Introduction to the Full Systems Study

Situated in Kansas, the Precision Electronic Parts (PEP), a small private firm, has for the past 20 years been specialized in producing a wide range of electronic components and replacement parts. However, the company has increased its services beyond the healthcare sector, substantially escalating orders. The introduction of efficient low voltage motors has led to massive sales increment, particularly in the marketing and manufacturing department. The phenomenon has strained the finance, inventory management, and ordering and shipping divisions in the remittances, charging, and invoicing processes. The PEP’s IT steering committee (ITSC) has assessed the preliminary investigation report, requirements specifications, and the proposed modern system design specification. The new IT solution will reduce the processing errors and facilitate fast billing, payment, and invoicing, thus meeting the increased demand for orders. Upon the approval and funding of this project, the company will obtain adequate relief, mainly in the financial department.

An Overview of the Events

For the last few years, the PEP company commenced constructing and delivering sufficient low voltage motors that minimized electricity expenditures and transitioned the older medical equipment to become eco-friendly. Currently, they have adopted a new production line of highly efficient low voltage motors that can be deployed in precision tools outside the healthcare sector. Due to such, the orders have significantly increased, making the finance, ordering & shipping, and inventory management face massive constraints in charging, remittances, and invoicing.

The Subject of the Study

The primary subject of the research is improving the financial division, which is incapable of maintaining its billing, invoice, and payment processes due to sprouted demand for environmentally friendly low voltage motors. As a result, the PEP’s ITSC wants to execute a modernized and automated billing and payment system for the company to attain the set objectives. The new process will effectively handle the increased order want from the clients and detect the system catalog for the inventory regulation.

The Objective and Scope of the Proposed System

The proposed system’s scope and objective are to increase the daily venture procedures and enhance the general efficiency of PEP’s processes by replacing the existing consumer charging and remittances systems. The paper will be abolished and the billing process automated, leading to the electronic generation of documents. Due to such, the proposed IT solution will enable clients to pay and control their accounts online (Jevtic, 2019). Lastly, regarding security, the customer data will be significantly protected as they will be independently accessible to authorized personnel and departments.

A statement of Recommendations and Justifications for the Proposed System

After the system analysis phase, the ITSC must pinpoint and define the current issues encountered by the PEP’s invoice, billing, and payment processes. The proposed new billing and payment system will improve productivity and efficiency for PEP. However, it is recommended to go via user acceptance testing, upon which the old data will be transferred to the modern solution.

Description of the Current Process/System

Recently, the PEP company started manufacturing efficient custom low voltage motors, increasing order sales. The phenomenon has resulted in elevated strain, particularly in the inventory management, finance, and shipping departments. The aging process cannot support many clients as it causes massive backlogs of payment, billing, and invoice procedures. However, the current system enables the finance division to have enhanced control over invoice generation after receiving an order, billing, and payment collections. This IT solution will assist in abolishing late payment, invoicing, and billing collection and minimize processing defects. The current system is used to manage the orders of the electrical components, replacement parts, and the newly established low voltage motors requested by the customers and ensure customer data security.

The purpose of the Current System

The current system’s purpose is to assist the PEP control client’s invoices, charging, shipping, and remittances activities. At the same time, it helps in inventory tracking and minimizing the workload encountered by the financial department, which has no adequate personnel and does not receive adequate support. In addition, with the current system, the customers and the PEP will immediately synchronize their transactions.

The problems of Existing Process and Rationale for New System

The PEP sales have skyrocketed due to the recent introduction of a low motor voltage. Nevertheless, due to the increased demand for the product, the company has faced many challenges, including late payments and processing errors. Due to such, the reason for implementing the new system is to ensure the inventory management, shipping, and finance departments effectively manage clients invoicing, remittances, and charging activities. The new system reduces the overwhelming experienced by the PEP workers.

The Operating Cost of the Present System

Notably, the cost of the present system remains unknown as they have not been identified. However, the price of upgrading or replacing the current IT system will be grounded on the training, design, installation, software, and hardware required to complete the project.

Description of the Proposed System

The new system, which is billing and payment, will assist the PEP in effectively managing the clients’ accounts and orders due to the skyrocketing sales. Since it is automated, the proposed system enables online transactions and protects customer data, leading to increased product purchases of low voltage motors, replacement parts, and other electronic components.

