The main difference between the weighted average costs of capital and the weighted marginal cost of capital is that WMCC is the new or the incremental cost of new capital to be issued by a company. This capital is to be issued or raised at a new cost according to the target capital structure which is laid down by the management of the company, while WACC is the cost of capital of existing capital both debt and equity.

In brief weighted marginal cost of capital is the weighted average cost of new capital and it maintains a certain capital structure. To distinguish between the weighted average costs of capital and the weighted average cost of capital addition capital is considered. In both cases is under WMCC and WACC two conditions that are made that is the investment projects under consideration will not change the riskiness of the company and the financial policy of the firm will remain unchanged. Therefore, component costs can’t change because of undertaking the new investments by a company (Brigham and Daves, 2010).

However, a company may wish to change the component by taking up more debt or equity to finance the new investment. Thus at a given point of time, the weighted average cost of new capital will remain the same for all projects and can be represented by a horizontal line when it is graphed. But it should be noted that the component cost of equity can change when new funds are raised externally or different form debt is sourced. When a company exhausts all retained earnings, it may issue new shares whose cost will be slightly more than the cost of retained earnings because of the underwriting cost(Brigham and Daves, 2010).

- Break-even point Schweser satellite inc.

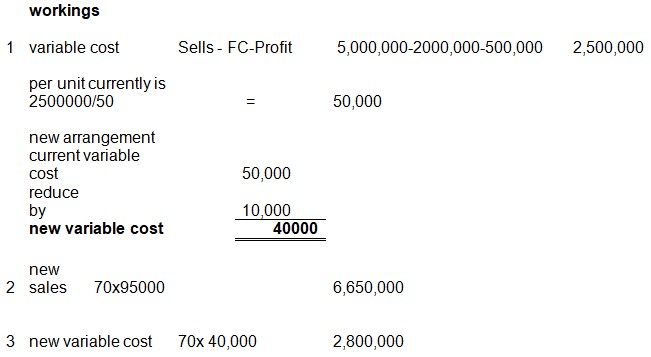

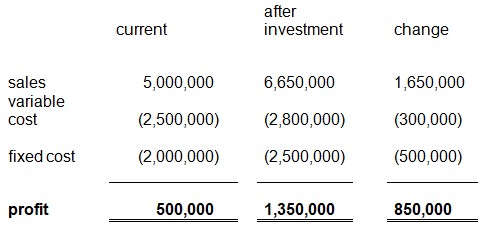

The incremental profit was $ 850,000

Therefore to determine the viability of the project, the current rate of return on equity is compared with the projects return on investment.

Thus incremental profit/Investment is compared with 16% which is required by equity

Return on investment = 850,000/4,500,000 x 100 = 18.89%

This means the investment should be made has it gives high return as compared to the existing return on equity.

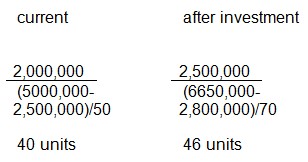

- Break event point for the project is calculated as fixed cost/Contributed margin per unit

From the above calculations it clear that break even point increased.

- The new situation will expose the company to more risk because it will be required to produce more to break even. This is because the higher the break even point the riskier the firm is.

The Proposed Investment

From the analysis carried out in the excel attached the company wealth will be improved because the Weighted Average Cost of Capital and Weighted Marginal Cost of Capital shows the new undertaking will have a return that the current business operation. The cost of raising new capital is relatively cheap as compared with the cost of the existing capital. The Company can use its weighted average cost of capital which is the discount rate for discounting the future cash flows from the investments. Cost of capital to a firm is generally defined as the opportunity costs of investors for making their investment in the firm WACC can be represented by the following formula: (Miller, McClure, Durkin and Wolff, 2004); Myers, 1974). WACC = were + word

Where we are defined as the weight of equity, re is defined as the cost of equity, wd is defined as the weight of debt, rd is defined as the cost of debt. When I was calculating the WACC and WMCC I made the following assumptions

- The target ratio for the financing elements will be 45% debt and 55% equity.

- The costs of the various elements given will continue and will not change due to the change of financial environment.

The cost of capital that will be used by this company in evaluating capital projects is 10% while WMCC is 9%. It remains valid so long as the factors are kept constant well as assumptions made are maintained.

In consideration of the analysis and calculation, it will be prudent to raise funds from the named sources to purchase the company. This will take the company to the next level and make us market leaders in the environment.

List of References

Brigham, E.F., & Daves, P.R. (2010) Intermediate Financial Management, (10th ed) ISBN: 978-0-324-59469-0 or 0-324-59469-0.

Miller, G. E. McClure,, D., Durkin, M and Wolff, L. (2004). Effective Management of Information Technology for Multi-Mission Organizations. Web.

Myers, S.C. (1974). Interaction of Corporate Financing and Investment Decisions – Implications for Capital Budgeting. Journal of Finance, 29:1-25.

Appendix