Introduction

Low taxes and low government spending makes Hong Kong to be ranked among the most successful tax systems in the world. Hong Kong’s tax system withholds Goods and services Tax, pay as you earn not used and focuses on big income sources. This has seen it gain a lot of public support from its citizens who benefit form the move to exempted form paying tax and lightly taxing the middle class (Huxham 1940, p. 12).

Characteristics of Tax System in Hong Kong

The Hong Kong tax system provides practical evidence for developed countrys tax legislation. It is evidence that developed countries can have a tax legislation that allows for a narrow tax base that is tied to operationally separate tax schedules from different sources of income. Hong Kong does not impose tax on the general income tax nor does it taxation rates. Hong Kong also does not tax income generated out side the region. Hong Kong tax rate also favors both the citizens and the government due to its stability while retaining the stamp duties (Huxham 1940, p.12).

Hong Kong tax system provides the developed countries with a practical tax solution. Hong Kong tax system allows the government to provide the necessary social amenities to the majority of its population. The various sectors such as housing, education, health, transport and communications are in relatively good state. Hong Kong, through its tax system, has managed to gather foreign currency to the tune of up to US $ 110 billion.

This can be attributed to the government’s reliance on the land policy of the country, which empowers the government to acquired additional revenue through long term leasing of the land. The demand for land in the region is ever rising ensures that the government profits through land leasing being the sole supplier of the commodity. Though the government raises revenue that caters for the majority of the citizens social amenities, Hong Kong needs to fix the narrow tax base arising form the leasing of land transactions.

According to (Littlewood 1989), in an effort to broaden the tax base and introduce reforms to their tax system, Hong Kong government engaged the public on the possible methods to be incorporated in the tax systems. The public was against the Goods and services Tax (GST), and instead proposed other measures to broaden their tax base. These alternatives included: Carbon tax to help safe guard the environment, tax on products not considered essential, land and sea departure tax and a reduction on personal allowances through salaries tax. Other proposals included by the public and organizations included: Taxing dividends, interests accrued, world wide income of businesses and individuals, increasing rates on tenements. As well as introducing a capital gains tax and increasing progressive elements of Salaries Tax (Cowperthwaite 1971, p.79).

Extent of the Hong Kong tax reform

Hong Kong government has come up with measures to cushion the country against increased expenditure on health care brought about by the increasing ageing population. To achieve this, the government has licensed the Hong Kong Jockey Club to help in promoting responsible practices and reduce the negative effects brought about by such social activities. Horse racing and football betting are some of the many activities the club controls (Littlewood 2005, p.689). This move has enabled the government to control social gambling thereby reducing the obvious harm caused by such activities to the public. The Hong Kong Jockey Club is the biggest employer providing a large sector of the public with a stable source of income.

The government played a crucial role in the provision and maintenance of a clean and safe environment by imposing a HK$ 0.5 tax on plastic bags. This move has seen the country experience positive environmental protection business initiatives. The introduction of the plastic bag tax has seen the country transform into an environmental friendly country with beautiful vegetation.

Cigarette tax in Hong Kong was raised by 50% in the 2011-2012 financial year, which was included in the budget. The chair person of the Hong Kong council on smoking noted that people are likely to avoid smoking due to such control measures introduced by the government. (VanderWolk 2002). The tax imposed on cigarettes deterred customers from purchasing the products. This affected the cigarettes business leading the sellers of the commodity to raise issues touching on the goods and services Tax. (Young 1976).

Tax reforms introduced Hong Kong by the government concentrated on offering relief measures towards people on the low income bracket and the adoption of a reduced and single Goods and Services Tax. (Little 1997). The approaches that the Goods and Services Tax will be use in addressing low-income households and effects on the retail industry through reducing the consumption rates of the public are the important areas of contention in relation to the Hong Kong Tax reform. Offering credit rates to help improve the quality of life among the low income earners, offering credit for the charges associated with water and sewerage services and using cash allowance are some of the possible solutions the will help address the issues affecting the tax reform. Analysis carried out across the country indicates that the Goods and Services Tax has been successfully adopted in not less than 135 regions on a global perspective. (Dancey, Kesler & Resendes 1991.

Goods and Services Tax approach enables the government to collect of tax directly from the suppliers rather than from the consumers. The withholding of the tax from the consumers as a method of revenue collection allows the government effectively to transfer the burden downwards. The method allows the government to ease the burden on consumers while at the sane time collect revenue effectively. The people who agree with low tax policy oppose the adoption of the Goods and Services. They argued the objective of the Goods and Services Tax approach is aimed at taxing the low income earners through with holding.(Dansey 1991).The Goods and Services policy was drafted by accountants and new generation capitalist who believe that, its effective in eliminating instability and uncertainty of government revenue.

