Introduction

The locomotive industry entails a diverse range of corporations and organizations involved in designing, developing, producing, and marketing motor vehicles. Stakeholders in the automotive industries vend machines across the world markets, which cover both advanced and developing nations. The development of the motorized industry has been affected by various inventions in fuel, manufacturing practices, and alterations in markets, vehicle constituents, general infrastructure, and changes in markets. The automobile sector traces back to the 1860s where various developers pioneered the horseless carriage. Even though steam-driven land automobiles were made previously, the backgrounds of locomotive manufacturing are based on the creation of petroleum apparatus. By the start of the 20th century, producers of the two countries had merged with the British, Italian, and American makers. Therefore, the paper aims to explain the international competitiveness of Germany in the automotive industry over the past with interpretations of historical data to expound on how the global markets would behave over the years. The report shall also highlight cultural and business practices that influence the German automotive industry using scholarly articles and actual events impacting the financial markets.

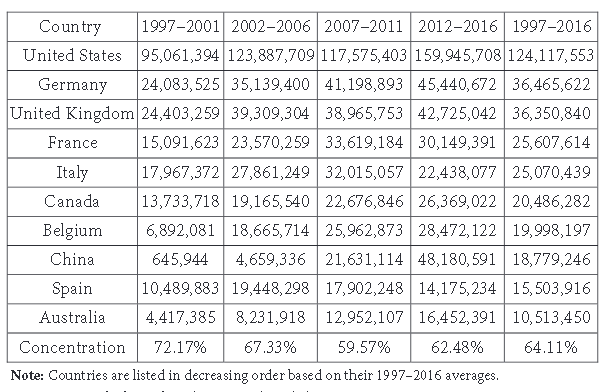

The International Trade

Trade is crucial to the advancement of economies and livelihoods of people across the globe. The automobile sector remains fundamental to the economic growth in Germany and the entire European Union as it impacts the region’s international trade. As Workman (2021) explains, free trade entails ease of market access for European commodities overseas and diversified options for domestic consumers. Europe’s automobile industry, especially in Germany, is a major global exporter with over 5.6 million vehicles in 2019 (Schwabe, 2020). As Homfeldt (2020) posits, the exportation generated a €74 billion trade surplus, not for the European Union. The sector also adheres to free and reciprocal commercial treaty initiatives, including mutually beneficial member states.

The European automobile industry remains in support of comprehensive liberalization of trade. According to (Scheuplein, 2019), trade negotiation treaties are fundamental in fostering innovations, economic advancements of the EU and the member nations. In terms of reinforcing competitiveness, ACEA, or otherwise the European Automobile Manufacturers Association, remains committed to enhancing trade conventions that create a fair and leveled environment (Krzywdzinski, 2019). The organization also advocates for policies that aim to align trade and the industry in totality to create an enabling surrounding for business. Exportation is an important area as it sustains numerous employment opportunities in the industry and others (Scheuplein, 2019) Germany’s export of automobile products to other countries has also continued to make the nations gain fame, setting standards to other areas.

