Introduction

Apple is a multinational technology firm specializing in the design, production, and sale of consumer electronics, including smartphones, personal computers, and accessories. The American company is headquartered in Cupertino, California, and has been in operation since its 1st April 1976 founding (Levy, n.d.). In 2018, the company broke the record to become the first company to attain a 1 trillion market capitalization (Peterson, 2021). Amid the coronavirus pandemic, Apple again achieved another milestone in 2020 when it became the first company in the world with a two trillion-dollar market value (Peterson, 2021). Thus, the company has risen steadily to become one of the world’s most valuable companies. It attributes most of its success to designing and producing innovative products that offer unique propositions to the market. The production of the first iPhone – the company’s bestselling product – led the institution to its current success, and performance has never dwindled.

Historical Overview of Apple

The company’s first CEO, Steve Jobs, helped create an effective organizational culture that influences operations at Apple to date. It puts emphasis on maintaining creativity, innovation, and quality and addressing customer needs. Thus, Apple’s core values allowed it to build products that empower consumers globally. The company’s leadership ensures that its devices, proprietary pieces of software, and services are created with accessibility in mind. Not surprisingly, Apple hardware, software, and services work together in a complementary manner, and purchasing one leads the consumer to want to purchase the next product. It is easy for people to appreciate Apple (by purchasing its products in large numbers) because it was the first successful personal computer company. It was also the first organization to make graphical user interphases popular among users. Its genesis is in Stephen G. Wozniak’s dream to build his own computer. The arrival of the Altair 8800 –the first commercially successful microcomputer – made Wozniak’s plan feasible (Levy, n.d.). Together with a former high school classmate – Steve Jobs – Wozniak built their first computer and named it Apple, and so began what would become a leading multinational corporation.

External Environment Analysis: Five Forces Model

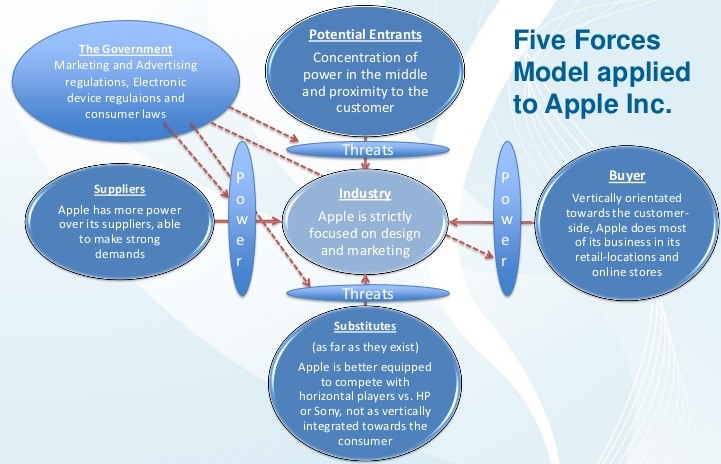

Porter’s five forces model can provide information about the company’s external business environment to help in strategy formulation and implementation. Regarding supplier’s bargaining power, Apple operates in an environment where suppliers have little bargaining power. As such, Apple can impose high-quality standards and expectations on its suppliers to maintain its product’s quality and appeal. Becoming an Apple supplier is not easy owing to the company’s size and people’s continuing wish to partner with it and partakes of the profits. The threat of new entry is also low because some of Apple’s competitive advantages come from the economies of large-scale operations. Factors barring new entrants into the industry include costs, technology, and specialist knowledge, among other things (Thompson et al., 2015). The consumer electronics market is saturated, and a company’s success depends on its ability to offer high-quality products that are differentiated. Quality consistency and the ability to manage operation costs also determine how successful the entrant becomes.

The bargaining power of the Apple Inc. customers is also significantly low. Most of the Apple customers are price takers capable of accepting any product pricing that the company suggests for new products. In 2020, Apple successfully released iPhone 12, which, unlike previous iPhone generations, did not come with standard accessories such as power adaptors and USB-C cables. Therefore, iPhone 12 customers purchase the phone plus the accessories to ensure the product works. Since people continue to buy this iPhone without complaining, their bargaining power is low. The threat of substitution is, however, quite considerable. Over the years, new products based on the Android operating system have threatened Apple’s market share. Specific examples include Samsung, Huawei, and Xiaomi. People find these alternative consumer electronics manufacturers appealing because, although they are cheaper, they offer superior quality in many aspects. Figure 1 summarizes the five forces model applied to Apple, Inc. The competitive rivalry of the industry within which Apple operates continues to change as different players metamorphose over the years.

