Introduction

During the last several decades, the retail industry has undergone considerable changes and achieved a number of positive, as well as negative results. On the one hand, there are fast and multiple distribution channels that can be used by different companies worldwide. On the other hand, significant competition and the necessity to improve strategic planning and monitoring create certain responsibilities in the industry. Still, despite the existing debates and attitudes to the place of the retail industry, the reports of the National Retail Federation (2014) prove that this industry as a type of American small business remains one of the largest employers in the country, offering about 42 million jobs and contributing about $2.5 trillion to the US GDP annually. Competitions in this industry turn out to be an ordinary issue, and the battle between Amazon and Walmart cannot be stopped. Though Walmart’s aggressive behavior helps to increase its online sales by up to 50%, Amazon’s unpredictable solutions like spending more than $13 billion to buy Whole Foods create new opportunities (Howe, 2017). The steps of these two companies vary but impress with their similar effects on the country’s economy.

The impact of the Internet on the work of these two global organizations cannot be neglected because it directly predetermines the possibilities of the companies and their relationships with potential customers. To prove the effectiveness of the Internet in regard to the retail industry, it is enough to compare the changes in the companies during the last ten years. In 2008, Amazon’s revenue was about $19 million, and, in 2017, this number increased up to $177.5 million (Morningstar, 2018a). Walmart’s revenue achievements are stable, but also impressive: $378 million in 2008 and $485.5 million in 2017 (Morningstar, 2018b). The chosen Internet retailers have the appropriate equipment and enough opportunities due to the developing globalization process.

The Internet is a good chance for companies to connect with customers in different ways. Retailers are not challenged by the necessity to spend much time searching for new clients. They are able to use online marketing and advertisement to attract people’s attention from different parts of the world. At the same time, the Internet is a threat to many organizations because it is hard to predict all its possible effects and outcomes. Therefore, regular evaluations and analyses are required to understand how to use the Internet and what the companies should do to be ready for new retail standards in this century.

The latest achievements and financial statements of Amazon and Walmart prove that the Internet does not prevent their growth, but promotes the possibility to increase sales up to 27% for Amazon and about 10% for Walmart. Such internet retailers do not know limitations and avoid measurements by any possible means to impress their clients and competitors. In this paper, certain attention will be paid to the development of the retail industry in the recent period of time through the main aspects of Porter’s Five Forces analysis and the growth of Amazon and Walmart during the last decade through the analysis of their business models, histories, and SWOT. In addition, financial analysis of the retail industry will be introduced regarding the results of Amazon and Walmart demonstrated in their annual reports in 2016 in order to understand and investigate future changes in the retail industry and the impact of the Internet.

Retail Industry Analysis

To understand the development and changes in the retail industry, as well as the impact of the strengths and weaknesses of the competitors, Porter’s Five Forces analysis, can be used with its threats of new entrants and substitutes, the power of buyers and suppliers, and rivalry among competitors.

Threats of New Entrants

In the United States, the threat of new entrants is significant because it is always possible for a company to introduce a new portion of services and attract the attention of people. A capital cost in this industry is moderate, and new organizations may allow themselves to try different approaches. The Internet is the place where millions of people like to spend their time. Geographical location, incomes, and social statuses lose their significance in the retail industry because anonymity and confidentiality are promoted due to the Internet. However, it is also necessary to consider the barriers and the presence of chain stores in this industry. Some organizations are not able to predict the results of their attempts and suffer from losses in the beginning. The threat of new entrants in the retail industry is moderate.

Threats of Substitutes

The peculiar feature of substitutes in the retail industry is its unpredictability. Though it is hard to find a market that can serve as a solid substitution for the chosen industry, a considerable threat of substitutes exists within the industry where customers get access to different companies and multiple services. For example, Amazon and Walmart are dangerous substitutes in the retail industry, and this threat is serious.

Bargaining Power of Buyers

Despite the fact that retailers focus a lot on the development of high-quality services to customers, the power of buyers remains insignificant in this industry. The amount of individuals is small; therefore, its pressure is not as significant as other aspects of the industry. Companies can use the opinions of buyers about their services and diversify their products regarding the demands of the populations. Still, the industry, in general, does not depend on buyers a lot. The power of consumers is low.