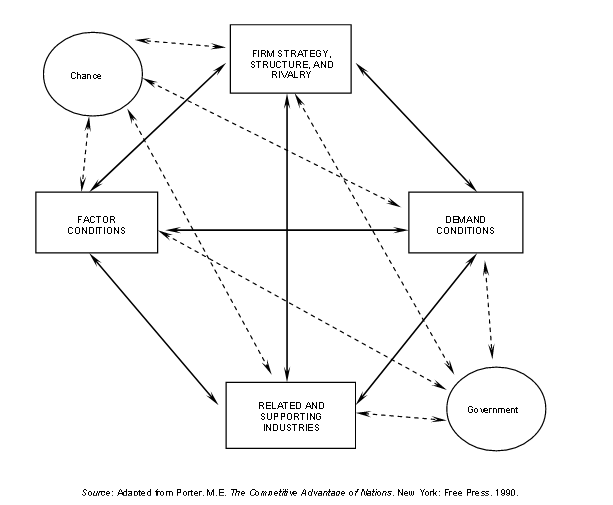

Competition in local and international markets is at an all-time high. According to Held et al. (2018), it can be divided into micro, meso, and macro categories. As Bormann et al. (2018) explain, global competition is dependent on four interconnected channels, defined as a diamond model. It includes material conditions, demand status, associated and sub-sectors, a strong strategy, framework, and controversy. Factor conditions refer to the workplace, the origin of home-grown resources, and the essential elements needed for successful production (Krzywdzinski, 2019). As Blatt (2017) explains, demand conditions encapsulate the demand for the final product in the local market. Bennasi (2017) states that when consumer demands are complex, they are at risk of suppressing car firms. On the other hand, the integrated and sub-industries are constantly competing globally, creating a solid image of low producers.

Related and supporting manufacturers supply inputs that are effective in price and higher quality to the vehicle industry. According to Workman (2018), firm strategy, framework, and local competition play a fundamental role in determining a country’s competitiveness. Internal circumstances highlight the factors considered when creating a company as domestic norms define the management method (Zimmer et al., 2017). As Judith and Jambor (2018) perceived, local rivalry pressures industries to maintain cost-effectiveness, innovation, and emphasis on consumers to ensure that the customers get the best of what is being produced. Domestic competition can be even more significant when topographical concentration is more. Considering the opinion of Porter, the administration plays a part in making a surrounding that offers its organizations an upper hand in the competitive Market (Schelgel, 2016). Direct state development can thrive in states that are in the early development stages. The nationwide state of attractiveness is extensively linked to universal trade theory, which aims to explain why nations deal with other nations (Blatt, 2017). A highly significant task in this sector was conducted in 1817 by David Ricardo. He invented the concept that allows countries to concentrate on manufacturing and selling goods with relative advantage.

As indicated by researchers and other literature content, competitiveness can be assessed and measured using different methods. A special assessment of the various forms of evaluating competitiveness has been offered (Nagy & Jámbor, 2018). At the state level, the ability to compete can be quantified by country-wide production levels, trade stability, workforce efficiency, and foreign currency exchange rate. Referring to the Ricardian concept of relative advantage developed a directory of discovered relative benefit internationally. This research examines the comparative benefits of car trading worldwide, which is currently unavailable in the existing literature. It adds value to existing texts in three different ways. First, it uses the idea that there is a comparable benefit to the primary manufacturing industry. Second, it analyzes the most crucial economic product, as cars represent the most critical sector in the global economy.

The motorized industry is among the most globalized industries. After the economic crisis, the industry effectively recovered with increased profits at 31% higher in 2012 when compared to the percentages of the last pre-crisis year, 2007 (Augsten & Marzavan, 2017). From the information provided by WTEx (Workman, 2021). In 2016, the locomotives industry led in exports, surpassing even earnings gained by crude oil that was relatively being sold at lower prices. In 2017, the website of news4business had reported global automobile growth, with the companies and their suppliers recording higher income (Workman, 2021). Newly defined drifts in the vehicle commercials are given as electric-powered cars, safety needs, ecological guidelines, and growing attention on developing markets. Basing on the manufacture of cars and trade vehicles, China is leading with the yearly manufacture of more than 28 million locomotives in 2016

The Germany Automotive Industry

German automotive industry is ranked as a major employer across the globe with over 857,000 personnel. The automobile industry has a large workforce of more than 866,000 workers since 2005 (Docplayer, 2017). According to Zimmer et al. (2017), the largest share of passenger vehicle manufacture in Europe goes to Germany with over 29% market share, France (18%) shares, Spain (13%), and the United Kingdom (9%). In the late 1870s, Karl Benz, a German mechanical engineer, and Nikolaus Otto single-handedly developed the combustion engine. Later in 1887, Karl Benz fitted his design to a couch leading to the modern-day vehicle and ultimately considering Germany as the origin of automotive.

