Introduction

The impact of small and medium-sized enterprises (SMEs) on the economy of a country cannot be neglected. The concept of SMEs is defined as small and medium enterprises depending on the number of employees. In the UK, a company is considered small with up to 49 employees and medium with up to 249 employees (Gledson and Phoenix, 2017, p. 224). With the world constantly changing, the impact of SMEs on the economy changes as well and needs to be continuously evaluated to predict possible consequences.

SMEs in the UK: Overview

A primary way to evaluate the growth and financial contribution of micro, small and medium private organizations to the UK Economy is by looking at the statistics. Statistics show that in 2020, there were more than 5.9 million private businesses, with about 99% being SMEs with less than 250 employees (UK SME data, stats & charts, 2021, para. 1). More than 50% of the UK private sector turnover in 2020 was accounted for by SMEs(UK SME data, stats & charts, 2021, para. 1). SMEs provided more than 16 million jobs which were more than 60% of all jobs in the private sector (UK SME data, stats & charts, 2021, para. 1). As Table 1 shows, most SMEs have up to 9 employees (Ward, 2021, p. 5). Statistics show that SMEs have a crucial impact on the economy and employment in the UK.

Table 1 SMEs in the UK by a number of employees. (Modified from source: Ward, 2021, p. 5)

The latest political and economic factors that impacted the development of SMEs across the world, including the UK, revolve around COVID-19. A recent survey shows that about 80% of SMEs report declining revenues (Albonico, Mladenov, and Sharma, 2020, p. 2). They are mainly concerned about defaulting on loans and their ability to retain employees and supply chains (Albonico, Mladenov, and Sharma, 2020, p. 2). Moreover, the impact on the UK economy is shown by the fact that SMEs are expected to rely on government support. For example, businesses take advantage of the government’s furlough program, which provides 80% of a furloughed employee’s salary (Albonico, Mladenov, and Sharma, 2020, p. 3). COVID-19 has impacted almost all industries and continues influencing SMEs in the country.

Another factor that impacts the development of SMEs in the UK is Brexit. A recent survey shows that about 56% of SME business owners are having difficulties in trading with the EU countries (SME Data Hub, 2021, para. 8). On the other hand, more than 30% of the surveyed say that they have not experienced any impact from Brexit (SME Data Hub, 2021, para. 8). However, research shows that for most of the UK, the effects of Brexit actually started only after January of 2021 and the real impact is to be seen (Marshall, Jack, and Jones, 2021, p. 2). Despite the government being ready to provide help, some businesses report having problems navigating the guidance, for example, finding GOV.UK is “difficult to use” (Marshall, Jack, and Jones, 2021, p. 12). Although some SMEs do not report experiencing much trouble regarding Brexit, there are businesses, especially those exporting to the EU, that have issues.