Disadvantages of Hong Kong Tax System

Hong Kong tax policy set up by the authorities make it difficult for local and foreign investors to set up a business in the region. Organization for Economic Corporation Development role is to provide a go ahead for the restructuring developments in the international income environment, following its model tax treaty and the interpretation to that treaty (OECD 2006). Every member of the OECD imposes Value-Added Taxes, this however does not include the United States. The OECD operates without international trade agreements the cover Value-Added Taxes. This converts to a lack of neither clear responsibilities of the OECD to oversee the reform for VATs nor the emergence of ecommerce. The organization has hence not been able to successfully introduce any meaningful reform to change the business environment.

There are cases whereby the investor earnings are taxed more than once: When the person exporting neither resides in the foreign country nor conducts any activity on the foreign country. In such instances, the exporter cannot get any income in terms of dividends, income license, or interest income from the foreign country. A withholding tax is introduced when Royalties paid to the parent, interest fees, tax dividends and the source principles and invoked by the host country. The parents home country will also tax all the residents around the world and invoke the principle.

While OECD identifies this as the proper way, it instead looks at the role played by the server to identify the gains that are attributable to the computer equipment. The changes made to the analysis to the OECD model tax treaty agree with the Hong Kong’s views with reference to the concerns about the cross-border income characterizations issues.

OECD (2006) clearly states that a remittance made for any commodity or service should not be subjected to withholding. This means that cross-border sales to buyers of small packages and other electronic transactions will prompt commerce. The importance for the assessment unification of Hong Kong’s Tax System based on the OECD jurisdictions. This is because the international standards make use of the all OECD member jurisdictions average figures as a benchmark.

OECD’s Tax Model with regard to Hong Kong

The role of the OECD is to endorse restructuring endeavors in the international earnings scenario, based on its model tax treaty and the interpretation to that treaty (OECD 2006). When looking into the possibilities of double or triple taxation, one should evaluate the residence and source principles. The first implies that all residents of the country, including: private persons living in the country; and incorporated companies established in the country, can be taxed on their worldwide income, while the latter implies that all the wages earned within Hong Kong, whether by locals or non-residents, can be taxed.

This implies that earnings can be taxed more than once, since there are no measures provided to protect them from double taxation. There are particular instances when multiple taxation can occur. The first instance is in the case of direct exports; whereby the pure exporter is not a resident of the foreign country and has no foreign activity. The exporter does not receive any dividends, license income, or interest income from the foreign country. In such as case, the alien nation cannot bring into play either the residence principle or the source principle. Home taxes only.

The second instance is in a case of foreign subsidiary. When the parent receives income from the subsidiary, a withholding tax is introduced when the host nation invokes the foundation principle and tax dividends, interest fees, or royalties remunerated out to the parent. Furthermore, the parent’s native nation will, as a matter of standard, raise the residence principle, and tax all its residents on their international incomes.

The Departmental Interpretation and Practice Note (DIPN) were issued in the year 2001, by the Hong Kong tax authorities. This showed their willingness to put into play neutral tax rules to e-commerce. The role of the DIPN was to ensure that all businesses would be equal in terms of taxable revenues. One of the characteristics of the DIPN is that an administrative board of review or court can overturn it, since it is not a binding authority. The OECD suggests that there are particular instances when the permanent establishments can be constituted by just the servers; an opinion that is not shared by the DIPN. The Hong Kong domestic law defines a permanent establishment as the combination of physical space ad personnel.

According to the OECD (2006), the correct procedure to identify the profits that a server based in Hong Kong is attributable to is by looking into the product and location (what and where) of the actual business, that produced the profits, as opposed to the electronic procedures. While the OECD declares this as the proper way, it instead looks into the role played by the server, in order to identify the gains that are attributable to the computer equipment.

The modifications made to the commentary to the OECD model tax treaty agree with Hong Kong’s views, with reference to the concerns about the cross-border income characterization issues. These modifications require that the substance of the electronic transfer be thoroughly checked, in order to identify whether the taxes on the payment should be withheld.

According to the OECD (2006), a payment made for a product or service is not subject to withholding. However, withholding as a royalty payment applies in the case where a payment is made to seek permission for the use of copyrighted material. This implies that cross-border sales to patrons of shrink-wrapped software, and other e-commerce transactions will instigate commerce, as opposed to royalty income. This is because the latter would be liable to withholding.

