Marschall’s Economics

Alfred Marshall was one of the most influential economists of the mid-nineteenth century and the beginning of the twentieth. His Principles of Economics brought ideas of supply and demand, production costs, and marginal utility into a coherent economic framework that is still relevant today. What is important to mention is that Marshall took economics to the level of mathematical rigor. To this day, Marschall is considered one of the most influential economists of that time, contributing to shaping the mainstream economic thought.

Demand Theory

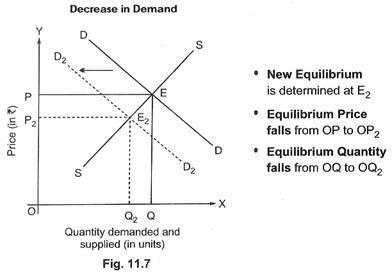

The demand theory is a theory that is associated with relationships between the need (demand) of consumers for a specific good or service and the established prices (Gwartney et al. 44). The more of the goods and services available, the lower the demand for them as well as the equilibrium price. Change in demand refers to any increases or decreases in customers’ need for a product or service due to different demand determinants; however, in this case, the price is kept on the same level.

On the other hand, change in quantity demanded refers to either increases or decreases in the purchased quantity of goods and services, which is associated with the fluctuations in the product’s or service’s price.

Supply Theory

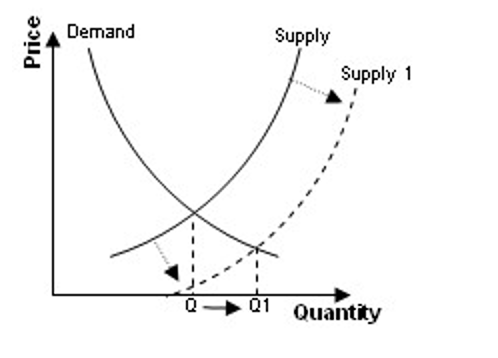

The theory of supply is a theory that states that there is a direct relationship between the price of a good or service and the quantity of it offered to customers for purchasing over a specific time period.

Determinants of supply include increased and decreased supply; the fluctuations can occur due to a variety of reasons ranging from changes in factor prices to political changes. However, changes in quantity supplied depend on only one factor: price.

Effect of Changes in Supply and Demand

Market price and quantity of goods depend on both supply and demand shifts. Any change in either of the mentioned factor will usually result in the immediate impact on equilibrium (“Changes in Demand and Supply and Impacts on Equilibrium”), balancing the new levels of supply and demand with an appropriate volume and the fair average price point for the specific product or service.

Implications of Tax

If customers have alternatives to goods or services with newly imposed taxes, they are highly likely to respond to the price increase by buying that alternative and not accepting the higher prices. Therefore, the tax has a direct influence on supply and demand for products and services; the only beneficial scenario for a business is associated with the lack of alternatives to the product or service with tax, causing customers to purchase them out of necessity.

Black Markets

The notion of a black market is associated with any economic activities that occur outside the channels sanctioned by the government. The transactions usually take place “under the table” (“Black Market”) so that participants can avoid price controls and taxes imposed by the government. Although, black markets have shown to be very harmful to the economy due to the absence of records of economic activities or tax payments.

Usually, black markets develop when governments place restrictions on markets due to philosophical commitment to controlled markets. Currently, governments lack resources to minimize the negative impact of black markets since open economies present even more challenges. However, laws and regulations targeted at controlling the influence of black markets have an impact on suppliers’ willingness to cooperate with businesses, especially when they come from different countries with different laws targeted at controlling the undocumented economic activities.

Works Cited

“Changes in Demand and Supply and Impacts on Equilibrium.” Boundless. 2017. Web.

“Black Market.” Investopedia, n.d. Web.

“Decrease in Demand.” CDN, 2013. Web.

Gwartney, James, et al. Economics: Private and Public Choice. 15th ed., South-Western College Pub, 2014.

“Supply and Demand Curves.” Boundless. 2017. Web.