The Scope of the Project

The project’s scope includes executing a new system to adequately assist PEP’s daily operations. The system enables the clients to make remittances online and ensure electronic invoicing. In addition, it allows all the PEP departments to share data minimizing processing errors efficiently.

The Tangible and Intangible Benefits of the Proposed System

Significantly, some of the noticeable tangible merits derived include speedy invoicing, charging, and remittance processing in the finance division, an escalation in the market share value, and the reduction in the PEP’s company operation cost. Finally, the intangible benefits are improved consumer contentment, enhanced corporate image and reputation, and advanced employee job satisfaction.

Feasibility Analyses

Regarding the technical feasibility, the present system will reinforce the inventory management, finance, and shipping department as it will be web-based, requiring no hardware transformations. New information databases will be needed as the modern IT solution enables digital invoicing. Secondly, based on the financial stability, the new system will handle the organization’s issues, including ineffective workload management, personnel turnover, processing errors, and late payments, billing, and invoicing. The PEP will record high sales and ensure increased client satisfaction, thus improving return on investment within the implementation year. Lastly, concerning the organizational/behavioral feasibility, as the PEP currently faces issues with lack of support and increased workload, the modern solution will effectively address the challenges faced by staff, leading to increased productivity.

Time and Costs Estimates to Implement the Proposed System

For the new IT solution (web-based application) to be implemented, it will take nearly two months. In addition, the company will develop a service level agreement (SLA) with the consultant and make remittances before utilizing the application (Torrecambo, n.d). The online payment and billing system will cost approximately $850 yearly, and it will be able to manage bills, organize receipts, track inventory, detect income & expenses, and run comprehensive reports.

Requirements Checklist

Each department of the PEP company has an operating monthly reporting plan. Nevertheless, their core inclination is to keep informed regarding the maintenance of invoices and the client’s payment assemblage.

Output Requirements

The following three crucial output requirements are available at the PEP firm:

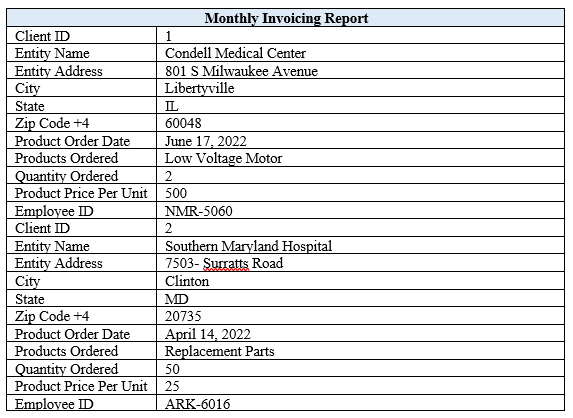

Monthly invoicing report: It will showcase the current situation from the marketing division as they manage the price setting and commodity tags utilized by the invoicing information on the 15th of every month.

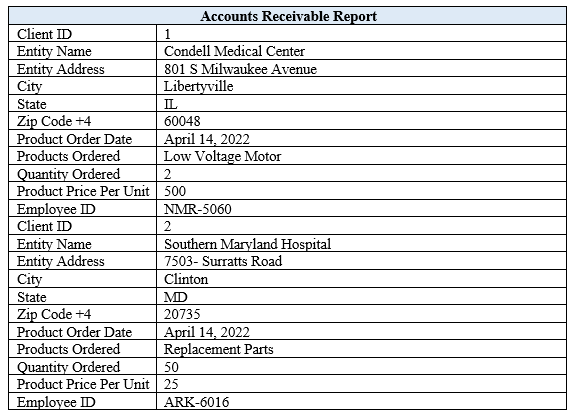

Accounts receivable (A/R) report: All the acquired huge sums of cash remittances from the customers become due to PEP by the 10th of each month, and the A/R division is mandated to update client account records and process payments.

Overdue collection report: Identifying overdue accounts is delegated to the invoicing division, which then sends them to the A/R and the sales department.

Input Requirements

There exist essential data elements required when designing the overdue collection, A/R, and the monthly invoicing reports.

