Introduction

Analysis of revenue sources is extremely important to understand how the financial health of the county can be improved. According to Aikins (2011), the majority of local governments struggle with meeting the growing needs of US citizens in government services. The primary reasons for the matter are decreasing financial support from the states and inefficient management of finances (Aikins, 2011). While identifying and reducing waste in the utilization of financial resources is crucial for local governments is crucial, reviewing revenue sources is also vital to ensure that local governments have sufficient cash inflow to meet the needs of the population.

The present report analyzes the sources of revenue of Anne Arundel County, Maryland. First, it provides descriptive information about the country. Second, it assesses if the expenditures and revenues of the entity are balanced. Third, it considers two important factors that affect the financial performance of the county. Fourth, the report evaluates three options of tax changes for improving financial performance. Finally, the paper recommends strategies for improving the current state of financial health.

Background Information: Anne Arundel County, Maryland

Anne Arundel County is located south of the city of Baltimore. The total area of the county is 588 square miles, 29% of which is water (Anne Arundel County, 2020b). The county’s population estimation in 2019 is around 588,000, which demonstrates a 9.3% growth in comparison with 2010 and 20% growth since 2000 (Anne Arundel County, 2020a). In other words, the population of the area has been growing at a steady pace since 2000 (Anne Arundel County, 2020a). Around 297,000 residents are females, and 291,000 are males (Anne Arundel County, 2020a). The majority of the population are non-Hispanic whites (391,000 people), non-Hispanic blacks (101,000 people), and Hispanics (50,000 people) (Anne Arundel County, 2020a). The majority of citizens speak English at home; however, at least 28,300 people speak Spanish (Anne Arundel County, 2020a). In total, around 10% of the county’s population uses a different language at home for everyday communication (Anne Arundel County, 2020a).

The county is relatively prosperous in comparison with the state average. The median household income is $99,552, which is high than the overall state median household income of $84,805 (Anne Arundel County, 2020a; US Census Bureau, 2020). The number of households has grown by 21 % since 2000, which is comparable with the overall population growth in the county (Anne Arundel County, 2020a). In 2019, the median household value was $368 thousand, and the average household size was 2,65 (Anne Arundel County, 2020a). In summary, the local government, under analysis, oversees a large and relatively prosperous county, which implies that it should not have any considerable complications generating sufficient revenue from taxes and other sources.

Analysis of the Local Budget

Evaluation of local budgets consists of the analysis of revenues and expenditures. Budgets of local governments should be balanced to ensure that all the money gained from taxes is used to benefit the community. A balanced budget implies that the projected revenues are equal to the projected expenses. A balanced budget is difficult to maintain, as it implies that the government needs to control its revenue collection and adjust the expenses accordingly. However, such adjustments should not affect the government’s ability to meet the needs of the population in terms of governmental services. In order to maintain control over the budget, the county officials created a guideline consisting of 11 basic rules that should help to keep the budget balanced (Pitman, 2020). These policies include maintaining a budgetary control system, devoting resources to loss prevention, utilization of multi-year forecasts to evaluate the effects of budgetary decisions, diversification of the revenue sources, and reviewing fees ensure a stable cash inflow (Pitman, 2020). In short, the budgetary endeavors seem appropriate to keep a balance between revenues and expenses.

