Introduction

Turkish Airlines is a major airline and national flag carrier that serves as a key aviation service provider and central hub for global flight. In order to determine a company’s competitiveness and business standing in the market, it is necessary to perform strategic analyses. This paper will examine and analyse Turkish Airlines to determine the firm’s position in the international market.

Brief History

Turkish Airlines was founded in 1933, initially as part of the Ministry of National Defence, initially meant to be a domestic carrier. By 1945, it began first international flights. Through the 20th century, the airline maintained a poor reputation for customer service, delays, and poor technical and safety records. However, entering the 20th century, Turkish Airlines began to expand rapidly. With opening a new terminal at Istanbul Ataturk Airport to extensive spending on new Airbus and Boeing jets, along with $350 million investment into a technical and training facility. By 2008, Turkish Airlines joined the Star Alliance, becoming its seventh European airline and significantly opening up international flight possibilities. The airline has greatly increased quality of service and safety as part of international standards. Currently, Turkish Airlines operates passenger services to 315 destinations around the world, having the greatest number of destinations for a large mainline carrier in the world. For more than 126 of these destinations, the flights are non-stop from Istanbul Airport which is also a record. Furthermore, Turkish Airlines operates a respectable cargo division of 24 aircraft serving 82 destinations (Turkish Airlines, 2021)

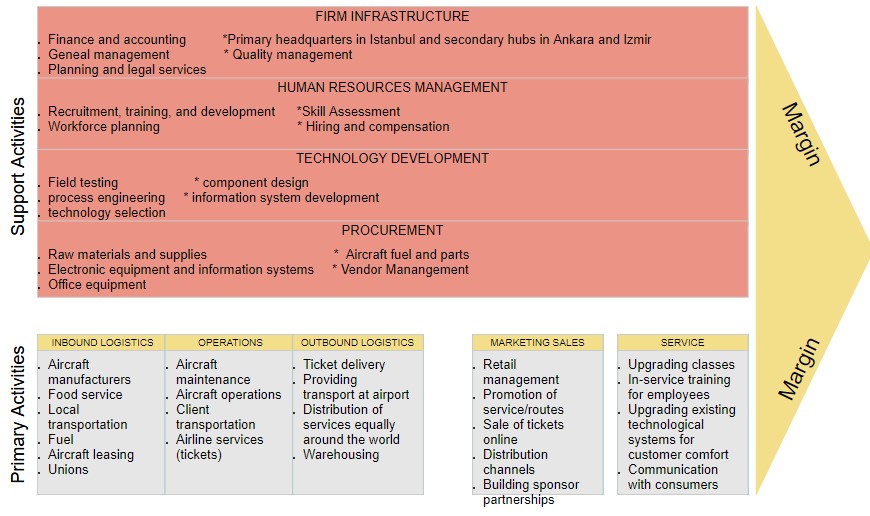

The value chain seen in Figure 1 for Turkish Airlines is standard as would be compared to industry. Airlines are complex organization consisting of many moving parts and infrastructure. Turkish Airlines seeks to maintain a strong organization by providing training, upkeeping a timely supply chain, and ensuring the logistics all work in collaboration to ensure operations are effective and efficient. The airline is supported and subsidized by the Turkish government. It has central offices at the Istanbul airport, which is its primary hub, and also presence in Ankara and Ismir. The airline operates a fleet of 350 aircraft. The airline has a large maintenance and repair center at the Istanbul Airport as well named Turkish Technic (Turkish Airlines, 2020).

Turkish Airlines is focused on both consumer and employee satisfaction when developing the HRM strategy. The foundation of the airline is on successful implementation of human resources and investments in training. The company runs a comprehensive training center for new hires and skill development in Istanbul. The facilities train everyone from pilots on simulators to technical and flight-attendant staff to ensure the excellent quality is maintained. The airline conducts workforce planning, particularly during the pandemic, to ensure all flights are fully staffed with COVID-tested individuals and work time is distributed fairly and evenly. The airline is consistently monitoring the status of the workforce via systematic structure to avoid disruptions to operations (Turkish Airlines, 2020).