Analysis of SMEs

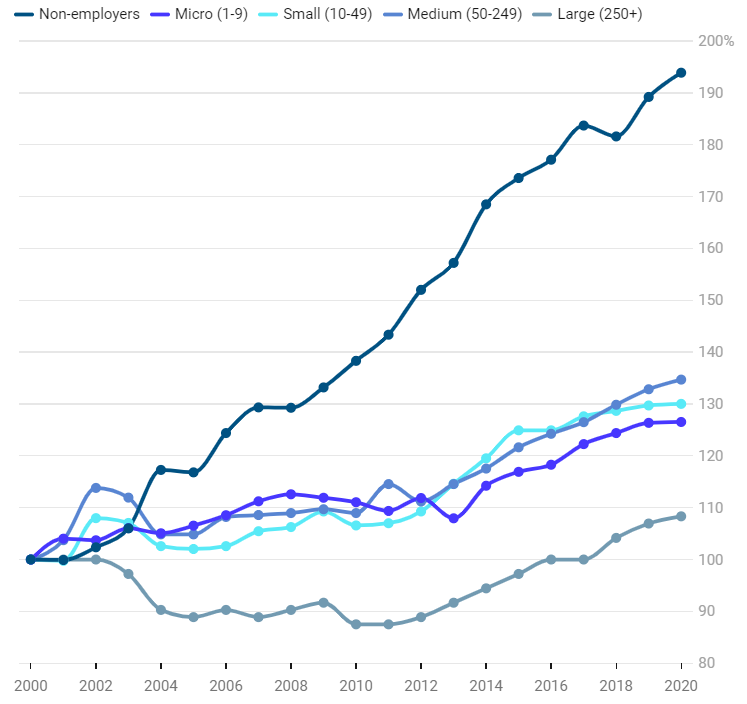

The role of SMEs can be seen by their contribution to the national economy. SMEs account for total revenue generated by businesses and create job placements. Figure 1 shows the growth of businesses in recent years in the UK (UK SME data, stats & charts, 2021). SMEs contribute to the development of different industries from retail to agriculture, from logistics to science. To broaden the views on the contribution of SMEs is important to analyze SMEs from different aspects such as various industries, regions, and countries.

UK Regions

The state of SMEs in Scotland and Wales was analyzed to see the impact of SMEs for two UK regions. SMEs account for about 99% of all private sector businesses in Scotland, providing more than 50% of employment in the private sector (Brown et al., 2020, p. 657). In Wales, SMEs also account for about 99% of businesses; however, 94.9% of those have less than ten employees (Henderson, 2020, p. 5). In 2020, there were 370000 SMEs in Scotland and 209000 in Wales (Ward, 2021, p. 7). Both Scotland and Wales were one of the first regions of the UK to respond to the impact of Brexit assisting SMEs (Brown et al., 2020, p. 657). However, average turnover by businesses in comparison between 2019 and 2020 increased by more than 8% in Wales, whereas Scotland saw an almost 3% decline (UK SME data, stats & charts, 2021, para. 6). The comparison shows that SMEs have a crucial impact on the economies of the two regions taking a significant part of private businesses, with Wales being more successful in operating SMEs in the recent year.

UK Industries

The state of retail and construction industries was analyzed to see the impact of SMEs on the UK. Retail is one of the industries in the UK that had the biggest increase in 2020 (UK SME data, stats & charts, 2021, para. 7). However, the construction industry is considered one of those most negatively affected by COVID-19 in 2020 (Albonico, Mladenov, and Sharma, 2020, p. 2). Table 2 presents more information on businesses in both industries (Ward, 2021, p. 8). With the two industries impacted differently by the end of 2020, the overall impact of their SMEs is also different.

Table 2 Businesses in construction and retail industries. (Modified from source: Ward, 2021, p. 8)

The retail industry plays a significant role in the economy of the UK. In 2020, businesses in the retail industry accounted for 18% of employment and 35% of turnover (Ward, 2021, p. 8). Overall, the retail industry accounts for a third of the UK turnover and 9% of all businesses (Ward, 2021, p. 8). Moreover, in 2020 there was growth in online retail, which influenced small or single person courier companies (UK SME data, stats & charts, 2021, para. 8). The retail industry accounts for an essential part of turnover and employment in the UK and has the ability to influence other companies.

Although the events of 2020 had a negative influence on the development of the construction industry, its impact should not be underlooked. Businesses in the construction industry account for 17% of all businesses in the UK (Ward, 2021, p. 8). Typically, construction workers in the UK are self-employed, meaning they do not affect the number employed in the industry (Ward, 2021, p. 8). With that being said, construction accounts for less than 10% of employment and turnover in the UK (Ward, 2021, p. 8). The impact of the construction industry on the economy depends on specific features of the industry and is vulnerable to external factors.

