Introduction

The Global oil industry is the industry that encompasses the process of acquiring oil through exploration, extraction, refining, marketing and distribution on a global level. Oil is a major source of energy and has been referred to as ‘Black Gold’ because it is vital to many industries and the modern civilization depends on it as a source of energy for various industries as well as fulfilling other energy needs. Oil also acts as a raw material for many other industries including plastics, fertilizers, pharmaceuticals, pesticides and solvents (Nye, 236).

Oil is a source of a large percentage of the global energy consumption. Europe is the lowest dependent on oil, with oil accounting for 32% of its energy consumption. The Middle East is the highest dependent on oil for its energy consumption, oil accounting for 53% of its energy consumption. An amazing 30 billion barrels is consumed globally every year. The developed nations are the top consumers of oil and its products, with the United States consuming 24% of all of the oil consumed in the world. The industry is broken into three major phases: downstream, midstream and upstream (Eckes, 26).

Summary of the study

This study will focus on the world’s oil industry. It will analyze how the oil industry performs its task of obtaining, processing and distributing of oil and its products. It will also focus on the impact of oil in the world’s economy and how the prices of the oil affect the world’s economy. The study will also look into the trends of the oil industry from the past, present and how the trends are likely to change in the future.

The table will also have an insight in some of the world’s leading oil producers, consumers, exporters and importers. This will give a broader picture into the trends of the oil industry in terms of pricing and marketing of the products.

In the oil industry trends, the study will focus on the issue of oil pricing and usages in diversified regions in the world. This will give an insight on how the oil is extracted, processed, refined and distributed to the final customers all over the world.

Oil exploration

The exploration of oil takes use of a process called Hydrocarbon Exploration. Geologists use state of the art technology to detect hydrocarbon whereby they employ the art of exploration geophysics to gather evidence about the presence of hydrocarbon and its extent. The tests are done on the earth surface and even underwater. The areas that are suspected of having hydrocarbons are surveyed using such methods as Magnetic Survey, Gravity Survey or seismic reflection surveys to investigate the characteristics of the sub-surface geology. If there is any interesting feature, commonly referred to as leads, then they are investigate further using the seismic survey. In case of a prospect being identified, it must be evaluated and then it is given the oil company’s criteria of selection. The oil company is responsible for drilling an exploration well which is the ultimate test for checking the possibility of the existence of oil or gas (Penrose, 211).

The exploration of oil is very risky not withstanding the amount of money that is involved. Only corporations that are of substantial wealth and size can afford an offshore exploration and a remote area exploration. The other entities that can afford such exploration are national governments. This is because it involves millions of dollars to explore and the risk involved is very high. Smaller companies are the ones that explore for onshore hydrocarbon deposits and they are relatively cheap because some wells can cost as low as $100,000 United States dollars (Penrose, 235).

Oil extraction

This is the process of removing the oil that can be used from the earth for processing. It involves three stages; primary recovery, secondary recovery and tertiary recovery.

The primary recovery stage involves a mechanism of natural orientation. It involves the oil being displaced by water up the well and the natural gas expansion on the reservoir’s upper side. There is also the expansion of gas that is contained in crude oil and also drainage through gravity which is a result of the oil movement in the reservoir moving to the lower parts from the upper parts. The factor of recovery during on this stage is usually 5% to 15%. All that is necessary after this is connection to an arrangement of complex piping and valving to be transported for processing and storage (Levy, 108).

In the secondary stage, since overtime the underground pressure will fall and there will not be enough pressure to push the oil up the well, they depend on external force in the reservoir. This is achieved by increasing the reservoir’s pressure by injecting fluids. There is the usage of pumps also in the secondary stage of recovery. The fluids used in increasing the pressure may vary from water, natural gas (re-injection), and air or carbon dioxide injection. The recovery factor of the secondary recovery from about 30% depending on the oil characteristic and the reservoir rock properties (Lesser, 158).

In the tertiary recovery stage, the major process is reducing the viscosity of oil so as to increase the production of oil. This involves the use of methods known as Thermally Enhanced Oil Recovery (TEOR). Using this method, the oil is heated which makes extraction easier. The most common form of TEOR is steam injection which involves the usage of a cogeneration plant. It uses a gas turbine which generates electricity and the heat produced is used to heat water to produce steam. This steam is then injected into the reservoir. Another method is carbon dioxide flooding which is also used to reduce the oil’s viscosity. This recovery stage is initiated when the secondary recovery is not capable of continuing enough production. It is also practiced only when there is the possibility of oil being extracted profitably. This stage recovery factor is 5% – 15% (Heiss, 36).

