Introduction

Nowadays, the construction sector seems to be one of the most important and rapidly growing industries in the UAE. This is caused by the extensive development of various other sectors, including hotels, residences, and cooperation with major international companies as well as upcoming events such as EXPO 2020, for example. The sector of oil and gas is also characterized by the increased demand for engineering projects and their implementation.

According to the US Energy Information Administration, the UAE is currently the sixth-largest oil exporter in the world, and it has the seventh-largest proven natural gas reserves. As for the enterprise risk management in the construction sector working for oil and industry, it is possible to note that it encounters operational, strategic, financial, and environmental risks (Olson and Wu 32). There is a need to work on reducing business risks and demonstrating consistency and openness to the public. This report will focus on Target Engineering, its risk management, and potential ways to improve it.

Review of Company

Target Engineering is considered to be an oil and gas contractor specializing in such fields as engineering, procurement, and construction of mechanical steel structures, instrumentation, industrial and marine services. The company covers both offshore and onshore areas. Target Engineering is one of the UAE companies that offers implementation of projects on the basis of engineering, procurement, and construction management (EPCM) contracts (Target).

The implementation of this scheme is quite widespread all over the world due to its transparency, ease of communication of the parties, and uniform distribution of risks. Target Engineering is responsible for all the key stages of a project within the framework of the complex project implementation that usually involves the collection of the initial and permissive documents, design and approval of a project, tendering for construction and installation works, construction management. Having all the necessary licenses, Target Engineering can nominally perform the function of a general contractor.

Target Engineering has a communication channel that proved to be successful on plenty of successful projects with both customers and the construction platforms, which play a decisive role in effective teamwork, especially on a tight schedule. The staff of the company has a rich experience in the design of all stages of commercial, industrial, and residential real estate. Among the most demanded services, one may note pre-project work, feasibility study, preliminary design, development and adaptation of project documentation, preparation of tender documents, supervision at all stages, etc. (Target).

For the successful implementation of projects, the initial and permissive documentation received in full and on time is a guarantee of a client’s security. Since many projects tend to be not implemented on schedule due to the disruption of the schedule for obtaining the initial data, the approval of the project and the receipt of permits compose the top priority for the company expressed in the planning and implementation of the mentioned type of services.

Speaking of construction management accepted in Target Engineering, it is possible to emphasize that there is full management of contractors in construction, planning, control, coordination, acceptance of works and volumes, reporting, and commissioning of the constructed facility. In the area of responsibility in the context of management of construction, the company is suited to special requirements, both for the qualification of engineering specialists and quality control and timing of implementation processes.

As a result of the ability to work according to world standards, the company successfully passed the certification of the quality management system according to the standard ISO 9001 in all spheres of its activity. It also has experience with the Building Research Establishment Environmental Assessment Methodology (BREEAM) standard (Target). Target Engineering also offers individual services that accompany the construction process, including civil and industrial buildings, power, instrumentation, and controls division that specializes in different voltage installations, and marine construction.

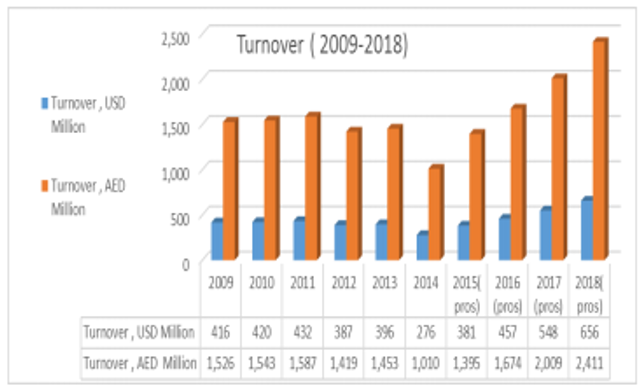

Table 1 presents recent data on the company’s financial performance.

In response to the need of customers to obtain reliable information on investment objects, the company also implemented a set of engineering services, including search and due diligence of land plots, cost engineering, a technical and legal audit of construction projects and projects, project planning, and other services. The corporate view of risk management is aimed at the provision of the safest buildings, working environment, and contracts.