The core data components for each month’s invoicing report are:

- Client entity name (completely mentioned with no abbreviations)

- Client entity street address

- Consumer city

- Customer state

- Zip code

- Products ordered

- Product order date

- Employee ID

- Quantity ordered

- Commodity price per unit

The crucial data elements for the production of the accounts receivable report are as follows:

- Client entity name (fully written without abbreviations)

- Quantity ordered

- Products ordered

- Item order date

- Commodity price per unit

- Amount due

- Calculated price

- Date paid

- Worker ID

Finally, the important data details embraced for producing the overdue collection report include:

- Client entity name (fully mentioned without abbreviations)

- Client street address

- Consumer state

- Customer city

- Client zip code +4

- Primary contact initial name

- Primary contact surname

- Primary contact mobile number

- Primary contact email address

- Secondary contact initial name

- Secondary contact surname

- Secondary contact mobile number

- Secondary contact email address

- Quantity ordered

- Product price per unit

- Commodity ordered date

- Products ordered

- Amount paid

- Calculated price

- Amount due

- Employee ID

- 2% overdue amount

- 30 days amount overdue

- 60 days amount overdue

- Over 60 days amount overdue

Processing Requirements

They include the following:

- Monthly Invoicing Report. It involves data input of the much-needed entry database into the modern system

- Accounts Receivable Report. Financial data is entered to cover costs through a safe online system.

- Overdue Collections Reports. The invoicing department of the PEP enters the invoicing data.

Technical Requirements

This section outlines the interface between the existing system and the upgraded one. The core areas addressed include system control, security, business continuity, and control requirements.

Security Requirements. When dealing with clients, it is vital to offer them the protection of their information to increase their trust in the business. Some of the essential security measures include:

System users: They require single sign-in and log-in particulars, which are not shared across the PEP departments.

Network security: In the PEP company, each workstation linked to the internet must have functional security protocols to ensure that it is not prone to external and internal threats.

Maintenance: There will be frequent testing and adequate safeguarding of the systems to ensure all security initiatives work properly.

System Control Requirements

In this case, the information technology (IT) system controls will enable satisfactory operation of the new system as projected by ensuring that PEP complies with the set government policies and the data is reliable (Torrecambo, n.d). For the overall management, the PEP needs to adopt and execute controls, including:

Change management: Any anticipated change will match the PEP preferences and ensure it has deteriorated influence on the daily venture practices.

Uncertainty regulation: All risks must be pinpointed and the specification of the solutions implemented effectively.

Disaster recovery: A detailed plan must be adopted for the frequent continuation of the daily enterprise practices.

Performance Requirements

The PEP senior management should identify several performance prerequisites to measure the IT system functionality, which includes:

Workload: Since the PEP has multiple divisions whereby several users have the accessibility to information at any given period, it is crucial to ensure the system can process payments from diverse clients concurrently, obtain data entry databases from various users, and design reports from different departments.

Response time: The difference between information entry to the system and the time after receiving the order must not exceed 24-48 hours.

Scalability: During both the peak and off-peak hours, the IT system should be capable of handling multiple users.

Business Continuity Requirements

The crucial steps required while developing a detailed business continuity plan (BCP) are as follows:

Generating the BCP Strategy: Here, the consultancy should design an approach that ensures progressive venture operations. The consultant company can select preventive or corrective remediation to expand operational prowess to handle outages and reduce impacts. In addition, the service provider must consult with all the PEP divisions to establish each one’s IT needs.

Executing the BC approach: When a need occurs, the PEP and the service provider can adequately implement BCP as it has the necessary database. However, testing is necessary to ensure that the BCP execution matches the projected outcomes.

Ongoing Plan Maintenance: There should be quarterly preservation of the BCP to ensure that PEP continues to add venture value via essential advancements to the blueprint as technology prerequisite dictates.