An American – economist, named Brady Robert broadly recorded the validation movement that designed German business in the 1920s. Scheuplein (2019) points that although Brandy’s available replica of the crusade related to the automobile industry, the sector deteriorated in its condition in the later years of the Weimar Republic. However, as Krzywdzinski (2019) explains, in the last years, Germany faced a significant challenge in the slow advancement of the sector, which left the market accessible for the advanced American auto manufacturing industries, including General Motors, which replaced Opel, a German company in 1929. Workman (2021) stated that the Ford Motor Company has continued to maintain an effective German subsidiary. The global economy’s collapse in the 1930s occurred during the Great Depression and significantly impacted the auto industry in Germany, leading to a severe crisis.

The German automotive industry is also known as the home of the new car and is considered the most attractive and pioneering worldwide. The German industry is also ranked at the third position in vehicle manufacturing globally and placed at fourth position in vehicle production in total. Germany made cars leading in the European Car of the Year and recorded an annual output of approximately six million, giving a 31.5% share of the European Union (Schmitt, 2017). In the awards given to the car of the century, the 4th and 5th positions were taken by Volkswagen Beetle and Porsche 911, respectively, all German vehicles.

Germany was majorly involved in the historical development of the automotive industry. The German mechanical engineer called Benz designed the first engine and, in the year 1885, practically created the first automotive propelled by an internal-burning engine, putting his country at the front line of the pioneers. Currently, Germany is prominent for its formidable and state-of-the-art cars. According to (Docplayer 2017), Germany’s most famous industrial sector is the automotive industry that records up to 17% of its exports from vehicles. In 2018, the automotive industry in Germany produced about 426 billion euros after its sales (Docplayer, 2017). The German vehicles industry is also prominent because of the high job creation rate, with up to 882 thousand jobs in automobile manufacturing, ranking her as the leading European country.

Germany is a primary location for advanced car producers and suppliers and harbors powerful vehicle brands like BMW, Audi, Volkswagen, and Mercedes. The country has a wide range of beneficial factors that help the automotive industry thrive. They include a solid industrial core, superb infrastructure, a professional workforce, and cutting-edge research and development. One of the prestigious brands of vehicles, BMW, runs 31 plants in 14 countries, with one of the plants being the largest in the world, has become a pride for the country (Bormann et al., 2018). The brand is thriving because it has taken advantage of the factor conditions offered by the government. BMW has been ranked 2019’s 3rd most valuable car brand globally, and it has been revealed that the company began manufacturing aircraft engines before switching to vehicles (Augsten & Marzavan, 2017). The brand’s successful growth has been linked with its outstanding car design, technological novelty, and labor force. The company also follows the recommendations of the Porter-Diamond Model by growing its workforce (Nagy & Jámbor, 2018). The BMW Company has a program called the Manufacturer-Specific Advanced Training (MSAT) that trains students and provides them with extensive knowledge and skills on BMW vehicles in preparation for them to work for the company.

Indicators of Competitiveness in Germany Automotive Industry

Production and Employment

The automotive industry remains crucial in the German financial sector and economy at large. Regarding the 2010 statistics of VDA, in 2008, German automobiles manufactured approximately six million vehicles and five million in 2009, placing it at the lead compared to other countries in Europe (Benassi, 2017). The German automotive companies are a vital contributor to the employment of both young and old individuals. According to Blatt (2017), approximately 1.4 million individuals are employed in Germany’s automobile sector or related sections. Additionally, the labor force has felt an increasing trend over the past decade and will continue to increase over the years, especially after the covid-19 pandemic has passed.

Export

Germany tackles the overseas market continuously. The rate at which commercial vehicles are exported grew by 4.2% and 11%, respectively (EIU, 2005). In the year 2009, the degree increased up to 68.8 percent (Krzywdzinski, 2019). When Germany is likened to Japan that focused on business relations with the US, Germany changed its welfares to deal with countries of Northern America (Workman, 2021). The enormous prevalence has been accomplished in the trade of vehicles and machinery.