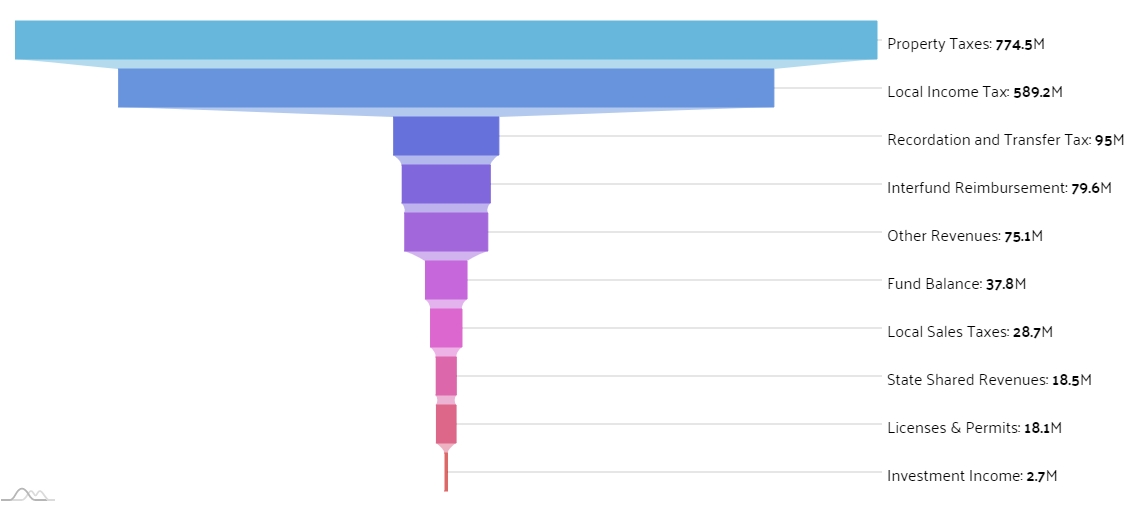

Currently, the highest source of revenue in the county is the local property tax, which is closely followed by the local income tax. In 2021, it is expected that the county will gain around $775 million from property taxes with the current rate of 90.2 cents per $100 of value (Pitman, 2020). The local government has also estimated that it will receive approximately $589 million from income tax, with the current rate of 2.81% (Pitman, 2020). Other significant sources of revenue include recordation and transfer tax ($95 million), interfund reimbursement ($79.6 million), and revenues classified as “other” ($75.1 million) (Pitman, 2020). The total estimated revenue for 2021 is $1,719.3 million. All sources of revenues are presented in Figure 1 below.

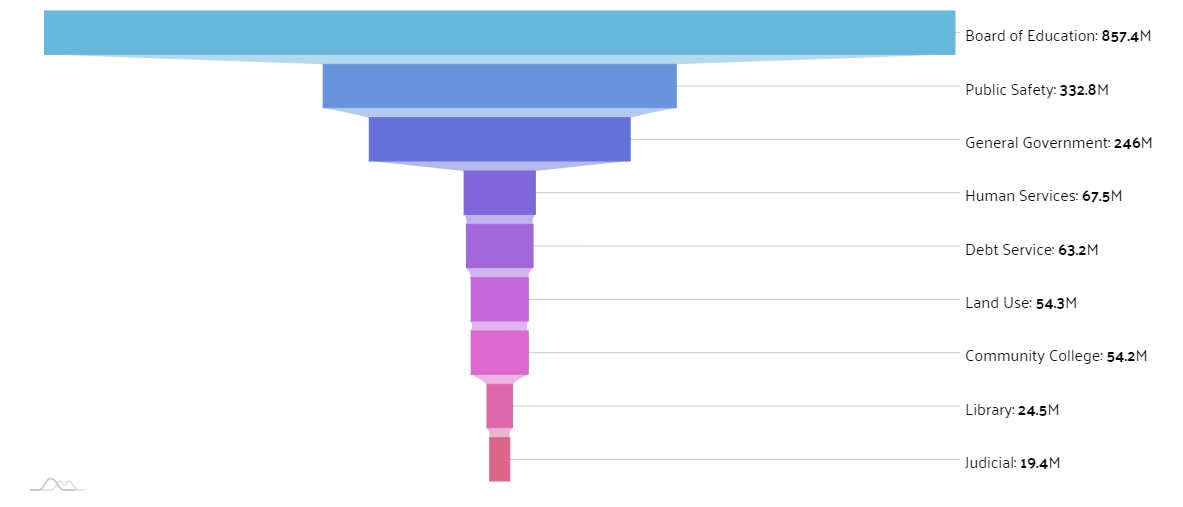

The major expenditures for the county include education and public safety. Roughly half of all the revenues ($854 million) are spent on the public-school system (Pitman, 2020). Another 20% of revenues ($333 million) are spent on police services, fire department services, and other public safety needs (Pitman, 2020). Other significant expenditures include general government expenses ($246 million), human services ($67.5 million), and debt services ($63.2 million), such as interest payments on bonds (Pitman, 2020). The total expenditures are equal to total revenues, with a total of $1,719.3 million, which implies that the budget is balanced. All the expenditures are listed in a comprehensive diagram in Figure 2 below.

