of housing units that normally houses several families who live thereby paying rent or leasing. The sale of these multifamily houses to external investors is significantly different from the sale of single-family houses, especially with regards to the size of the establishment as well as its ownership (Kessler 41). Most of the multi-family houses comprise two or more families living side by side on apartments that are situated one on top of the other. Close to the same time, I observed the appraiser take a photo of the street in both directions while in the subject’s driveway then began to measure the exterior dimensions going around the house from front to back creating a sketch of the perimeter. Then he began to observe all the exterior conditions the roof, siding, gutters, windows, noting the materials and conditions they are in. The owners of the homes are now generally from different families, that reside on the duplexes, with some of the families leasing the apartments for a given amount of time. They can now take the advice

- Contacting a Lawyer, Lender and Realtor

The first step towards selling a multi-family establishment is arranging consultations with a licensed lawyer or realtor in order to advise the homeowner of their intent on selling the property (Carnevale 58). Consultations with the financial institution holding the current mortgage as well as the realtor/lawyer are necessary at this point. Regular contacts with the realtor and lawyer are necessary in order to be abreast of the financial and legal proceedings of the sale. - Apartment for New Owner

Because of the fact that most of the multi-family homeowners reside on the property being sold, then it is compulsory to set aside the residence for its new owners. This is done in order to give the new owners a chance to view the property, giving them a chance to purchase it in the event that it becomes vacant. This also gives the probable customers of the apartment an opportunity to see how it looks like when it is empty. The potential home to be sold has to be tidied up, starting with the top of the house and getting rid of any extra structural components that might reduce its market value. It is thus important to gather and bag all the clutter and litter that might be within the house and its exteriors, as well as cutting all the grass and adding more environmentally friendly components to increase the appeal of the establishment. - Multifamily Home Financial Receipts

It is also very essential to prepare a computerized monetary filing system of any of the rent receipts of the tenants therein as well as any obligatory maintenance and preservations that have to be carried out and attended to. The receipts for electrical repairs and installations as well as gas and water fixtures have to be maintained as well as be correctly calculated for an appraisal (Kessler 56). - Best time to sell

Choosing the right time to sell the multifamily house is paramount to increasing the chances for a fast sale. According to the FAH, the best time to sell houses in both Europe and the United States is in late spring and early summer. It is also important to investigate the presence of new big businesses, such as hospitals and/or schools, which might be taking residence in the area before conducting a sale. This is because most of these establishments will require accommodation for their workers, potentially increasing the sale price of the property.

Interview Statements with a Multi-Family House Appraiser

Multi-Family House

Start Time: 12:07 pm on 11/13/10

End Time: 1:17 pm on 11/13/10

I observed the appraiser take a photo of the street in both directions while in the subject’s driveway then began to measure the exterior dimensions going around the house from front to back creating a sketch of the perimeter. Then he began to observe all the exterior conditions the roof, siding, gutters, windows, noting the materials and conditions they are in. Then he takes a photo of the front-rear and both sides of the subject. Now it’s time to enter the subject and create a sketch of the interior room layout showing walls, hallways, fireplaces and flooring noting the condition of them also taking photos of all rooms. Since this house was a 3 family house 3 interior sketches for each floor layout are required. Then the appraiser went down to the basement to inspect the foundation of the subject also noting the type of heat supply and hot water tank. After all that is done, that completes the physical part of the appraisal process for a multi-family house.

Conclusion

Even though an appraisal is an extra cost that has to be incurred by the homeowner, it is evidently money well spent. By putting in a couple of additional hundred dollars into the supposed sale of the property, a consumer or broker of a building establishment is kept from paying more than the building establishment is worth, while at the same time the seller ends up earning a maximum profit, with regards to the market charge value of the property. Though most of the single-family homeowners ignore the services of property appraisal, they have proved to be very beneficial, taking note of all the health and security concerns and deficiencies that might be present in the house and preparing them for remedying before the next family moves in. appraisals for multi-family houses are much more tasking, as most of them are purchased as financial investments. This might involve the hiring of extra-legal and civil professionals to assist in the purchase, further increasing the move-in condition and market selling value.

Works cited

Carnevale, Rob. The sale of houses. New York, NY: McGraw-Hill/Irwin Publishing Company, 1992.

Kessler, George. The case for teaching house appraisal and establishment examination. New Jersey, NJ: Wizard Books, 2005. Print.

Quinn, Walter. The Home Appraisal Process: Purchases 101. Oxford: Weidmann-Greven-Verlag, 2006.

Racine, Simon. Analysis of Internet sale of single- and multi-family houses. New York, NY: McGraw-Hill/Irwin Publishing Co., 1999. Print.

Ringhof, Alfred. United States District Court District of New Jersey. New York, NY: Kent Gallery, 2001.

Smith, Jeremy. Sparknotes 101 literature. New York, NY: Penguin Classics, 1998.