Innovativeness

A key element in transformation provides the development of automated industries in Germany. This manufacturer offers superior state-of-the-art conservation technology, noise reduction, and recycling. According to Workman (2021), research spending is above the EU average, responsible for 3% in the country, while 2% of Gross Domestic Product across the European Union (Docplayer, 2017). Finally, the German automotive sector puts financial strain on and captures the attraction among European countries.

The “Diamond Model” by Michael Porter

According to the “Diamond Model,” the attractiveness of a specific country in a particular industry is dependent on four primary factors. Firstly, the factor conditions include a qualified workforce, natural resources, and infrastructure quality, which are deemed primary aspects of manufacture in a country (Bormann et al., 2018). The second factor is the demand conditions which incorporate the home requirements for the industrial goods or services. Thirdly, related and supporting industries relate to the dealers and other countries linked (Augsten & Marzavan, 2017). Lastly, Firm plan, organization, and rivalry describe how institutions are made within their structure, organization, governance, and local rivalry.

Human resources denote knowledgeable and competent workers in organizations. Physical resources refer to customary conditions and capitals in the nation. Information properties: the level of schooling in the state, such as campuses, research establishments, and statistical interventions (Held et al., 2018). Significant resources: a fund for the provision and study investment of scientific advances in the industry. Infrastructure: an essential component of the competitive landscape regarding the transport system, communications system, and basic infrastructure in the nation.

According to OECD figures, Germany’s total area is estimated to be 356,000 sq. Km. Fifty-three percent of which are agricultural and 30 percent forest. With its populace, which is recorded at approximately 82 million with about 43 million workers, equated to other countries in Europe, the German people provide competitive gain in industrial growth (Schmitt, 2017). Moreover, the number of jobs in the German vehicle companies is very high.

While in need of natural resources, Germany can maintain its competitiveness with the European automotive industry. Highly knowledgeable, trained, and inspired personnel is an integral part of its environment (Blatt, 2017). It is noteworthy that German goods receive the highest properties and services worldwide, particularly in the production of holy technology. By pursuing another means of maintaining an attractive position, Germany overpowered the downsizing by creating a creative process. The high level of the public education system has focused on methods. Education in Germany is in line with the needs of the local sector, especially in science and high technology (Homfeldt, 2020). In this regard, German employees are well vast in theoretical knowledge, which gives them an upper hand in their skills in work in certain areas.

On the contrary, there has been a noticeable increase in Germany’s use of study and development when likened to other countries like the US and France. Germany significantly invested in research between 1986 and 1989, accounting for 2.7 percent to 2.9 percent of GNP (Nagy & Jámbor, 2018). Besides, German’s R&D calculated as a percentage of GDP surpassed that of the US in 1987. For example, Germany’s Volkswagen emerged victorious in the 2008 awards of the Golden Drop of Oil for the company’s new launch of the gearbox (Nagy & Jámbor, 2018). These latest technologies provide environmentally friendly solutions and reduce fuel consumption (Augsten & Marzavan, 2017). In addition, at the 2009 International Motor Show, among the world’s top 100 carmakers, 55 of the industries originated from Germany, proving the country’s competitiveness in the automotive sector.

Demand Conditions

In 2006, Germany’s gross domestic product (GDP) surpassed the US, rising by 3.7 percent. As Workman (2021) explained, the growth was also realized in the following year with a 1.5% margin, which played a significant role in the European economy. A large part of its domestic want in Germany is manufacturing products. Meanwhile, facing full-fledged local businesses, the nation dealt with a unique problem equated to the countries that possessed export zones. Germany changed its welfares to make high-value and durable goods (Schwabe, 2020). Germany’s most significant achievement in the automotive industry is local solid consumer companies because of its integrated business.