Technology is central to modern airlines, including Turkish Airlines which has recently signed a partnership agreement with Sabre. The technology firm will aid the airline with its Flight Plan Manager solution to generate cost savings and efficiency. The company also sees to maintain a versatile and accessible customer website where tickets can be purchased, and registration is easy. Systems improvements were conducted in the last year to be compliant with data protection laws. Automation is the future of many of the value chain concepts for airlines, and Turkish Airlines is embracing it as a critical element of its value chain. The airline launched ‘Terminal’ which is a Technology Innovation and Entrepreneurship platform that contributes to building partnerships with technology companies for a sustainable future (Turkish Airlines, 2020).

Turkish Airlines is a major business, and procurement plays a major role in attaining higher-level efficiency through optimized strategy. Procurement is carefully planned through a complex cycle to ensure that the airline has the products it needs in the right quantity, at the right time, with the right quantity. Airplanes need fuel to reach their destination, and the flight has to have food and drink on deck for the passengers, while maintenance crews need all the equipment to conduct pre-flight checks. Turkish Airlines works with hundreds of partners to procure necessary goods for all of its infrastructure, with usually pre-planned delivery schedules and well-established quantity and quality parameters. Procurement activities are vital, without them the airline will not be able to operate, so the supply chains are notoriously monitored and reviewed via various processes.

SWOT

The strength for the airline is that it is the largest airline for Turkey and its national carrier. It is based in Istanbul a growing city and developing airport as its hub, a potential gateway between the West and East. Turkish Airlines has developed a large global network, with a strong core passenger flow being on European routes. Turkish Airlines also has more destinations in Africa, Latin America, and the Middle East then its Gulf or European competitors. The company has an efficient level of unit cost, it is below the trend line for European airlines against average trip length. The young fleet with more efficient engines as well as the location of the hub contribute to these cost-cutting measures. Turkish Airlines has multiple opportunities, particularly expansion into new routes and cargo which it has been doing, taking on opportunities such as in Africa that other airlines are less willing to, but gaining a significant passenger flow from the continent where there are few national airlines. Turkish airlines was rapidly gaining consumers prior to the pandemic with its rebranding and excellent customer service, it should strive to upkeep these standards in the post-Covid era as well to remain competitive.

Porter’s Five Forces Analysis

- Threats of New Entrants – Low – The airline industry is notoriously difficult to enter at all levels. While there has been a rise of ‘budget’ airlines, these operate mostly on short routes, and Turkish Airlines has a strong control of the domestic market. International flights remain largely under control of national carriers, and especially now during COVID times, airlines are operating at a loss. It takes enormous capital to start an airline, and without stable income, it is highly unlikely anyone will enter the industry (Wolla and Backus, 2018).

- Bargaining Power of Suppliers – Low to moderate – Some suppliers such as for aircrafts, the bargaining power is low since there are only two major suppliers of Boeing and Airbus, and airlines work with long-term contracts and loan agreements. The suppliers need airlines to buy planes and service them to generate income. Other suppliers such as fuel, food service, technology, etc have slightly great bargaining power as they typically work with multiple contracts and airlines compete to have services present in a timely manner, but nevertheless it is extremely profitable for most business.

- Bargaining Power of Buyers – High – Consumers, particularly for international flights, typically have a wide variety of choices on which airlines and which destinations to fly. Airlines are competing desperately for consumers as during COVID income is low. Meanwhile, switching costs for consumers are low. Airlines are forced to focus on brand building and positioning, to offer the best quality and efficiency of services and operations to attract consumers.

- Threats of Substitutes – Moderate – Popularity of trains has been growing in Europe for travel on the continent. However, aviation remains the only choice for intercontinental long-range flights. The only issue is that due to COVID-19, international travel has increased dramatically, and people choose to travel within the continent, using alternative means of transportation (Papa, 2020).

- Competitive Rivalry within the Industry – Very high – The rivalry is extremely high due to a highly saturated market with limited long-term competitors. The market is shared among the major airlines and the industry is highly standardized. The whole process of flying is standard across the world in terms of booking, checking in baggage, in-flight experiences. While some airlines attempt to differentiate, the differences between airlines come down to the smallest details and brand-associations. COVID has made the situation even more difficult where both domestic and international travel is highly limited, so airlines have to cut costs by limiting services and frequency of flights (Wolla and Backus, 2018).

