Abstract

Shoppers Drug Mart is the largest Canadian drugstore chain with 1,350 licensed units opened throughout the whole country. This company provides its customers with high-quality health and beauty products as well as assisted-living services. This paper aims to provide a full review of Shoppers Drug Mart internal and external operations. In the first part of the research, the author examines the history of the company and its founder, Murray Koffler.

The second part investigates the internal structure of the organization, including its mission, vision, and value, target market, human resources management, and marketing mix. The author also provides full SWOT analysis, outlining the main strengths and weaknesses of the company. In the next part, the author investigates Shoppers Drug Mart’s external affairs, concentrating on the competition between drug sellers in Canada, the popularity of the online drug sales, and the major stakeholders of the company.

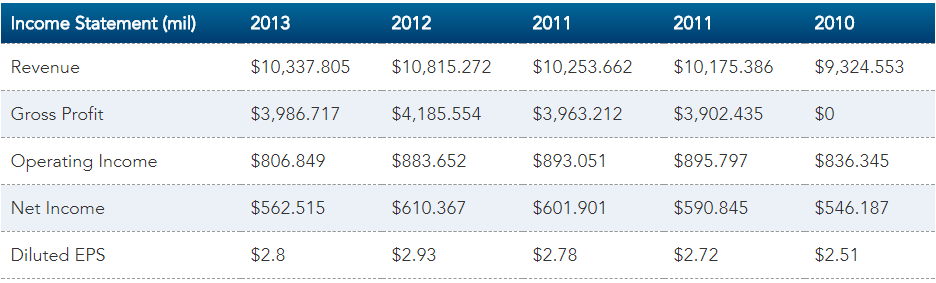

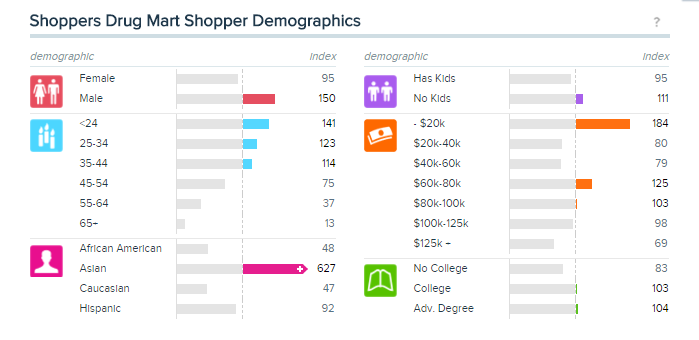

Furthermore, the paper discusses current political and economic issues of the chain, analyzing such points as income statements and balance sheets, the company’s cash flow, and balancing strategy. Finally, the author gives some recommendations for Shoppers Drug Mart, which can help the company to improve its performance. These recommendations focus on such themes as the company’s loyalty program, diversification, and independence from other businesses.

Introduction

Shoppers Drug Mart (SDM) is the largest drugstore chain currently operating in Canada, with 1,350 licensed units across the country. The company has been providing its customers with high-quality products and services for over 50 years, distributing medicine directly to patients. It was founded in Toronto in 1962 by druggist Murray Koffler, who developed the business without partners, with the assistance of his family. The company was called Koffler’s Drugs and was renamed only when Koffler already owned 17 stores. In 2014, Loblaw, a huge Canadian retailer, acquired SDM (Loblaw Companies Limited, 2015).

The company currently employs the best specialists in the pharmaceutical industry, who have advanced knowledge of the products. In addition to independent pharmacies, the company also licenses more than 60 care stores (selling healthy products and providing assisted-living services) and over 50 pharmacies located in hospitals. Another source of revenue for SDM is beauty products that are sold in more than 300 boutiques scattered across large shopping malls. The products include perfume, cosmetics, and skincare products aimed at customers with a high level of income (“Despite difficulties, SDM,” 2014).

The paper at hand is going to provide a business analysis of the company’s operations, including internal, external, economic, and political aspects, in order to understand how SMD functions to achieve its goals and how its competitive edge is created.

Historical Overview

The major events in the SDM’s history are (Loblaw Companies Limited, 2015):

- In 1962, Murray Koffler inherited two pharmacies in Toronto and developed them into a chain of 17 drug stores. The company quickly gained popularity as the owner managed to build a new image of the Canadian pharmacy of the 20th century (e.g. all pharmacists were required to wear white coats to emphasize that the services provided by the company are highly professional).

- By the middle of the 1960s, Koffler had decided to adopt franchising.

- In 1968, the company already owned 52 stores, 33 of which were acquired by merging with Plaza Drugstores.

- In 1972, SDM opened the first Pharmaprix store.

- In 1986, SDM purchased Super X Drugstores–a network encompassing 72 stores.