Product quality improvement helps the sustainability of businesses in terms of inclusive trade. Companies expect the merit of a cohesive market in conjunction with the European standard. For example, Ford operators in Germany assigned dealers throughout Europe to avoid land grabbing and ensure efficiency in car repair (Krzywdzinski, 2019). Additionally, the effect of SEM, or otherwise the single European market, improves communication between its members. Trade between European countries tends to continue and encourages economic growth. The macroeconomics impact of SEM continues to play a fundamental role in the success of Germany’s automotive industry. The Monti Report evaluated that one percent of domestic investment and 900,000 additional jobs are growing.

Associated and Subordinate Industries

Germany’s vehicle industry remains prominent in the manufacturing segments worldwide. The district surrounding Stuttgart city has the backbone of Daimler-Benz and the company’s suppliers. According to Held et al. (2018), another associated site closer to the Regensburg BMW station, and the chief automotive manufacturers, Volkswagen, tests its net outcomes in Germany (Blatt, 2017). All the top automotive products have benefited from their industrial collections.

Collections give birth to a well-produced process. Sophisticated suppliers near automakers are backed by suppliers of small items, such as metal, plastic, iron, and steel, which are outside German history. Held et al. (2018) states that consumers and suppliers work together to improve their services. As German-based technology firms, their business connections are often close. Therefore, there are various opportunities for consumers and suppliers to cooperate with new products and develop them, which control the competitiveness of a particular industry.

Factor Conditions

The factor conditions of a country refer to the human resources, the capital, and natural resources that are present for her companies to utilize. Germany has a vast pool of human resources supported by the significant population in the working sector (Schmitt, 2017). The excellent infrastructure and very knowledgeable workforce enable Germany to be good at production. The quick acquiring of natural resources is another factor that has helped Germany succeed in the sector.

Firm Strategy, Structure, and Rivalry

In disparity to other kinds of organizations, the typical buildings of German corporations are small and medium-sized. To some extent, this gauge allows establishments to cover manufacturing costs. In addition, high-quality car congestion, new products, and undeniable German car manufacturing services have taken the first place in customer loyalty (Workman, 2021). German car manufacturers are looking at the international market, and their dominance lies in addressing the relationship between industry, organization strategy, and robust execution.

As the automotive companies have experienced competition in global markets, German firms face a challenge from other car manufacturers. Using the example of Volkswagen, there has been a fantastic competition between them and General Motors in the US. However, after changing its governing strategy, VW produces 40 percent more material, which is higher than other European car manufacturers (Zimmer et al., 2017). Strategic change empowers VW to maintain its most important position in the automotive industry.

The Responsibility of Government

Germany offers one of the world markets that are open and accessible. The concept of international business is unique to Germany as it chiefly relies on organizations and not the governing body. Sectors in the country have a role in dealing with competitiveness independently as they strive to develop it. As Schwabe (2020) explains, the government plays a significant role in developing German industries. Automotive production needs experts and technicians to better manufacturing values, and the county’s authorities support the automotive sector with educational and financial research. That is a competitive decision for German automated production. In addition, the role of government is essential concerning the global context (Held et al., 2018). German car manufacturers are benefiting from this point, being targeted at domestic and international markets.

The Role of Probability

The nation agonized serious adversities with fatalities as a result of the World Wars. However, exemplary achievements outweighed the bad ones as it was clear that Germany had achieved great success in the post-war industrial competition. Manello & Calabrese (2019) noted that wars had developed adverse effects in producing higher-tech commodities and sophisticated materials. In addition, literate people have realized significant improvements in post-reconstruction—creating opportunities for Germany by the war to improve its technology in the production of machinery.

