Background information

Formed way in 1958, the American Association of Retired Persons (AARP) is a non-profit organization that advocates focus on addressing the needs and interties Americans of middle-aged to elderly descent. The association owes its formation Ethel Percy Andrus, a retired teacher whose goal was to assist the elderly to maintain physical and intellectual fitness through service to other people. The group’s mandate was further enhanced in 1982, following its merger with National Retired Teachers Association (NRTA) (Gupta et. al., 2004). NRTA had initially focused on securing pensions as well as health insurance for educators who had retired from service. The association’s membership currently runs at 50+ million and is steadily rising. This is attributed to the increase in the number of elderly people in America. This mighty membership and hence voting block made it a vital advocacy grouping in the United States. Its influence in American politics can therefore not be ignored. Its leadership is made of a 21 member board charged with the responsibility of decision making. Other than that, it has a team of administrative staff who manage its day-to-day operations. Its funding is almost entirely drawn from the annual membership fee. The association’s Board of Directors is elected at a biennial convention and serves voluntarily. Its charitable affiliate is guided by the vision, “A country that is free of poverty where no older person feels vulnerable.”

AARP offers its members a broad range of services which it deems beneficial to them. Services offered range from health insurance covers, insuring vehicles, discount bargains, and community assistance services among others. The group also underrates community-based activities aimed at bettering the lives of its members. Such include information dissemination on critical issues and offering counseling services to its members among others (McAllister, 2006). The group also offers consultancy on retirement programs it avails videos, and print materials to educate the elderly and the community on health problems as well as other age-related issues. Most community-based initiatives are however left for management by the respective local chapters. It also engages in legislative processes through advocacy campaigns on issues affecting its membership. Over 30% of its membership is drawn from the workforce. The association has well-staffed offices across the United States. Its wide local chapter networks, national community service programs, and NTRA membership facilitate the association’s ability to achieve its objectives within the broader target landscape (Besack, 1997).

Its role in advocacy on matters affecting the elderly and ability to lobby for its positions within the congress and government agencies has been largely attributed to its enlarged membership. However its areas of primary focus include social security lobbying activities, representation of medical care issues and charitable work on long term issues affecting the community. The organization has for a long time zealously fought for provision of quality and affordable healthcare to elderly and disable individuals. Further, the organization has doubled its efforts in protection of benefits entitled to retired population from interference by congressional legislations (Besack, 1997). Its advocacy includes development of policy proposals and lobbying the congress to formulate friendly and beneficial legislations on the mentioned areas.

In 2000, the organization was credited for its efforts in proposing ways of maintaining short term solvency of the hospital insurance solvency fund. This is possible by informing them about their rights under the existing legislative system. The organization has further strengthened its efforts aimed at helping the elderly more aware of the best health management initiatives in place. Its efforts in voter education can also not be underestimated. This is done by a non-partisan wing of the association known as AARP/VOTE which focuses on enhancing public awareness on issues that should shape their voting patterns. The program facilitates policy based campaigns while at the same enhancing electorate awareness and development. This facilitates voting patterns based on reason rather than euphoria.

In addition to the mentioned roles, the association provides its members with various benefits. Various service providers are licensed to use its name in operations. For instance, members are offered a choice of insurance plans thus availing the services to members who would have otherwise not have accesses the service given prevailing conditions. It receives administrative allowances or royalty from such privileges which are in turn used for the organizations advancement of activities within the society. Its nationwide volunteer program offers much help to the elderly. Nationwide volunteer programs including availing information to the elderly, supporting those upbringing their grandchildren, provision of legal aid where necessary and offering assistance in preparation of income return tax documents. Such programs are however partly funded by the federal government. Its information dissemination campaigns include radio network series, monthly magazine publications and website resources. In the recent past, website has grown in popular as more percentage of the elderly get computer literate. The outreach program e.g. collaborative national effort has increased its effort in assisting the elderly learn ways of leading independent life and access long term care.

Considering it’s out of government operations aimed at proving citizens with an avenue for voicing their opinion of public decisions, the group is considered a special interest group. Since inception though, the role of the group in political advocacy cannot be ignored. The association has maintained a 501(c) (4) status (Geist, 2002), which allows it to actively lobby on behalf of its members to the government. Although it is not politically affiliated, the association highlights on issues affecting its members in order to create a wider understanding and hence an informed choice. Main issues it involves in include social security and medical benefits proposed to its clients as well as policies encouraging incentives to the elderly population. The organizations political actions have been subject to controversy in the recent past with some of its members criticizing its role in politics.