The purpose of risk management adopted by Target Engineering is to ensure and maintain an acceptable level of risk along with other limits and restrictions. This is supported by the need to ensure capital adequacy to cover significant risks, achieving stability of the company, minimizing possible financial losses from the impact of the risks in accordance with accepted development strategy (Target). The adherence to international standards and best regulatory practices in all the activities of the company is also regarded as the corporate strategy with regards to risk.

Evaluation of Organization’s Risk Management

In order to assess how the company aligns its strategy, activities, financial performance, and risk management, it seems necessary to identify key risks that Target Engineering may face. The risks associated with the company’s activities should be taken into account when making any decisions.

- Macroeconomic risks. Unfavorable macroeconomic conditions, instability of the world financial markets, and weak economic growth in the world economy as a whole can lead to a reduction in the costs of physical and legal entities, which can negatively affect the profit received by the company. The company’s ability to conduct business, the level of the expenses for business as well as the prospects for business development both at the national and international level are subject to political and regulatory risks.

- Operational risks. The company is exposed to operational risks, including those related to technical malfunctions, violation of the normal functioning divisions (Olson and Wu 48). The company’s competitiveness may be reduced if it would not develop and implement innovations and provide useful products and services to customers. Target Engineering invests in new businesses and products, services, and technologies, the creation of new properties of existing products and services. All such investments are intrinsically risky.

- Financial risks. The company is exposed to the risk of untimely payment from customers, including from state organizations or companies with other companies. The activity of Target Engineering to reduce the risks of changes in prices for services is subject to market, currency risks, as well as the risk of changes in interest rates.

- Brand and marketing risks. In case the company’s efforts to create a commitment to the brand, its development aiming at attracting customers and increasing their satisfaction and loyalties will not be successful, it is likely to negatively affect the results of its operation.

- Climate change and environmental problems. Oil and gas companies should expect the revision and expansion of regulatory and legal requirements in the field of safety engineering, as well as improving preparedness to prevent and reduce environmental risks (Olson and Wu 49). Industry participants should carefully monitor the risks under consideration and other risks that they face.

Target Engineering’s risk management policy defines the objectives and principles to improve the company’s reliability in the short and long terms. The company’s paramount goal in the field of risk management is to provide additional guarantees that it will achieve its strategic goals through early warning and risk identification and maximization of the effectiveness of management measures.

The main objective of the risk management process is to provide the continuity of the production process and the stability of operations by preventing threats and limiting the impact of external and internal negative factors on the company’s operations. Among other essential objectives, one may note identification and assessment of the significance of the types of risks; assessment, aggregation, and forecasting of the level of significant risks; establishment of limits and restrictions on significant risks; monitoring and control over the volume of the accepted risk; and implementation of measures to reduce the level of the company’s accepted risk with a view to maintaining it within the established external and internal constraints.

By ensuring efficient allocation of resources to optimize the risk ratio and profitability, the company applies capital planning based on the results of a comprehensive assessment of significant risks, tests stability in relation to internal and external risk factors, and, what is also critical, strives to ensure a common understanding of the risks at the company level in general and at individual divisions as well.

At this point, Target Engineering links its strategy, financial aspects, and activities, directing them to the achievement and maintenance of safe production. In particular, the company considers risk management as an integral part of its operation and introduces a risk-oriented approach in all aspects of production and management activities, supporting the latter with the systematic analysis of identified risks. Also, Target Engineering strives to monitor the effectiveness of risk management activities and ensure understanding by all employees of the company’s fundamental principles and approaches to risk management. Adopted by the company, the normative and methodological basis makes it possible to distribute authority and responsibility for risk management among the company’s structural divisions.

According to the overview of Target Engineering’s approach to risk management based on data collected from the official website and other credible sources, one may state that this company values risk prevention and monitoring issues, thus putting the safety on the top priority. Nonetheless, the identified risks may significantly reduce the effectiveness of the company in case of their occurrence, especially in emergencies. Therefore, it is critical to seek ways to enhance the current situation, focusing on modern tools and techniques, one of the most beneficial of which is COSO framework.