Oil refining

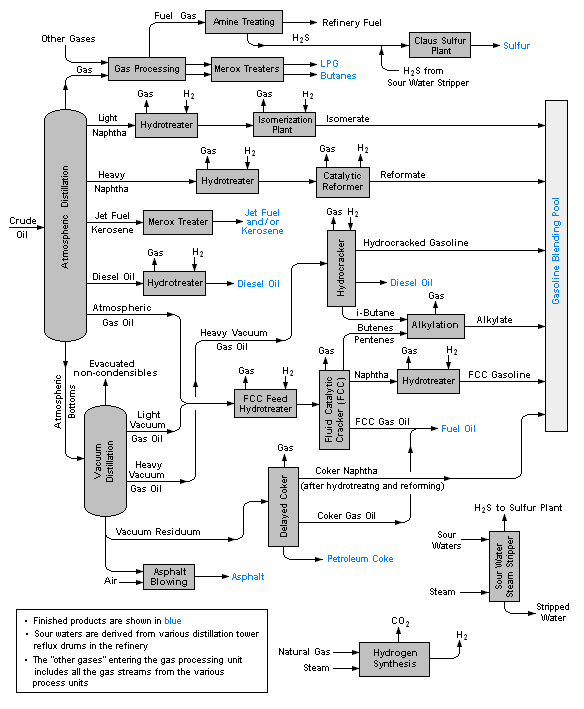

Oil refining is done in an oil refinery.

It encompasses industrial processing of crude oil into useful products which are used as a source of energy. These products include petroleum, diesel, heating oil, petroleum gas, asphalt base and fuel.

World major oil producers

In the world the leading oil producer is Saudi Arabia which boasts of a capacity of 10.72 million barrels of oil on a single day. It is closely followed by Russia with a capacity of 9.67 million barrels a day. The table below represents the world leading oil producers.

World major oil exporters

This list is again championed by Saudi Arabia and followed closely by Russia. Saudi has a capacity of exporting 8.65 million barrels on a single while Russia has a capacity of 2.54 million barrels per day (Koppes, 23).

The table below shows the world leading oil exporters.

Product Usage

The petroleum products after they have been fully processed and distributed are used in very many ways. For example all of the transportation energy in the world today is virtually dependent on petroleum products. In this era of globalization, petroleum is a paramount and very important source of energy before there can be invented other sources of energy.

Petroleum products are also used in other industries as well. There is a good host of industries which are dependent on petroleum products and by products for their manufacturing. A good example is the fertilizers and plastics industries which use the petroleum products and by products as a fundamental raw materials for their production (Levy, 258).

Other industries as well are indirectly dependent on petroleum products for their production. Many industries that use machinery in their line of operation are dependent on petroleum because they have to fuel the machines and other uses like oiling. Electricity generation also depends on fueling and thus petroleum is very vital to any economy (Penrose, 258).

World leading oil consumers

The United States is the leading oil consumer in the world followed closely by China and Japan. The table below shows the leading oil consumers in the world and the million barrels they consume per days.

Current trends in the oil industry

Prices of oil products

The world has witnessed a rising trend in the prices of the oil products which raised concerns about this primary source of global energy. This can be explained by the fact that oil products are the kind of products that are dependent on the global economy and hence they pricing is dictated by the global demand and supply for them. In the recent years, oil production is expected to fall while in the markets the oil demand is increasing globally. The prices of oil products are also dependent on the price of crude oil and that has been rising steadily in time (Clark, 209).

Currently, the oil industry has been faced with criticism over its raising of petroleum products prices. However, as we have witnessed above, the supply of the oil products is seen to be diminishing while the demand is overwhelmingly increasing. It is common economics why the prices of petroleum products are rising by the day. The Oil Producing and Exporting Countries (OPEC) organization have tried to resolve this issue by putting quotas on the producing countries, but in so doing they have also recognized the predicament of rising the cost of fuel. In short, raising the cost of petroleum products is hold in the global economy at ransom and this should be addressed with specific policies on oil production and marketing throughout the world (Heiss, 365).