Naturally, joining the organization is voluntary. Irrespective of political affiliation, prospecting members are providing with vast information about the organization prior to their inclusion more so with respect to the activities of its political branch. The contributed earnings trickle down to ever y branch of the organization in order to allow it get in touch with the immediate and future needs of its members. Generally, AARP’s operations are similar to that of most interest groups across the United States. Its status as an interest group is no secret. Other similar organization across the United States includes American Civil Liberties Union, American Israel Public Affairs Committee, and Americans for Democratic Action, and AFL/CIO – American Federation of Labor/Congress of Industrial Organizations among others.

Overall Goals of AARP

While AARP focuses on many areas affecting its members, its main aims and goals can be summed up into four distinct categories. These are advocacy, community services, information and communication, research and products and services. In advocacy, it acts as a lobby that advocates for its members welfare. The organizations in many instances take position on issues touching on social security,, medical care reforms and retirement investment options. It basically plays a watchdog role against the government, legislature and policy makers on issues touching on the elderly populations. In community service, the group offers help to those in need. Its funding for these roles is drawn from grants by government and non-governmental entities, and membership contribution fess. The organizations also engages in fund raising when need arises (American Association of Retired Persons, 2003). Additionally, the group helps in tax filing and resource management to these in need. This is in addition to provision of legal services, healthcare screenings and other services to the elderly.

In information and communication, the association avails various forms of information to its members as well as the public. These include website, TV shows, radio shows and webcasts. Additionally, it produces magazines. These media ensures that its members are well entertained and informed at the same time. The association also engages in research on matters affecting the aged. The findings are then published by its Public Policy Institute. Areas of research include nursing care, Medicare, retirement plans (American Association of Retired Persons, 2003), Social Security and caregiver issues. The association has a subsidiary outlet which engages in branding of products using its logo and management of funds resulting from this venture. This usually involves a partnership with institutions intending or use its brand and in turn the association receives royalties. Additionally, this allows negotiations for discounts to its members as well as special arrangements for travel for instance when a group of its members want to tour a given area. Others services provided include product negotiation on behalf of its members, offering financial services assistances and negotiating with providers for discounts on behalf of its members. Other aims are summed up below (American Association of Retired Persons, 2003);

- Assist targeted populations take advantage of their rights in decision making.

- Build the association’s image among members, potential members and partnering organizations through engaging in community related matters.

- Educate targeted populations on issues affecting their lives and how they can cope with changing times and trends

- Advocate for better conditions of its members in various spheres of life including health.

- Work with decision-makers to make implementation of policies as smooth as possible.

In promoting its perception by the general public, AARP undertake a number of initiatives including the under-listed.

- Provision of professional advocacy services including the following;

- Lobbying for its members interests..

- Monitoring and evaluating the changing healthcare trends nationally..

- Create avenues for consultation on legislative matters affecting its members and operations.

- Representing its members on consultative boards and organizations.

- The organization also avails professionally documented resources aimed at increasing awareness amongst its members. This it achieves through the following;

- Providing informative articles on educational and management issues.

- Availing guidelines to enlighten its members on State-of-the-art clinical practices and their medical rights and entitlements.

- Provision of timely information regarding its activities, including current, past and future.

- Funding research initiatives touching on its areas of operation and more so care for the elderly.

- The association also avails networking opportunities through a number of media including print publications, website resources, and volunteer opportunities/ specialty sections.

AARP Tax exempt status

As earlier stated, association, Inc. is exempt from federal income tax by virtue of being organized and operated pursuant to section 501(c)(4) of the IRC. In order to attain and retain tax-exempt status, a 501(c) (4) civic or social organization must comply with the following criteria.

- It must primarily engage in activities which enhance the common good and welfare of the society.

- Must operate within the provision of non-profit making organizations.

- May, if necessary, involve itself in legislative lobbying provided it’s meant to further the interests of the groups it represents.

- Its political involvement is limited to not being its prime focus area

Additionally, it should be noted that tax-exempt organizations are expected to compensate their employees in a reasonable manner. Compensation packages that are deemed excessive or unreasonable are subject to monetary penalties. To qualify for tax exemption as according to section 501(c) (4) of the IRC, the association must exclusively focus on social welfare promotion. This is interpreted as meaning that the organization must entirely focus on promoting the general well being of the society group it serves.