The overview provided above demonstrates that even though revenue sources are diversified, the majority of revenue is generated by property and income tax. Property tax accounts for 45% of the local government’s revenue, while income tax accounts for 34.3% of all revenues. Even though the revenues from property tax seems to be balanced by the income tax revenues, revenues sources do not seem to be diversified enough, which may cause instability in revenue collecting, especially during the COVID-19 pandemic. According to Carroll (2009), greater diversification of revenue sources is associated with the improved financial performance of local governments. Thus, further diversification of the revenue sources would be an appropriate strategy for increasing the county’s financial health.

It should be mentioned that at least 5% of all the revenues are used to create a Revenue Stabilization Fund, which is crucial for balancing the budget in emergency situations (Pitman, 2020). The policy demonstrates that the stabilization fund balance should grow by at least $5 million every year (Pitman, 2020). The presence of the fund is crucial for the local government to cover the risk of overspending in extreme scenarios. However, the ability to use the fund should be limited by strict policies to ensure that the government makes every effort to reduce expenditures before using the reserved money.

Factors Impacting the County: Changes in Tax Burden

One of the crucial factors that affect the financial performance of the county is changes in the tax burden. In particular, in 2019, the local government decided to raise the income tax rate from 2.5% to 2.81% to increase the revenue inflow (Pitman, 2020). The raise was associated with increased education expenditures that will arise in the nearest future. As it was mentioned in Section 2 of the present report, the population of the county is growing rapidly, which requires a sustainable schooling system to meet the needs of the arriving citizens. According to the latest report on the situation with schooling facilities, the county needs to build at least two elementary schools, two middle schools, and a new CAT North (Pitman, 2020). The decision to start building was postponed several times due to the inability to find funding for the significant capital investments required to start building the schools. During the budget meeting for FY2020, it was decided to fund the capital investments using the money from the increased income tax rate (Pitman, 2020). These funds will also contribute to adding ten sworn police officers to meet the growing needs in public safety (Pitman, 2020). Thus, the change in tax burden seems appropriate to serve the cause of improving the current state of the educations system, which can attract new residents and businesses to the county.

While unpopular, the decision to raise taxes appears to be appropriate in this situation, as the county may make the county more attractive. A popular opinion says that tax cuts improve the economic development of the area while raises decrease the speed of economic development (Lynch, 2004). However, this opinion was challenged at the beginning of the 20th century, as Lynch (2004) claimed that low state and local taxes are often irrelevant to business investment decisions. Moreover, jobs that may be gained from creating new public services may offset the possible jobs lost in the private sector (Lynch, 2004). Thus, the planned tax raise will affect the county’s financial performance by increasing its revenues.

Deterioration of the Revenue Base

Another significant factor that affects the financial health of the county is the deterioration of its revenue base. Even though the number of residents and households is growing, which helps to increase revenues from property tax, the real income of residents deteriorated significantly due to the COVID-19 pandemic (Pitman, 2020). The budget for 2020 was based upon the projection that the income of residents would grow by 4%. However, at the end of 2020, it was estimated that the income level of the county’s population decreased by 1% in comparison with 2019, which had a severe negative effect on the revenues of the county.

Revenue from the income tax is derived from the personal income of the residents that live in the county, as well as from capital gains, interest, and some business income (Pitman, 2020). During the pandemic, many people lost their jobs or experienced salary cuts, which negatively affected personal and household incomes. As a result, the local government experienced a deterioration in the revenue base, which caused expenditure cuts (Pitman, 2020). Even though the state and Federal governments employed strategies to offset local budgetary losses by providing direct grants to counties, this was not enough to cover the increased cost of human services and decreased revenues from income taxes.

Deterioration of the revenue base is expected to have a significant negative impact on the county’s financial health. In particular, it will offset the increased income tax, which was meant to complete several capital projects for the Board of Education, improve public safety, and replace the 15-year old helicopter (Pitman, 2020). As a result, it will become a significant obstacle for the economic development of the area, as the creation of public jobs will be delayed. Moreover, the local government may be forced to utilize the money from the stabilization fund to cover the expenses of the public sector if the situation with coronavirus continues to deteriorate. This will decrease the prestige of the area for new businesses and reduce the number of private-sector jobs.

Evaluation of Options

The county’s revenue can be increased by raising different taxes. The present report evaluates three options for the local government to consider. First, the government is offered to increase the sales tax by 0.5%. Second, it may consider increasing the restaurant tax by 3%. Finally, the local government can increase the tourism tax by 5%. The evaluations of every option are provided below.

