Introduction

The current situation in recent years associated with the pandemic of coronavirus infection has changed the world and made its adjustments to the modern realities of the whole world. However, the USA was selected for analysis since it is of certain interest. The fallout from the Covid-19 pandemic has had a much deeper and more serious impact on the United States than most experts initially assumed. The infection pandemic has been a real blow to the American economy since the Great Depression.

This situation has affected global economic ties, making it difficult for American firms to fulfill orders, sending workers to the distressed areas while reducing the supply of labor on the one hand. On the other hand, it slowed down the demand for US goods and services. COVID-19 has directly impacted economic losses through supply chains, demand, financial markets, globally adjusting business investment, household consumption, and international trade.

The quarantine restrictions necessary to combat the virus have gradually frozen the economy, which has also led to widespread unemployment, as a consequence, the widening gap between the rich and the poor. The situation demanded immediate measures to resolve it, which the presidents took to overcome the economic recession. However, the full recovery is still far away, and one thing is clear that it is impossible to return to the previous state of the economy; it will be a new one with improved mechanisms.

A Short Overview of the US Economy

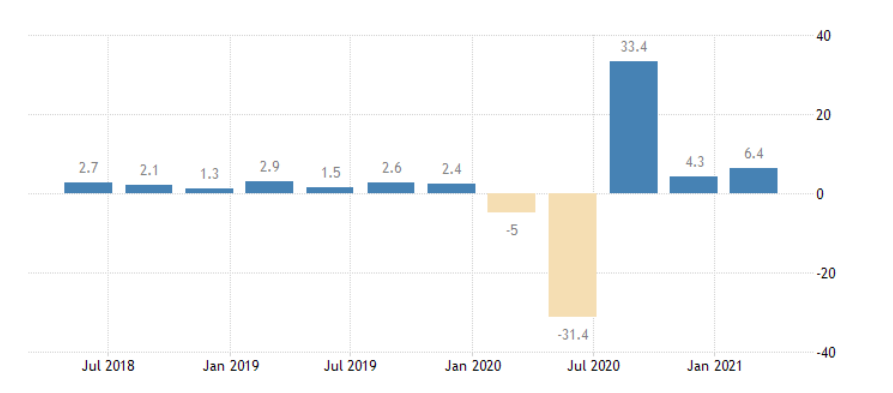

The United States is the country with the largest economy; nearly a quarter of the world’s GDP comes from the United States. Although the pandemic’s negative impact has changed the situation, unlike many countries, America has more opportunities to restore and normalize the processes of this sector. Currently, the US economy continues to recover from the shock, while due to the second pandemic wave, the speed of the economy’s return slowed down. According to the first estimate, “the US GDP grew by 4% after increasing by 33.4%.” (Goldstein et al., 2021, p. 5139) Fiscal and monetary stimulus measures have taken the American economy out of a state of shock. When making decisions, the FRS focuses primarily on the labor market and inflation. According to official figures, employment in nonfarm payrolls has increased, but the unemployment rate also remains an issue that has yet to be dealt with.

Inflation is well below the Fed’s 2% target, based on the CPI. The Fed’s rate cut has led to a drop in market interest rates. The real estate market reacted positively to this, reflected in the sales of new buildings, houses on the secondary market, and other statistics. The financial crisis demanded an increase in government spending, and hence an increase in debt. Since the beginning of 2020, the ratio of US government debt to GDP has grown from 107% to 127% (Federal Reserve Board, 2021).

Over the past decade, the size of US government bonds in circulation has grown from $ 13 trillion to $ 27 trillion, fueled by an era of ultra-low rates. US foreign trade is predominantly import-oriented; the inflow of financial capital offsets this; since the beginning of last year, the deficit has widened even more. After Joe Biden came to power, the risks of trade wars are likely to have decreased, which is good for the economy.