- In 1992, the Western Canadian chain Pinder’s Drugs joined SDM.

- In 1995, another Western Canadian chain, 24 Bi-Rite Drug Stores, was acquired.

- In 1996, the company opened its first Shoppers Home Health Care store.

- In 2000, the Shoppers Optimum loyalty program was launched to become of the most comprehensive and effective programs ever introduced in the country.

- In 2000, SDM was sold to institutional investors.

- In 2001, David Bloom retired, and Glenn Murphy became the Chairman and Chief Executive Officer of SDM. The company appeared on the Stock Exchange of Toronto.

- In 2002, the company introduced its new, large-scale stores with improved design.

- In 2014, SDM was acquired by Loblaw Companies, and the chain began cooperating with Loblaw grocery stores.

Internal Analysis

Mission, Vision, and Value

The mission of the company is formulated in the following way: “To be the leading drugstore retailer in all communities across Canada by providing superior customer satisfaction beyond expectation, resulting in a hassle-free, feel-good experience.” According to Anitsal, Anitsal, and Girard (2013), its vision is “to be the leader in helping Canadians discover a healthier outlook on life” (p. 9).

The major values that support these statements include (Loblaw Companies Limited, 2015):

- accountability of all company’s operations;

- increased transparency for employers;

- ownership;

- passion for achieving results in product and service improvement;

- the satisfaction of health care needs of the community;

- innovation aimed to increase the quality of goods and services and thereby ensure customer commitment.

Target Market

As has already been mentioned, Shoppers Drug Mart is a multifaceted company that provides numerous categories of products to its customers. They include health-related goods, beauty and convenience products, and food.

SDM aims to attract those Canadians who are ready to pay rather high prices for the best available service and products of the premium quality. Moreover, convenience goods offered by the company are those that people use on a daily basis, which creates high demand. As far as beauty products are concerned, SDM is primarily focused on conscious beauty customers who have a high level of income that enables them to opt for personalized service and elite products (Shoppers Drug Mart, 2017).

The situation is different from medicine and other goods related to healthcare. In this aspect, the company targets not only upper-class customers but various other segments of the population. In fact, their target audience includes everyone, both men and women of all ages, who are in search of medicine that would ensure quick recovery from a disease or mitigation of its symptoms. In addition, SDM is particularly focused on women’s health and wellbeing and frequently launches programs aimed to enhance the health of the Canadian female population.

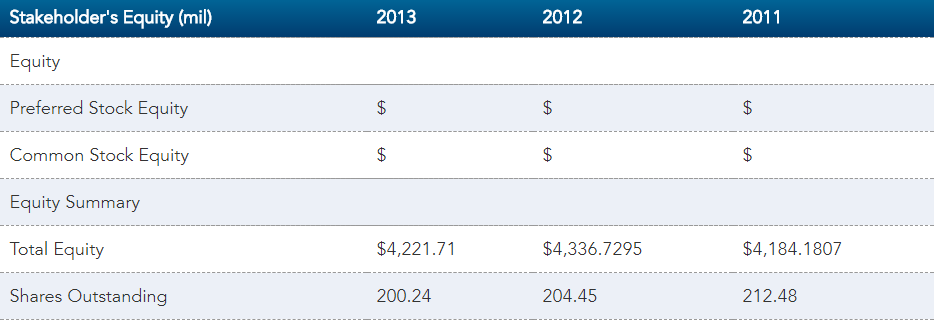

Thus, it can be stated that the company targets all types of customers who have a common desire–to save time purchasing all products they need under one roof without having to look for products in different stores (the shoppers’ demographics overview is provided in Figure 6, Appendix 1) (Warnica, 2013).

Another target SDM has to provide retail services in the pharmaceutical sector in order to improve health services in Canada, thereby exhibiting their corporate social responsibility towards the population of the country. They launch and support community investment programs that are aimed to enhance the quality of life and provide funding to national organizations (Warnica, 2013).

Human Resources Management

The most widespread position the company offers is Health-Watch Pharmacist. It is present in all its stores as the practice of pharmacy (although the focus has been shifted to beauty products) is still taken very seriously. According to Penm, MacKinnon, Jorgenson, Ying, and Smith (2016), there are also such jobs as Pharmacy Assistant and Overnight Pharmacist.

Yet, it is far from being the only sector in which one can build a career. The company needs a lot of store and cosmetics managers to be able to operate all its numerous stores. Besides, in order to ensure that the work of the whole franchise is properly organized and controlled, SDM hires a lot of analytics, marketing specialists, and merchandising managers.

The major HR values of the company include (Loblaw Companies Limited, 2015):

- the commitment of employees to the company mission and values;

- diversity allowing different beliefs, worldviews, and needs to coexist in harmony;

- accountability for the outcome of the job;

- inclusion, presupposing respect to other members of the team and cooperation;

- customer orientation;

- equitability, implying fairness in all practices, policies, and statements;

- accessibility, meaning that everything is placed within reach.