SWOT Analysis

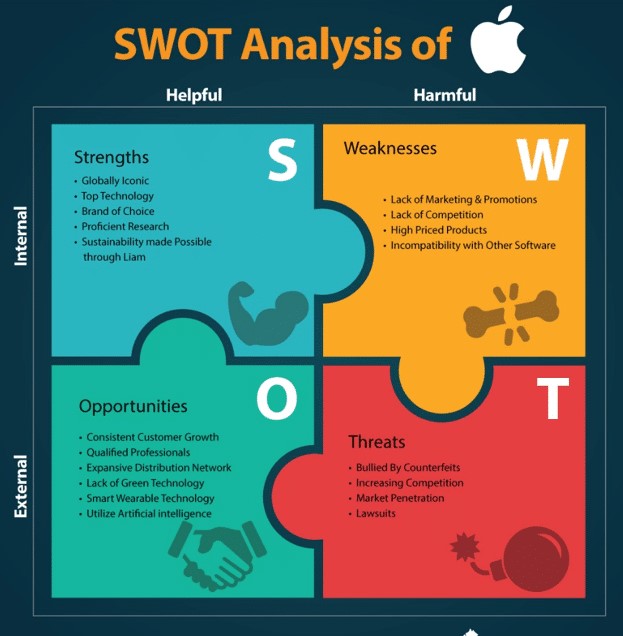

A SWOT analysis reveals peculiar strengths, opportunities, weaknesses, and threats available to the company. One of the company’s strengths, as shown in Figure 2, is that it is a global brand. People not only recognize the Apple brand but desire to own it despite its premium prices. Other strengths include advanced technology, proficiency in research and development, and effective culture and organizational design (Thompson et al., 2015). However, a lack of marketing campaigns and promotions is a weakness. Likely, the desirability of the Apple brand could increase if the company implemented traditional marketing campaigns. The company’s lack of concern over the competition is also a weakness. Although Apple products are highly differentiated and desirable, not being wary of potential challenges in the market could be disastrous for the company. The company’s premium prices are also a weakness. They exclude many potential customers and could push existing ones away.

Luckily, the market has many opportunities that Apple can take advantage of to grow and increase its profitability. One such opportunity is the growth in the demand and purchase of consumer electronics, including mobile phones and personal computers. With a bigger market overall, Apple can produce more products and services and capture a new segment. Technological developments in the market also allow Apple to advance its products and make them even better in meeting customer demands and expectations. For example, the 5G network technology promises to offer customers better services, and Apple can leverage this new technology to popularize itself among the existing and new market segments. Emerging markets like wearable technology and an increasing pool of talented developers in the job market could also serve as opportunities for improvement. In developing future business and creating new and improved products and services, Apple, Inc. must be aware of such threats in the external market as increasing competition, changing legal requirements, and increases in counterfeit goods.

Next Year Forecast of the Economy, Industry and the Company

The negative impact of the coronavirus pandemic is unlikely to wane. Complete vaccination of the entire global population and effective measures to prevent the spread of the disease is needed. In the coming year, countries will still be struggling to contain the virus, although the situation would have improved significantly compared to the present moment. Although travel restrictions and other COVID-19 rules may still apply, business performance in 2022 will likely be better than in 2020 and 2021. Given the robust economic recovery in 2021, the forecast growth for 2022 on a year-over-year basis is 3.5 % (The Conference Board economic forecast for the US economy, 2021). The economy, at the moment, has largely rebounded from the deep contraction in 2020’s first half. The factors that would determine how fast – and to what extent – this growth will continue include the spread of the virus, the effectiveness of the deployed vaccines, fiscal and monetary support’s impact, and timing, labor market and household status, and the rate of lifting travel and mobility restrictions.

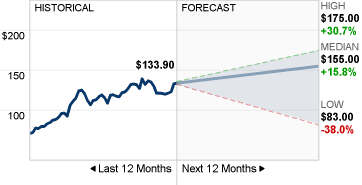

The economic recovery projections for 2022 will affect all sectors of the economy. For example, a 3.5 percent economic growth will imply modest growth in all sectors (The Conference Board economic forecast for the US economy, 2021). In this regard, the consumer electronics industry will recover more strongly in 2022 than it has done in 2021. This growth rate is most likely because it assumes that the cases of COVID-19 will reduce in the subsequent months of 2021 due to vaccination. Consequently, governments worldwide will relax these travel and mobility restrictions, allowing a steady though gradual return to normalcy (The Conference Board economic forecast for the US economy, 2021). It also assumes that the financial support announced by the US government in March 2021 is deployed in the second half of 2021 and causes positive outcomes. Given these conditions and Apple’s steady growth over the years, it could achieve a market capitalization of three trillion dollars in 2022. As shown in Figure 3, based on historical data, the most likely scenario is that Apple, Inc.’s stock prices will increase by 15.8 percent over the next 12 months as economies worldwide recover and productivity peaks again. The least possible scenario is a 38 percent decrease in the next 12 months.