Additionally, no part of its earnings should be used to benefit a private shareholder or person. As a condition of tax-exempt status, section 501(c) (4) entities are expected to operate for the benefit of the community, however evidence suggests association may have strayed from that mission. The scope of the associations social welfare activities in comparison to its insurance related operations have raised questions as to its role as an entity meant for community assistance. This is backed up by the shocking figures revealed in the congressional report whereby royalties from insurance companies almost tripled between 2002 and 2009. For example, despite this significant increase, contributions to its affiliate charitable branches remain at lowest levels.

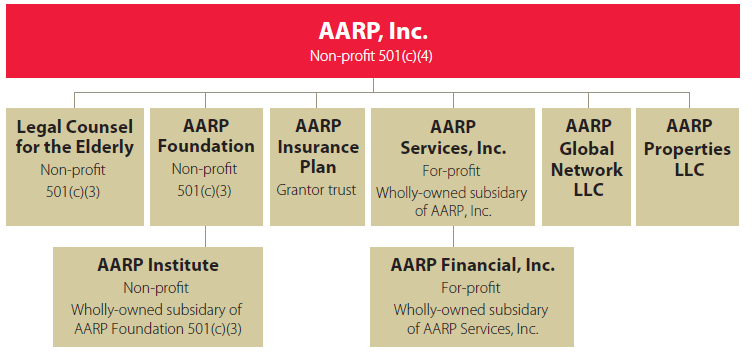

Findings of a report presented to the congress have raised a number of issues against AARP’s non-taxable status. In presenting the financial status of the organization, the report highlights various information. AARP is considered one of the largest and sophisticated enterprises within America. It is estimated that the organization owns over $2.2 billion in total assets and generated over $1.4 billion in collections in 2009. In 2010, the AARP enterprise included AARP, Inc., the tax-exempt social welfare organization under section 501(c) (4) of the IRC, which is parent to the taxable subsidiary AARP Services, Inc., which in turn is the parent to the taxable AARP Financial, Inc. In 2010, there were six other AARP-related organizations, both tax-exempt and taxable. Related institutions include AARP Insurance Plan, a grantor trust which collects and processes billions of dollars of insurance premiums. AARP CEO A. Barry Rand describes the AARP Insurance Plan as AARP’s “for-profit side.” Despite repeated requests, AARP refused to provide to Members of Congress federal tax returns and other financial information relating to the AARP Insurance Plan. Also included in the 2010 AARP empire were the AARP Foundation, AARP, Inc.’s affiliated charity, and the AARP Institute, a wholly-owned subsidiary of the AARP Foundation, both of which are exempt from taxation under IRC section 501(c)(3). The Legal Counsel for the Elderly (LCE), another AARP-affiliated 501(c)(3) organization, AARP Properties LLC and various other taxable affiliated entities and properties comprised the AARP enterprise in 2010 (Machan, 1998). Together, these entities are collectively referred to as “AARP.”

Accusations and counter accusations against AARP

According to the report, AARP paid an estimated $206 million for its Washington, DC headquarters. Spending on legal fee, accounting fee and compensations amounted to $3.4 million, $713,000 and $218 million in 2009. Its financial growth is increasingly reliant on endorsement royalty payments from insurance company’s intending to use its brand name in sales of its products. It capitalizes on its brand reputation to act as a consumer advocate for its members. This new source of income has largely reduced the organizations reliance on membership fee for management of its operations. Other traditional sources of income associated with the organization include membership subscriptions, conference registration fees, and publication advertising fees. The sources of revenue for the association include royalties mainly from insurance proving corporations, subscription fees paid by members, earnings from advertisement in its publications, and grants. According to a congressional report, in 2009, the association’s membership subscriptions rose by 32%, an equivalent of $60 million. Within the same duration, from AARP’s business relationships, majorly insurance companies, almost tripled, an equivalent of $417 million, raising total royalty collections to $657 million. Royalties from profit making entities constituted approximately 46% of AARP collections, while membership subscriptions amounted to 17% of total collections.

As a result of various findings, AARP has found itself subject o both internal and external conflict. While within, various members have questioned the association’s policies and stands on some national matters, external pressure has mainly been a result of into non-taxable status. In the republican report, “Behind the Veil: The AARP America Doesn’t Know,” the organization is portrayed more as a multibillion business entity rather than a non-profit making organization. It is claimed that the organization has placed its business interests above those of the members it was intended to serve.