The company offers not only full-time jobs in the pharmaceutical field, category management, logistics, merchandising, finance, human resources, supply chain, real estate, information technology, store management, and business analytics but also part-time positions, such as a cashier, merchandiser, and other roles allowing to combine work with studies.

HR policy of the company is supposed to (Loblaw Companies Limited, 2015):

- provide high-quality client service without any prioritization or discrimination regardless of the segment of the public;

- ensure the prejudice-free selection and hiring practices for applicants;

- reflect racial diversity when hiring new employees;

- maintain a working environment excluding the possibility of harassment or any other type of discrimination;

- guarantee that every case of such discrimination is thoroughly investigated and justice is restored;

- take measures against those who show disrespect to co-workers or clients;

- make decisions about hiring or promotion based on objective criteria that are connected with job requirements, not with personal preferences.

Employees, in their turn, are expected to (Loblaw Companies Limited, 2015):

- abide with the Human Rights Codes and legislation as well as the rules of the company concerning equal opportunities and values;

- promote the company’s vision in all interactions with co-workers and customers;

- report any activity that contradicts SMD values to upper management;

- show respect to all team members and clients and treat them with honesty and courtesy;

- report discriminatory behavior or harassment.

Yet, despite the fact that the company values and beliefs sound rather positive and encouraging, the real state of things is different. One of the major HR problems is connected with the diversity issue. While SDM provides excellent health care goods and services in Canada, its HR policies are contributing to a health disaster in South Africa. There were three recruiting campaigns (in 2005, 2006, and 2007) that aimed to promote racial diversity in the company.

SDM promised huge salaries to pharmacists from South Africa and an opportunity to build a brilliant career in Canada as compared to the continent that could not promise much success in the future. As a result, most Canadian citizens are now treated by professionals from South Africa, including doctors, pharmacists, and nurses. The quality of such care is usually excellent, which increases customer satisfaction. Moreover, SMD has fully achieved its diversity goals (Warnica, 2013).

At the same time, such a proliferation of foreign employment in Canada has brought about catastrophic results for South Africa, where almost 20% of the population is HIV positive. South Africans are currently deprived of their best health care specialists who immediately go abroad after graduation. Patients have to wait for several days to be examined or to get a prescription. Hundreds of pharmacists are needed to dispense drugs, but most positions continue staying vacant also due to the fact that SDM has renewed its practice of foreign recruiting, which leads to a relentless migration of professionals to Canada (Warnica, 2013).

Of course, other countries and huge pharmaceutical companies also promote the practice of giving advertisements for jobs abroad. Yet, such passive advertising campaigns are incomparable with what SDM does. This activity is referred to as “poaching” and consists of targeted and systematic encouragement of brain drain. Minimum twice a year, the company sends a recruiting team to South Africa to attract applicants and interview the most talented candidates.

They are guaranteed a huge number of non-financial benefits (leaving alone minimum earnings of $100,000), which they can never receive staying in their home country. Furthermore, SDM provides assistance in filing immigration applications to facilitate leaving for practicing pharmacists, students, and professors for teaching in Canada (Warnica, 2013).

Although the reputation of SDM was considerably marred by such HR practices, the company is far from being ashamed of this policy. On the contrary, it is proud of it and is going to continue recruiting in developing countries. SDM competitors and critics often accuse it of unethical conduct since the organization is taking advantage of the higher education system funded by taxes that the citizens pay. The company refuses to subsidize scholarships in South African or Canadian schools educating health professionals. This behavior is still acceptable in the industry where poaching has already become a norm, supported by the Canadian Association of Chain Drug Stores (Warnica, 2013).

SWOT Analysis

The key strengths of the company can be summarized as follows (“Shoppers Drug Mart Corp SWOT analysis,” 2016):

- SDM offers a broad range of healthcare, convenience, and beauty products to its customers, which makes the company the leading retailer in Canada. Its success in the market is largely determined by the perfect coordination of all stores that comprise a network. As has already been mentioned, the company has recently shifted the focus from pharmaceutical products to cosmetics and perfume. Still, all its offerings are categorized into three groups: food and home, health and pharmacy, and beauty. The first group includes snacks, groceries, beverages, sweets, pet food and supplies, home supplies, and electronics. The second category offers all kinds of drugs for widespread illnesses and health conditions such as pain, cough, flu, cold, sore throat, and others. Customers can also buy vitamins, food supplements, diet products, fitness food, mother and baby care, personal care, and sexual wellness goods. For those who suffer from diabetes and heart problems or goes into sports, the company offers wellness tools allowing them to calculate BMI, monitoring glucose level, and a heart condition. Finally, the third group includes makeup, perfume, skincare, personal care, and nail care products. There is a separate line of goods designed for men. Both male and female customers can purchase accessories, jewelry, and fragrances. SMD offers not only goods but also numerous services, including pharmacy consultation, vaccination administration, assistance in managing chronic diseases, health examination, lifestyle recommendations, medication review, and others. This diversification policy not only allows the company to satisfy a huge number of customers but also mitigates the risk of becoming too dependent on several products.

