This paper is intends to introduce readers to the special edition journal- Observation, Replication and measurement issues relevant to sports economists. Its main interest is on how acquired firsthand information is conveyed to secondary users, the relationships that exist between different groups of persons engaged in sports analysis whose activities are not subject to scrutiny such as peer reviews, the integrity of firsthand data, the replication of this firsthand data, and secondhand deductions that are drawn from this firsthand data meant to address the underlying economic questions. The author’s contribution, however, is on the effects of these issues in his personal work.

The study is mainly on the scientific approach of sports economics in regard to the collection of data, its replication and transfer to secondary users, data measurement, and its interpretation. The author does this by observing disparities in the processes of data collection that distort data to the detriment of the whole sports economics field.

The author recognizes that although sports data is readily available, perhaps even more than in other industries, however, it is almost exclusively secondhand data. This makes its interpretation and use in making economic deductions unreliable. The disparities in both, within leagues and among them are due to lack of full disclosure due to bottle necks in the administration of sports and sports information. These bottle necks filter out valuable data that can be used to balance the equations that are necessary to fully understand the value of the American sports industry. An example is where college teams do not broadcast their finances to their fans as a measure meant to protect their financial integrity and reputation thereof. Although the author acknowledges that his knowledge on ‘metricians’ is limited, however, he observes that attempts to source data on team valuations from Forbes and converting this into a cash flow value and/or ‘Picasso value may lead to over quotes or inflation of the ‘Picasso’ value. He also gives an example of a situation where the true value of the highest paid slugger is computed by holding a collection of factors constant. Even though this is common in economics, it creates a huge margin of error in data collected in regard to the value of individual sluggers and the industry as a whole.

The author tests theories by comparing the standard deviations in player salary tables from 1959 to 2009 as computed by industry players and interpreting the disparities between them. He makes deductions that explain these evident disparities and goes further to explain their effects on the scientific approach of sports economics in regard to the collection of data, its replication and transfer to secondary users, data measurement, and its interpretation

The author has limited his study to player salaries only, although this is only one aspect of the general sports economy. Rodney has also been unclear on many of his alleged findings. An example is on his observation of major league baseball teams’ attendance sheets, which are compulsory for revenue sharing purposes. He doesn’t elaborate on his conclusions and justifies this by quoting a line from the movie ‘top gun’.

The study could be improved by examining other aspects of the sports economy apart from player salaries as the author has done. It would be of particular interest to incorporate sports financing through corporate endorsements and grants into the study. The author’s findings are correct and prove the importance of economists investing in firsthand data.

- “I am attending college on a full athletic scholarship, so the opportunity cost of attending college is zero for me.”

The opportunity cost of attending college is not zero since, if I was not attending college even on a scholarship, I would be doing something else with my time probably even more constructive. Hence, the statement is false. - If the St. Luis cardinals sign Yu Darvish:

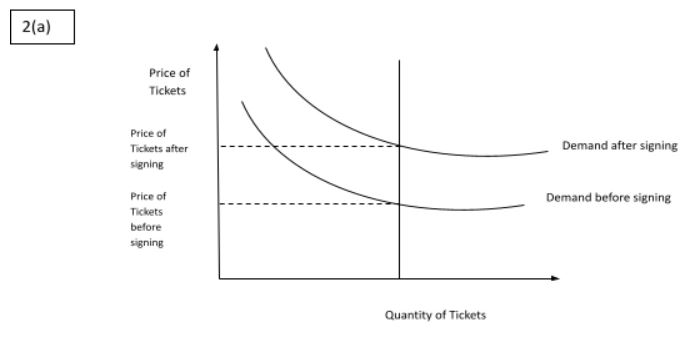

- For a five year contract ticket prices will go up. This is because:

- The signing of Yu Darvish will attract more fans and with the increased demand for tickets it’s logical for them to increase ticket prices

- Also the St. Luis cardinals have to recover the cost of the signing to balance their balance sheets.