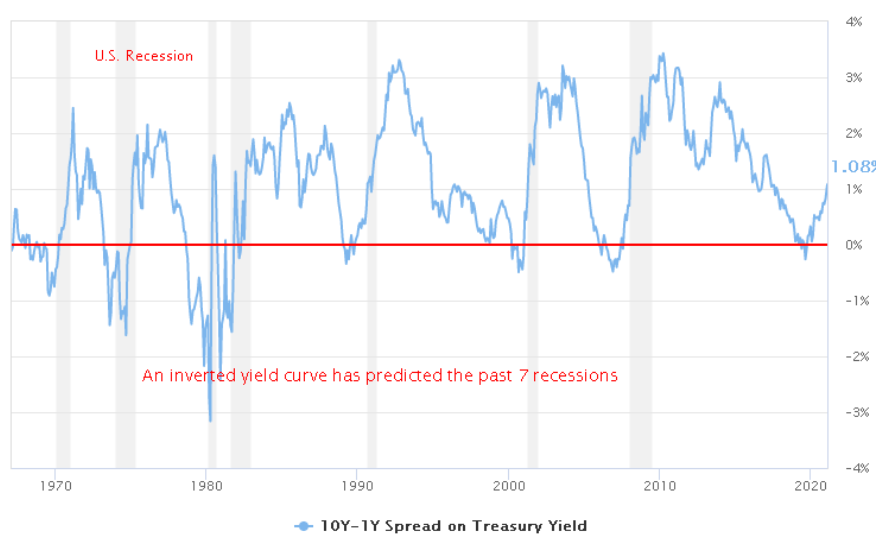

The cycle of monetary tightening of the Fed fits well with the concept of business cycles. The full business cycle covers 5-10 years and three periods: revival, expansion, and economic contraction. It is also about four stages: early, middle, late, and recession. Each stage covers several years, in different stages the most relevant sectors, cyclical or security papers. This crisis is unusual as it is caused by an “external shock – the coronavirus pandemic.” (Padhan & Prabheesh, 2021, p. 231) Mass vaccination of the population removes residual lockdowns from the service industry, and this, in turn, benefits the American economy.

A long-term risk factor is the budget deficit and the US national debt. According to the Congressional Budget Committee forecast, by 2030, federal debt on the balance sheet of “public structures will amount to 109% of US GDP.” (Goldstein et al., 2021, p. 5139) The emergence of negative debt in the distant future is predicted to lead to the fact that the yield on government bonds may rise, and the stock market may experience strong sales. Therefore, at the moment, the country’s economic situation is quite stable, aimed at recovery from the recession. A new fiscal stimulus package is expected to enable economic acceleration and development.

Affected Sectors of the Economy

The crisis has affected almost all spheres and sectors of the economy. Among the leaders in the decline in production and employment is public catering. Catering occupies a special place in the US economy, employing more than 15 million people, “about 10% of the entire US workforce.” (Groshen, 2020, p. 216) Taking into account the supporting industries, about 2 million more people should be added to this figure. It is clear that in conditions of uncertainty in terms of the spread of the pandemic, consumer demand in this area will not recover quickly. Large-scale losses in income and employment were suffered by such industries as tourism, recreational services, and transport; here, on average, losses in income exceeded 40% (Škare et al., 2021). The real economic sector was also forced to adapt to new realities. Some large corporations, such as Apple and Microsoft, were forced to partially suspend production due to the rupture of production chains, primarily with China and falling demand.

The fall in demand, including for durable goods, hit all sectors of the economy; for example, in housing construction, the number of new buildings fell only from February to April by 43%. The volume of sales of residential buildings in April 2020 amounted to 75% against the level of February. Investment in housing construction began to decline even before the crisis – by 1.5% in 2018 and 1.5% in 2019. Still, the real collapse occurred in 2020 when the volume of investment in housing construction fell by 29.7%. Overall, private direct investment fell by almost 25% in 2020. Low demand in 2020 and 2021 will be difficult to recover.

The decline in employment took on catastrophic proportions. In the first two months of the crisis alone, employment fell by 20 million. Almost 50% of those who worked in public catering, recreational services, and transport lost their jobs. On average, employment in material production decreased by 10%. Ahead of the crisis, employment growth rates have begun to decline. So, in 2019, the number of new jobs increased by 170 thousand compared to 192 thousand a year earlier. On average, in 2020, the reduction in the number of jobs exceeded 1.5 million. The unemployment rate reached an average of 14%.

In the hotel and recreational services, employment in March-April 2020 decreased from 17 million to 9 million people, that is, almost two times. As usual in times of crisis, the highest unemployment rates were recorded among African Americans (15.4%), Hispanic Americans (14.5%), and young people aged 16-19 (23.2%). Another 8 million people left the workforce; they did not attempt to find a job.