- The second major strength of SDM is the Shoppers Optimum loyalty program that offers plenty of benefits to its customers. Spending one dollar on goods or services offered by any store of the chain, a member of the program receives 10 points. Collected points can be spent on goods and services at Pharmaprix, Shoppers on Campus, Shoppers Drug Mart, Shoppers Simply Pharmacy, Pharmaprix Simplement Sante, Shoppers Home Health Care stores, and Murale. All the points can be redeemed for qualifying merchandise. Currently, this program is the leader among loyalty card programs in Canada across all industries, with a new member joining it every 23 seconds. What is even more impressive is that every second, a product of SDM is redeemed for points at the company’s stores. As a result, Shoppers Drug Mart increases customer commitment and attracts new customers enlarging its client base and increasing revenue.

- SDM enhanced its competitive edge through synergy with Loblaw, one of the hugest retailers in Canada. When the company was acquired by Loblaw, the two industry leaders could complement their offerings, organizing a combined store network (comprised of more than 2,300 stores), which allowed satisfying practically every customer with any level of income. At the same time, Shoppers Drug Mart gets considerable financial support from Loblaw and can attract more customers using the brand recall of its parent organization. However, in order to avoid monopolization, the Competition Bureau imposed certain conditions on Loblaw, including a limited number of pharmacies in Loblaw stores and some restrictions concerning interactions with suppliers (which are regularly reviewed by the Bureau) (“SDM’s merger with Loblaw,“ 2017)

- Synergies with the parent Loblaw, a large food and pharma retailer in Canada, acquired Shoppers Drug Mart in 2014. This acquisition brought together complementary offerings of Canada’s leading food retailer and those of Canada’s leading pharmacy and beauty retailer. A combined store network of more than 2,300 stores in now enabling the companies to serve a huge customer base. The transaction has also allowed the companies to offer more choice, value, and convenience to Canadian customers. Loblaw generated sales of C$45,394 million ($35,543.1 million) in FY2015 of which, Shoppers Drug Mart contributed about 26%. Hence, synergy between such huge players in the market offers significant advantages to the customers. In turn, Shoppers Drug Mart will be able to leverage the market reach, financial support, and brand recall of its parent. This helps the company attract more customers and generate significant profits (“SDM’s merger with Loblaw,“ 2017).

As far as weaknesses are concerned, they are (“Shoppers Drug Mart Corp SWOT analysis,” 2016):

- One of the major weaknesses the company has to overcome is the frequent recall of products. The company has recalled numerous goods in recent years owing to various negative effects they might produce. For example, in 2015, SDM had to recall the whole lot of ‘Life’ brand instant-read digital temple thermometers because all of them featured certain product defects that could not be submitted. Examples of incorrect reading were reported to the company by several consumers. The same happened not only to pharmaceutical but also to convenience goods. For instance, in 2015, SDM had to recall seasonal lights since six indoor and outdoor models failed to meet standards set by Canadian Standards Association (CSA), which implied that these lights were hazardous and could potentially cause a fire. Another case of such a failure occurred later in the same year. The company was forced to recall President’s Choice Menu Bran Flakes after scandalous reports from customers indicating the presence of plastic pieces in it. Although these cases are not numerous, they still significantly undermine the reputation of SDM and negatively affect its brand name. What is even worse, the company loses even its most loyal customers.

- The company’s rapid and robust growth for 11 years has also played a low-down trick with it. Between 2001 and 2011, Shoppers Drug Mart managed to expand its selling space from 5 million to 13 million square feet and its annual revenue–from $5 billion to more than $10 billion. Yet, now SDM has to slow the pace simply due to the fact that Canada (although being a huge country) cannot take so many drugstores. SDM now experiences the effects of redundancy it created. Despite the fact that it still remains the most profitable organization in the industry, the company is under pressure because of the lack of global presence. If it wants to keep growing, it will inevitably have to expand beyond Canadian borders.