Strengthening Competitive Position: Strategic Moves, Timing, and Scope of Operations

Apple can strengthen its competitive position by implementing strategic moves effectively and in a timely way. One way to do so is to increase the operational scope. Presently, Apple focuses on providing premium consumer electronics such as personal computers and smartphones and related accessories, including wearable devices. However, given its size, Apple can repurpose or adapt some of its technology to new business scenarios to increase profitability and market coverage. For example, the company could hasten its development of driverless vehicles or technologies for sale to car manufacturers. The electronic and driverless vehicle segment is fast developing and emerging as a promising business segment. Indeed, after the COVID-19 pandemic, scientists are now worried that the next epidemic could have everything to do with global warming and climate change. Investing directly in cleaner and more sustainable technologies, including driverless cars, could help avert the next crisis while rewarding first entrants with excellent profitability.

Apple could also invest in the provision of a wider variety of consumer electronics. For example, artificially intelligent personal assistants such as the Amazon Echo are also becoming popular in a fast-paced world. Apple could enhance its SIRI artificial intelligence system for application in other areas. SIRI and driverless cars will also work complementarily to each other, helping the company capture a bigger market for both products for the future. For example, with a driverless vehicle model, a reliable artificial intelligence system, and the current range of products, Apple could launch its version of Uber, capturing yet another essential market in the future. People with iPhones could hail the Apple taxi using the SIRI artificial intelligence system. People will tell SIRI to find “an Uber,” and the AI will use its integration into the system and interconnectedness to find the closest taxi, increasing people’s convenience. At Present, Apple is already bundling its products with more Apple products, preventing third-party players from filing a noticeable gap; it could scale up this strategy in the future.

Strategies for Competing in International Markets

The primary strategy for competing in the international market is offering a product or service with unique propositions. For example, Apple’s iPhone, which is currently the company’s best-selling product, maintains and enjoys a superior market position because it has impressive designs and features. The Apple iPhone also feels prestigious to own, which explains why people will continue to buy it despite its high products. If Apple, Inc. continues to offer quality differentiated products with unique propositions, the company will continue to enjoy a significant market share internationally. Another way to achieve a more prominent international market share is to customize global products according to the needs of those users. For example, in the Asian market, Apple could create in-built applications for popular services like WeChat and Baidu. Doing so will represent the company’s concern and resolve to serve and empower its customers. It will also prove that the company continues to care for its customers, regardless of their country of residence.

Another approach to competing in the international market is running subtle campaigns in these foreign markets. For example, the company can do extensive corporate social responsibility programs abroad and highly publicize those engagements to create greater awareness of the company and its products in those countries. People are more likely to buy a company’s product if they perceive that company as a sustainable business that genuinely cares about the environment and the community. Apple could also position itself in the mind of its consumers as a luxury product. It can do this by using celebrities and notable public figures to explicitly advertise the product, focusing on the key features making it a luxury product.

Corporate Strategy: Diversification and the Multi-Business Company

Diversification and operating various businesses lead to increased chances of success and better market penetration. As noted earlier, Apple can expand its business to the transport sector because it already has the technology it needs to succeed in this area. Alternatively, the company can increase its offering of consumer electronics to the market, particularly in assistive artificial intelligence systems. Because environmental protection is fast becoming a priority area internationally, findings business opportunities in this area and investing could yield desirable outcomes in the future.

Recommendations and Conclusions

Apple, Inc. is among the biggest consumer electronics companies in the world. It has grown steadily from a simple institution to a large, valuable conglomerate whose value is likely to surpass the three trillion-dollar mark. The company’s commendable performance is partly due to its significant investments in technology and the provision of high-quality products and services. Apple can continue to enjoy its market position and dominance by maintaining its quality and diversifying into new areas that have potential. Therefore, it is recommended that Apple invests in the transport sector to release self-driving vehicles in the future. The company should also invest more in environmental protection and preservation through enhanced corporate social responsibility programs to capture a large international market and continue making profits in the future. Apple must constantly examine its internal and external environment and make appropriate changes depending on the findings of these assessments.

References

Levy, S. (n.d.). Apple Inc. Britannica Encyclopedia. Web.

Thompson, A., Strickland, A. J., & Gamble, J. (2015). Crafting and executing strategy: Concepts and readings (20th ed.). McGraw-Hill Education.

The Conference Board economic forecast for the US economy (2021). The Conference Board. Web.

Peterson, M. (2021). Apple could hit $3T market cap by 2022, says analyst. Apple Insider. Web.