EU Countries

The state of SMEs in Slovakia and Hungary was analyzed to see the role of SMEs in EU countries. A survey conducted in Slovakia shows that SMEs in the country consist of 64% of micro-enterprises, 24% of small enterprises, and 12% of medium enterprises (Hudáková and Masár, 2018, p. 148). Most SMEs in Slovakia operate in trade, construction, and catering industries (Hudáková and Masár, 2018, p. 148). Business owners in Slovakia identify risks for their SMEs as mostly coming from the market, financial, and economic factors (Hudáková and Masár, 2018, p. 148). Most SMEs in Slovakia are presented by businesses with up to 9 employees and operate in the trade industry with possible risks coming from the changes in the market.

In Hungary, there is also detected a significant spread of SMEs. SMEs in Hungary take over 99%, of which 94% are presented by micro-enterprises (Koloszár, 2018, p. 26). SMEs in Hungary provides about 70% of job placements and mostly and are mostly domestically owned businesses (Koloszár, 2018, p. 26). A Survey conducted in Hungary shows that business owners are most concerned about risks coming from the market, personal, and financial factors (Hudáková and Masár, 2018, p. 154). Like in Slovakia, most SMEs in Hungary are micro-enterprises influenced by the changes in the market.

Recommendations

Recommendations that may be helpful in operating SMEs should be based on mistakes done by business owners and employees. Significant mistakes in operating SMEs revolve around shortcomings of management and lack of information regarding business processes, such as setting financial goals only for the short term (Koloszár, 2018, p. 29). With SMEs taking the biggest part of business in the UK, business owners have to develop strategies on improving the competitiveness of their SMEs. Business owners have to be ready to operate under changing external factors. Identifying internal and external risks for the business and preparing strategies for risk management is also crucial (Hudáková and Masár, 2018, p. 156). For example, it may be helpful to research government policies regarding the support of SMEs. Recommendations regarding SMEs also depend on the industry in which the business operates. For example, for SMEs in the food industry, the training and competence of employees are crucial rather than the support of the management (Koloszár, 2018, p. 29). Business owners have to continuously research the industry and be prepared for changes caused by internal and external factors.

Conclusion

To summarize, the significance of SMEs to the economy of the UK is evident since most of the businesses in the country are presented by SMEs with less than 250 employees. SMEs account for a crucial part of private sector turnover and provide job placements influencing the development of different industries. However, SMEs, as well as the industries, can be vulnerable to political and economic factors, with some having more troubles than others. When businesses have difficulties operating due to external factors, it is important to be aware of supporting policies from the government and how to apply them. With the market changing and SMEs being highly spread across the country, it is important to constantly work on increasing competitiveness. SMEs have to Business owners have to develop long-term strategic plans considering external and internal changes and their possible outcomes to successfully operate SMEs and positively influence the economy.

Reference List

Albonico, M., Mladenov, Z. and Sharma, R. (2020) ‘How the COVID-19 crisis is affecting the UK small and medium-size enterprises’, McKinsey Article.

Brown, R. et al. (2020) ‘Shocks, uncertainty and regional resilience: the case of Brexit and Scottish SMEs’, Local Economy, 35(7), pp. 655-675.

Gledson, B. J. and Phoenix, C. (2017) ‘Exploring organizational attributes affecting the innovativeness of UK SMEs’, Construction Innovation, 17(2), pp. 224–243.

Henderson, D. (2020) ‘Demand-side broadband policy in the context of digital transformation: an examination of SME digital advisory policies in Wales’, Telecommunications Policy, 44(9), pp. 1–13.

Hudáková, M., and Masár, M. (2018) ‘The assessment of key business risks for SMEs in Slovakia and their comparison with other EU countries’, Entrepreneurial Business and Economics Review, 6(4), pp. 145–160.

Koloszár, L. (2018) ‘Opportunities of Lean thinking in improving the competitiveness of the Hungarian SME sector, Management and Production Engineering Review, 9(2), pp. 26–41.

Marshall, J., Jack, M. T. and Jones, N. (2021) ‘The end of the Brexit transition period’, Institute for Government.

SME Data Hub (2021).

UK SME data, stats & charts (2021).

Ward, M. (2021) ‘Business statistics’, House of Commons Library, 06152, pp. 1–20.