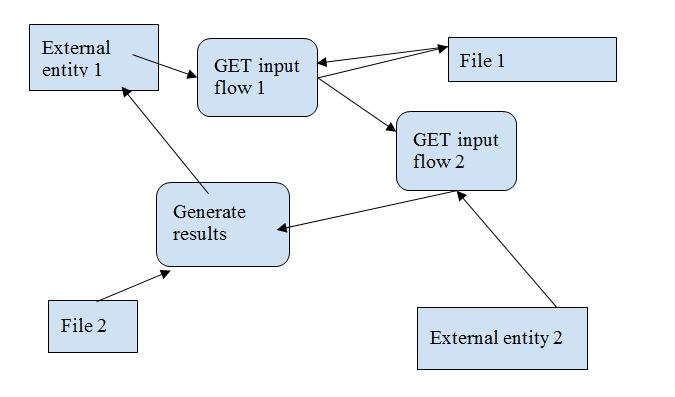

Data Models

Significantly, the data flow diagram (DFD) showcases the information streaming from the commencement to the termination. Using DFD, PEP can effectively visualize workflow within the daily enterprise practices and in the IT system confines (Conger, 2008).

Process Models

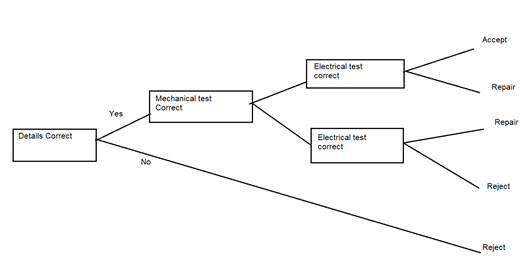

The consultancy service provider has offered three processing methods, including structured English, decision tree, and decision table, to ensure that the PEP can successfully make highly informed choices regarding the launch of the IT upgrade. The models provide the required database to the system users and analysts, ensuring they do not misinterpret it.

Structured English

This method elaborates the system information sequence, selection, and process iteration to a greater extent. In the case given, the data flows as follows:

Start

↓

IF the elements are not OK

Reject item

ELSE (Accept)

IF the mechanical test is OK

IF the electrical test is OK

Pass product

ELSE (electrical test OK)

Repair product

ENDIF

ELSE (mechanical test is not OK)

IF the electrical test is OK

Repair product

ELSE (electrical test is not OK)

Repair product

ENDIF

ENDIF

End.

Decision Table

The decision table acts as a form of a matrix that showcases an array of options and payoffs for a choice set by the system.

Table 1: Decision table

Decision Tree

For the proposed system, the decision tree showcases the methods of approximating the projected choice turnout points. In the PEP case scenario, the decision tree from the above decision table is as follows:

System Design Specification

Output Layout

The functional requirements for the new system summarize the crucial prowess of the proposed IT solution, including database entering, information obtained from the system, and data processing.

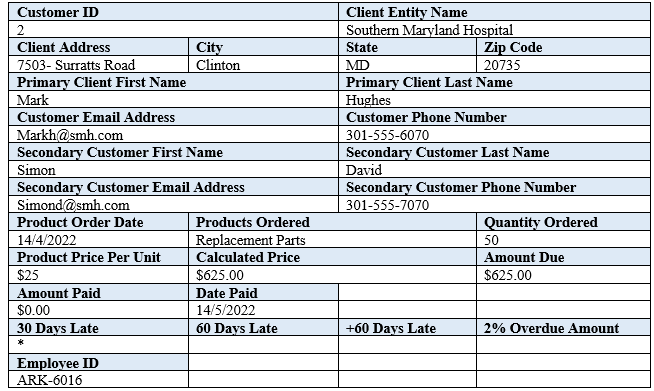

Output Layout 1: To a greater extent, the PEP has the following monthly invoicing report:

Table 2: Monthly Invoicing Report

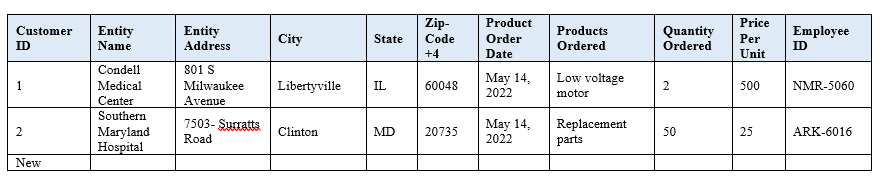

Output Layout 2: The A/R department can monitor the customers owing cash and how far they are behind the remittance plan as follows:

Table 3: Accounts Receivable Accounts

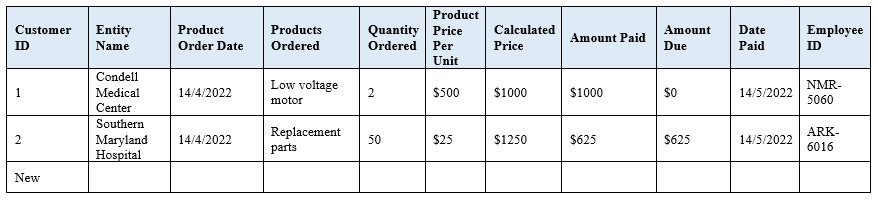

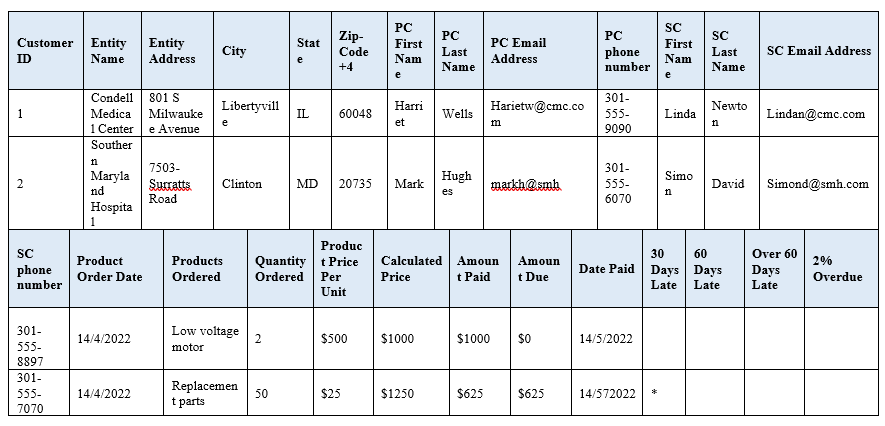

Output layout 3: An example of the overdue collection that PEP will be able to generate upon implementing the proposed IT system is as follows:

Table 4: Overdue Collection Report

Input Layout

Effective data entry is key to ensuring that all the vital database is entered into the system. Due to such, ITSC can obtain the three reports together with other individuals in rank to access the information.

Input Layout 1: Significantly, to acquire a database to construct monthly invoicing reports appropriately, the data must be entered into the system as follows:

Table 5: Monthly Invoicing Report Data

Input Layout 2: Considerably, the following data must be input to the proposed IT system to acquire a database to construct account receivable reports effectively:

Table 6: Accounts Receivable Report Data

Input Layout 3: The following data need to be entered into the system to obtain a database to construct overdue collection reports properly:

Table 7: Overdue Collection Report Data

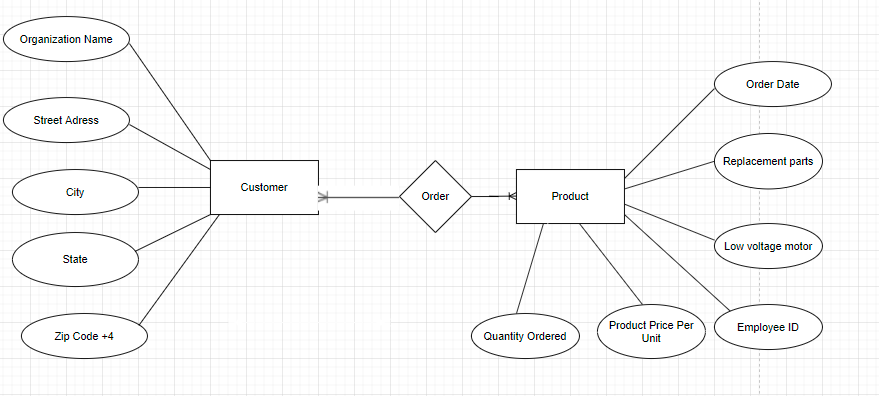

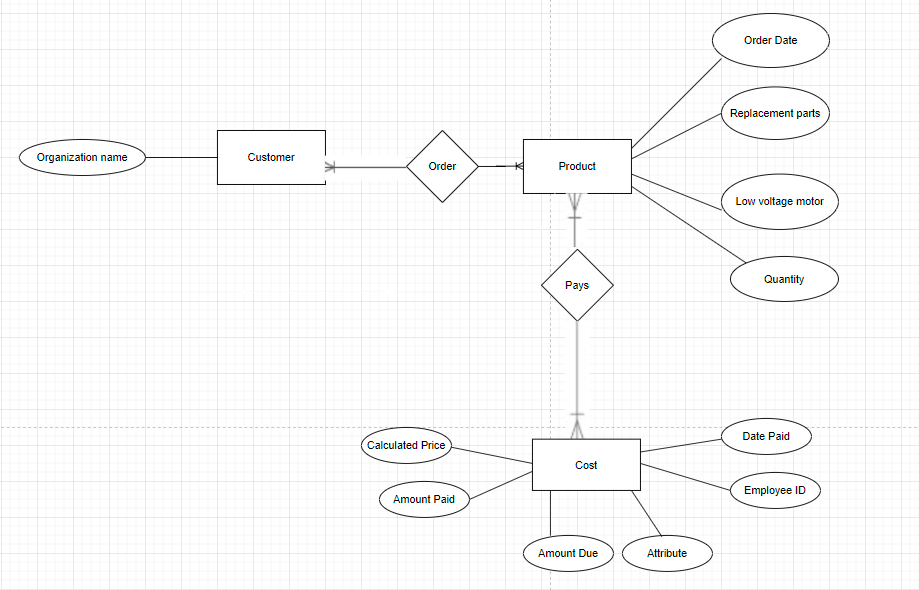

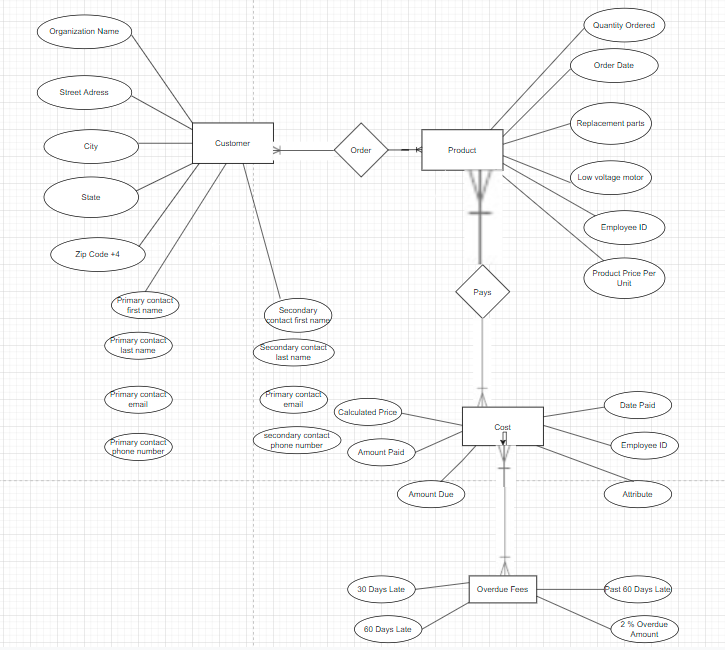

File/Database Design ERDs

In this scenario, the consulting company and the PEP can mutually agree on how the ERD performs and if it provides the projected results. ERDs will assist in establishing the relationship between the overdue collection, accounts receivable, and monthly invoicing reports and how they relate to the information inputs and outputs (The University of Regina, 2017).

Database Design ERD 1. The main entities of the monthly invoicing report include product and customer, each having multiple attributes and an elaborate relationship as follows:

Database Design ERD 1. The main entities of the accounts receivable report include product, cost, and customer, each having multiple attributes and an elaborate relationship as follows:

Database Design ERD 1. Finally, the crucial entities of the overdue collection report include product, overdue fees, customer, and cost, each having multiple attributes and an extensive correlation as follows.