As the entire economy, foreign trade was also under attack. Exports stopped growing as early as 2019; in 2020, they fell by almost 15%. Imports suffered even more – the fall was more than 17%. The US budget system is under the greatest pressure. Since the budget deficit was about $ 1 trillion, then only in the first ten months of 2020 FY it exceeded $ 2.8 trillion. By its end, the deficit in the budget is expected to amount to $ 3.7 trillion; it will reach 18% of GDP. The growing shortage of funds was due to a catastrophic drop in production and, accordingly, a sharp drop in tax revenues to the budget. In addition, this was facilitated by supportive measures for the economy and the population, which the state was forced to undertake.

Measures Taken to Resolve Problems

The federal government and the US Congress have used several basic measures to contain the spread of the coronavirus pandemic. The first thing that noticeably influenced the deepening of the economic recession was the regime of social distancing and self-isolation, the regime of staying at home. It led to the closure of many enterprises, primarily in the service sector. The right not to make such decisions was transferred to the states. In doing so, the federal government went to unprecedented measures of financial assistance for the population. A total of $ 2.2 trillion was allocated, which was used in three main areas.

The first direction involves financing the healthcare sector, particularly expanding the production and use of artificial lung ventilation devices, disinfectants, and masks, developing drugs and vaccines, and deploying temporary hospitals. For this purpose, $ 400 billion has been allocated, including $ 150 billion in aid to state hospitals. The second direction involves providing individual material assistance to all citizens, especially those who have lost their jobs because of the economic situation. $ 500 billion was allocated for these purposes, going to direct payments and unemployment benefits to Americans.

Following this area of support, a family of two receives $ 2,400 and an additional $ 500 for each child. The third area includes economic assistance, including subsidies and loans for small businesses for $ 350 billion and $ 500 billion to support large corporations.

According to many experts, these measures will not be enough. According to Hynes et al. (2020), additional stabilization measures will be required, the cost of which is estimated at $ 6.3 trillion, which is close to 30% of GDP. (p. 181). In turn, this will lead to an increase in the scale of financial borrowing and an increase in public debt. In the current situation, the state is likely to follow the traditional path, the opposite of the one that followed the 2008-2009 crisis. The policy of the so-called quantitative easing, that is, the redemption of bonds and the injection of money into the economy through the banking system, is possible. In the current fight against the crisis, the policy of selling Treasury bonds and thus receiving funds into the budget to finance programs to support the population and business will be rather pursued.

Conclusion

The pandemic’s impact on the country’s economy turned out to be stronger than the global financial crisis; thus, being an unprecedented event in the history of the United States. In early 2020, a recession began as the US gross domestic product — the measure of the production of goods and services — fell sharply. Most businesses have closed as home-living orders were introduced, and it became clear that the coronavirus was a national emergency. As the economy contracted, it all led to unemployment, business closures, debt, stock market crashes, and other dire consequences for its economy. Without extraordinary support measures, the impact of the crisis could have been much more severe.

The authorities offered the troubled industries and all businesses affected by the pandemic systemic support measures that made it possible for the population and the economy to stay afloat. Investments in new forms of public health and a sustainable model of social protection and institutional resilience are needed to restore productivity and economic development. However, it is noted that the way out of the crisis caused by the COVID-19 infection should result in the formation of a different economy. The efforts made during and after this crisis focus on building more equitable, inclusive, and resilient economies and societies that will be more resilient in front of climate change, pandemics, and many other global challenges that the world may face in the future.

References

Elgin, C., Basbug, G., & Yalaman, A. (2020). Economic policy responses to a pandemic: Developing the COVID-19 economic stimulus index. Covid Economics, 1(3), 40-53.

Federal Reserve Board. (2021). Economic Research. Web.

Goldstein, I., Koijen, R. S., & Mueller, H. M. (2021). COVID-19 and Its Impact on Financial Markets and the Real Economy. The Review of Financial Studies, 34(11), 5135-5148. Web.

Groshen, E. L. (2020). COVID-19’s impact on the US labor market as of September 2020. Business Economics, 55(4), 213-228.

Hynes, W., Trump, B., Love, P., & Linkov, I. (2020). Bouncing forward: a resilience approach to dealing with COVID-19 and future systemic shocks. Environment Systems and Decisions, 40, 174-184.

Padhan, R., & Prabheesh, K. P. (2021). The economics of COVID-19 pandemic: A survey. Economic Analysis and Policy, 70, 220-237.