Increase in Sales Tax

The current level of sales taxes in all counties of Maryland is 6%, which is expected to generate $28,725,000 in 2021 (Pitman, 2020). This projection is based upon the assumption that the collection of sales taxes will increase by 3% in comparison with 2020 (Pitman, 2020). If the sales tax rate increases by 0.5%, and the growth rate remains unaffected, the changes in revenues can be calculated using the following way:

This implies that the total revenue will increase by $2,393,750, which is 0.14% of the total revenue of the county. This implies that such a change will not have a significant effect on the county’s revenue even if the increase in taxes will have no effect on demand. However, such an increase can contribute to the ability to pay for additional government jobs, such as ten new police officers, which were initially meant to be covered by an increase in the local income tax. However, it should be considered that the increase in sales tax may decrease the demand for consumer products, which will lead to a downturn in the economic growth of the region.

Increase in Restaurant Tax

Currently, the restaurant tax is similar to the overall sales tax in Maryland of 6%. Unfortunately, the budget of the Anne Arundel County does not state how much it is planning to earn from this type of tax in 2021. Therefore, it is impossible to make specific projections about how the effect of a 3% increase in restaurant tax. However, it can be projected that such an increase will have a drastic negative impact on the restaurant business in the country. According to Song et al. (2020), the Covid-19 pandemic struck the restaurant business in the US by decreasing demand for services and causing problems with adherence to new policies. As a result, many smaller businesses shut down, while others were forced to change the business model to providing delivery services (Song et al., 2020). Therefore, it is not recommended to increase the restaurant tax, as it is unlikely to generate additional revenues for the county. Instead, it may force restaurants to go out of business due to decreased demand.

Increase in Tourism Taxes

Anne Arundel County attracts tourists who want to visit the Chesapeake Bay. However, the tourism sector in the county is currently only developing, which demonstrates that an increase in taxes may create additional barriers to the development of the sector. The suggested 5% increase in tourism taxes will also have a significant negative effect on the county’s tax revenues. According to Škare et al. (2020), the industry should be supported with local policies to be able to survive the consequences of the pandemic. Therefore, the increases in taxes in the tourism sector should be avoided, as the demand is expected to be elastic.

Conclusion

The present report revealed that Anne Arundel County managed to balance the budget without using the stabilization fund during the first year of the COVID-19 pandemic. Even though the local government had decreased progress in building the new schools in comparison with planned values, the financial performance of the entity was satisfactory. Among factors that affect the county’s financial health, changes in tax burden, and deterioration of the revenue base were considered the most impactful. After analyzing three options for increasing the county’s revenues, it was decided that a 0.5% increase in sales tax is the most appropriate option for achieving the goal, as it can cover the increasing costs without having a significant effect on demand.

In the future, the county is recommended to utilize effective and efficient audit strategies to decrease expenditures by identifying, assessing, and reducing waste. According to Linnas (2011), well-established systematic audits of expenditures can help to address the changing needs of residents. Such audits can be created by assessing the best practices of the neighboring counties to learn from their successes and failures. Such an endeavor is expected to improve the financial health of Anne Arundel County.

References

Aikins, S. (2011). An examination of government internal audits’ role in improving financial performance. Public Finance and Management, 11(4), 306-337.

Anne Arundel County. (2020a). Demographics. Web.

Anne Arundel County. (2020b). Land use.Web.

Carroll, D. A. (2009). Diversifying municipal government revenue structures: Fiscal illusion or instability? Public Budgeting & Finance, 29(1), 27-48.

Eisenstein, L. (2019). How to approach local government budgeting effectively. Diligent Insights. Web.

Linnas, R. (2011). An integrated model for the audit, control, and supervision of local government. Local Government Studies, 37(4), 407-428.

Lynch, R. (2004). Rethinking growth strategies: How state and local taxes and services affect economic development. Economic Policy Institute.

Pitman, S. (2020). Approved current expense budget and budget message. Web.

Škare, M., Soriano, D. R., & Porada-Rochoń, M. (2020). Impact of COVID-19 on the travel and tourism industry. Technological Forecasting and Social Change, 120469.

Song, H. J., Yeon, J., & Lee, S. (2020). Impact of the COVID-19 pandemic: Evidence from the US restaurant industry. International Journal of Hospitality Management, 92, 102702.

US Census Bureau. (2020). Maryland. Web.