COSO Framework Potential

Introduced by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), the Enterprise Risk Management (ERM) framework focuses on ensuring internal controls. The five components of the framework include:

- Control environment. It is the basis for all other components of internal control, including integrity, ethical values, personnel competence, organizational structure, and distribution of powers and responsibilities;

- Risk assessment. This component includes the identification and analysis of relevant risks that hinder the achievement of the organization’s objectives and forms the basis for determining how these risks should be managed (Bromiley et al. 270);

- Control Activities. They ensure that the organization takes the necessary actions in response to identified risks;

- Information and communication (information system). This element provides identification, collection, and transfer of internal and external information in such a form and in such a time that employees can perform their duties;

- Monitoring. This involves ongoing or periodic monitoring and evaluation of the quality of the internal control system, which is necessary for its effective functioning.

To add value to the company, all the mentioned components may be applied to Target Engineering, since internal control is most effective when all controls are built into the organization’s infrastructure and serve part of the organization itself. This allows for avoiding unnecessary costs and responding rapidly to changing conditions and environments. To build an adequate risk management system, Target Engineering may collect accounting and control-analytical information.

Among the issues addressed by the company in the field of risk management, the most important is the determination of the amount of risk that it is ready to take in the course of its activities as well as the development of management techniques for impact on risk, depending on its estimated value. One of the modern approaches to solving these problems is the formation of an internal control system.

Thus, the effectiveness of internal controls directly affects the effectiveness of the organization as a whole. Such an assessment allows determining how credibly the company’s statements reflect its actual situation. Thus, Target Engineering can reduce the risks of the company by monitoring, evaluating, controlling, and making timely management decisions. More to the point, risks can be managed by predicting the onset of a risky event and taking measures to reduce the degree of a certain risk. Summarizing, one should note that in COSO, great importance is attached to the internal environment.

However, a much greater role is given to the monitoring of internal control as a form of follow-up control. As a process carried out by the board of directors, top management, and the rest of the organization’s staff, COSO should be applied to the achievement of goals in the following categories: efficiency and productivity of operations, reliability of financial reporting, and compliance with laws and regulations.

Difficulties and Risk Intelligence

To work with risks and uncertainty, one may use the concept of risk intelligence (RQ) that refers to “the ability to estimate probabilities accurately” (Roeser et al. 604). Uncertainty increases with the growth of unpredictability of business projects. The efficiency of production is relatively easy to measure, but the efficiency of services is not. Uncertainty is, perhaps, the most difficult issue in risk management. When it comes to certain risks, one at least knows what he or she wants.

One can imagine what he or she is aiming at to accomplish the goals set. Uncertainty comes into play when all conceivable outcomes are undesirable, when it is necessary to choose from several negative points, and when even a favorable outcome has extremely undesirable side effects (Wu et al. 5). The difficulty of making such a decision is explained by the inability to compare what is measurable and what is not.

The enterprises that have high-risk intelligence have more effective strategies and vice versa. However, the inclusion of uncertainty in a number of significant factors broadens the scope of management. For a long time, it was believed that organizations and leaders should strive for maximum controllability and predictability, as noted by Wu et al. (6). Nevertheless, one who deals with a factor of uncertainty should adapt to deliberate unpredictability and try to take advantage of any of the possible outcomes. One can apply such tools as scenario planning systems, for example. In fact, uncertainty cannot be addressed completely, and no one can give guarantees that at least one of the presented scenarios will be implemented.

The study of the situation of risk intelligence based on fuzzy logic allows not only to simulate the likelihood of the risk of damage, but also to take indicative, executive, and evaluating decisions on risk management. The indicative solutions make it possible to conclude that the forecasted situation is risky. The executive decisions allow modeling the economic situation in order to reduce the risk of damage while evaluating solutions to provide information on how to reduce the economic risk in emerging circumstances.