The association has in turn denied these allegations citing the report as a distorted representation of they company by malicious groups out to sabotage its operations. The republicans stand on basis of the aforementioned report ahs been widely rubbished by other functions who view it as an act of witch-hunting aimed at further the urge by republicans to privatize medical care and social security in the United States. AARP’s insurance business has constantly grown more so on royalties whereby association-branded health insurance products are sold to Medicare recipients. The association works hand in hand with health insurance providing companies to endorse various policies which are then sold under its brand. AARP has often mentioned that it does not underwrite insurance covers and neither does it employ agents to act on its behalf. Management of AARP has often held that the increase and change in revenues strategies is a measure to hold down subscriptions by members. AARP does not pay taxes for any of its royalty collection due to its status.

Another controversy rocking the association is its stand on health reform, a position that has cost it a large membership. It has been claimed that the organization is advocating for cuts in Medicare services which is likely to negatively affect its members while on there other hand enhance its health insurance offer, a position it has widely refuted.

According to congressional report, the cuts will encourage the elderly to seek other policies which supplement Medicare provided. Supplement policies, also known as Medi-gap are sold using the associations’ brand. The association is therefore expected to largely gain from passing of the healthcare law. Critics argue that the organization operates as a multi-million insurance corporation. Critics have often argued that the associations operations can only be compared to that of large multinational insurance companies and that the there is no possibility of the organization engaging in spending such as the ones recorded recently purely using members subscriptions. It is estimated that to sustain such, Membership subscriptions would have to be raised to two and one-half times higher (assuming constant membership population). The association would have to widen its subscription payments for membership by 166%, or raise the advertisement fess six times higher if royalties were to be eliminated (Waldrum & Geral, 1997). On this basis, the critics argue that AARP has grown accustomed to these collections and has constructed and maintained built and maintained business ties with various insurance corporations to facilitate sale of the products they endorse.

Operations of AARP

The association is widely applauded as fully addressing issues that affect elderly Americans. This is done through various initiatives. In terms of lobbying, the organizations places efforts at both state and national levels on basis of its 501(c)(4) status. Due to its non-partisan position, it neither supports nor discredits any candidates or political entities. In 2006, it was estimated that the organization spent a total of $23 million on lobbying activities. Most of the association’s funding is used in providing information to product consumers for purposes of benefiting their decision making ability (Moore & Monica, 2004). Its services entail a variety of products to its over 50 million members. (Walker, 1999). The AARP Financial Incorporated is a subsidiary of the association which manages the associations’ endorsed products and funds.

Influence strategies adopted by AARP

To influence its members, stakeholders and the government, AARP’s leadership adopts a number of strategies. The organizations’ leaders acknowledge that leadership without influence is almost synonymous with impossibility. Influence is more of a way of exercising powers and lack of influence is representative of ineffective management (Morris, 2006). A number of approaches are employed by management of the association to win influence over the aforementioned. These include the measures discussed hereafter.

Use of reason

Reason is the best way to gain influence over others. The organizations leadership presents reasons to its members for various standpoints and decisions they adopt. This is done through both print and visual media whereby the management spokespersons directly address the members. This allows members to evaluate and decide whether or not support the decision adopted by the leadership..

In instances where other organizations present reasons why one or more of the organization’s policies goes against the wishes of the public, the organization initiates the concept of resisting reason to counter such (Rosenfield, 2003). For instance when accused on supporting a health policy based on its perceived benefits to the organization, it immediately came out through the media to strongly dispute that it stood to gain in way noting that the policy allowed each individual state to formulate it own Medicare policy to supplement the deficits in care.

Present alternative reasoning

Additionally, the organizations present alternative points of reasoning to its members as a measure to counter policies and decisions which its members may lack adequate knowledge to assess. They either ask the members to

- Cooperate if the decision is deemed appropriate, or

- Tactfully explain why they should reject the idea or policy if deemed detrimental to the members and the public at large.

This generally involves highlighting all the possibilities to its members before letting them making individuals decisions..

Defending rights

When the rights of its members are infringed, the organization uses all tools at its disposal including legal mechanisms to reverse the same.

Firmly refuse

In some instances, the association is forced to take a firm opposing stand against issues if it deems the issue as unacceptable and hence inapplicable to its members and the public. This may occur in instances where the implementing authority has refused to take heed of the opinions of the organization on behalf of its membership.