Bargaining Power of Suppliers

The retail industry is based on the services offered by suppliers. However, due to the large size of the retail industry, companies may ask for different suppliers and make choices regarding their own principles and interest. At the same time, competitors may offer better terms for suppliers, as well as get access to lower prices. Therefore, the role of suppliers cannot be ignored, but the possibility to choose and evaluate create certain freedoms. It is possible to say that the power of buyers is moderate in the retail industry.

Rivalry Intensity

Regarding the results of the analysis, it is clear that the retail industry is a strong economic body in the United States. Though it cannot be replaced or changed, numerous competitions within the industry create new options and impose strong rivalry. Competitions touch upon such aspects as price, services, and suppliers. Small retailers cannot survive the existing competitions, and such e-commerce giants as Amazon and Walmart may continue their competitions, neglecting other online organizations.

Amazon

Business Description

Amazon is one of the leading e-commerce companies in the retail industry. It was founded by Jeff Bezos as a customer-centric company with about 150 employees working there in 1995 (Amazon.com, 2016). Today, more than 340,000 people have full- and part-time jobs in the company. By 2016, the company demonstrated considerable growth in sales (from $15 million in 1996 to $136 billion in 2016). In the beginning, the company focused on selling books online. In a short period, Amazon developed its business and included the selling of video- and MP3-downloads, electronics, furniture, food, and toys to its services. The company’s retail sites are located in many countries around the whole world, including Canada, Brazil, France, Italy, China, and India. The expansion of the company is impressive, and it is hard to predict the next step of its executives in retail competition. Customers have access to millions of products and unique services. Sellers can use multiple programs with the help of which they can improve their business. Suppliers get a credible and responsible partner.

Business Model

A peculiar feature of the business model developed by Amazon is its constant movement. Being a leader in e-commerce retailing, Amazon offers B2B and B2C services that support the interests of customers and shareholders in the best possible way. Bezos is not afraid to take new steps and integrate technology in different aspects of the company’s work. In addition, Amazon suggests different e-commerce options for other businesses, attracting the attention of local, as well as world-known companies.

The key elements of Amazon’s business model include:

- Growth in profitability;

- Direct sales of goods and services (Amazon Books, Music and Videos);

- A solid platform for other retailers without a fee (Amazon Marketplace);

- Premium membership for customers and businesses when it is necessary to pay annual fees (Amazon Prime);

- Improved services at affordable prices that are optimized regularly (Amazon Fire Products, Gaming, Web Services);

- Generation of revenues that are developed on the Kindle basis, including e-reading and mobile applications;

- Promotion of an idea of invention;

- National recognition of its brand name and the brand names of sellers on the top of web surfing.

It is not enough for Amazon to choose one direction and stick to it using the same methods and similar ideas. Its business model provides the company with a possibility to identify the main needs of customers, clarify their opportunities, and investigate a variety of services that can be offered.

Company’s History

The beginning

1995 was the year of the first business operation made by the company and its founder Jeff Bezos. The first name of the organization was Cadabra. Still, due to certain problems in pronunciation and spelling on these letters, Bezos decided to change it to something easier and memorable. Amazon was interpreted as something different and even exotic. This was that he wanted to offer to the world. The biggest river, Amazon, the strongest female warriors, the Amazons, and the best retail company could be added to this list. The main goal of Amazon was to gather as many books as possible and sell them to people online. Despite the decision to deal with books, Bezos believed that one day he could create a company where everything would be sold. However, till 1998, Amazon was an online bookstore with Barnes & Noble as its main competitor.

Past achievements

In less than five years after its foundation, Amazon enlarged its services, went far beyond books, and provided customers with free shipping. 17 categories of products were offered to Amazon customers in 1998Investments at this company were justified in less than ten years. $1000 spent on Amazon in 1997 can bring about $500,000 today. At the end of the 1990s, it was hard to predict the possibility to develop its services. There were about 30-40 million people who knew how to use the Internet, and only half of them or even less were aware of online purchasing. It was difficult for e-companies to establish trustful and fair relationships with ordinary people. Still, even though people did not know what they can get with online purchasing, in 1997, they spent about $2 billion on Amazon products. Every year, the number of regular and new customers increased in Amazon. New services made the company recognizable in different countries, and the loyalty of American buyers encourages the leaders to think about additional options and rewards.

