Product Portfolio Management

Portfolio management is vital to successful new product development. Portfolio management focuses on resource allocation. That is, it shows how a business utilises its capital and people resources and identifies specific development projects for investments. Portfolio management also reflects project selection. It ensures that organisations have a steady stream of a major new product for competitive markets.

Further, portfolio management reflects the strategy. That is, portfolio management is one method by which firms apply to operationalise the organisational strategy. Numerous opportunities are noted to inspire organisations to revamp their product portfolio management performance. Generating profits from product portfolio requires organisations to execute multiple processes effectively.

From a general perspective, a successful product portfolio management may focus on various initiatives to improve processes across financial areas to optimise returns on research and development (R&D) and investment in technologies, sustain a competitive organisational edge, and effectively allocate scarce organisational resources. Additionally, firms strive for product portfolio management develop mutual relationships between project selection and business strategy, attain strong focus, determine the best balance of investment and projects, communication important business priorities, and ensure greater objective during the selection of projects.

In this essay, using theoretical concepts and perspectives of product portfolio management, attention is drawn to product portfolio management at Apple, Inc. and Procter & Gamble Company (P&G) – two companies from different industries. While some firms have done exceptionally well in portfolio management, it is imperative to recognise that effective portfolio management has proven to be a challenging goal for many organisations (Jugend et al. 2016).

The Current Business Landscape

The current business environment is characterised by fierce competition. Thus, businesses are struggling to cope with and sustain their competitive edge. Consequently, many firms increasingly depend on innovation to attain superior performance and generally, to sustain their market positions for a longer period (Lichtenthaler 2014). Apple, Inc., for instance, is touted as the most innovative company in the IT industry while Tesla, Inc. is recognised for its innovative electric car, solar roof, and space technologies. Additionally, P&G aims to deliver more consumer-friendly in the Fast Moving Consumer Goods (FMCG) market. Thus, from IT, chemicals, machinery, automotive, electronics, and others, no industry is left behind in product innovation activities.

More specific, firms in developed western markets now focus on innovation as one major strategic approach to cope with the increasing price-driven competition from emerging economies, such as China and India. Effective managerial focus on innovation attracts insights that drive innovation. Such practices, however, are characterised by risks and uncertainties, implying that firms with low affinity to risk are more likely to engage in limited innovative processes. Nonetheless, company executives can improve their company’s new product performance depending on the deployed innovation management processes.

Procter & Gamble

In an earlier announcement, P&G announced that it was planning to eliminate almost 100 brands from its product portfolio (Chernev 2014). This reflected a major shift in its product portfolio strategy. One must understand that the current business competitive environment is defined by brand proliferation. Thus, it appears unusual for P&G to concentrate on the product portfolio of ten categories consisting of about 65 brands after it developed some of the best brand portfolios in the FMCG market (Morgan 2015). These categories are baby care; feminine care; family care; fabric care; home care; hair care; skin care and personal cleansing; grooming; oral care; and personal health care.

Observers believe that the shift in product portfolio at P&G does not mean its brand is losing power (Chernev 2014). On the contrary, P&G is reacting to market forces, such as fragmentation and brand proliferation by redefining and concentrating on a small product portfolio. According to Peter Drucker, any business organisation has only two fundamental roles, namely marketing and innovation. Although P&G has attained the leading position in the global market, the ever-increasing market competition, complexity, and fragmentation with the introduction of many players who have complicated innovation and marketing for P&G. Today, customers are presented with multiple product options to buy and additional power to influence the reputation of an organisation. These factors continue to complicate market fundamentals and could negatively affect product portfolio management.

This implies that P&G must invest additional resources to manage every product in its portfolio. For profitability, P&G must, therefore, concentrate on products, which have scale and synergies while gradually eliminating brands with dwindling power.

These challenges in the market have forced business organisations to allocate more resources to novel technologies to enhance the quality of their products. The issue is, however, that R&D can improve products and investments in technology can improve processes. Hence, P&G must assess its technological resources and competencies and determine the best product portfolio that can drive revenues and profits while advancing innovation. Thus, the company will eliminate products that do not support revenue growths.

