Background

The purchasing of a house is one of the most complicated financial decisions people make. It requires significant efforts to choose the most suitable option, taking into account all the current and potential necessities of a family. The vital point is the price of a house and other related expenses, which should be affordable for a family, in view of their budget. Therefore, it is possible to outline the two steps of successful preparation for purchasing. The first is researching the market for the appropriate options according to a family’s needs. The second is developing a budget that would meet the financial opportunities of the family. This paper will discuss the options and choose the most suitable one, providing a detailed budget, calculation of insurance and property taxes, and monthly mortgage payment. In addition, it will examine the benefits and drawbacks of purchasing and owning a home and how the acquisition affects the Gross Domestic Product nationally and locally.

Choosing the Best Option

Living in a world of multiply choices and daily decisions implies that people often have to choose the best among offered options. Usually, it is complicated with budget constraints, limiting someone’s possibility to afford something (Greenlaw and Shapiro). The scenario introduces three distinct houses, one of which should be chosen. As it usually happens, none of the options meet all the requirements. Therefore, it is necessary to apply one of the fundamental principles of economics, which is that “every choice has an opportunity cost” (Greenlaw and Shapiro 29). This concept implies that every option has its value, which can be compared to other items a person desires to purchase. From this position, every potential acquisition is less or more attractive and favorable than another one of the same price, which should be considered before buying to make the best decision.

The mentioned concept is complemented with another significant tool for making decisions which is marginal analysis. It means the examination of the benefits and costs of every option (Greenlaw and Shapiro). It is vital to balance desires and financial opportunities, as additional benefits always have their price. In addition, according to the law of diminishing marginal utility, the more of a good person gets, the less valuable it becomes, which also should be taken into account during the decision making (Greenlaw and Shapiro). The mentioned principles are essential for considering what benefits should be forsaken to fulfill more significant needs.

On the other hand, it is significant not to underestimate necessities or overestimate finances (Fontinelle). This notion refers to the major aim of the scenario, which is choosing the house the buyers love at a price they can afford. It is advisable to search at the low end of the price range to find the sufficient option at minimal cost, making it unproductive to conduct further market research (Fontinelle). Because of the budget constraint and considering the necessity to take a loan, according to the scenario, it should be noted that paying more results in even higher expenses. All the described nuances shall be paid attention to before making a final decision.

The following line of thinking can be built to make the optimal choice considering everything. First, the significant needs of the young couple should be distinguished. Paula and David are hoping to have children in a year or two, which means that they should not count houses that do not have at least two bedrooms. It implies that offer #3 with an attractive price and perfect location that suits the young couple’s taste cannot be an option, as it will not be comfortable after several years. Houses #1 and #2 have two bedrooms, but the location is not that convenient.

However, there are other two points to consider, to deciding between these two offers. It is desirable to have a big yard, where future children will be able to play with their parents and grandparents. Both option has areas available, but the second one is bigger. Simultaneously, the price of the second option is more favorable, as it is $16000 less, which will be a great economy. It can be deceiving that the second option has HOA duties amounted to $110 per month or $1320 per year, which will be equal to $16000 after twelve years roughly. However, this payment will not obligate young couples to pay interest and will be a burden on the budget while resulting in better living conditions. To conclude, it is not possible to satisfy all the needs, as none of the options meet all the requirements. However, house #2 offers comfortable living with children, active leisure, and an attractive price in exchange for the convenience of location.

Benefits of Purchasing a House and How It Affects Gross Domestic Product

There are a variety of advantages, mostly financial ones, of purchasing a house. A new property has always been considered a long-term investment. For instance, according to the article “Advantages and Disadvantages of Owning a Home,” “The Federal Reserve Bank of St. Louis reports that the average price of homes sold in the United States rose 10% from 2014 to 2019”. It implies that after some years, a house can be sold for a greater price. Moreover, owning a personal property enables one to build equity with a flow of time. Federal taxes are also beneficial for ones who purchased a house, as mortgage interest is deductible as interest on home equity loans and some closing costs. Fixed-rate monthly payments are stable and will not increase as well as rent eventually will. In addition, owning a house implies greater privacy, the opportunity to renovate in accordance with specific needs, and stability that renting cannot provide. It is convenient and financially beneficial to purchase a home.

Purchasing a house has several positive influences on local and national Gross Domestic Product (GDP). Housing’s contribution to GDP occurs in two basic ways, which are residential investment and consumption spending on housing services (“Housing’s Contribution to Gross Domestic Product”). The first one implies constructing new structures, producing manufactured homes, and brokers’ fees, while the second one consists of the owner’s imputed rents and utility payments. According to the article “Housing’s Contribution to Gross Domestic Product,” “Residential investment averaging roughly 3-5 % of GDP”, while consumer spending on housing services “averaging roughly 12-13% of GDP“. On the other hand, the housing market also is important for the local economy as building new structures increases the financial flow. Purchasing houses implies that more customers will visit local shops and use services, which is beneficial for an area’s economy overall (“How does the Housing Market Affect the Economy?”). Therefore, national and local GDP is benefited from buying a new property.