The opportunities Shoppers Drug Mart may use for improving performance are (“Shoppers Drug Mart Corp SWOT analysis,” 2016):

- According to business analytics, there are rather positive prospects for the health and beauty industry in Canada. It is expected to continue growing in the next five years, which means that SDM reorientation to beauty products was the right strategic move. It has been estimated that this retail market has already exceeded $11 billion due to rapid urbanization, increasing the aging of the county population, and increasing the popularity of the fitness and beauty industry. It is expected that this sum will increase by a minimum 3% between 2017 and 2020, which means that Shoppers Drug Mart is also going to flourish. It currently offers OTC medications, cosmetics, perfume, health and beauty aids, and other goods but is still going to diversify the line depending on the trends that are to gain popularity in the nearest future.

- The popularity of retail pharmacies in Canada is also growing as for most people, they are more affordable and accessible. There has been a tendency during recent years to give preference to retail services since they feature two key advantages: First and foremost, entry points are cheaper; secondly, hours of operations are longer than most hospitals offer. Every year, more and more Canadians opt for convenient health care services and lower prices, which means that the segment is likely to expand and attract new customers. According to industry statistics, during the last year, app. 230 million prescriptions were dispensed (which is 27 million more than the year before). The competitiveness of Shoppers Drug Mart is likely to grow also due to the fact that it provides not only pharmacy services, but also medical examinations, vaccinations for typhoid, hepatitis A and B, whooping cough, shingles, flu, and tetanus (over 950 thousand flu shots were administered in 2016), screenings for glucose levels and blood pressure. After the company was acquired by Loblaw, it conducted over 760 thousand medication reviews, 10 thousand diabetes screenings, 600 bone screenings, and more than 33 thousand blood pressure screenings (“Despite difficulties, SDM,” 2014).

- The growing number of chronic conditions in Canada is another trend that will lead to an increase in the company’s revenue. According to Papastergiou, Folkins, and Li (2016), SDM partners with governmental agencies that assist citizens who suffer from chronic diseases and provides necessary medications and services. In 2015, SDM helped the government in dealing with depression in senior patients.

- Furthermore, the company also partners with the government to help Canadians deal with chronic disease conditions. For instance, in July 2015, Shoppers Drug Mart teamed with the Government of Canada and the CCSMH to help senior citizens deal with depression. Shoppers Drug Mart/Pharmaprix stores offered customers to undergo an examination to detect symptoms of depression and access treatment.

- Finally, the demographic situation in the country during several years indicates that the need for medicine will increase dramatically. The point is that the proportion of people over 65 is growing unprecedentedly fast. Currently, senior citizens already outnumber children between 0 and 14. According to statistics, the current percentage of people over 65 amounts to 16%, and the number is expected to increase by up to 20% by 2024. As a result, the demand for drugs, health services, and various beauty products is going to increase.

Yet, on its way to success, SDM may face the following threats (“Shoppers Drug Mart Corp SWOT analysis,” 2016):

- Canada is currently experiencing a considerable shortage of labor and an increase in labor costs due to increased overtime, a higher proportion of full-time workers, tight labor markets, and increases in minimum salaries. The minimum wage is still on the rise practically in all Canadian cities (e.g. the minimum wage in Ontario was $9.1 per hour in 2015 and increased up to $10 per hour in 2016; in Alberta, it grew from $8 to $9, in Quebec–from $8 to $8.5). Such increase in labor costs may produce a negative effect on SDM profit margin.

- Since the company has to deal with intense competition, it is experiencing a substantial lack of pharmacists. Shoppers Drug Mart now competes with retailers offering non-prescription drugs, banner groups, retail chains, independent agents, supermarket networks and other operators reducing prices or dispensing fees to win competitive edge and penetrate deeper into the market. That is one of the major reasons SDM needs to recruit plenty of new pharmacists as their shortage is not critical and could undermine the company’s growth plans (Penm et al., 2016).

- Regulatory oversight is another threat that the company must take into consideration. Since SDM sells not only non-prescription but also prescription medicine, it is subject to numerous rules, laws, and regulation at the federal, territorial, and provincial levels (setting drug prices, providing public drug plans and drug coverage, determining patient and drug eligibility, etc.), all of which must be followed. These laws may also define producer allowance funding this or that pharmaceutical company receives, restrict permissible drug costs of prescription products or impose fees for sales of prescription medicines to categories of patients indicated in the drug plan. In case patient is prescribed a generic product, the law puts forward requirements determining designation of the drug as interchangeable with a branded one, at the same time controlling its labeling, sale, marketing, storage, handling, packaging, dispensing, distribution, price, and disposal.

- Finally, reimbursement for drug prescription might be reduced or restricted to products on closed formularies by private third party payers due to legislative or any other changes that happen in the pharmaceutical industry. The company is unlikely to increase its revenue if it fails to comply with all new requirements and laws as it may bring about regular audits, fines, product recalls, penalties and even legal proceedings if some customers are dissatisfied. Since it has already happened several times, nothing can guarantee that the company’s reputation and financial performance will stay unaffected in future.

