Abstract

The high number of foreign students studying abroad implies that these students are introduced to large sums of money without having any knowledge of personal financial management. This paper investigates the overseas students’ awareness of money management in Glasgow International College (GIC) or English as a Foreign Language Unit (EFL). The study states that almost 85% of students do not have the basic financial skills to manage their own finances. The results were based on a questionnaire in which a sample of 50 foreign students participated. The results of the study confirmed the literature review in which the reasons for incorrect management can be related to the availability of parental support and the reliance on one’s own perceptions. Additionally, buying luxury items was seen among the top items of students’ spending items. The paper proposes interventions in the form of educational courses in personal financial management, informational brochures, and facilitation with finding part time jobs, along with informing the students regarding the existent standards for part-time jobs.

Findings and Discussion

This part of the paper analyzes the results obtained from the survey, examining the degree to which the results reflect the financial knowledge of the respondents.The findings of the survey were expected, although contained some contradicting results. The gender distribution for the 50 participants was divided as 60% and 40%, for females and males respectively, see Figure 1. All of the respondents preferred to use cash paying for their shopping expenditures. This finding combined with the distribution of answers regarding the monthly checking of bank statements or credit card reports, where only 40% of the respondents stated that they do so, might lead to an interesting result.

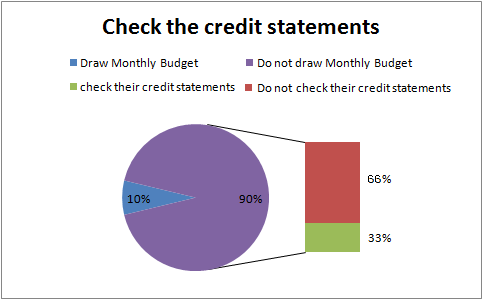

In order to assess this result, another study finding will be added to this group, which is the decision to draw a monthly budget in order to decide how much money might be spent; 90% of the respondents do not draw a monthly budget to manage their expenses. Thus, the contradiction in some of these numbers might conform to the findings of Radecki & Jaccard, where students rely only on their perceptions of their financial realities rather than on actual numbers and statements. In that regard, even the 40% who do check their monthly bank statements do not use the actual numbers to draw a budget and manage their spending. Thus, among the 90% of the respondents who do not draw a budget, at least 30% check their credit statements and draw cash on a regular basis to do their shopping.

In the figure it can be seen that the bar, representing the 90% of the sample who do not draw a monthly budget, reflects the portion of the sample where at least 33% check their credit statements. The rest of the bar represents the population who do not draw monthly budgets and do not check credit statements. The existing problem of money management can be seen through the frequency of worrying about money matters, where about 24% of the respondents admitted worrying on a weekly basis. Only a small portion of the respondents – 16% worry on a daily basis, while more than a third of the respondents failed to state whether they worry about money matters or not. In that regard, worrying about money matters and awareness of the amount of money spent, where the majority of the respondents (38%) admitted that they only have a general idea of the money they spend. This can be seen as a confirmation of the external influences of the financial situation outlined by Kidwel, as it can be seen that the source of the money might be a contributing factor for the awareness of the amount of money that is left. In the latter example, it can be assumed that the source of the money is coming from the parents, but nevertheless, it is not implied that the 14% who are always aware are more responsible in that matter. As from graph 2 it is clearly seen that the category falls into the majority who does not draw a monthly budget in that matter, and whether they check their financial statements or not the awareness does not give positive results.

In general, it can be seen that budgeting and awareness of the money students have lacks any particular pattern in terms of consistency or interrelation between other variables. The most obvious example is the failure to acknowledge whether the person worries about money matters or not.