Solution for the Scenario

It is possible to develop the budget of the family and calculate the loan for house #2 that would benefit the couple the most. Monthly paychecks amounted to $4800.00 after taxes, while expenses are $2700.00, which implies the available money to spent is equal to $2100.00. HOA dues are $110/month which reduces the balance to $1990.00. The money the couple has available is $25,000 plus $20,000 plus $10,000, which equals $55,000, while the house is offered at $219,000. The property tax depends on an assessed home value, at is amounted to 0.550% annually on average, for South Caroline, where Greenwood County is located (“South Carolina Property Tax Calculator”). Therefore, this type of expense equals $1204,5 annually or $100.375 per month. Simultaneously, average home insurance with dwelling equals $200,000, liability amounted to $300,000, and the deductible cost is $1000, the annual payment is $2,655 or 221,25 per month (Megna). The family has $55,000 minus $1000, minus $3000 for side costs, that is $52,000 available for the down payment. The balance for the month is 1990.00 minus 100.375 and minus 221.25 which is 1668.375 for paying the mortgage.

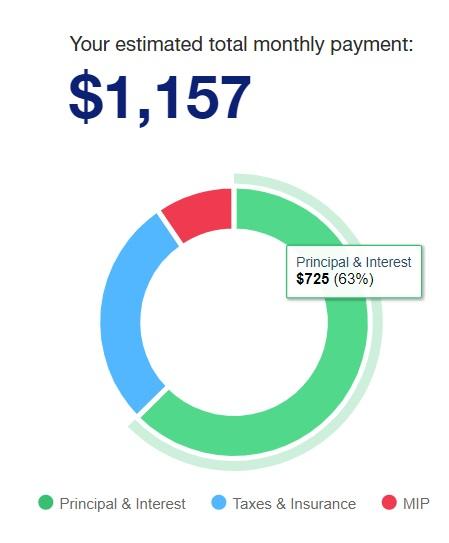

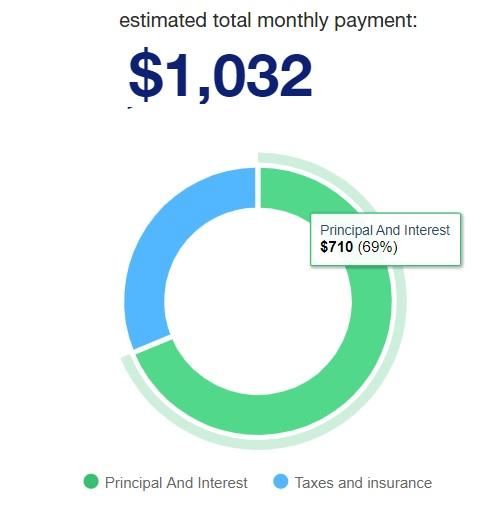

The couple will need a $167,000 FHA or standard loan on a 30-year or 15-year mortgage note. When the interest rate is 3.125%, the total monthly payment, as shown in Figure 1 and Figure 2, is $1562 and $1,157 for 15-years mortgage and 30-years mortgage note respectively (“FHA Loan Calculator”, “Today’s mortgage rates in South Carolina”). FHA has a mortgage insurance payment (MIP) that is $110 and $64 for the first and the second option, respectively, while other expenses are previously explained.

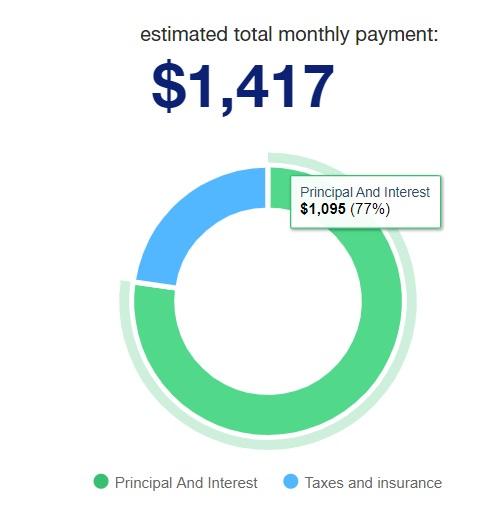

The second loan the couple is qualified for is a fixed-rate mortgage, with interest rates equal to 2.990% and 2.125% for 30-year and 15-year notes, respectively (“Today’s mortgage rates in South Carolina”). As shown in Figure 1 and Figure 2, the estimated total monthly payments are $1417 and respectively (“Fixed-Rate Mortgage Calculator”). That brings to the conclusion that a fixed-rate mortgage is more beneficial as it does not have MIP because the interest rate is lower. A 15-years mortgage note is preferable as it is within the couple’s budget but enables them not to pay more.

References

“Advantages and Disadvantages of Owning a Home.” Incharge. n.d. Web.

“FHA Loan Calculator.” Usbank. n.d. Web.

“Fixed-Rate Mortgage Calculator.” Usbank. n.d. Web.

“Housing’s Contribution to Gross Domestic Product.” NAHB. n.d. Web.

“How Does the Housing Market Affect the Economy?” Bank of England. n.d. Web.

“South Carolina Property Tax Calculator.” SmartAsset. n.d. Web.

“Today’s Mortgage Rates in South Carolina.” Usbank. n.d. Web.

Fontinelle, Amy. Top House-Hunting Mistakes. Investopedia, 2021. Web.

Greenlaw, Steven A., and Shapiro David. Principles of Macroeconomics for AP® Courses 2e. 2nd ed., OpenStax, 2011

Megna, M. Top South Carolina Homeowners Insurance. Insurance, 2021. Web.