The Determinants as a System

The concept of diamonds applies not only to the individual but also to each other. To some extent, the results were present in each part of the “diamond” segment that determined national competition (Kharub & Sharma, 2017). Refined producers such as the German automotive companies retain their competitive edge in the entire system’s performance rather than negative consequences. For example, Germany has no natural resources included in the conditions; however, construction has been established as new advancements focusing on environmental defense and conserving energy. To facilitate the development of advanced technologies, the German authority focuses on investment in schools and research, which is portrayed as government work on diamonds. Besides, the development of new strategies in the automotive industry enhances its competitiveness compared to competition posed in the international market for the development of vehicles.

Cultural and Business Practices

As important as the diamond building is, ethos is a crucial element of modest power. Krzywdzinski (2019) argues that national and local cultures impact governance, including multinational, multicultural organizations in the civic and reserved sectors. German car producers save energy because of their excellent management. Culture affects other decisions such as management plans and manufacturing costs. Other conflicts can duplicate the benefits of competing as a profession, and ethos is an exceptional feature of the individual and the country. Cultures, therefore, provide conditions for capturing certain competitive aspects.

Munich / Berlin, May 2011: Global growth in the motorized sector forces establishments to increase their core skills in creation, manufacturing, and cross-border promotion. Complete integration of world value chains is, therefore, a significant achievement in the sector. It is the discovery of a study entitled “How car companies effectively manage their operations across borders.” Compiled by Roland Berger Strategy Consultants and ESCP Europe Business School Berlin, the study looked at 95 car producers and suppliers.

Universal competition in the vehicle manufacturing industry is intensifying with each passing day. Companies, therefore, face a significant challenge to improving value chain chains, explains Wolfgang Barnhart, Partner at Roland Berger Strategy Consultants and lead author of the study. The research assessed six ways to coordinate international operations effectively: focusing/allocating decisions to make processes, direct self-regulation, frequent communication, production control, social networking, and unofficial communication (Manello and Calabrese, 2019). Locomotive companies wishing to use effective strategies abroad must prudently contemplate all these substitutions. These methods are effective and competitive globally, which leads to effective integration.

A good mix of individual working areas ultimately requires the use of all six ways to some extent. However, the corporation puts some focus on each sector. For example, good mixing in manufacturing concentrates on systematic planning and production control. In juxtaposition, good communication between promotion activities stresses direct governance and production control. In development, discharge control is given first (Bormann et al., 2018). However, research has also shown that corporate cultures and internal networks also play an important role in integration and these work-related approaches.

Promoting commercial ethos and systems to get international growth, a robust commercial ethos among workers remains fundamental. According to Nagy & Jámbor (2018), much of this is done through internal corporate connections, as it enables employees to transfer and share information and ideas outside of their jobs. Organizations may promote this message conveyance without hierarchies in all categories and departments by establishing different working groups. It shows that workers from other sectors work harmoniously on specific projects (Homfeldt, 2020). Frequent revolving managers of various industries and locations can also add to the smooth running of the company’s communications. In this manner, automotive organizations can grow a business culture followed by all employees: shared prices, ideas, or machine statements are essential.

The objective is not to transfer the culture of the leading company to its agencies or global companies (ethnocentric approach). Nor is it permissible to permit each company under its company policy (polycentric method). Instead, the cultural aspects of each country should be incorporated into the same company policy, adopted and implemented by all workers (geocentric approach). For example, business objectives can be shared and distributed worldwide through various channels, such as newsletters, reports, or websites. Similarly, internal marketing campaigns and promotions can assist personnel in spreading company standards and objectives within the company (Workman, 2021). Many companies in Germany are making quality assumptions in their investment decisions. Most large companies use price-based measures to evaluate investment opportunities. Many companies use cost-effective currencies (WACC) as a discount rate (Zimmer et al., 2017). The report contributes to the information by providing new budget information technology to German car companies.

German firms have transformed existing products and developed suitable new ones, especially at low cost and in a technologically low economy. German manufacturers are still putting themselves at the top end of the growing market, but good quality is comparative and not natural. According to Held et al. (2018), the company’s ability to protect itself from cost competition depends on context. German manufacturers are producing local engineering skills and are developing their marine cost-cutting programs to strengthen their competitive positions (Schmitt, 2017). As a result, procurement is regional, foreign technology and engineering are growing, and legal processes to create and reduce costs within the company’s production systems are being distributed worldwide.