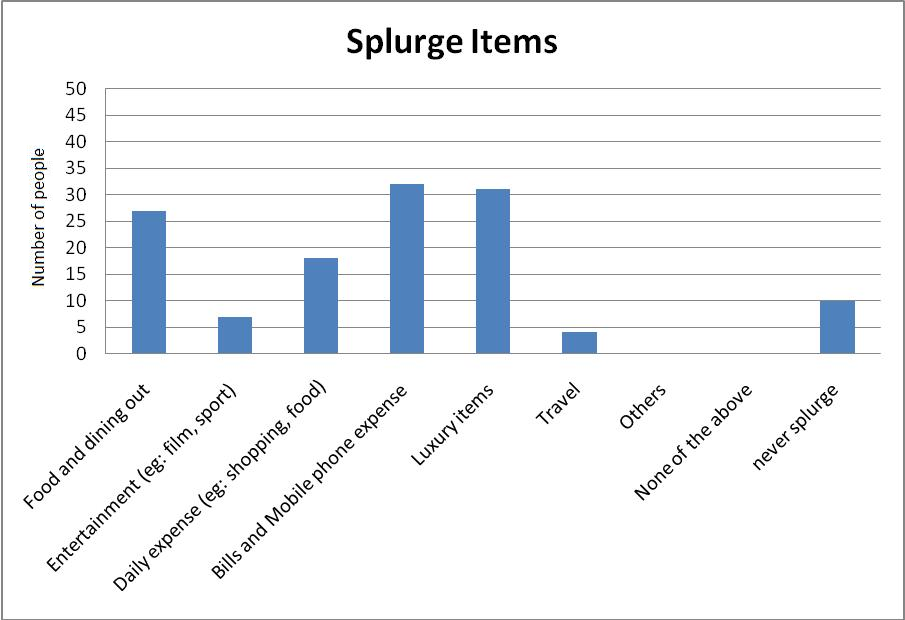

The part of the questionnaire that indicates the most items that students spend money on is mostly corresponding to Zhou et al and Chang, where the luxury products just fell a little short behind Bills and Mobile phone expense, 62% and 64% respectively. The next item in the list is food and dining out, where almost half of the respondents indicated this item as a money spending item.

On the other hand, only 20% of the respondents indicated that they never splurge, which might be assumed in different ways, due to the negative assessment of the word splurge. In that regard, the real frequency and the scale of expenses can be implied from the indicated items, where more frequent spending such as mobile phone bills, luxury items, food, and entertainment should be compared with less frequent spending such as travel.

Thus, the significance of this finding should be related to the 80% of the respondents that are aware that they are splurging and they are acknowledged what are the items that they spend money on and possibly will continue doing so. Accordingly, the importance of social status items might be generalized based on Chang and the finding of this study.