Lobbying by AARP

Lobbying for various issues also take various forms. This includes use of exchange and pressurizing the implementing authority. When the government presents a policy or a proposal, the organization may according to its policies support or oppose it. When opposed to it, the organization adopts a two pronged approach, either agree to it or disagree. In case of disagreement the association may come up with an alternative proposal to counter the one proposed as a means of taking care of its member’s interests. These comes as a form of exchange where the organization trades its proposal with that of the government to come up with a compromised position or versions that takes the interest of its members as much as possible. However, in some instances, the organization may wholesomely oppose a proposal and call upon its membership to reject the same (Van, 1998). The association also uses pressure to strengthen its demand. Pressures come in various forms including mass action and demonstrations against the policy implementers. Alternatively, the organization may adopt legal alternatives to resists measures to undertake an initiative it considers detrimental to its members.

Other than the influence mechanism mentioned above AARP, also adopt other influence mechanism including (Van, 1998);

- mass media

- litigation

- boycotting

- campaign contributions

- campaign endorsements

Criticism

Years after formation of AARP, the organization is subject to plenty of criticism from across its ranks. Its critics hold that the organization has morphed into an insurance and advertising giant only comparable to some of the largest insurance companies in America. As earlier mentioned, the organization earns millions of dollars in form of insurance company royalties and advertisement fees annually. Only a small part of its revenues are directly from membership subscriptions. Despite a large increasing in earnings, critics note that the company’s funding of charitable work has been n decline. Basically the relation between earnings and charitable funding has been described on basis of an inverse relation. For instance, contributions to its charitable wing, AARP foundation rose by a mere 11% in between 2002 and 2009, while the legal assistance offered to the elderly declined by 9% (Birnbaum, 2003). According to the congressional report, this is a clear indication f the association lack of commitment to provision of welfare services. Rather than fulfill its formation visions, the organization is accused on hugely diverting its focus to the booming insurance business.

A concern also raised id the compensation according to the executive leaders of the organization. This has led to accusations being leveled to the organization as being focused on enriching of executives at the expense of the public and the members it’s was intended to serve. Comparing the organizations compensation of executives to other charitable organizations singles it out as an outlier falling way beyond the $500 million bracket (Birnbaum, 2003). Additionally, the association has maintained travel policies which go against best practices of charitable organizations. The widening difference between generated income and charity spending have been the subject of criticism and have been cited as the organizations point of deviation from originally intended purpose. This has made the critics question the rationality of allowing the organization operate within the provision of 501(c) (4) tax-exempt organization.

Legislative successes of AARP

Challenging a legislative session where seeking non-immunity of services to budget cuts, the legislature soften operations for Medicaid as well as various long-term medical provisions. A tiered approach was used was applied rather than the 10% across boards. This includes imposition of cuts to entities which provide skilled care to the elderly as well as others which do not provide skilled care but have a considerable large population of elderly persons under its care. Other than the cuts, the elderly continuously receive funding as well as tax credits in order to facilitate their well-being.

Despite budgets, continued funding was approved elderly and disabled tax credits. Additionally, tax refunds are availed to qualifying low income elderly persons on property tax. AARP supported this initiative due to the perceived benefits it was expected to accrue to its elderly members. A result has been more than 2500 persons qualifying for tax credits and an accompanying average refunds amounting to $165 (McAllister, 2006). Its passing also made it an obligatory to submit annual reports the trends and situations of the elderly. The law becomes operational on the 1st of June, 2011. Other than the aforementioned, the law makes it obligatory to report of suspected of abuse by both licensed and non-licensed caregivers (Finger, 1998). The threshold of reporting is comparable to that provided by the state laws on cases of children abuse.

Additionally, in a bid to protect vulnerable individuals, HB 1062 legislature was passed in Dakota (2011). The law is known as the Uniform Adult Guardianship and Protective Proceedings Jurisdiction Act and is aimed at protecting incapacitated adults interests especially those in need of help in making key life decisions. Support for this bill by the association was primarily premised on its perceived benefits to the elderly subject to abuse neglect of the elderly and exploitations suffered by the elderly population.

This legislation is expected to reduce cases of abuse directed towards the elderly through a number of ways. These are;

- Minimize cases of snatching from the old where the elderly are moved from one states to another in a bid to gain control of their assets and other life decisions.

- Allow courts the discretion of choosing the jurisdiction deemed to best represent the interest of the elderly subjected to abuse.

- Enhance co-operation between interstate courts over abuse allegations.

- Allow transfer of abuse cases and hence remove abused persons from such situations.