In general, the decisions made allow discussing the effectiveness of managing economic risk in specific business conditions (Roeser et al. 607). It should also be noted that the study of situations of economic risk with the use of fuzzy logic requires some experience. This experience is best acquired on the basis of the case-study method, focusing on specific situations of risks based on the real experience of business activity. Thus, it is impossible to prevent all the risks, yet there is the opportunity to reduce them to the minimum.

Recommendations

As applied to project engineering, the following sources are considered to be risks: personnel, infrastructure, design technology, management (management), suppliers, etc. (Hull 104). The principles that guide the management of the company in the development and implementation of certain risk standards are to be primarily determined by the strategy of the enterprise. For example, if an enterprise is focused on ensuring its financial sustainability, the relevant principles that should guide managers of the program will dictate the choice of risk management methods that ensure this financial stability (McNeil 2). Such a specific principle can be, for instance, the principle of the company’s orientation to transfer all risks to the external environment.

It is also possible to recommend that Target Engineering should make a risk management plan annually. It will reflect the costs of risk reduction procedures as well as the risk management activities themselves. In addition, it will contain information on staff responsible for implementing risk management tasks (Lam 87). The risk management plan should also contain a list of measures for the protection of the enterprise, instructions for actions in critical situations, and safety regulations.

In particular, the risk management plan should be drawn up for each project of the company, thus contributing to more detailed consideration of risks in the project implementation process and planning of risk management activities that will be more effective (Meyer and Reniers 75). The frequency of the implementation of a set of actions to neutralize risks throughout the life cycle of the project is to be established. The level of admissibility of risks should also be indicated.

In the planning process, the risk management department should identify risk indicators, identifying a set of parameters characterizing the state of the market. The introduction of such a system will allow checking and accumulating information about negative phenomena. Top and middle managers of the enterprise should use the risk management plan for both strategic management and tactical management.

Speaking of addressing some risks in detail, one may note the importance of environmental factors. In connection with the increased relevance of the social responsibility of business as well as the growing significance of economic factors and control by regulatory bodies, it becomes increasingly obvious that there is a need to shift to managing these risks both to ensure short-term profitability and long-term sustainable development of oil and gas companies (Hull 124). It is for this reason that this report also presents the most effective ways of minimizing risks by improving the strategy of management, investing in the development of technologies, optimizing processes related to various activities, and so on based on COSO framework.

Conclusion

In conclusion, it is essential to point out that Target Engineering is a large UAE-based company operating in the field of engineering, procurement, and construction in the oil and gas industry. Its risk management was evaluated as the effective one, yet having some risks such as strategic, operational, financial, and brand-related. In order to enhance the current situation, it was proposed to use COSO framework that implies a set of elements embracing all the divisions of the company and allowing them to anticipate risks, thus making them less hazardous. Furthermore, uncertainty with regards to risk intelligence was discussed, and a range of recommendations for Target Engineering’s risk management was provided.

Works Cited

Bromiley, Philip, et al. “Enterprise Risk Management: Review, Critique, and Research Directions.” Long Range Planning, vol. 48, no. 4, 2015, pp. 265-276.

Hull, John. Risk Management and Financial Institutions. 3rd ed., John Wiley & Sons, 2012.

Lam, James. Enterprise Risk Management: From Incentives to Controls. 2nd ed., John Wiley & Sons, 2014.

McNeil, Alexander J. “Enterprise Risk Management.” Annals of Actuarial Science, vol. 7, no. 1, 2013, pp. 1-2.

Meyer, Thierry, and Genserik Reniers. Engineering Risk Management. Walter de Gruyter, 2016.

Olson, David L., and Desheng Dash Wu.. Enterprise Risk Management. 2nd ed., World Scientific Publishing, 2015.

Roeser, Sabine, et al. Handbook of Risk Theory: Epistemology, Decision Theory, Ethics, And Social Implications of Risk. Springer, 2012.

Target. Target, 2016. Web.

Target. Target, 2017. Web.

Wu, Desheng Dash, et al. Business Intelligence in Risk Management: Some Recent Progresses. Information Sciences, vol. 256, no. 2, 2012, pp. 1-7.