Competitions and conflicts

Like any successful business, Amazon faced a number of conflicts with its competitors. One of the most unpleasant and memorable events occurred at the end of the 1990s when the case Amazon against Barnes & Noble began because of the violation of patent rights on one-click checkout system. The case was solved, and Amazon proved its rights to use their technologies and did not lose its customers.

SWOT

The history and progress of the company can be identified in terms of one analysis that is called SWOT. It identifies the strengths, weaknesses, opportunities, and threats that have to be investigated and used for further development with fewer mistakes being made in the same field.

Walmart

Business Description

The retail industry is full of competitions and innovative ideas, and Walmart is a company that is defined as one of the main competitors of Amazon. Walmart is an international retail organization with a number of hypermarkets and stores that bring the highest revenues in about $450 billion annually. It was founded by Sam Walton in 1962. During the last several decades, the company proved itself as a real innovator in the retail industry. The peculiar feature of this organization is the readiness to invest in its people. For example, in 2016, the company spent about $2.7 billion on employees’ education, training, and increased wages (Walmart, 2016). More than 2 million people work in Walmart at this moment. The revenue of the company is almost $500 billion, and it continues to grow. Compared to Amazon, Walmart finds it necessary to focus not only on customers and sellers but on its employees and their professional growth. The leaders of the company want to introduce a strong system according to which the needs of employees are equal to the needs of customers.

Business Model

There are many factors that can influence the development of business models. Walmart introduces new approaches every year, proving that organizational changes and outside factors play an important role. Operational excellence is a core of the Walmart work. It determines the business model of the company the key segments of which are:

- The presence of different stores and centers, including small stores, hypermarkets, discount centers, and wholesales;

- The development of private label brands;

- Physical and digital access to Walmart products;

- Intentions to invest in access and assortment;

- Attention to price changes and affordability;

- Great experience that is delivered through years;

- Recognition of employees’ needs and opportunities.

Company’s History

Though the official date of Walmart foundation was 1962, its history had begun several decades earlier, in 1945, by buying a branch of stores from the Butler Brothers. The goal of this organization was to offer products at low prices and achieve high sale volumes in a short period of time. The main challenge was the inability to deal with high prices established by suppliers, and Walton experienced losses and the necessity to increase prices. In less than ten years, revenue of more than $250,000 was achieved.

However, the organization had to be closed because of inappropriate leasing conditions. In 1962, Walton opened a new store, Walmart Discount City, and, in 1967, Walton owned 24 stores in Arkansas with annual revenue of $12 million. In 1969, he founded a new company known as Wal-Mart. During the next two decades, Walmart spread its services in different states, including Arkansas, Kansas, and Oklahoma. In Texas, Walmart created more than 7000 working places in 1975. Till the beginning of the 1980s, the company had enough stores and the staff that it was possible to establish a foundation and develop its own organizational culture, standards, and demands.

In 1992, the founder of the company, Sam Walton died after he had received the Medal of Freedom because of the significant changes in the lives of ordinary consumers. His family continued this business opening new stores and employing more people. In 1993, a $1 billion sales week was reached in the United States for the first time. Walmart started opening its brick and mortar stores in Canada and China. In Europe, a certain success was achieved before the 2000s. In addition to organizational improvements and customer-oriented services, Walmart was involved in numerous activities aimed at protecting the population and supporting people after the outcomes of such natural disasters as hurricanes.

SWOT

A better understanding of Walmart financial and organizational benefits can be understood through SWOT analysis development. The main company’s strengths, weaknesses, opportunities, and threats have to be clarified:

Financial Analysis

Regarding the nature of business developed by such organizations as Amazon and Walmart, the impact of the Internet is evident in their work. It is necessary to improve the already existing business models and connect people with various interests and abilities from different parts of the world. The analysis of the financial statements of both companies can be a helpful step in the identification of possible problems and challenges in the retail industry. In this paper, a financial analysis touches upon three main aspects, including balance sheet, statement of income, and ratio analysis.