Conclusion

In conclusion, it is important to mention that the organization was formed purely to focus on the interests of the elderly population. It has a global view of reforms appropriate for assistance of the elderly persons in the society. In particular, one might question whether AARP is primarily operating to promote the common good and general welfare given the fact that AARP has become increasingly dependent on hundreds of millions of dollars in royalty revenue from insurance companies, which have increased substantially in recent years. Furthermore, to maximize revenue from its insurance business, AARP has repeatedly taken positions that, while benefitting AARP financially, run counter to the interests of millions of AARP members and arguably the community at large. Additionally, AARP’s structure, with overlapping board membership between its “for-profit” and non-profit entities raises questions as to whether AARP is truly organized as a non-profit or if AARP is simply setting up shell affiliates to maintain tax-exempt status for the parent organization. Lastly, AARP appears to provide compensation packages and travel benefits for its employees, particularly for its executives, that are substantially more lucrative than those for other tax-exempt organizations.

As stated at the beginning of the report, AARP, Inc. is exempt from federal income tax by virtue of being organized and operated pursuant to section 501(c)(4) of the IRC. In order to attain and retain tax-exempt status, a 501(c) (4) civic or social organization must comply with the following criteria. The organization:

- Must primarily operate to promote the common good and social welfare of a community of people;

- Must be organized as a non-profit;

- May engage in legislative lobbying in the furtherance of the organization’s social welfare purpose; and

- May engage in political activity (including campaign-related activity), provided it is not the primary activity of the organization.

Additionally, it should be noted that tax-exempt organizations are expected to compensate their employees in a reasonable manner. Compensation packages that are deemed excessive or unreasonable are subject to monetary penalties.

In order to qualify under section 501(c)(4) of the IRC, an organization must be “operated exclusively for the promotion of social welfare,” meaning the organization “is primarily engaged in promoting in some way the common good and general welfare of the community” by “bringing about civic betterments and social improvements.” In addition, no part of the net earnings of such entity may inure to the benefit of any private shareholder or individual. These are the principles upon which the organization is founded and hence has to operate within. Today, despite the challenges’, criticism, politics, many Americans still have trust in the organization and view it as a platform upon which they can enjoy their old age. However, its enlarged financial base, and influence on matters affecting the society makes it susceptible to political manipulation and misuse, a fact that can only be mitigated through clear policy guideline rather than imposing taxes as a means of punishing the organization.

References

American Association of Retired Persons (2003). Available online at Besack, M. (1997). “AARP Gets Ready for the Boomers,” Workforce, pp. 27-28.

Birnbaum, J. H. (2003). “Washington’s Power 25,” Fortune, pp. 144-52.

—, (2003). “Washington’s Second Most Powerful Man,” Fortune, pp. 122-26.

Finger, A. L. (1998). “What This Man Wants, You May Get,” Medical Economics, pp. 177-91.

Geist, B. (2002). “Surviving Your AARP Attack; A Boomer Will Turn 50 Every Eight Seconds, and the Ugly Reminder Is Sure To Follow,” Washington Post, p. Z12.

Gupta, D. K., et. al. (2004). “Group Utility in the Micro Motivation of Collective Action: The Case of Membership in the AARP,” Journal of Economic Behavior and Organization, February 1997, pp. 301-20.

Machan, T. R. (1998). “AARP Turns Extortion into a Group Activity,” Arizona Republic, p. B7.

McAllister, B. (2006). “AARP Alters Name to Reflect Reality,” Washington Post, p. A25.

Moore, W. & Monica, K. (2004). “AARP’s Legal Services Network: Expanding Legal Services,” Wake Forest Law Review, pp. 503-44.

Morris, C. R. (2006). The AARP: America’s Most Powerful Lobby and the Clash of Generations, New York: Times Books.

Rosenfield, J. R. (2003). “AARP: Slaying the Mail-Order Insurance Dragon,” Direct Marketing, pp. 42-44.

____, (2003). “Boomers and Branding: The Agonies of AARP,” Direct Marketing, 1998, pp. 60-62.

Van A. (1998). Trust Betrayed: Inside the AARP, Washington, DC: Regnery Publishing, 1998.

Van, A. (1998). Trust Betrayed: Inside the AARP. Chicago: Regnery.

Waldrum, S. B. & Geral, N. (1997). “Age Diversity in the Workplace,” Employment Relations Today, pp. 67-73.

Walker, S. (1999). “Congress May Bite Hand that Feeds Members,” Christian Science Monitor, 1995.