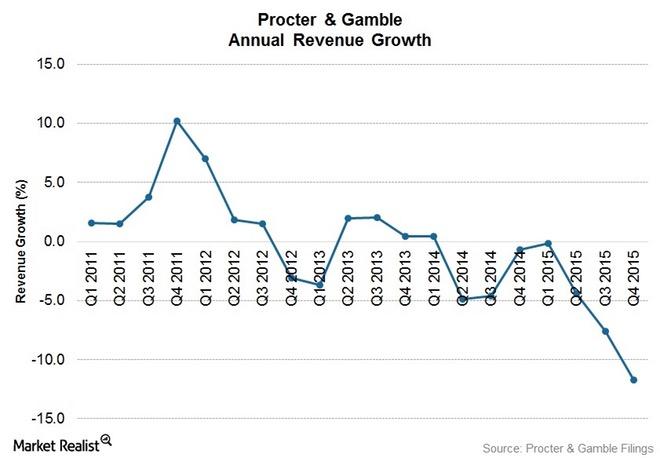

The company previously had 200 brands, which was broad, deep, and intricate. Thus, the shift is meant to bring about simplicity and profitability. It will reduce or eliminate non-core product categories to improve product portfolio management, helping the company to concentrate on what it does best. As shown in the above figure, the motivation behind a shift toward a leaner product portfolio could be, in part, driven by the desire to cut costs and improve revenues and profitability. In 2013, for instance, P&G observed that its leading 80 brands generated about $84.1 billion in sales while the other 120 brands were responsible for about $2.4 billion (Kaufman, Hall & Associates, Inc. 2014). Thus, eliminating non-core brands offers an opportunity for P&G to revamp its financial position.

Equally important, by reducing the number of products in the portfolio, P&G would significantly simplify its operating processes and structures, reorganise management into strategic business units. At the same time, R&D would concentrate on a few specific products. Further, the company’s marketing department would only concentrate on a few brands and ultimately stream its supply and manufacturing processes.

P&G is a complex company today because it did not watch its fast rate of growth. The company product portfolio became too complex than the pace of revenue growth. Consequently, P&G has unmanageable operations, minimal focus, rising costs, and lower revenues and profitability (Khosla & Sawhney 2014).

While for some firms, there might not be a clear financial benefit associated with product portfolio management governance models; for others, it is different (Tolonen, Harkonen & Haapasalo 2014). Kraft Foods, for example, realized massive financial success following its strategy of product portfolio management that focused on few brands – the company increased revenues from $5 billion in revenues to $16 billion within six years with a profit margin growth rate of up to 50% (Khosla & Sawhney 2014).

For P&G, the immediate issue is how to initiate and manage the process of reducing the product portfolio and the fate of divested brands. The company has the option of selling strategically weak brands or discontinuing their production without necessarily selling them to competitors. Improper approaches to product portfolio management can hurt P&G if its leading brands fail to generate more revenue to compensate for the divested brands. The company must manage new prices, avoid disruption, and hold on to some few non-priority brands, at least, for a given period to continue generating profits during transition. P&G must learn from its White Cloud divested brand that Wall-Mart resurrected to create a major option for consumers at the expense of the company.

Few product portfolios would reduce complexity at P&G, allow executives to execute their top to bottom strategies. The ultimate goal of product portfolio management for P&G is to ensure a leaner company, operations, and ensure profits and sustained growth.

Apple, Inc.

Khosla and Sawhney (2014) write that Apple offers only a few products and brands. That is, prioritising a few products and delivering the best to customers – maintaining a lean product portfolio. This approach contrasts the strategy of P&G that previously focused on 200 brands.

For Apple, good product portfolio management implies that it has various products at every stage of the product life cycle, managing risks, increasing revenues, and blocking potential competitors. The ultimate goal is to reduce risks, ensure long-term, sustained revenue growth and profitability, and to protect itself from revenue and profit fluctuations during different trading quarters.