Balance Sheet

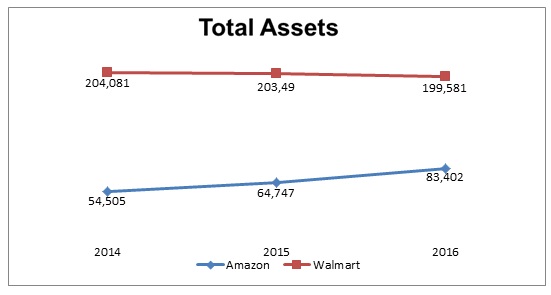

A balance sheet is one of the financial statements with the help of which companies may summarize their assets, equity, and liabilities in a certain period of time. These changes show what a company can do and earn under specific conditions and what factors play an important role in organizational growth. Amazon and Walmart lead the lists of companies with the best balance sheets and effective financial statements. For example, assets demonstrate a monetary value, liabilities are focused on monetary relationships with other organizations, and equity serves as evidence of possible benefits. As it is shown in Figure 1, during the last several years, Amazon has been able to gain more benefits regarding the growth of the Internet impact. Its total assets continue increasing compared to the assets of Walmart that have been decreased in 2016. Though total assets of both companies are located in different money categories, it is possible to observe that at the same time that Amazon’s results raised, Walmart experienced some decrease proving that Amazon was better prepared for the penetration of the Internet in the world of retail business.

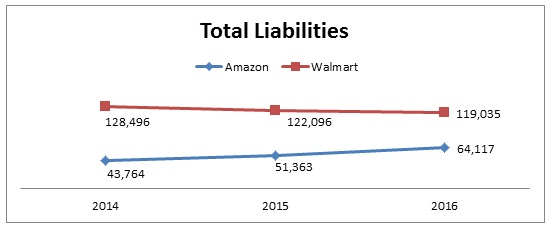

Liabilities introduce another important factor in the development of business and understanding its main threats. Regarding the balance sheets of both companies, it is possible to observe similar changes in liabilities of Amazon and Walmart in Figure 2. The companies do not demonstrate considerable improvements. Still, the liabilities of Walmart continue decreasing compared to the increased liabilities of Amazon proving that Walmart is better prepared for outside changes and challenges. Both companies also understand that unknown liabilities of the companies they acquire or invest can create new problems and the necessity to take unpredictable steps.

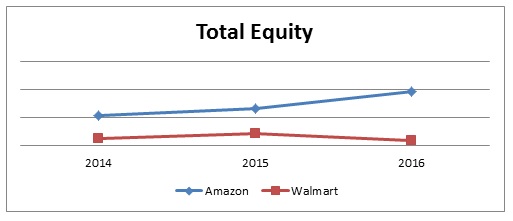

Finally, the analysis of equity should show how much money the companies are able to save. In Figure 3, the results of both companies are introduced and prove that despite the possibility to earn huge money and cooperate with customers at different levels, Walmart fails to achieve the same positive results demonstrated by Amazon. In other words, regarding the existing impact of the Internet on the retail industry, Amazon’s equity in $19,285 is higher than the one of Walmart that is $80,546 in 2016.

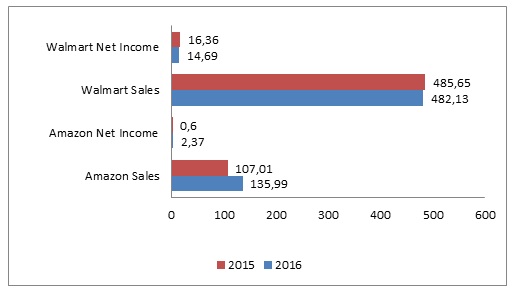

Statement of Income

Annual income statements can be used to understand the recent achievements of companies and their readiness to new demands and tasks. Amazon and Walmart have successfully dealt with millions of tasks during the last decades and demonstrated good results in the chosen industry. The financial results of both companies are positive. Still, in Figure 4, it is seen that Walmart experienced some changes that did not provide it with a chance to earn more or, at least, to stick to the same level of income. Amazon, in its turn, shows certain progress every year proving that a flexible business model based on the Internet activities and operations can help to manage expenses and achieve numerous benefits.