Marketing Mix

The market mix is basically the strategy of the organization outlining its key goals and methods to conduct business operation in such a way that all objectives could be achieved. Developing its marketing mix, SDM tries to meet the requirements of its potential customers, anticipating their future preferences and wishes as they define product promotion strategies and presentation of new goods and services in the market. Moreover, pricing policy should also appeal to consumers and align with their buying capacity; otherwise, the company will quickly lose its leading position (Shoppers Drug Mart, 2017).

Another aspect that has to be considered before SDM marketing mix could be implemented is to ensure that employees are capable of adhering to the chosen strategy and cope with problematic situations that may emerge in their day to day activities.

In addition to this, the company must conduct a detailed assessment of the market competition in order to compare its marketing strategies with those applied by its competitors. This is highly importance since SDM must be prepared to possible price wars and decide in advance what can be done in response to the activities of its major competitors in the market to be able to retain its profits.

The marketing mix consists of 4 Ps, each referring to one of the business approaches of the company (Shoppers Drug Mart, 2017):

- Product: SDM managed to develop a highly diversified portfolio of products and services, which is divided into three major sections: healthcare, cosmetics, and convenience. As a result, the company can meet the demands of all categories of customers. Moreover, it is especially convenient for consumers to be able to access various kinds of goods without having to go to different stores. This increases customer satisfaction and the company’s profit.

- Price: Shoppers Drug Mart prefers high/low pricing strategy to everyday low pricing (EDLP) usually used by other representatives of the industry. This means that it typically charges premium prices on the majority of offered goods and services.

- Place: SDM stores are usually situated in the best places for doing business: the company chooses locations with high traffic, in the city center or other crowded business areas. This allows SDM to charge high prices.

- Promotion: The company uses numerous promotion techniques including promo codes and coupons for discounts, advertisement campaigns, and volunteer work. Its multi-channel strategy is reinforced by media partnerships and sponsorship relationships.

External Analysis

Drug Sales Competition within Canada

In order to understand the conditions, in which the company has to operate, it is necessary to analyze the peculiarities of Canadian pharmaceutical market, which is currently the eighth largest in the word. Canadian market accounts for more than 2% of the global drug market. Furthermore, the market demonstrates a steady tendency for growth and ranges among the top growing pharmaceutical industries (following China, the United States, and Spain), which implies that developing business in Canada is profitable for all players in this market.

As it is shown in Figure 2, it is expected that sales will grow by minimum $2 billion by 2020. Most companies gradually switch from branded to generic drugs, increasing profits. The most problematic issues concern the lack of uniformity in policies and regulations and the protection of intellectual property (Government of Canada, 2017).

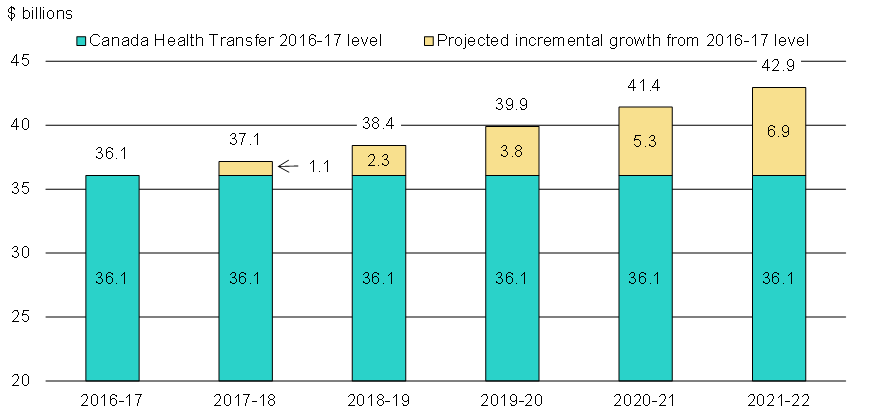

In Canada, the spending on pharmaceuticals is one of the highest in the world due to the percentage of the elderly population. According to Husereau, Dempster, Blanchard, and Chambers (2014), the country currently spends more than 10% of GDP on healthcare and is going to reach $200 billion by 2020.

One of the biggest issues is the increasing competition within the industry as the number of appearing companies is huge, which creates redundancy. Companies have to compete on a lot of factors (including costs, accessibility, productivity, the ability to attract young specialists, promotion strategies, bonus systems, etc.) since any of them can become decisive for attracting customers. Another key success factor in creating competitive edge is the ability of the company to face pressures from global competition (Husereau et al., 2014).

Currently, half of the whole pharmaceutical market of Canada was controlled by ten companies, all selling both prescription and non-prescription medicines:

Table 1. The Leading Companies.

(Government of Canada, 2017).