Over the past decade, Apple has realised significant growth in its markets. Some analysts refer to this as the blue ocean or market-creating strategies (Kim & Mauborgne 2015). In this case, the product portfolio of the blue ocean consists of iMac, iPod, iTunes, the iPhone, the App Store, and the iPad. In fact, since 2011, when the company launched its iPod, its market capitalization has grown more than 75 times while sales and profits have defied every prediction.

Nonetheless, competition from Samsung, other peers, and cheap products from emerging economies have caused sales of iPads, Mac, and iPhones to decline year-over-year. The company already had other products on the way to spur growth and revamp its product portfolio. The Apple Watch is in the early stages of adoption, particularly among consumers interested in healthy living and fitness. The company is working on a value proposition to attract a large consumer base for the Watch to increase sales and penetrate new markets beyond the current early adopters.

Apple’s product portfolio management is defined and driven by innovation. While fans had previously complained of lack of innovation at the company, it, however, appears that they narrowly defined product innovation to only new products launched. At least every year, Apple has been updating and launching its existing products – this is innovation. Innovation is not only restricted to new products for new markets.

When the company updates, improves and transforms its current product portfolio, it is innovation. This reflects the company’s approach to incremental innovation. Tim Cook has continuously demonstrated that innovation is the cornerstone of Apple. As such, every year, new, improved products are launched to manage the company’s product life cycle and ensure better product portfolio management than the competition. Thus, Apple strives for both innovation process maturity and better product portfolio management.

It is acknowledged that Apple produces some of the best products globally (Grobart, 2012). Nearly all its products reflect enormous success while never-ending rumours constantly focus on what the company is working on, whether a new iPhone, Apple car, and others. To this end, some critics argue that Apple should drop some products in its portfolio either due to lack of revenues or because of better competing products (Grobart 2012). Grobart (2012) sees Apple as a company that cannot fail to innovate because they merely acceptable product portfolio is seen as unacceptable. Hence, Grobart (2012) contends that Apple should eliminate products, such as Safari, Game Center, Pages, Numbers, and Mission Control.

Like P&G, the focus on Apple’s product portfolio management is driven by a year-over-year decline in revenue but in the most recent fiscal years. As such, shareholders and critics expect the company to innovate or change the product portfolio to revamp its growth. The growing concerns involving weak revenues from iPhones – the major source of revenue for the company – have resulted in negative changes for Apple’s stock. Some now claim that the smartphone market, particularly the high end that the company controls is now saturated (O’Brien 2014).

Thus, by noting that Apple relies on smartphones to generate a substantial portion of its revenue, any slowdown in sales is upsetting. Consequently, many market analysts maintain that Apple requires an intense overhaul of its current product portfolio or introduce new product categories for new markets if the company wants to sustain growth (O’Brien 2014). The CEO maintains that innovation is deeply a part of everyone at the company, and they intend to focus on extremely few products, do them better, and disrupt the market in a major way.

