Executive Summary

This report identifies challenges faced by NorLand Limited, such as siloed business units, lack of collaboration, misaligned incentives, and the need for succession planning. The report recommends increasing transparency and communication, investing in technology, and developing a succession plan to address these issues. An action plan outlines immediate, short-term, and long-term actions assigned to specific departments or individuals, with estimated timelines and cost impacts. The report concludes that the recommended course of action and implementation plan will position NorLand for long-term success by improving communication and collaboration and creating a more cohesive and efficient organization.

Introduction

The case focuses on NorLand Limited, a Canadian firm operating in various industries, to reach $500 million in revenue and $50 million in NOI by 2025. The stakeholders include the CEO, CFO, SVPs, business unit managers, and employees, all with different concerns. The CEO and CFO aim to retain value and scale the company while creating a cohesive organization. Business unit managers are concerned with the value they receive from Shared Services. Employees are concerned with rewards and compensation. The stakes for stakeholders include the company’s financial success, potential career growth, and financial gain.

The Problem or Opportunity

The main challenge for Norland Limited is internal and organizational. As the company expands, leaders see that current practices may hinder growth. They aim to create a more cohesive organization and continue growing by changing the operating model, structure, and rewards. The goal is to reach $500 million in revenue and $50 million in net operating income while preserving business value.

Problem Analysis

The company’s internal strengths and weaknesses (SWOT analysis)

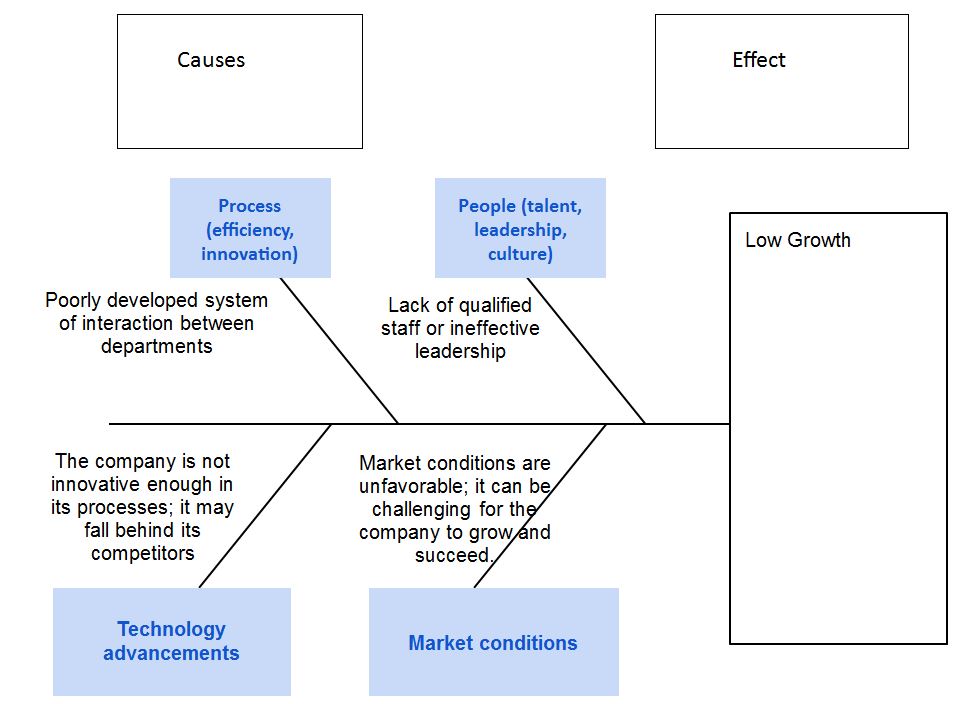

Fishbone

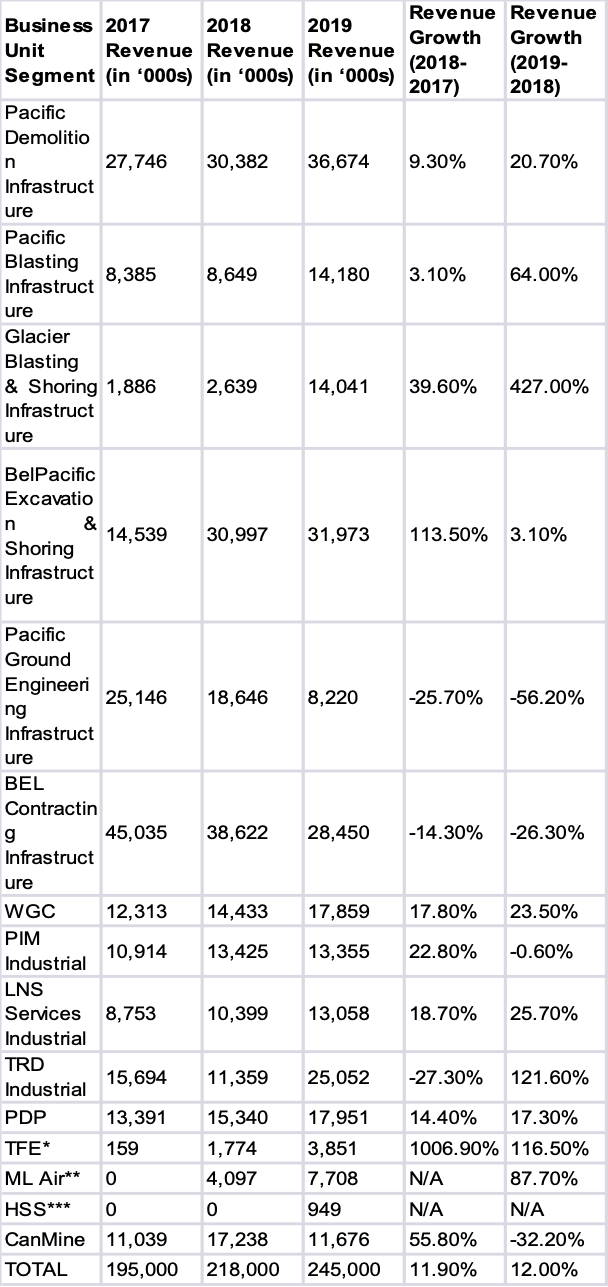

Revenue Trend Analysis

TFE = Traxxon Foundation Equipment ** ML Air = ML Air Produits de Forage *** HSS = High Standard Scaffolding

Identification and Evaluation of Alternatives with Cost Included

Recommended Course of Action

Action Plan & Implementation

Conclusion

NorLand Limited faced challenges such as siloed business units, lack of collaboration, misaligned incentives, and the need for succession planning. Alternatives recommended were increasing transparency and communication, investing in technology, and developing a succession plan. The organizational structure needed realignment, and incentive plans needed to be revamped to align with NorLand’s goals. An action plan was developed with immediate, short-term, and long-term actions assigned to specific departments or individuals, including estimated timelines and cost impacts. The recommendations will position NorLand for long-term success and create a more efficient organization to achieve its goals.