Market Position

Turkish Airlines remains a strong competitor on the international aviation market, but remains relatively small to make significant impacts compared to some of the giants of the industry. Outside of the diversity of routes, there is no real competitive advantage that the airline can offer, nor its branding has the recognizability or clout that some of the other airlines. The airline has some core strengths such as a solid position in the domestic market, a well-established route network, and highly competitive cost base. Similar to other airlines, Turkish Airlines was strongly affected by COVID-19, carrying significantly less passengers in 2020 while seeing an increase in seats before the pandemic. The company is forced to cut costs but is attempting to do so without compromising quality of service.

Due to COVID, flight cancellations, and developments in the industry, global aviation capacity is expected to continue decreasing and passenger load factor will decline. This is affecting all airlines. Fitch ratings and long-term outlook for Turkish outlines project negative growth. This is once again constrained by high leverage and lack of certainty in the COVID pandemic, resulting in delayed industry-wide recovery. In addition to strengths, Turkey also has a viable cash-flow-accretive growth strategy (Fitch Ratings, 2021).

Turkish Airlines is attempting to gain a competitive advantage by reaching out to major destinations. However, that is not effective, and in reality, it remains a regional airline. For far markets such as Americas or Asia that are highly lucrative, Turkish Airlines falls behind its major regional competitors such as British Airways or Emirates in penetrating those markets. The company has ground-breaking numbers but offers little concrete value. Turkish Airlines should instead focus on its successful markets such as Europe and Middle East, and gradually build up in other regions in a way which is cost-effective. Another area where Turkish Airlines struggles outside its domestic market, is its brand recognition. It needs to ramp up market promotion internationally if it seeks to become the airline connecting West and East through the Istanbul hub similar to that of Emirates through Dubai.

The airline began the process prior to the pandemic around the premise of being ‘Delightfully Different’ with an emphasis on customer service and innovation. Turkish Airlines did many things right with a new visual identity, PR, and digital campaigns. It even launched in-flight catering that began to garner it recognition as profits increased (Prophet, n.d.). However, COVID essentially cut off all momentum, and currently the flights have no where near the same experiences as social distancing is required and food is served cold.

There is very little differentiation in the aviation industry, so Turkish Airlines faces largely many of the similar issues to other airlines. There are some political risks due to the nature of leadership in Turkey, as the company was already banned once of making flights to and from the U.S. This may serve as a deterrent for investors unfortunately. However, Turkish Airlines have sought to build international partnerships and form new opportunities for growth and new routes. With the modernization and growth of Istanbul airport and investments of the airline into its fleet, training, and maintenance, it is posed to emerge from the COVID era as a leader in growth, potentially reaching some of its more well-known European counterparts.

By all accounts, Turkish Airlines is a relatively young airline. Considering that it only became a relevant international player in early 2000s when it became a part of the Star Alliance. The company’s fleet is young, being less than 10 years of age for most aircraft, leaving it many more years of exploitation and minimal repair and maintenance costs. This is a benefit that Turkish Airlines has over many others which are currently undergoing rotating out their old fleets, a time consuming and expensive process. The company is also highly adaptable and modern. During the lockdowns as passenger flow decreased by over 60%, it transported cargo in various capacities with efforts to remain afloat (Turkish Airlines, 2020). The airline is committed to becoming a leader in European aviation, and it is doing so via innovation and excellent customer service.

Reference List

Fitch Ratings. (2021) Fitch Publishes Turkish Airlines’ First Time ‘B’ IDR, Outlook Negative. Web.

Papa, E. (2020) Goodbye Air Travel? Imagining a Future Where Trains Replace Planes. The National Interest. Web.

Prophet. (n.d.) Launching a delightfully different experience. Web.

Sahin, T. Turkish Airlines expanding fleet, opening 4 new routes in 2020. AA. Web.

Turkish Airlines. (2021) About us. Web.

Turkish Airlines. Annual report 2020. Web.

Wolla, S.A. and Backus, C. (2018) The Economics of Flying: How Competitive Are the Friendly Skies? Web.