Usage

In the modern world, petroleum products are virtually used to power all transportation related machines all over the world. Apart from that, other industries are dependent on petroleum products as their main source of raw materials. These industries include pharmaceuticals, fertilizers, plastics and other industries which are numerous to mention. The oil products in the world that are most commonly used include such products like gasoline, diesel, heating oil and jet fuel. Apart from that, other by products are also used in the named industries. So the industry is depended upon by various industries which are very vital to the modern civilization. Over 40% of the energy that is used by manufacturers, households and businesses is derived from petroleum products (Lesser, 198).

Production and distribution

Currently, there are various steps taken from the point of production to the point of marketing. One step is the production of the petroleum products. This step involves the processes of exploration, which is to find the location of hydrocarbon deposits. This process is very costly as it needs both sophisticated technology and equipment and also highly trained professionals. It also involves the process of extracting which is also very expensive and can only be done by very large corporations in some instances like offshore drilling and remote place drilling. It also requires state of the technology and equipment and also highly trained professionals. There is also the process of transportation which also involves trucks or pipelines. The maintenance cost of the trucks is also very expensive whereas the construction of pipeline systems is very expensive as it requires a lot of labor both trained and untrained (Levy, 296).

The next step is refining which is the process of turning the crude oil into usable products like gasoline and asphalt base. This process is also very expensive because it will also use state of the art technology and sophisticate equipment. The employees of oil refineries are also highly trained and thus costly to hire. There is also the workforce who include trained and untrained people who work in the refineries and they are also very expensive to hire. Most of all the maintenance of any refinery is very expensive (Eckes, 55).

The distribution step comes as the last step. This step is involved in moving the finished products to the end consumers. It is also an expensive step because it involves transportation using various forms of transportation. In the third world countries, there have been concern over the usage of tankers in transporting oil products because they are responsible for the deteriorating road systems in the countries. It is also very unfortunate because the governments are hard pressed by their respective budgets that it is very hard for them to repair the roads that have been damaged by the tankers. It is in this respect that oil companies are heavily taxed and hence the burden usually falls on to the end consumer (Koppes, 63).

The current trend in the oil industry can be said to be the root of the high oil prices, which can then be connected to the rising global demand for oil products, heavy taxation, over reliance by the global markets and finally the process of production and distribution of the petroleum products.

Future trends

As far as oil products are concerned, the future trends are dependent on a number of variables. One of them is that there is the emergence of renewable energy which, some experts believe, will phase out the use of fossil fuels. But before then, with the increased usage of renewable energy, the reliance of petroleum products will have to diminish and hence the prices are expected to fall or mostly to remain constant over some years (Patterson, 365).

All the other trends will have to remain as they are now unless new technologies are developed for exploration, extracting, processing and distribution. The international organizations will also have to curb the use of fossil fuels in relation to the rising global climate concern which the burning of fossil fuels are believed to be chief in affecting the global climate.

Oil marketing

In the 1960s the oil industry was dominated by multinationals such as Shell, BP and Mobil. These multinationals accessed around 80% of the global oil and related products reserves. But today, western multinationals are in control of about 10% of the global oil and the rest is controlled by firms that are run by states all over the world (Clark, 236).

The oil sold to governments all over the country especially where no oil is mined or where the country cannot produce enough oil to sustain itself. It sold as crude oil to corporations owned by the governments. Many governments in the world own their own refineries which are run by corporations. The distribution of the products of the government owned refineries is done by the government run corporations. In many countries the government own corporations then distribute the products to the wholesalers and retailers and the production eventually reach the end consumer.

References

Clark, John G. The Political Economy of World Energy: A Twentieth-Century Perspective. Chapel Hill, N.C., 1990.

Eckes, Alfred E., Jr. The United States and the Global Struggle for Minerals. Austin, Texas, 1979.

Heiss, Mary Ann. Empire and Nationhood: The United States, Great Britain, and Iranian Oil, 1950–1954. New York, 1997.

Koppes, Clayton R. “The Good Neighbor Policy and the Nationalization of Mexican Oil: A Reinterpretation.” Journal of American History 69 (1982): 62–81.

Lesser, Ian O. Resources and Strategy. London and New York, 1989.

Levy, Walter J. Oil Strategy and Politics, 1941–1981. Edited by Melvin A. Conant. Boulder, Colo., 1982.

Nye, David E. Consuming Power: A Social History of American Energies. Cambridge, Mass., 1998.

Patterson, Matthew. “Car Culture and Global Environmental Politics.” Review of International Studies 26 (2000): 253–270.

Penrose, Edith T. The Large International Firm in Developing Countries: The International Petroleum Industry. Cambridge, Mass.

World-Oil, (2008), Web.