The need for a unified tax system in Hong Kong

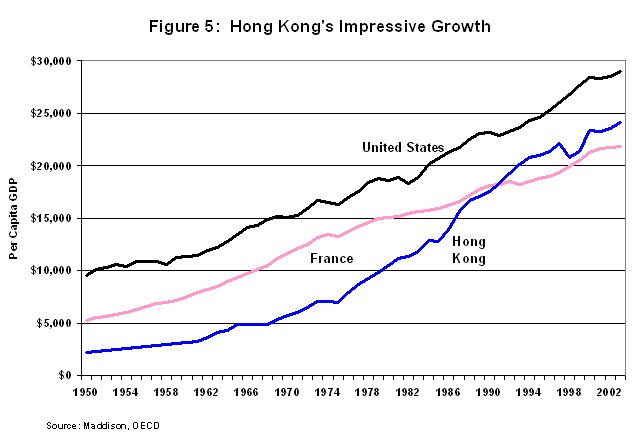

Business transactions between financial institutions and telecommunications across countries will be improved with the adopting of a unified tax system. Hong Kong’s inclusion will play an important part in the development of an improved tax system aimed at addressing trade at the international level. (Brooks 1992). Hong Kong stands to benefit from a unified tax system as it will serve to increase the competitive power of the country at a global level (VanderWolk 2002). This is because Hong Kong can open up its region to the world by unifying the tax system to allow for international trade. The Hong Kong tax system allows it to more money than the federal tax system in the United States. The tax system has allowed to experienced tremendous growth a shown in the table below , its per capita GDP has risen form approximately $2.500 to over $27,000.The current tax system in Hong Kong is largely depended on tax revenue form property and income. According to OECD, the tax system relies much more than the correspondent proportion of revenue in the OECD member countries (OECD 2006).

It is clear that the current tax system used by the Hong Kong authorities is not the best compared to the other tax systems used in the rest of the world. The answer to the debate emerging from the Hong Kong tax system does not only depend on a technical answer, the adoption of the tax system that is politically acceptable and technically efficient. Hong Kong needs an objective broad tax base that will produce enough avenues for tax revenue. The most important solution for the tax issue for Hong Kong is for the authorities to broaden the tax base.

Conclusion

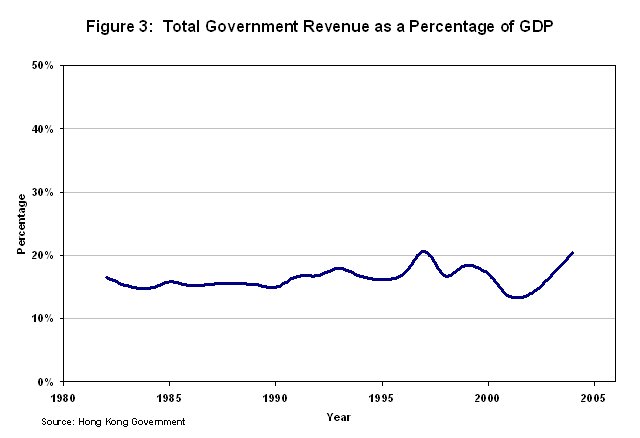

The rules pertaining to deductibility are appealing, as indicated in figure 1, whereby the government revenue is about 20% of the GDP (Littlewood 2007).

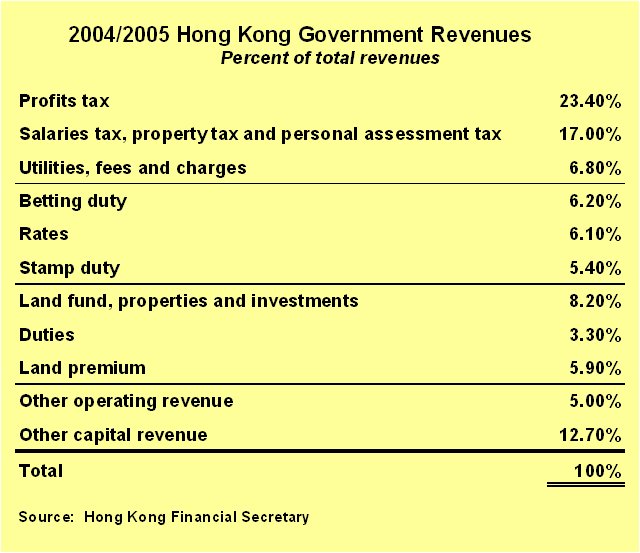

The Hong Kong tax system allows it to collect about 20% of GDP, which makes it better than the federal tax system in the US, which is just above 18%. This is amazing since the tax system of the former has low tax rates and minimal income double-taxation, as can be seen in figure 2 in the government revenues for the period 2004/2005.

Owing to its tax system, Hong Kong has experienced tremendous growth as seen in figure 3, whereby per capita GDP has risen from approximately $2,500 to well over $27,000 (Littlewood 2007). This growth has been achieved over a period of several decades, during which the flat tax system was in implementation (Zee, Holland & Welling 2004).