Online Drug Sales

Online drug sales are gaining immense popularity in Canada as savings on brand name drugs bought online from any legitimate pharmaceutical company can be high. This accounts for the fact that a lot of Americans are currently switching from their home country pharmacies to Canadian ones. Cost comparisons prove that retail prices for several common medications in New York are incomparably higher than in any of the Canadian drug stores providing online purchase services. Customers save 81% on average if they opt for Canadian drugs. The highest savings amount up to 94% (for Lanoxin) (Husereau et al., 2014).

The tendency is not the same within the country since Canadians still prefer buying drugs from physical stores. They can also save money on buying online but such savings refer mostly to drugs with narrow therapeutic index (NTI), which means that the safe dose closely borders with a toxic dose. Thus, customers prefer going to a pharmacist to receive consultation on dosage variability. Another factor that makes Canadians to look on online stores with suspicion is that not all pharmaceutical websites can be trusted. Some of them are fake or sale counterfeit or substandard drugs (Husereau et al., 2014).

SDM is also engaged in online sales in collaboration with one of the top Canadian online shopping clubs, Beyond the Rack. They created a subscription-based site that allows offering deals and rewards on designer fashions, electronics, jewelry, and accessories in exchange for Shoppers optimum points. The members of the new program will receive discounts up to 80% as well as chances to win prizes for every purchase (Warnica, 2013).

Stakeholders

Since Shopper Drug Mart operates in three sectors (pharmaceutical, cosmetics, and convenience goods), it has to deal with the following groups of stakeholders who take part in the competition in each of the three markets (Warnica, 2013):

- Trade groups (TGs) are comprised of retail stores of various types.

- Pharmacies include drug, cosmetics, optical, personal care, and other stores. In many Canadian cities, such stores must be operated by a person with a professional pharmaceutical education.

- Food and general merchandise stores make up the general merchandise stores sector combining the food and beverage stores: supermarkets, beverage stores, and specialty food stores. Since Shoppers Drug Mart does not sell any alcohol beverages, it is excluded from one of the sectors.

- All other sectors include furniture, vehicles, software and computers, building materials, clothes, books, sporting goods, hobbies, and electronic appliances. SDM ranges among minor stakeholders in the last sector since it sells some health appliances.

Besides competitors, other stakeholders include Canadian customers and the government since it provides laws and regulations, which companies have to follow.

Political Issues

Shoppers Drug Mart was never engaged in any activities related to politics. Yet, recently, the company became actively involved in the medical marijuana game. This political move is popular not only in the United States but also in Canada since the Federal Liberals legalized the use of marijuana for medical purposes (IMS Brogan, 2017).

Loblaw was one of the first companies to apply for the approval of the government to sell medical marijuana through SDM chain. The problem is that the company is applying for a producer license, which is harder to obtain, despite the fact that its representatives claim that Loblaw intends online to distribute the drug. The CEO of SDM believes that permission to sell medical marijuana in drug stores will considerably increase safety, quality of care, and access to health products for millions of Canadian citizens for whom the use of this drug is a substantial part of their treatment.

However, it is now impossible for the company to distribute marijuana in its locations since this would require a change in the existing laws. Currently, producers are allowed to sell marijuana only by mail. Another option for patients is to grow it on their own. This made SDM involve in political matters in attempt to convince the government to change the imposed regulation and remove the restrictions. It was expected that this will happen at the beginning of 2017 but the results have not been achieved yet (IMS Brogan, 2017).

For SDM, it is an important aspect as it would allow the company increase its market penetration. The company does not have an international presence, which means that it has to find other sources of revenue. Becoming a front-line dispensary of marijuana, it can become extremely efficient in managing controlled substances, which contribute a lot to its brand reputation.

Economic Analysis

Income Statement

Cash Flow

Balance Sheet

Pricing Strategy

As it has already been mentioned above, Shoppers Drug Mart implements high/low pricing strategy, where a company charges high prices for popular products and later gives discounts or organizes through clearance sales when they lose popularity. It is a kind of pricing is not typically adopted by huge corporations and is more popular among small and medium-sized companies. Still, SDM is successful in it since its stores are located in busy prime locations, which allow charging high prices without losing customers (“The Shoppers Drug Mart formula,” 2017).

Another attraction is created when customers see the difference between the sale prices and the initial one since the prices in SDM stores are generally much higher as compared to other companies. At the same time, sale prices are considerably lower than at any other retailer. Regular sales help the company get rid of products that no longer sell well since there appeared other popular items.

Yet, there are also some disadvantages involved in the use of high/low pricing strategy. They include: increased costs of advertising, price wars with cheaper retailers (which the company rarely wins), high rates of order volatility, and some others (“The Shoppers Drug Mart formula,” 2017).