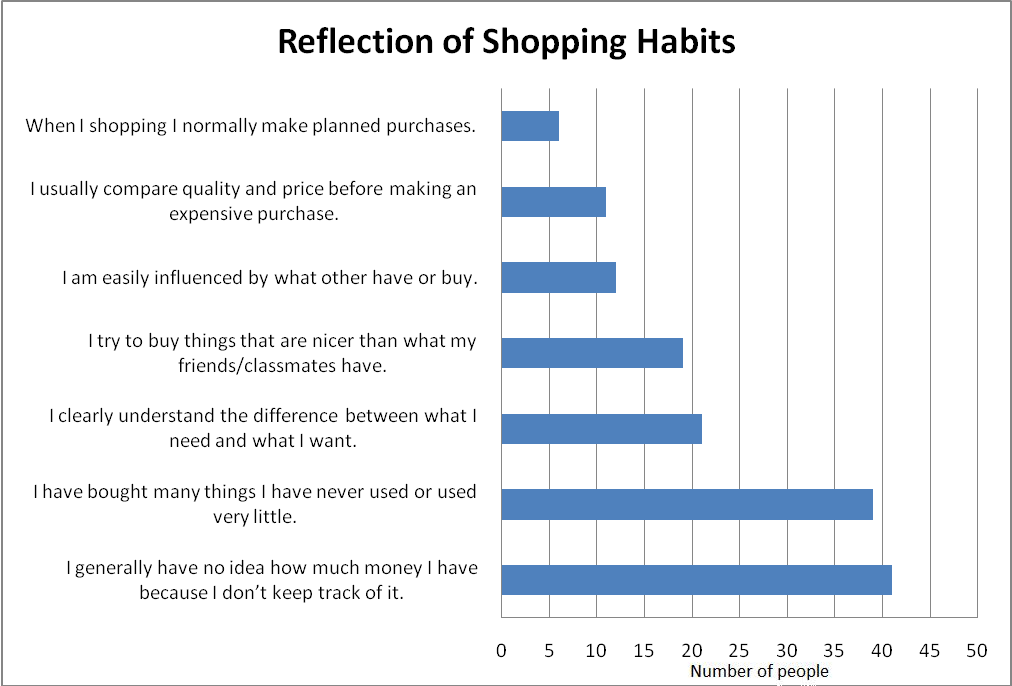

The answers of the final question in the survey also bear important implications. In response to a self assessment question regarding how students evaluate their spending habits, the personal characteristics of the respondents are contradictory. The top chosen answers which respectively are 82%, 78%, and 42%, in order reflect the spending habits of people who have no idea how much money they spend, bought many things that they never used or used a little, and clearly understand the difference between what they need and what they want. Thus, clearly there is a portion of the respondents who ticked these three answers, and accordingly it is implied that understanding what they want and what they need is not reflected on their spending, where they bought many useless things, and they even do not have a clue how they might be financially affected.

The rational part of the respondents – 22%, that indicated that they compare price and quality before making an expensive purchase, also have a slight portion that fall into the category of people that do not keep track of money, although it might be assumed that they are rationally only in the short term, without making much planning in general. On the other hand the people that indicated that they normally make planned purchases are only slightly above 10% of all the respondents, which in turn might confirm a percentage of the respondents that indicated in the previous question that they never splurge.

As a result, combining all the findings it might be concluded that approximately seven respondents, which is almost 15% are managing to keep track of the spending, and are aware of their budget. The rest of the respondents, i.e. about 85% fall into the category of most students who have low awareness of personal money management, and according to Marriott have no skilled financial knowledge.

Recommendations and Conclusion

In the light of the aforementioned findings it should be recommended that the basics of personal finance management should be an important subject in the curriculum, especially for overseas students. Compared to overseas students, compared to the locals, are in a position when they lack the control of their spending, and on the other hand most of them are dependable on their parents. In that regard, a course during the first year of the education might help the students to be aware of their spending.

An alternative solution might be beneficial in providing informational support through printed materials and brochures, so as to raise the awareness of the students to their financial situation. The brochures might have basic information on how to make plan, draw a budget, various methods for saving and etc.

In that regard, a similar example was shown through the initiatives taken by the University of Glamorgan’s Business School, who developed an online tool by financial experts at the University for that matter. The main purpose of the tool is “helping freshers across the University to get to grips with managing their finances as they start university life.” (Glamorgan News Centre, 2006). Thus, conducting a similar approach might be helpful for first-year students, for whom “it will be the first time that they have direct access to large amounts of money” (Glamorgan News Centre, 2006).

Another approach can be taken in facilitating the possibility for students to have a part time job. Many of the foreign students might not be even aware of such possibility, while others do not have information regarding the standards of work and wages. In regard of the aforementioned, by implementing a special informational department, where foreign students will be able to find information on possible job position and the information that they should be aware of when applying to one is definitely a step toward helping students managing their finances.

Accordingly, it should be noted that a combination of these recommendations might be the most efficient, in terms that it will raise the financial knowledge of the students and at the same time will offer them the opportunity to rely on sources of income other than grants, loans or parental support.

In conclusion, it should be stated that the problem of financial awareness of overseas students should not be underestimated. The introduction to adult life is not only through travelling abroad and separating from parents for the first time. It is also about being responsible of own decisions and taking measured approaches toward self-management.

Universities’ populations are diverse with students from different backgrounds and with different levels of income, and students who will be following the group in spending might find themselves going into debts as soon as they face their first serious financial problem. In that regard, being financially responsible is as important as other knowledge students acquire in universities, and thus should be taught.