The current tax system in Hong Kong is observed to be profoundly dependent on tax revenue obtained property and income. According to the data provided by the OECD, this reliance is much more than the correspondent proportion of revenue in the OECD member countries (OECD 2006). The solution to the debate between the Hong Kong government and its people on the inefficiency of its tax system does not rely solely on a technical answer, rather the adoption of a tax system that is politically acceptable and technically efficient. It is evident that the present tax system used in Hong Kong is not adequate in comparison with the tax systems used in the rest of the globe.

It is necessary to view the alternatives that are steady with regard to the international experience, as well as those that do not undercut international competitiveness. This move is emphasized by the advancements in international pressure on both tax rates and types of taxes. What Hong Kong needs is an impartial and secure broad tax base that will produce sufficient channels for tax revenue, that will be consistent.

Recommendations

The most prudent option for Hong Kong to broaden its tax base is a consumption tax rate that is significantly low; below 4%. Such a tax rate would be advantageous since it can broaden the tax base in impartial way, according to international benchmarks. In addition to this, such a tax rate is adequate enough to meet the extra revenue that is needed, without putting into risk the low tax status in Hong Kong., as well as its international competitiveness. Other benefits of a broad tax base include consistency, reliability and continuity into the future, and its ability to tackle the concerns raised in the current Hong Kong tax system (KPMG 2011).

A broader tax base only seems to be possible only with the considerations of a GST. Other options are likely to interfere with the tax design principles, as well as the stipulations of reference of the Advisory Committee, which would pose challenges in sustaining the international competitiveness and low tax rate environment in Hong Kong (KPMG 2011).

References

Professional Journals

Cowperthwaite, J., 1971, Hong Kong Hansard, Budget Speech, pp. 79.

Haddon-Cave, P., 1979, Hong Kong Hansard, Budget Speech, Annex 15, pp. 600.

Littlewood, M., 1989, Consultative Paper: Sales Tax, Hong Kong, Hong Kong Government Secretariat.

Littlewood, M., 1997, HKLJ, The Taxation of Manufacturing Profits: A Re-interpretation.

Littlewood, M., 2005, How Simple Can Tax Law be? The Instructive Case of Hong Kong, Tax Notes International, pp. 689.

Littlewood, M., 2007, The Hong Kong Tax System: Key features and lessons for Policy Makers, Prosperitas , 7(2), pp. 4-19.

Littlewood, M., 2010, The History of Hong Kong’s Troublingly Successful Tax System, Taxation Without Representation.

Miners, N., 1991, The Government and Politics of Hong Kon, Hong Kong: Oxford University Press.

OECD, 2006, Towards a Level Playing Field: 2006 Assessment by the Global Forum on Taxation, Tax Cooperation.

Academic Books

Brooks, 1992, the Canadian Goods and Services Tax: History, Policy and Politics, Australian Tax Research Foundation

Dancey, K., Kesler, R. H., Puthon, K., and Resendes, R., 1991, A Guidecto the Goods and Services Tax, 2nd Edition, CCH Canadian Limited

Hall, R. E. & Rabushka, A., 1995, The Flat Tax, Stanford: Hoover Institution Press.

Huxham, H. J., 1940, Report of the War Revenue Committee, 12.

Kaldor, N., 1955, An Expenditure Tax, London: Allen & Unwin.

Rabushka, A., & Rose, M., 2000, The Flat Tax: American and European Perspectives, Massachusetts: American Institute for Economic Research.

VanderWolk, J., 2002, The Source of Income: Tax Law and Practice in Hong Kong, Hong Kong: Sweet & Maxwell.

Welsh, F., 1997, A History of Hong Kong, London: Harper Collins.

Whiteman, P. G., 1988, Whiteman on Income Tax, London: Sweet and Maxwell.

Reports

Button, k., 2008, The impacts of Globalization on International Air Transport Activity; past trends perspectives

Hong Kong Special Administrative Region, 1999, Inland Revenue Department, HKSAR – Annual Report 1999-2000

KPMG International Tax and Legal Centre, 2001, KPMG Global Tax Notes 2001: Corporate Tax Rate Survey –2001

KPMG. (2011). China’s 12th Five-Year Plan: Hong Kong Tax Proposals. Hong Kong: KPMG China

Willoughby, P. & Halkyard, A., 1993, Encyclopaedia of Hong Kong Taxation, Hong Kong: Butterworths.

Young, S., 1967, Report of the Inland Revenue Ordinance Review Committee Part I. Hong Kong: Government Printer.

Young, S., 1976, Report of the Third Inland Revenue Ordinance Review Committee, Hong Kong: Government Printer.

Zee, H. H., Holland, G. & Welling, M., 2004, Policy and Administrative Issues in Introducing a Goods and Services Tax: Further Considerations, Hong Kong SAR , pp. 9.