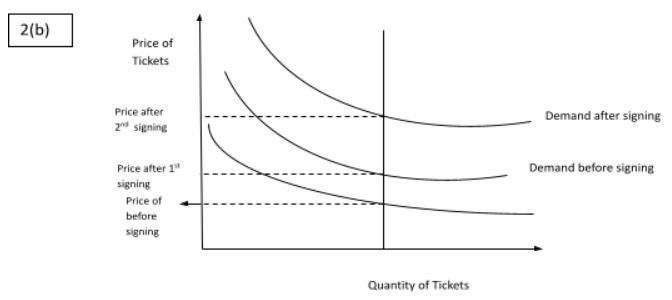

- A further five year contract worth a hundred million dollars

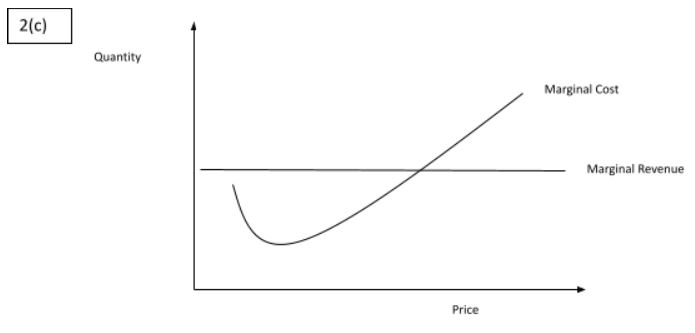

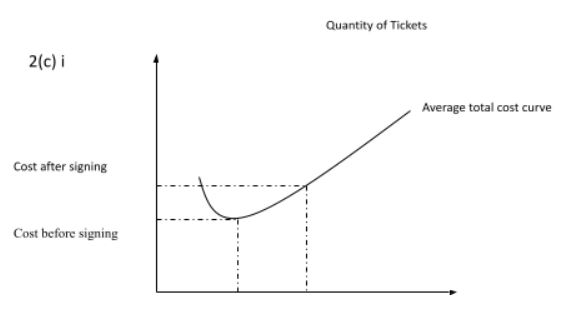

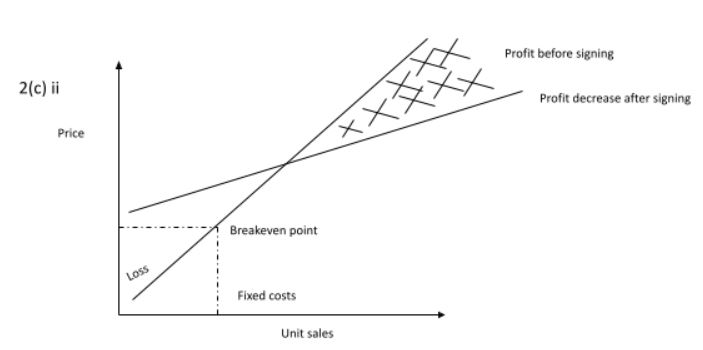

A further five year contract worth a hundred million dollars will lead to ticket prices going up though by a lesser value to cover the additional $30 million added in the contract - The marginal cost will increase since the change in total cost will be higher than the change in demand for tickets especially since the contract cost is recoverable for five years.

- The total cost will increase due to an increase in overheads for the team

- The profits will decrease due to the increase in total cost

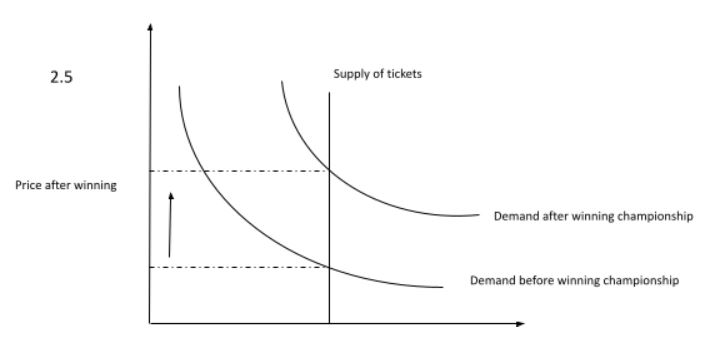

- Teams that win championships typically raise their ticket prices in the next season due to increased demand by the influx of fans.

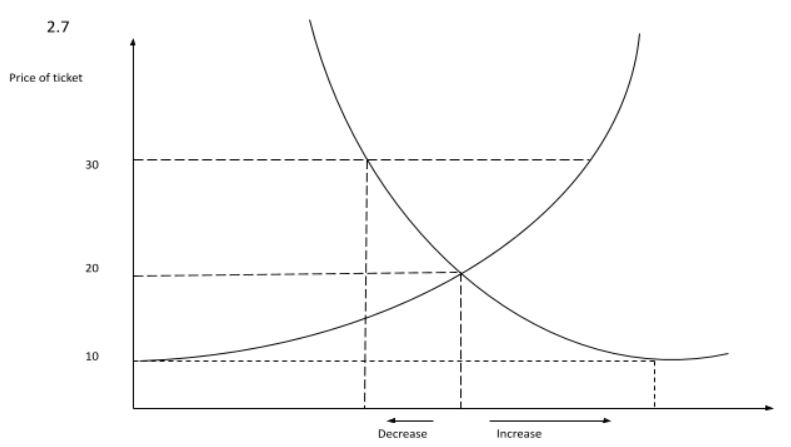

- Suppose the market demand for tickets to see a University of Tennesse women’s basketball game is Qd = 40,000 – 1,000p, and the supply is Qs = 20,000.

- Equilibrium price is where:

Qd=Qs

Therefore: 40000-1000p=20000

40000-20000=1000p

20000=1000p

P=$20 - With a price ceiling of $10 there would be increased demand for tickets in the market due to their low cost.

- If the price ceiling were $30 the demand for tickets would decrease since the price would be increased to $30 to reap maximum profits.

- independent variables would be:

- Quantity of tickets demanded

- Quantity of tickets supplied

- Market price of tickets

- Ticket price ceiling

- Ticket price floor

Graphs and Appendices