Ratio Analysis

In any financial analysis, much attention is paid to the changes of a current ratio because it determines the ability of an organization to pay back all its liabilities and deal with all assets in a proper way. In Figure 5, the appearances of both companies do not influence each others’ liquidity. There is no sustainable growth of ratios in the companies, and each year brings new results proving that Amazon, as well as Walmart, cannot control the impact of the Internet on their performance. Still, Walmart has more efficient ratio compare to Amazon, and this outcome may be explained by its long history and penetration in digital and brick-and-mortar markets at the same time.

In general, despite the fact that Amazon uses the Internet as its main source of customers and advertisement, this company has never achieved similar results demonstrated by Walmart. However, Amazon’s business model is unpredictable, and regarding the achievements made by Amazon in such a short period of time, it is possible to say that in some cases, Walmart may surrender to Amazon.

The Future of the Retail Industry

Today, it is impossible to reject the fact that the retail industry undergoes a significant revolution due to the rise of e-commerce and the presence of famous brands (Wigglesworth, 2017b). Jeff Bezos introduces the Amazon effect when brick and mortar stores are replaced by online services several decades ago. The acquisition of Whole Foods and the attention to other physical stores in the country prove that online services can be effective only in case they are properly combined with physical stores (Wigglesworth, 2017a). Therefore the future of the retail industry regarding the existing Internet opportunities, needs, and interests of customers may be defined as safe and prosperous.

The Internet may create certain benefits and challenges for the organizations that work in the retail business. Amazon and Walmart demonstrate their readiness to work and develop services to people regardless of their geographical location, age, gender, race, and other demographic segments. The benefits of the Internet on retailing include:

1. Delivery improvements. Nowadays, it is possible to receive an order in one or two days. However, the Internet opens new doors, and such organizations like Amazon and Walmart may allow using drones to faster their products’ delivery up to 30 minutes. When people recognize their options, they can increase their purchases and increase companies’ incomes a lot.

2. Fast search and options. Today, it is normal to use Google and surf the web when a person wants to find something or, at least, to understand what the nearest stores that may have the required products are. Amazon and Walmart are on top lists in online search. However, with time, new organizations and new services may appear, and companies have to compete harder in order to achieve the required progress and success.

Still, there is a threat of new and old problems in retailing. Amazon impresses with its fast growth and impact on people. During the last two years, this company has achieved considerable recognition worldwide and challenged many organizations. For example, 31% of all purchases American customers make online belong to Amazon. Several companies have failed to introduce appropriate competition in the industry and declared their bankruptcies.

The standards established by Amazon in several years are impressive, and it is difficult to predict what new options can be offered to customers and business partners. New acquisitions, strategic alliances, and retail changes can be promoted through the Internet growth and the Amazon Effect. Walmart does not find it necessary to panic. Only rational and evidence-based decisions are required. Current free shipping for purchases higher than $99 may be changed because many companies want to reject an idea of payment for delivery in order to attract customers’ attention. Amazon is not ready to leave this practice because it is a good chance to motivate customers. In its turn, Walmart focuses on strategic decisions and sustainable growth improving its sales up to 3-4% annually.

Conclusion

The impact of the Internet cannot be neglected or misunderstood in today’s retail industry, as well as in other business. The examples of Walmart and Amazon can be used to understand what the Internet can offer to the companies and what challenges may be created. The business models of Amazon and Walmart vary: Amazon prefers flexible schedules and numerous options that cannot be controlled or predicted, and Walmart continues focusing on its employees and high-quality services offered online and at brick and mortar stores. The Internet creates new opportunities in the field of retailing. Still, even such online giant as Amazon does not want to stop on online services and support them with several effective physical stores. People should have real access to stores and products in order to understand that everything is real. The financial analysis of both companies explains the steps and decisions of Amazon and Walmart and proves that both models have its positive and negative aspects, and the Internet should be used not for the solution of problems but for the recognition of new grounds for competitions between different companies worldwide.

References

Amazon.com. (2016). Annual report. Web.

Howe, N. (2017). Amazon and Walmart battle for retail’s future. Forbes. Web.

Morningstar. (2018a). Amazon.com Inc. Web.

Morningstar. (2018b). Walmart Inc. Web.

National Retail Federation. (2014). The economic impact of the US retail industry. Web.

Walmart. (2016). 2016 annual report.

Wigglesworth, R. (2017a). Will the death of US retail be the next big short? Financial Times. Web.

Wigglesworth, R. (2017b). Charting the US retail revolution. Financial Times.