Recommendations

The following recommendations can be suggested for the company to improve its performance:

- SDM should adhere to its diversification strategy since the competition is rather tough. Increasing the number of product categories, the organization will be able to penetrate new markets and find new potential consumers.

- A loyalty program has to be further developed to support the image of the most successful loyalty card program in the country. SDM needs to offer new benefits and discounts for its most committed customers.

- The company should not rely on the advantages provided by the acquisition by Loblaw as they are minimized with such frequent recalls of products. Instead of this, it would be more reasonable to pay attention to production errors as now too many scandals concerning the quality of SDM’s products have significantly marred the company’s reputation.

- In order to avoid the effect of redundancy created by the excessive number of pharmacies in the region, SDM should shift its focus of attention to global expansion. Now, the company has no global presence, which makes it an easy victim for competitors who do.

- Due to the growing popularity of the healthy life style, it might be profitable for SDM to add fitness products and additives to the list of beauty products that it currently offers.

- The company can also shift the focus of attention from goods to services and increase the number of medical interventions and injections that it can offer.

- It is critical for SDM to leave behind its aggressive recruiting policies. It is unethical to attract people from developing countries since it brings about detrimental outcomes for countries of origin. Another reason for doing this is that such notorious HR practices quickly become known to potential consumers who may change their mind to continue using SDM’s services and opt for another company, demonstrating a more dignified and trustworthy behavior.

- The company should continue its partnering relationships with the government instead of relying too heavily on Loblaw’s support. The larger organization may easily change its priorities and policies, which would mean that SDM will lose its privileges.

- The company will have to develop strategies to address its labor policies. Otherwise, it runs the risk of losing its employees due to a considerable shortage of labor in the country.

- SDM may try to provide scholarships to Canadian students in order to increase the number of pharmacists since now their shortage is threatening.

- The company’s leaders must be more attentive as per its compliance with all regulations and standards of the industry. Penalties and legal proceedings may undermine SDM’s revenue and reputation in future.

Conclusion

It is unquestionable that SDM is currently the biggest drugstore chain that currently dominates the Canadian market. Furthermore, the company has won its reputation due to its high-quality products and services for over half a century. SDM employs the best professionals of the industry, which allows it to ensure customers’ commitment. Furthermore, all the decisive strategic moves of SDM turned out to be successful.

The company has benefited a great deal from the acquisition by Loblaw (since now it can promote its activities under this recognized brand name) and managed to earn a huge revenue when it shifted the focus from pharmaceutical products to the beauty line. Yet, despite the fact that SDM is unlikely to be threatened by any newcomers in the market, the company still has to review some of its policies.

First and foremost, SDM’s reputation is marred by its unjust HR practices as the company fosters brain drain from developing countries. Furthermore, it has other problems connected with excessive reliance on Loblaw, absence of international presence, inability to comply to all standards, etc. This leads to the conclusion that it is high time that SDM made an effort to innovate its practices.

Appendix 1

References

Anitsal, I., Anitsal, M. M., & Girard, T. (2013). Retail mission statements: Top 100 global retailers. Academy of Strategic Management Journal, 12(1), 1-20.

D&B Hoovers. (2017). Shoppers Drug Mart corporation revenue and financial data. Web.

Despite difficulties, SDM increases market share. (2014). Chain Drug Review, p. 149.

Government of Canada. (2017). Pharmaceutical industry profile.

Husereau, D., Dempster, W., Blanchard, A., & Chambers, J. (2014). Evolution of drug reimbursement in Canada: The pan-Canadian pharmaceutical alliance for new drugs. Value in Health, 17(8), 888-894.

IMS Brogan. (2017). Canada’s pharmaceutical industry and prospects. Web.

InfoScout. (2017). Shoppers Drug Mart shopper insights. Web.

Loblaw Companies Limited. (2015). The way we do business: 2015 corporate social responsibility report. Web.

Papastergiou, J., Folkins, C., & Li, W. (2016). Community pharmacy‐based A1c screening: A Canadian model for diabetes care. International Journal of Pharmacy Practice, 24(3), 189-195.

Penm, J., MacKinnon, N. J., Jorgenson, D., Ying, J., & Smith, J. (2016). Need for formal specialization in pharmacy in Canada: A survey of hospital pharmacists. The Canadian Journal of Hospital Pharmacy, 69(5), 356.

SDM’s merger with Loblaw will benefit both parties. (2017). Chain Drug Review, p. 178.

Shoppers Drug Mart Corp SWOT analysis. (2016). Business Source Complete, pp. 1-8.

Shoppers Drug Mart. (2017). Retail formats and specialty services. Web.

The Shoppers Drug Mart formula continues to resonate. (2017). Chain Drug Review, p. 175.

Warnica, R. (2013). Less drug, more Shoppers. Canadian Business. Web.