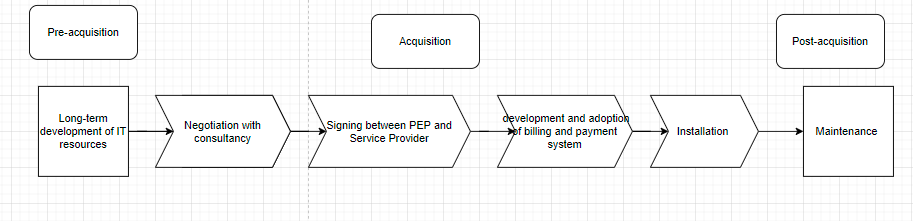

Recommended Acquisition Strategy

The following is the recommended acquisition strategy for the company’s new IT billing and payment management system product.

Scope of What to Buy

- Product or service? The best product to buy is the billing and payment management system due to its efficiency regarding business growth.

- Commercial-off-the-Shelf or Custom? It is good to have a customized product, whereby the service provider can tailor the designed software to fit every PEP’s company department’s prerequisites.

- Use in-house or Contractor Support? Using contract support to minimize expenditures is highly recommendable as it is cheaper.

Select Hosting Alternative

The best option for the PEP to adopt for this new system is to deploy cloud computing as it enables the employees to work remotely, abolishing backups and sustainability mandates from PEP.

Implementation Plan

The following is the implementation plan to ensure that the new billing and payment management system is executed effectively:

Table 8: Implementation plan

A list of Personnel

- Risk specialist. He will undertake an uncertainty assessment of the system and ensure all the pinpointed risks are effectively mitigated during and after project execution.

- Project manager. He will oversee the whole project from its commencement to closure, ensuring it is completed successfully per the stipulated period.

- System engineer. He will ensure that the PEP hardware matches the billing and paymentment management software system and recommend any changes.

- Budget analysts. They will release funds when needed and be responsible for the entire project’s financial aspect.

- Network engineers. They are mandated to design the IT solution and ensure the network works effectively.

- Tester. He will ensure that the developed new system meets the specified requirements specifications and ensure it functions appropriately.

A proposed Timetable

The following is the proposed timetable for installing the new system and the daily-working schedule of the staff:

Table 8: Proposed Timetable

Financial Information

The Operating Cost of the Present System

From the interview undertaken with the PEP stakeholders, the case study did not indicate to have any cost to the current system. Nevertheless, by observing the operation of the financial system, it seems expensive to maintain and run.

The Estimated Implementation Cost of the Proposed System

Notably, the new system will cost nearly $ 1000 to execute and make it operate. This involves the cost of designing new and integrating departmental sites, purchasing equipment, and total labor.

The Estimated Operating Cost and the Estimated Useful Life of the New System

Significantly, the operating cost will rely on the contract between the service provider and the PEP company. However, the estimated operating cost is approximately $500 annually, including maintenance, payroll, and other expenses. The estimated useful life of the billing and payment management system is about 30 years due to the changing nature of technology and business growth. It offers much-needed support to the clients and general staff.

The Tangible and Intangible Benefits of the Proposed System

Considerably, some of the noticeable tangible merits derived include speedy invoicing, charging, and remittance processing in the finance division, an escalation in the market share value, and the reduction in the PEP’s company operation cost. The financial benefits include minimizing errors caused by failed order delivery, thus recording more profits. In addition, it will ensure cost-saving as the service provider will undertake maintenance. Lastly, the intangible benefits are improved consumer contentment, enhanced corporate image and reputation, and advanced employee job satisfaction. Another intangible financial benefit is increasing compliance reducing legal charges, and improving user experience to minimize training expenditures.

Summary

The proposed system is crucial as it enables upkeep with the customer orders and improves the billing, charging, and remittances processes, thus minimizing late payments and procedural errors. Even though the cost of executing the new system is high, in the long run, the PEP will save more money and minimize the employee turnover rate as the schedule for implementation is only two months. The workers can enjoy remote working while generating customers’ monthly invoices, overdue collection, and accounts receivable, enabling the consumers to transact online.

References

Conger, S. A. (2008). The new software engineering. Course Technology Press.

The University of Regina. (2017). Data modeling and entity-relationship diagram (ERD). Web.

Torrecambo, D. (n.d). Systems requirements specifications. Project Management. Web.

Jevtic, G. (2019). What is SDLC? Phases of Software Development, Models, & Best Practices. PhonenixNAP. Web.