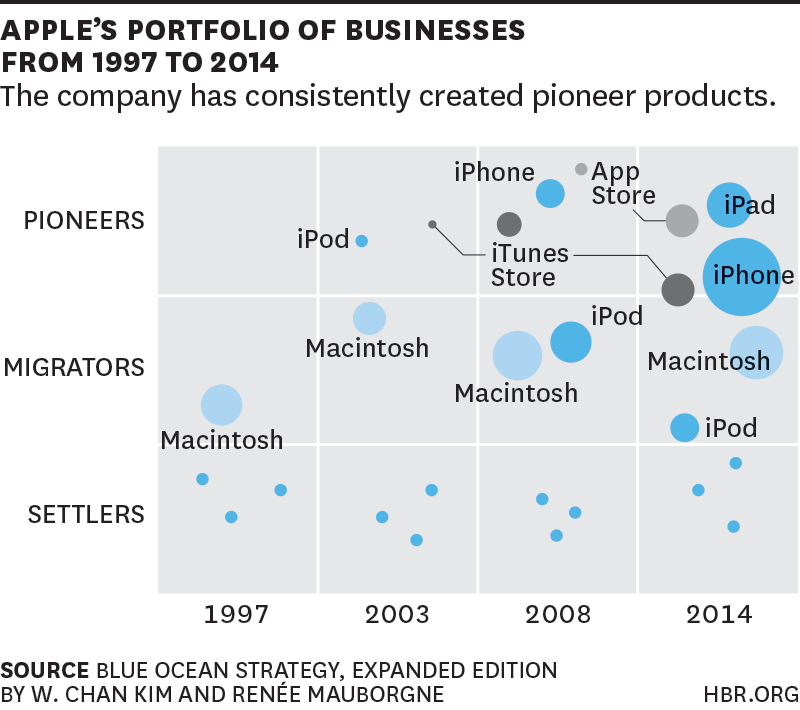

Kim and Mauborgne (2015) developed a map to demonstrate product portfolio management at Apple. They show that competitors copied the iPod in 2008, and it moved into the migratory category. As a result, Apple moved into other blue oceans to launch new products – the iPhone and App Store. That is, Apple has been able to optimise growth opportunities by ensuring a healthy balanced product portfolio consisting of “pioneers, migrators, and settlers” (Kim & Mauborgne 2015, p. 1). As such, the company has been able to mitigate the adverse impacts of imitation and competition.

As the above map demonstrates, the company’s product portfolio management goes beyond the blue ocean (Kim & Mauborgne 2015). No company should only concentrate on the blue ocean. As such, P&G, Apple, GE, and other firms with diverse product portfolio often find themselves in both blue and red oceans to grow and sustain success.

For instance, once other firms introduced the imitated version of iPod, Apple had to move swiftly and launch a wide range of iPod products with various price tags, including iPod mini, nano, shuffle, touch, and others. As a result, Apple was able to fight competition and keep them away. Meanwhile, it also created new blue oceans, allowing it to gain significant market shares and generate more revenue than any other competitors and imitators. Once Apple noted that the iPod’s blue ocean had become a red ocean because of imitators, the company launched the iPhone to create a new blue ocean.

As previously observed, the issue for Apple going forward is to revamp its product portfolio, as it seeks to transfer pioneers like iPhone to migrators and settlers in red oceans. The company must, therefore, strive for innovative products for robust product portfolio for sustained profitability and future growths.

Issues at Hand

The best in class firms now face the challenge of sustaining growth and success in a competitive business landscape. For now, it appears that Apple has been able to maintain a clear balance across its product portfolio consisting of pioneers, migrators, and settlers. On the other hand, P&G is now struggling to do just that. Despite being the global market leader in the FMCG market, the company had a huge product portfolio that was difficult to manage.

Microsoft also experienced the same challenge, but now wants to focus on a few products (Khosla & Sawhney 2014). P&G has realised that it cannot grow into the future with a large portfolio consisting of 200 brands. As such, it has started working towards product divestiture to ensure a good, balanced product portfolio in ten areas so that its brand can compete effectively in red oceans as it strives to create blue oceans. P&G will, therefore, have to renew, grow, and create leading-edge brand value in highly competitive segments.

One major issue, therefore that P&G must assess is whether settlers or migrators dominate its current portfolio. Settlers indicate that the company is on the decline in its product life cycle. Further, for Apple, it must understand that its current product portfolio is now moving from pioneers to migrators to settlers, and revenues and profits are most likely to decline if due to slow growth if no new pioneers are introduced. However, a well-balanced product portfolio can guarantee growth and competitive edge in challenging market environments.

More importantly, forward-thinking company executives must now recognise the words of Peter Drucker that business is about innovation and marketing. Hence, only long-term innovation would ensure its growth and profitability. Executives must now assess their resources to determine how they drive product portfolio management.