Conclusion

By assessing and evaluating the German automotive industry concerning the idea of the Porter diamond, it is clear that German automotive production retains its attractiveness in the sector equated to other producers, despite the lack of natural resources. The whole system works well in the German automotive industry by holding on to its competition despite the need for car manufacturers to keep up with the pace of global market progress to stay on top of the world. Germany can be said to be the perfect example of a crucial position in the automotive industry worldwide. The country has advanced modern technology, excellent services, and customer loyalty, producing a prosperous result in the industry. The readily available human resource that is well vast in automotive professionalism also gives the country an advantage in the market making Germany a great competitor in the industry. The country also has great companies with good maintained culture in the manufacturing of vehicles that make them dominate the industry. The country has also invested in the study and more research on creating better products to take care of their competitive position in the future. Therefore, one can conclude that the future is bright for Germany in the automotive industry as it has shown that it has achieved its goals and objectives.

References

Augsten, A., & Marzavan, D. (2017). Achieving sustainable innovation for organisations through the practice of Design Thinking: A case study in the German automotive industry. ISPIM Conference Proceedings, 1–1.

Benassi, C. (2017). Varieties of workplace dualisation: A study of agency work in the German automotive industry: Varieties of workplace dualization. Industrial Relations Journal, 48(5–6), 424–441.

Blatt, B. (2017). Research of the German automotive industry. Latgale National Economy Research, 1(9), 14–24.

Bormann, R., Fink, P., Holzapfel, H., Rammler, S., Sauter-Servaes, T., Tiemann, H., Waschke, T., & Weirauch, B. (2018). The future of the German automotive industry: Transformation by disaster or by design? Friedrich-Ebert-Stiftung.

Docplayer. (2017). Outlook for the automotive industry in 2017.

Held, M., Weidmann, D., Kammerl, D., Hollauer, C., Mörtl, M., Omer, M., & Lindemann, U. (2018). Current challenges for sustainable product development in the German automotive sector: A survey-based status assessment. Journal of Cleaner Production, 195, 869–889.

Homfeldt, F. (2020). Integrating supply chain partners into the front end of the innovation process: Empirical evidence from the German automotive industry. VIII, 187 pages. Web.

Kharub, M., & Sharma, R. (2017). Comparative analyses of competitive advantage using Porter diamond model (the case of MSMEs in Himachal Pradesh). Competitiveness Review: An International Business Journal, 27(2), 132–160.

Krzywdzinski, M. (2019). Globalization, decarbonization and technological change: Challenges for the German and CEE automotive supplier industry (pp. 215–241).

Manello, A., & Calabrese, G. (2019). The influence of reputation on supplier selection: An empirical study of the European automotive industry. Journal of Purchasing and Supply Management, 25(1), 69–77.

Nagy, J., & Jámbor, Z. (2018). Competitiveness in global trade: The case of the automobile industry. Economic Annals, 63(218), 61–84.

Scheuplein, C. (2019). Private equity as a commodification of companies: The case of the German automotive supply industry. Journal of Economic Policy Reform, 1–16.

Schmitt, B. (2017). World’s largest automakers: Renault-Nissan outranks Volkswagen, could pass #1 Toyota. Forbes.

Schwabe, J. (2020). Risk and counter-strategies: The impact of electric mobility on German automotive suppliers. Geoforum, 110, 157–167.

Workman, D. (2021). Car exports by country. World’s Top Exports.

Zimmer, K., Fröhling, M., Breun, P., & Schultmann, F. (2017). Assessing social risks of global supply chains: A quantitative analytical approach and its application to supplier selection in the German automotive industry. Journal of Cleaner Production, 149, 96–109.