Companies are now focused on their product portfolio management, and they are taking actions. P&G, for instance, intends to divest some products while Apple is always on the path of innovation and product launches. All these efforts are meant to drive growth and sustain market position while optimising the use of limited resource and lessening potential product failure. Thus, issues related to balanced product portfolio development, improved success rates of newly launched products, more revenue from new products, and increased product value.

It is, however, imperative to recognise that business organisations face multiple challenges as they strive to realise efficient product portfolio management. For example, they may not sufficiently determine the value for some products, especially in product divestiture, have reliable data for decision-making, define poor criteria, and continued investment in failed products. In most instances, organisational politics and inactions influence major decisions about product portfolio majorly because of challenges associated with discussions concerning actual values of products or data-driven portfolio.

As such, most firms continue to experience drawbacks associated with poor product portfolio performance and management. Even the best in class firms, such as P&G, still face challenges meeting their targets related to revenue growths, product development, cost controls, marketing time, and process management. While the best in class firms, such as Apple, can still realise superior performance, their competitors, like Samsung and Nokia, are struggling to beat the competition. Apple has so far attained such performance, at least in part, because of its robust product portfolio management. A study by Tolonen et al. (2015) concluded that firms need better frameworks for managing product portfolio renewal across the whole product life cycle driven by strategic, tactical, and operational performance indicators.

Recommendations

Firms should assess their product portfolio management. Factors, such as product profitability, enabling technology, and favourable processes are important in effective product portfolio management.

- It is important to review business objectives and use them to select the best product portfolio; for instance, P&G should rely on such criteria to determine products to drop.

- Product portfolio should account for processes involved in product development, develop metrics for renewal over the life cycle.

- The product portfolio should aim to maximise market value, drive the product to success, and manage resources.

- Firms should concentrate on enabling technologies that can assist them in standardising and leading in the industry best practices, improving their product portfolio management and scale them to account for diverse needs of users.

In this dynamic market environment, organizations should focus on innovation to ensure innovation excellence for better product portfolio management. Many firms have failed to allocate adequate resources for innovation excellence. Thus, executives have an opportunity to develop their products and lead in product pioneering to create blue oceans for future, sustained growth, particularly for firms with declining revenues and facing fierce competition in red oceans.

Reference List

Chernev, A 2014, ‘P&G’s plan to ditch half its brands is not as strange as you think‘, Bloomberg. Web.

Grobart, S 2012, ‘Five products Apple should stop making‘, Bloomberg. Web.

Jugend, D, da Silva, SL, Salgado, MH & Miguel, PAC 2016, ‘Product portfolio management and performance: Evidence from a survey of innovative Brazilian companies’, Journal of Business Research, vol. 69, no. 11, pp. 5095–5100. Web.

Kaufman, Hall & Associates, Inc. 2014, Procter & Gamble’s lesson in reducing complexity. Web.

Khosla, S & Sawhney, M 2014, ‘The wisdom of less: how Procter & Gamble can grow by shrinking‘, Fortune.

Kim, WC & Mauborgne, R 2015, ‘Identify blue oceans by mapping your product portfolio‘, Harvard Business Review.

Lichtenthaler, U 2014, ‘Innovation portfolio management: enhancing new product performance’, Performance, vol. 6, no. 4, pp. 32-39. Web.

Morgan, P 2015, Mega brands set to dominate in P&G’s new product portfolio.

O’Brien, C 2014, ‘Pressure builds for Apple to overhaul or expand product portfolio‘, Los Angeles Times.

Tolonen, A, Harkonen, J & Haapasalo, H 2014, ‘Product portfolio management—governance for commercial and technical portfolios over life cycle’, Technology and Investment, vol. 5, no. 4, pp. 1-10. Web.

Tolonen, A, Shahmarichatghieh, M, Harkonen, J & Haapasalo, H 2015, ‘Product portfolio management – targets and key performance indicators for product portfolio renewal over life cycle’, International Journal of Production Economics, vol. 170, pp. 468–477. Web.